How Do You Qualify For A Loan

– Zack, AL

30-Year Fixed-Rate Refinance Mortgage Example:The payment on a $225,000 30-year fixed-rate cash out refinance loan at 3.250% with a 70% loan-to-value is $979.21 with 2 points due at closing. The Annual Percentage Rate is 3.520%. This assumes a FICO score of at least 690. Payment does not include taxes and insurance premiums, which will result in a higher monthly payment. Interest rates and annual percentage rates are based on current market rates and are subject to change without notice. Rates offered may be subject to pricing add-ons related to property type, loan amount, LTV, credit score, and other variables. Mortgage insurance may be required for LTV > 80%. If mortgage insurance is required, the mortgage insurance may increase the APR and the monthly payment. Stated rate may change or not be available at the time of loan commitment or lock-in.

Conventional Versus Fha Loans: Definitions And Differences

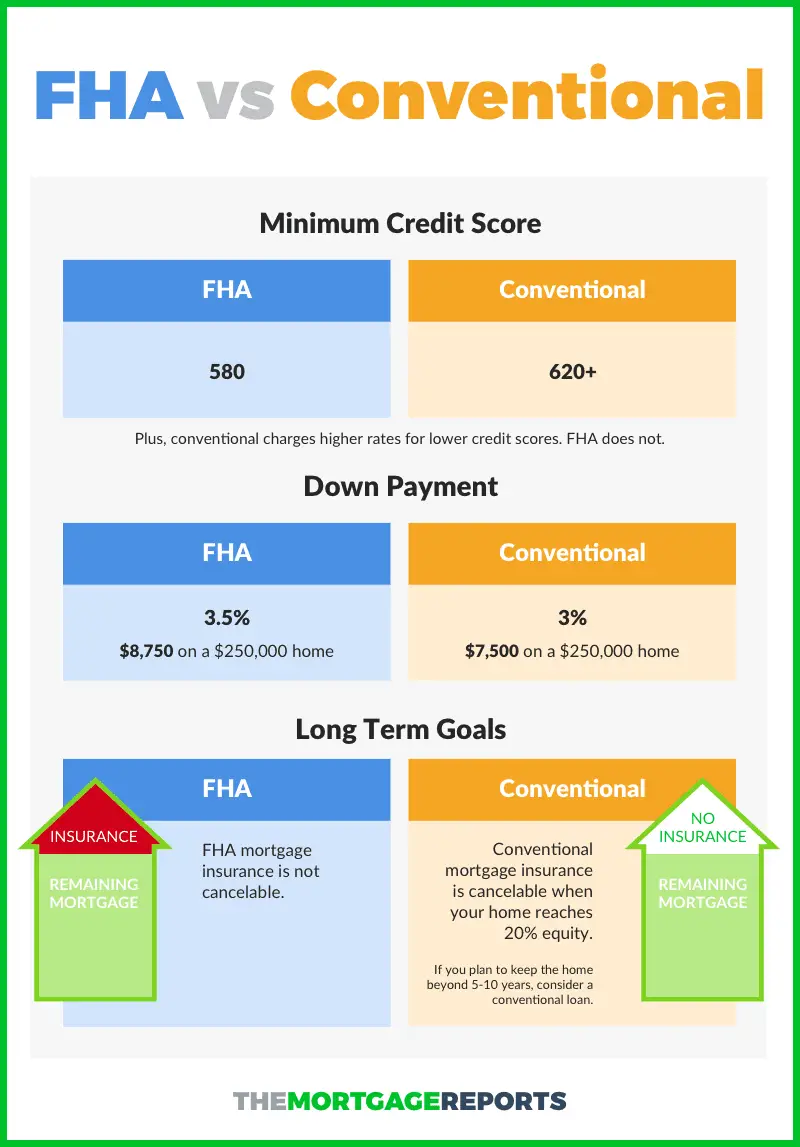

We should start with the key differences between conventional and FHA loans. Its important to understand how these two mortgage products are different, because it relates to the mortgage rate you receive from a lender.

An FHA loan is insured by the federal government through the Federal Housing Administration. This agency falls under the Department of Housing and Urban Development, or HUD. This insurance protects the lender, not the borrower. Lenders who offer FHA loans can file insurance claims if the borrower defaults on the loan down the road .

A conventional home loan does not receive any kind of government guarantee or insurance. This sets it apart from both the FHA and VA programs, which do have government backing. Conventional mortgage products are originated within the private sector. In some cases, a conventional mortgage loan might require insurance similar to the FHA program. But the insurance policy is provided by a company in the private sector not by the government. That is the key distinction between conventional and FHA home loans.

How Do I Compare Fha Loans And Other Mortgage Rates

Typically, FHA loans offer rates that are more favorable than conventional mortgage rates and refinance rates especially for borrowers with lower credit scores. But you need to look beyond the interest rate when comparing offers, and also consider the fees associated with the loans.

