A Problem With Preapproval

If you have top-tier credit, usually meaning a FICO score of 700 or better, you may not need to have your credit run to know what interest rate a credit union or bank will offer on a car loan. Top-tier credit will almost always get the lowest interest rate and a visit to a credit union’s website or a quick call to a bank is all it takes to find out what that is. Once you know your interest rate, figuring out a payment using an Edmunds calculator is a snap.

But it’s not as snappy for the borrower whose credit is not tip-top. Rates for second- and third-tier credit scores are almost never advertised, so anyone whose credit is fair, average or good but not quite excellent has to guess the loan’s annual percentage rate and the corresponding car payment. The only way around that is to let a potential lender run a hard credit inquiry.

Some car buyers find that worrisome, for good reason: If they’ve recently had other hard credit inquiries, one more could result in an immediate drop in a credit score, putting a good loan out of reach.

Another Option: Bring Your Own Report

If you don’t want to get preapproved, prequalified or guess a dealer’s interest rate, there is a fourth option: Run your own credit report and take it with you to the dealership. The Fair Credit Reporting Act requires the three credit agencies Equifax, TransUnion, and Experian to provide you with a free credit report once a year. This report won’t include your score, however. The agencies will charge an additional fee if you want that, so have a credit card ready.

Getting your report only takes a few minutes once you’ve logged in, and since this is a soft credit inquiry, it won’t hurt your score. Once you’ve accessed your report, be sure to print the whole report not just the summary and spend a few minutes with a finance or sales manager. The manager should be able to tell you what rate you’d qualify for on the spot.

Hard Vs Soft Credit Inquiries

Hard inquiries are what lenders use when you apply for a loan or credit card. This inquiry will stay on your credit report for up to two years. A single inquiry will likely shave 2 to 8 points from your score.

A couple of points shaved off your credit would typically not be a big deal. But some people seeking preapproved car loans report that their scores have reduced as much as 50 points because of multiple hard inquiries. Such cases aren’t the norm, but the even a small drop is trouble for shoppers whose credit score is on the bubble. The loss of just a few points can mean the difference between qualifying for a loan with a low APR or one with a considerably higher rate.

During the dozen years I sold cars, I saw plenty of shoppers miss out on good financing because their score was 7 to 10 points below the acceptance threshold for a particular credit tier. As a consequence, these shoppers had to pay hundreds and sometimes thousands of dollars in extra interest over the life of the loan.

On the other hand, there’s the “soft” inquiry, which is a credit check that takes place apart from an actual loan or credit card application. An example would be an employer checking your credit before offering you a job or an insurance company checking your credit before providing you a coverage quote. These inquiries will show up on your credit report, but they won’t affect your score.

Read Also: Sofi Student Loan Refinance Rates

Tips For A Successful Car

Buying a car today is almost nothing like it was just a few decades ago, with online lending networks and digital loan applications now the new normal. But, even though buying a car is easier today than it used to be, it doesnt mean the process is entirely without hurdles especially for car-buyers with bad credit.

With an average price well into the five figures, a vehicle is no small purchase, so it pays to be careful throughout the process to ensure you dont wind up with a bad deal. And this means more than simply trying to get the best interest rate on your loan here are a few more tips for making your car-buying experience a successful one.

Capital One Auto Finance

Capital One Auto Finance offers soft pull prequalification of car loans. Yes, its the famous credit card company that you know and trust.

To prequalify, you must be looking to finance at least $4,000 for a new or used vehicle available at a participating dealer, and the minimum monthly income required is $1,500 to $1,800, depending on your credit qualifications. If you prequalify, youll be shown your monthly payment amounts, APRs, and offers for vehicles you may be considering.

You have up to 30 days to complete the vehicle purchase before your prequalification expires. Accepting a loan offer may require you to approve a hard pull credit check.

Read Also: What Is Portfolio Loan In Real Estate

Ready To Get Prequalified

With a prequalification offer, you will know within minutes your potential borrowing power. Use the offer to open an auto loan, credit card, or personal loan. This will all be done without impacting your credit. And if you like the offer, you can easily accept the terms and complete the process within minutes.

Not a member of Sound? No worries. You can still access your offer and if you like it, a savings account with no minimum balance requirement, will be opened for you during the loan acceptance process. Being a member of Sound is a requirement to participate in this offer and if you live or work in Washington State you’re eligible to join.

