Types Of Small Business Loans

There are many different funding options small business owners may qualify for, including the following.

Commercial real estate loans

Commercial real estate loans are used to purchase or renovate commercial property. Typically, lenders require business owners to occupy at least more than half of the property to qualify for this type of loan.

Invoice factoring

With invoice factoring, also called accounts receivable financing, you sell your outstanding customer invoices to a factoring company at a discount. The factoring company will give you a portion of the total outstanding amount and then collect payment directly from your customers. Once it has collected payment from your customers, the factoring company will release the rest of the funds to you, minus a factoring fee.

Equipment loans

Equipment loans are commercial loans that allow you to buy or lease the equipment you need without putting any money upfront. These loans also use the equipment itself as collateral if you cant repay the loan, the lender will seize your equipment.

Business lines of credit

Business lines of credit are revolving loans, which means more funds become available to you as you repay what you borrow similar to a credit card. Lines of credit are a good alternative for companies that need funds quickly to cover emergency expenses. You pay interest on what you borrow, and repayments are scheduled daily, weekly, or monthly.

Term loans

Merchant cash advances

Franchise loans

How Hard Is It To Get An Sba Small

SBA lending requirements tend to be less strict than a typical bank loan SBA loans are intended to help provide credit, backed by the federal government, to small businesses that otherwise might not be able to qualify for credit. However, in case you dont have a good enough credit score or meet other eligibility requirements for an SBA loan, you should consider applying for a business loan from an online lender.

Give Your Small Business A Fighting Chance With Sufficient Financing Heres A Step

Documents you need for a small business loan

Although the world has largely gone digital, youll need some crucial documents to apply for a small business loan including:

- Personal Net Worth Statement: Personal assets for collateral may be required.

- Your credit rating and history: To be accessed by the lender, requiring signed consent provided as part of the Personal Net Worth statement above.

- A business plan: This is important for new start ups.

- Year-end financial statements: Including your Balance Sheet, Income Statement and Expense Report, along with a Year-to-Date Statement for existing businesses.

What to include in a business plan for your small business loan application

The business plan is extremely important for a successful small business loan application. It should include:

- A brief history of the business

- Size, key management positions and expertise of staff

- Operational details

- Main products and services

- Data on cash flow, revenue, costs, profits and losses

- Growth plans and sales forecasts

Dont forget to tell a story: what makes your business special and unique? Put some passion into your plan! Be brief, keeping it to two pages, if possible, but also be compelling.