An FHA loan has an upfront mortgage insurance premium of 1.75%, in addition to monthly mortgage insurance costs. With a conventional loan, you can waive the mortgage insurance requirement with a down payment of at least 20%. So depending on your situation conventional loans can have more reasonable fees than FHA loans.

Read Also: What Is An Rv Loan

Borrowing Costs Can Vary

The MBA report cited above looks at average rates for FHA conventional loans, with a weekly snapshot taken from loans originated across country. These averages are useful in that they help us identify certain trends, such as the fact that FHA rates can be lower than conventional.

But the actual rate that you receive on a home loan whether its an FHA or conventional mortgage product might be higher or lower than average due to a number of factors.

Mortgage lenders use risk-based pricing when assigning interest rates to home loans. This means that borrowers who are considered a higher risk for the lender are generally charged higher mortgage rates.

Risk can be measured in a number of ways, such as a persons credit score and debt-to-income ratio. The size of the down payment and the corresponding loan-to-value ratio also play a role here.

So keep this in mind when viewing average interest rates and similar reports that cover the industry as a whole. Yes, FHA rates tend to be lower / better than conventional mortgage loans. But this is based on averages. The only way to find out what kind of rate you qualify for is to apply for a mortgage quote from a lender. Better yet, obtain multiple quotes so you can compare costs.

Fha Loans Vs Conventional Loans

It may not always seem clear whether to apply for a FHA loan or conventional loan. FHA loans have typically been known as loans for first-time homebuyers, filled with extra paperwork and complexity since its a government-insured program. But borrowers can use multiple FHA loans for purchasing or refinancing a home loan. However, FHA loans usually may not be used for second homes or investment properties, unless they have been approved by the Jurisdictional HOC.

As a borrower, the additional paperwork for FHA loans is minimal and probably undetectable. The appraiser does have an additional duty to point out any health and safety hazards that are present and require them to be fixed prior to closing. The difference in processing time required for FHA loans as compared to conventional loans is negligible.

The major advantage to selecting an FHA is that easier credit standards must be met to obtain financing. Typically, FHA requires a low down payment amount, lower credit scores are allowed, less elapsed time is needed for major credit problems and, if needed, you can use a non-occupant co-borrower to help qualify for the loan using blended ratios. Blended ratios are debt-to-income ratios that equally blend the borrowers and non-occupant co-borrowers income and monthly payments to qualify for the loan. Except for HomeReady mortgages, conventional loans do not allow non-occupant co-borrowers.

Don’t Miss: What Type Of Loan Do I Need To Buy Land

Report: Fha Mortgage Rates Lower Than Conventional

Home buyers turn to the FHA loan program for a number of reasons. It offers a low down payment of 3.5% and flexible qualification criteria, when compared to a conventional mortgage.

But theres another potential benefit as well. FHA rates are often lower than those assigned to conventional mortgage products. In fact, the latest industrywide surveys clearly confirm this trend.

Each week, the Mortgage Bankers Association publishes a home loan application survey that reveals current trends across the mortgage industry. In their latest survey, published on November 8, the industry group reported the following:

- The average interest rate assigned to a 30-year fixed rate conventional mortgage with a conforming loan balance was 4.18%, for the week ending November 3, 3017.

- The average rate assigned to a 30-year fixed FHA loan was 4.05%, during the same week.

This is just one report that reinforces what weve stated above. FHA mortgage rates are often better and lower than conventional loans at least on average.

Fha Vs Conventional Private Mortgage Insurance

EXPECTED READ TIME: 3 MINUTES

When you’re getting ready to shop for a home loan, you’ll hear the term private mortgage insurance . And on an FHA loan it’s called a mortgage insurance premium . In this article, we’ll discuss what PMI is, and how it compares between an FHA loan vs. a conventional loan. And, most importantly, how to get rid of it. Read on to learn everything you need to know about PMI so that you can choose the right mortgage for you today and tomorrow.

Private mortgage insurance is not homeowner’s insurance. It’s in addition to homeowner’s insurance, which you will need. PMI insures the lender not the borrower. The only advantage PMI has for a borrower is that they can put down a smaller down payment. Let’s expand on that.

For a conventional mortgage, you’ll need to have a 20% down payment of the sales price to avoid PMI. So, if you’re purchasing a $300,000 home, you’ll need $60,000. That’s not an easy feat for most people. Both conventional and FHA loans offer mortgage programs with a low down payment. You can get into a conventional loan for as little as 3-5% down. And FHA has a low down payment requirement of 3.5%.

But this low down payment creates a problem for the lender. The lower the down payment, the higher the risk of default. That’s where the PMI comes in. The PMI protects the lender in case the borrower defaults. With that guarantee, lenders are more willing to loan their money because their risk is lower.