What Is A Soft Credit Inquiry

A credit check when you are not applying for a new line of credit is called a soft credit inquiry, or soft pull. For example, if an employer checks your credit, theyll execute a soft pull. Soft credit inquiries do not affect your credit score.

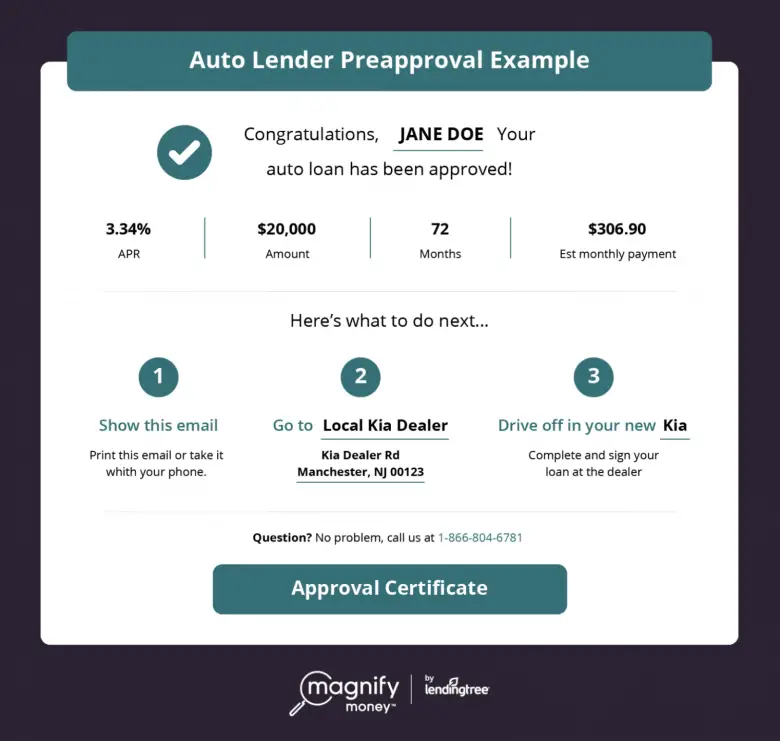

Auto loan pre-approval is another example of a soft credit inquiry. But what is pre-approval?

Also Check: How Long To Get Approved For Student Loan

Get Protection From Financing Markups

Dealer financing is convenient, but if you havent shopped around, a dealership finance manager might take advantage of that by . Dealers have a number of lenders they work with at predetermined rates for a given financial profile. They can add a certain amount as much as 1 or 2 percentage points to your approved rate. That can add up to hundreds of dollars over the life of your loan.

Youll want to fill out a credit application at the dealership anyhow. The dealer may be able to beat your rate. Often, dealers have access to cheaper financing through captive lenders banks set up by the car companies just to make auto loans which can offer rates that are lower than those at other banks.

Receive Your Loan Check

Once you’ve been preapproved, we’ll issue a check with your funds. You can pick it up at your nearest branch or have it mailed to your home.

The amount on the check is how much you’ve been approved forbut you dont have to use it all.

Youll only be responsible for the amount youre applying toward the car.

Recommended Reading: Is Personal Loan Secured Or Unsecured

Can You Be Denied A Car Loan After Pre

Certainly, pre-approval is no guarantee that your vehicle loan wont be denied on any number of grounds. Information learned through a credit check may defeat your chances for final credit approval.

For example, if youve been convicted of fraud, a dealer may be unwilling to do business with you unless much time has passed.

Other events that may deep-six your loan include prior delinquencies, repossessions, collections, write-offs, settlements, garnishments, foreclosures, bankruptcies, and legal judgments.

Most derogatory information ages off your credit reports within seven years, although some bankruptcies may remain on your reports for up to 10 years. Therefore, you have cause for hope even if your loan is denied now, it may be approved later on if enough time has passed since your last major financial problem.

Many folks with blemished credit reports hire the services of a that will aggressively work to challenge and remove unverified, incorrect, or misleading information from your credit history. You can attempt to do this yourself, but it requires time, patience, and an understanding of how this process operates.

Not all credit repair companies are reputable, so we urge you to check our recommendations and third-party ratings before signing up.