Read Also: Does Spouse Have To Be On Va Loan

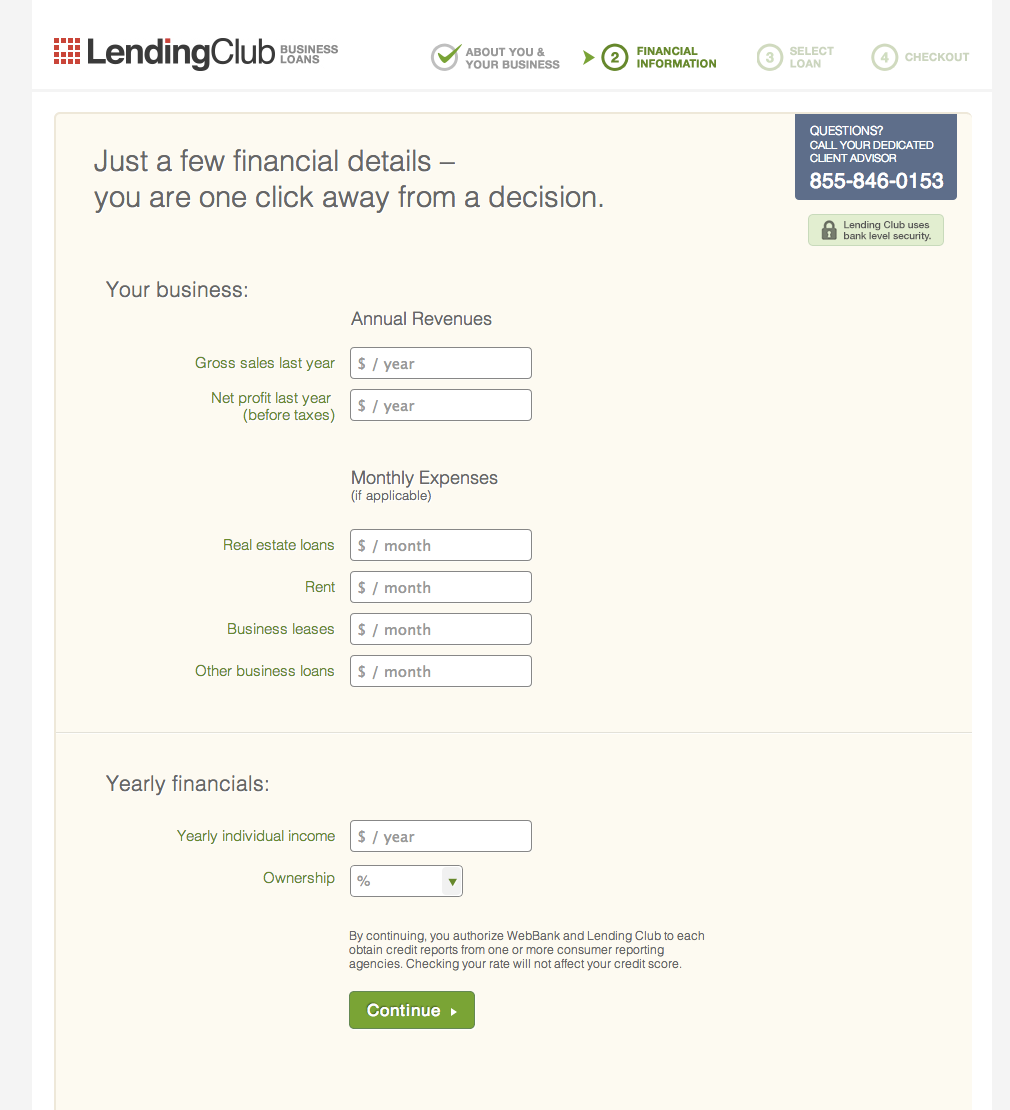

What You Need To Apply For A Business Loan

Most lenders will request certain documents and information when you apply for a small business loan. Before you begin the application process, ensure you have the following on hand:

- Legal documents: Business licenses and registrations, articles of incorporation, franchise agreements, and commercial leases

- Business plan: Outlining who you are, what you do, and how you intend to use the funds to meet your goals

- Income tax returns: Business returns and personal tax returns of owners

- Financial statements: Balance sheets, income statements, and statements of cash flow accounts receivable and payable financial projections

- Resumes: To demonstrate the management teams experience

- Business credit report: To showcase your business history regarding borrowed money

Small Business Administration Loan

SBA loans are available in amounts from less than $50,000 up to $5 million, and offer low rates and favorable repayment terms. Only SBA Disaster Loans are made by the U.S. Small Business Administration. All others are made by participating lenders. The loan process can take weeks or months, depending on the type of SBA loan you are trying to obtain.

You May Like: Va Home Loan Requirements 2020

Calculate How Much You Need

Before you can apply for a business loan, use a loan calculator and have a good idea of how much funding you need. To answer this, youll have to identify what you need a business loan for.

The Federal Reserve Bank of New York found three core reasons US businesses take loans:

- Business expansion

- Operating expenses

- Loan refinancing

For example, lets say you run a small but growing home-based catering business and want to open a single brick-and-mortar location, from which you intend to make and sell various baked goods.

At an average cost of $95,000 for kitchen equipment alone, our hypothetical catering company is already looking at a considerable business loan just to properly equip a single kitchenand thats before commercial real estate and licensing costs.

When estimating how much funding your business will need, its also worth considering the costs beyond initial investments. It may cost an average of $95,000 to fully equip a professional-grade kitchen, but what about:

- Maintenance costs

- Commercial insurance

Its easy to focus on the sticker price of new hardware, but theres a lot more to consider. This can be especially important for businesses in industries with notoriously tight margins, such as food service, which can take longer to reach profitability, because this will directly affect how easily a borrower can meet their repayment obligations.

What Are Short Term Loans

Short term loans work just like term loans, but have shorter payback periods. Typically, short term loans have payment terms of 1 year or less.

While you have a shorter period of time to pay the full payback amount, there is also less time for interest to accrue. For this reason, short term loans can actually be the best option for some small business owners.