Also Check: Va Loans On Manufactured Homes

Fha Vs Conventional Loans: Interest Rates

Mortgage interest rates are affected by the following high-level factors:

- The state of the economy

- Investor demand

- The Federal Reserve

Though these factors do play a role, its important to focus on the financial factors you can control. Lenders will take into account your credit score, the amount you borrow, your down payment amount, whether you choose an adjustable or fixed-rate mortgage and discount points.

Monthly payments on adjustable rate mortgages change periodically depending on the prevailing interest rate after the fixed-rate period expires. Fixed-rate mortgages keep the same interest amount and payment until you pay off the mortgage.

Discount points are fees paid to a lender to get a lower interest rate. You pay for discount points to enjoy lower monthly mortgage payments over the life of the loan.

Is There A Difference In What Kind Of Home You Can Buy

Both FHA loans and conventional 97 loans have limits on the amount of money you can borrow, though these limits are determined by different factors and sources.

The FHA sets its limits based on the county in which the home being purchased is located, while conventional loan limits are subject to the conforming loan limit set each year by the Federal Housing Finance Agency.

Additionally, the FHA requires an additional appraisal for homes being purchased using an FHA loan. Though this may feel like an added layer of bureaucracy, the agencys higher standards are based on adherence to local code restrictions, as well as ensuring safety and soundness of construction.

FHA loans are not available for homes being sold within 90 days of a prior sale.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

What Are The Benefits Of A Conventional Loan

Conventional loans are not as expensive to obtain as a FHA loan is. Conventional loans have more flexible payments, and they usually have lower interest rates and closing costs. Traditional mortgage loans also have fewer fees associated with them than FHA loans do.

When considering whether to make the switch from an FHA loan to a conventional loan, there are many benefits of switching. For example, with a conventional loan, you only need to pay for private mortgage insurance and property taxes which are not included in the FHA loan. Additionally, your monthly payments will be less with a conventional loan. Overall, it is better for your finances to go with a conventional loan when possible.

What Are Fha Loan Requirements

Every year, the Federal Housing Administration, along with a slew of assisting government agencies, publishes their 1,000-plus-page FHA loan handbook.

If federal loan manuals dont make your reading list cut, no problem. Weve summed up the top FHA loan requirements applicable to todays prospective home buyers:

Note: FHAs mandatory mortgage insurance requires borrowers to pay not one but two mortgage insurance premiums: Upfront premiums and annual premiums.

- Upfront mortgage insurance premium: Currently, upfront insurance premiums for FHA loans are a small percentage of the total loan amount. It is paid as soon as the borrower receives their loan.

- Annual mortgage insurance premium: Like upfront mortgage insurance premiums, annual mortgage insurance premiums are calculated based off of a small percentage of the total loan amount.However, variables like loan terms also influence rates. This premium is paid monthly, with installments calculated by taking the premium rate and dividing it by 12 months.

Recommended Reading: Auto Refinance Calculator Usaa

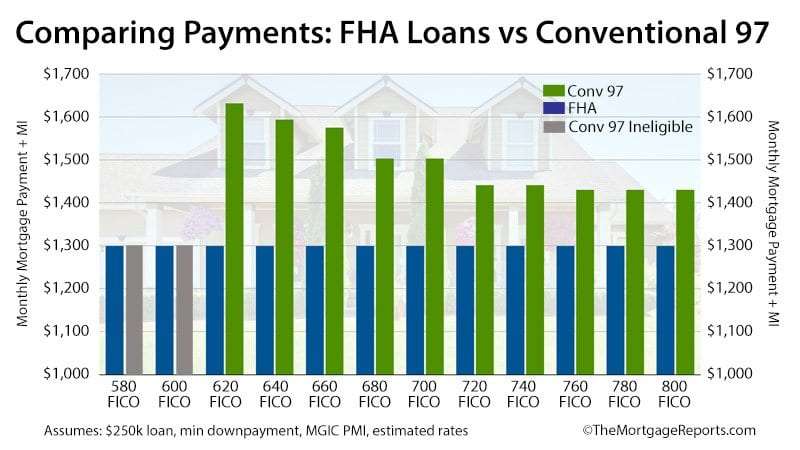

Are Fha Loan Rates Really Lower Than Conventional Loan Rates

Average FHA loan rates arent necessarily lower than average conventional rates. However, the rate you receive will typically be lower than the rate youd receive if you got a conventional loan under the same terms. This is especially true if you have a lower credit score and a low down payment.

Lenders can afford to offer FHA loans at a lower rate because the government helps ensure they dont face substantial losses if a borrower defaults. This reduced rate can make a big impact for borrowers.

However, because FHA loans have lower down payment requirements , your monthly mortgage payments might not be lower than theyd be on a conventional loan. If you qualify for an FHA loan with a 3.5% down payment, you may have to borrow more and face higher payments.

The table below shows how a conventional and FHA loan might look like if you wanted to buy a $300,000 house.

| FHA Loan | |

| $205 | $0 |

Because you put 20% down on the conventional loan in this example, you do not have to pay for PMI. However, you do have to pay for FHA mortgage insurance equal to 0.85% of the loan value for your FHA loan, and youre required to pay this for the life of the loan if you put down less than 10%.

You are also required to pay an upfront fee for mortgage insurance when you take out an FHA loan, which you dont have to pay on a conventional loan even if you put down less than 20%.

Do Fha Finances Have Higher Passion Rates

FHA rates will certainly be higher than conventional rates when the customer has reduced credit history. Although FHA finances are assisting to make own a home a lot more inexpensive, reduced credit history signify high danger to FHA lending institutions. The reduced ball game, the higher the price will certainly be.

Recommended Reading: Can Other Than Honorable Discharge Get Va Loan

Header Keywords: The Title The Headline Content And Seo

There are so many different loan types, calculators, and loan programs today. The largest one is the Federal Housing Administration loan. These loans usually have low down payments and less stringent credit requirements. They come in five different types of plans with a fixed rate for a set term such as 30 years or 15 years with 30 or 15 years of amortization respectively. There are some other mortgage options in the form of conventional loans, jumbo mortgages, interest-only mortgages, private mortgages, or adjustable rate mortgages.

As a mortgage calculator, the Mortgage Calculator can help you make educated decisions about whether or not to take out an FHA loan. Unlike conventional mortgages, the FHA loans require less paperwork but have stricter guidelines. The individual must be an eligible borrower for both types of loans and must meet certain credit requirements for a conventional mortgage as well.

What Iis A Va Loan

Similar to FHA loans, VA loans are government-backed mortgages that are partially guaranteed by the U.S. Department of Veterans Affairs . They are issued by independent financial institutions, which are able to offer more favorable terms since the VA guarantees a portion of the funds.

VA loans are specifically designed to help service members, veterans and eligible surviving spouses become homeowners. They can be used to purchase a property as a primary residence or refinance an existing mortgage.

You May Like: How Much To Loan Officers Make

Increase Your Down Payment Amount

Many people are attracted to FHA loans because they require such low down payments. But a larger down payment could help you qualify for a better rate and also reduce the risk of ending up owing more than your house is worth if its real estate value declines.

A higher down payment could also help you to avoid being stuck with lifetime mortgage insurance, which is based on the size of your down payment and your loan amount, and which can add thousands to the cost of your loan.

Major Differences Between The Loans

With the affordability of conventional loans increasing, more borrowers are looking for ways to get into a new home. However, many people have been fooled by the thought that FHA loans would be cost prohibitive for them. There are some major differences between the two types of loans, so it is important to know which type is right for you.

The FHA loan is backed by the US government and can help you obtain a mortgage at rates that are always less than those of conventional loans.

Also Check: Usaa Car Loan Pre Approval

Condition Of The Property

When you compare conventional loan vs FHA loan, the condition of the property and the intended use are important factors to consider. FHA appraisals are a lot stricter than conventional appraisals. Why? Because they dont only assess the value of the property, but also the safety, adherence to local codes, and the integrity of the construction. FHA loans are meant for a primary home where youll be living at, so homes that are going to be flipped or investment properties dont qualify for this kind of loan. On the other hand, conventional loans can be used to purchase a primary home, an investment property, or even a second home.

Which One Offers Lower Rates

Which kind of mortgage loan offers lower interest rates, FHA or conventional? The answer is that it depends.

Your mortgage rate is primarily determined by your credit score, the size of the loan, the amount of your down payment, and the rate structure . Those are the primary factors that will determine the mortgage rate you receive from a lender. Choosing an FHA or conventional loan has a lesser impact on the rate you receive.

With that being said, some surveys have shown that FHA borrowers receive lower rates than conventional mortgage borrowers, on average. Perhaps this is due to the government provided insurance that we discussed earlier. Lenders might be willing to offer better mortgage rates for an FHA loan, because they know they are insured up to a certain amount in the event of borrower default.

But this is just one factor of several that can affect the rate you receive from a mortgage lender. Here are some other factors:

Disclaimer: This article answers the question, do FHA loans offer lower rates than conventional? Every lending scenario is different because every borrowers different. So your situation might differ from the scenarios mentioned above. The best way to find out what kind of mortgage rate you can get is to request a quote from a lender. We encourage borrowers to get multiple quotes so that they can comparison shop for the best deal.

You May Like: Drb Student Loan Refinance Reviews