Short term loans are the ideal option for expenses that directly drive revenue, such as marketing, the costs of taking on a new project, and expansion.

Recommended Reading: Va Loan Vs Conventional Loan

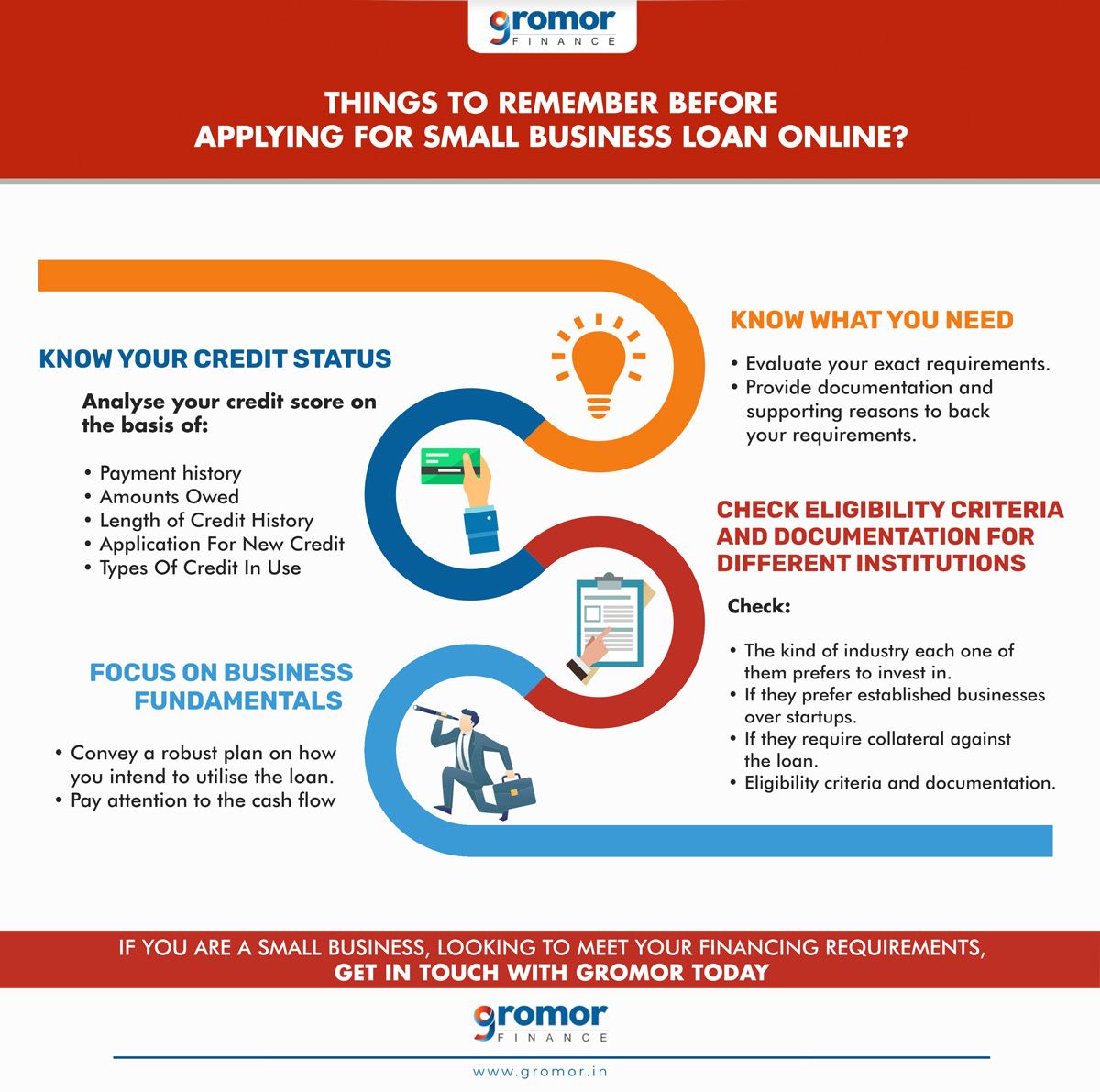

How Can Small Businesses Prepare To Apply For Alternative Lending Options

Applying for financing entails much more than just filling out an application. To increase your chances of getting financing, small business owners should do their homework and have a strategy.

Here are five tips to help you prepare your business for financing success:

Collateral For Secured Loans

Lenders offer both unsecured and secured business loans. If you apply for a secured loan, lenders require you to pledge collateralsomething of value, such as accounts receivable or real estatethat they can seize if you fail to repay the loan.

The collateral requirements can vary, depending on your specific loan. For instance, you could take out a loan to purchase a business assetlike equipment, a business vehicle or commercial real estate. The collateral in that scenario would be the asset purchased. This means if you purchase equipment such as a commercial printer, the printer will serve as collateral.

In addition, some lenders will require you to provide a personal guarantee, which means you accept responsibility for repaying the loan with your personal assets if the business fails to do so.

You May Like: Does Applying For Personal Loan Hurt Credit

Grow Your Business With A Fazz Business Loan

If you are a small business owner looking for a working capital loan to run your day-to-day operations, Fazz Business is here to help. Gain capital support to close your cash flow gaps and leverage more opportunities to fund your business expansion with short-term loans of 6 to 12 months tenure. With daily interest rates as low as 0.05% with approval within 48 hours, accelerate your growth with a Fazz Business Loan today!

Where To Get A Small Business Loan

You can get a small business loan through a bank or a non-bank online lender. Again, banks tend to offer more competitive rates than online lenders, but online lenders typically offer quicker application and funding times.

Another form of lending thats become popular for small businesses is peer-to-peer lending. P2P loans are funded by individual investors as opposed to lending institutions. These loans are available through P2P lending platforms that act as intermediaries to match investors with qualifying borrowers.

Don’t Miss: Business Loan No Credit Check

Why Might Small Businesses Seek Alternative Financing

There are several reasons why small business owners might turn to business loan alternatives. Here are three of the most common.

- Lower credit requirements: Traditional banks are almost certain to decline loans to borrowers with credit scores below a certain threshold that, though different for each loan provider, is often between 600 and 650.

- Easier qualification: Not all small business owners meet the additional requirements to apply and be approved for traditional loans. In these cases, business loan alternatives are helpful.

- Faster approval: Traditional bank loans can take weeks to be approved, whereas some business loan alternatives give you access to funding in as little as one week.

Copy Important Business Documents

Your business loan application should also include copies of these documents:

- Business certificate or license

- Business and personal federal income tax returns for the previous three years

- Any previous loan applications youve submitted to any lender

- Personal résumés for each owner or partner

- Your current lease or a signed letter from your landlord that outlines the lease terms

These are items for SBA Eligibility, which may be requested from your lender after your loan credit approval:

Read Also: How To Ask For Student Loan Forgiveness

How To Use Business Financing To Grow Your Business Easier & Faster

Every owner wants to grow their business, but doing so requires money.

The only ways you can grow your business are reinvesting profits, raising equity, or using small business loans .

At first glance, reinvesting your profits is the cheapest option. But with working capital covering every cost, it can take years for you to reach your goal.

Utilizing small business loans for startups and other types of businesses can actually be more profitable for your business in the long run. You can obtain cash to cover all growth-related expenses right away, putting you on track to boost revenue as soon as possible.

Here are some of the ways financing can help your business.

What’s Your Credit Score

Your credit score is one of the most important factors lenders will look at while evaluating your application. You should be prepared for a business credit check as well as a personal credit check. If your business hasnt developed credit history, your personal score will have more weight.

Banks and credit unions will almost never approve a small business loan if your credit score is below 700. However, online lenders tend to be more lenient.

National Business Capital is a fintech marketplace where you can browse over different 75 lenders, many of which dont maintain minimum credit score requirements.

Also Check: Does My House Qualify For Usda Loan

Can You Afford The Payments

Strong revenue is a positive signal to lenders. However, revenue doesnt mean much if your expenses are eating up a large portion of your income.

Lenders want to know that youll be able to comfortably repay your business loan. Your cash flow, or the money moving in and out of your business bank account over time, is a solid indicator of whether youll be able to manage your business loan payments.

Ideally, youll want your total monthly gross income to be at least 1.25 times your total monthly expenses – including the loan payment. This ratio might vary according to different lenders, so make sure to ask each prospective lender about their preferred income/expense ratio.

What Are The Different Types Of Business Loans

Once you understand how business loans generally work, itâs time to look into your options for small business loans. There are many different types of loans available to businessesâfrom government loans to working capital loans to franchise startup loans. Which loan you choose will depend on:

Letâs go over some of your options!

Recommended Reading: How To Apply For Sba Express Loan

Use A Business Loan Calculator

A business loan calculator can be a helpful tool to help you get a better sense of how much debt you can afford ahead of timeâand even more useful when you actually have a loan offer on the table.

With a business loan calculator, you can estimate the monthly payment on your loanâso that you can evaluate your cost of debt on a long-term basisâand how this payment will or wont fit amongst your other expenses.

To use the calculator, youâll need to plug in the loans interest rate and termâyou can then experiment with the loan amount and see how your monthly payment changes based on the size of the loan.

Then, you can check your businessâs profit and loss statement, and determine if the incoming revenue is enough to cover the monthly payment. You should also have a âcushionâ to comfortably cover other business expenses.

Gather Detailed Information For Your Small Business Loan Application

If you want to be successful getting a small business loan, you have to be prepared to provide detailed information and documents about your business it is important to be prepared and organized. The following is the type of information that is often required from bank lenders, depending on the type of loan:

- Name of business

See also 65 Questions Venture Capitalists Will Ask Startups.

You May Like: How To Find Loan Sharks Online

Consider Your Options Before Making A Decision

Taking out a business loan is a major financial decision and not one that should be taken lightly. As 2020 handily demonstrated, significant economic disruptions can have a profound effect on everything from revenue forecasting to the financial feasibility of a business itself.

Only you can decide whether taking out a business loan is right for your business. Before making any decisions, be sure to double-check that youve covered as many of your bases as possible:

- Have as close to a precise dollar amount in mind as possible before applying for a business loan, and know exactly how youll invest that funding into your business.

- Even if not required as part of a business loan application, consider making a formal business plan to identify any important points you may have overlooked, such as realistic revenue projections.

- Be realistic about how much your business can afford in terms of repayments, and identify any external factors that could jeopardize this when considering repayment terms.

- Consider discussing your plans with a financial adviser in your community to learn more about types of business financing

In uncertain times, some financial support can go a long way. Shopify Capital is here for you with quick and easy access to funds. Shopify Capital helps you get funding based on your history with Shopify and skip lengthy application processes.

Sba 7 Loans Small Business Administration Loans

The 7 is the SBA’s most widely used loan program. While the loan is partially guaranteed by the Small Business Administration, the financing is delivered through an approved SBA lender. This way, you can borrow anywhere between $20,000 and $5 million for as long as a 10-year term. Keep in mind, a 10 to 30 percent down payment is usually required for these types of loans. The SBAâs 7 loan program is attractive to many small business owners for its below-market interest rate. If you apply through Funding Circle’s network of SBA lenders, you’ll see that the interest rate is currently set at Prime + 2.75% .1 Payments are made monthly and you won’t face any fees for early repayment. Your business should have an operating history of at least three years to qualify. Use the proceeds for working capital, refinancing debt, making major purchases, and more. Learn more about applying for SBA loans through Funding Circle.

Recommended Reading: How Much Loan Can I Borrow From Bank

The Benefits Of Alternative Lending

Startups can enjoy a few key benefits in securing funding from a nontraditional source, according to Serkes. She believes that with alternative loans, a business owner gets a strong, invested partner who can introduce them to new clients, analysts, media and other contacts.

These are some other benefits of working with a nontraditional lender.

- The startup gets to borrow some of the goodwill that the strategic partner has built up, and working with an established investor lends weight to the brand.

- Infrastructure help: The larger partner likely has teams for marketing, IT, finance and HR all of which are things a startup could borrow or utilize at a favorable rate.

- Overall business guidance: Its likely the strategic partner will join your board as part of the investment. Remember that they have a wealth of experience in business, so their advice and viewpoint will be invaluable.

- Relatively hands-off partnership: A strategic partner still has their own business to run, so they are unlikely to be very involved in the day-to-day operations of the startup. Occasional updates on your business, such as monthly or quarterly, are usually sufficient check-ins for them.