Keep in mind that there will be little that a credit repair service can accomplish if your credit reports are already clean. Thats why they cant guarantee significant results in terms of lifting your credit scores.

What Is The Minimum Credit Score Needed For A Car Loan

Our research indicates that some lenders have no minimum credit score requirements for an online auto loan. Auto Credit Express, Car.Loan.com, and Carvana fall into that category, as does LendingTree Auto Loan . Capital One Auto Finance offers car loans to consumers with a minimum credit score of 500.

Even though some lenders say they have no minimum credit score, your chances of getting an online auto loan when your credit falls below 500 are not too good. But since all the lenders in this review can prequalify you without a hard pull, youve literally got nothing to lose by attempting to prequalify for an auto loan from any of them.

You May Like: Rate For Home Equity Loan

What To Watch Out For With Loan Prequalification

Keep in mind that a prequalification isnt a guarantee that youll be approved for a loan. You still have to get final approval from the lender.

Keep your eyes on the loan terms before you sign your loan agreement, including these important figures.

- Loan amount How much you can borrow

- Interest rate and annual percentage rate How much you pay to finance the loan

- Loan term How many months youll have to pay back the loan

- Monthly payment The minimum payment each month over the life of the loan

Does Preapproval Guarantee A Car Loan

Unfortunately, preapprovals do not guarantee youll be approved for a car loan. The auto loan preapproval process is built to be fast, which means the underwriting of the applicants riskiness is minimal.

If you pass the auto loan preapproval step, youll have cleared a major obstacle to final approval, but you must prepare yourself for the possibility that your credit application will ultimately be declined.

Preapprovals can thus be seen as a process in which multiple lenders winnow away the least creditworthy consumers. Only after preapproval will lenders be willing to foot the extra expense of performing the due diligence necessary for final loan approval. This is why you can be preapproved in seconds, but final approval may take considerably longer.

You May Like: Navy Federal Loan Calculator Auto

Gather The Following Information To Submit With Your Application:

Note: A preapproval can only be used to buy from a dealership, not a private seller.

Now Featuring Experian Boosttm

700Credit is excited to offer Experian BoostTM to all QuickQualify customers who are using Experian to pull credit. This exciting new tool, from one of the leading lenders in the market, can give your thin file customers that extra push they may need to feel confident when visiting your dealership.

You May Like: What Is Refinance Home Loan

Is Chrysler Capital Pre

Just making sure that this truly is a soft pull because I’m not ready to make a decision yet. Still exploring which vehicle I want and as you know, there’s slim pickings right now.

anyone have experience with this?

@Ev40x40 wrote:

Just making sure that this truly is a soft pull because I’m not ready to make a decision yet. Still exploring which vehicle I want and as you know, there’s slim pickings right now.

anyone have experience with this?

I don’t have recent experience with it, but in 2020 it was a soft pull… it told gave me an amount I supposedly qualified for and an interest rate.

About two hours after application the local dealership started calling me. Just a warning if you’re anything like me and don’t want sales people giving their advice until you’ve narrowed down on your own what you think you want.

EQ:608, EX:617, TU:625 EQ:695, EX:703, TU:720Goal Score: 740+Member of the Synchrony Bank giveth then Taketh away April 2020 Club! $86,900 in available credit gone without warning.Newest Account July 8, 2020 — Last HP October 24, 2020 — Gardening Goal: August 2022 and reach 0/24

What Is Better: Pre

Going through pre-qualification for an auto loan is a good idea at the start of your loan-hunting process when you have no idea about the rates and lenders. Pre-qualification will only need a soft credit pull. However, once you have zeroed in on a lender and have finalized the loan amount, its best to apply for pre-approval to see if the loan can come through. This will include a hard credit pull which may temporarily affect your credit score.

Also Check: Can I Refinance My Gm Financial Loan

Where Can I Get Prequalified For An Auto Loan

The five companies we review here all prequalify auto loans. That means you can quickly find out whether its worthwhile to apply for a loan without risking the damage to your credit score inflicted by a hard pull.

The companies are of two types. The first, consisting of Auto Credit Express, Car.Loan.com, and MyAutoLoan.com, are loan-matching services. They each work with a network of lenders and car dealers that are willing to lend to subprime consumers. These companies perform only soft pulls because they only prequalify you for a loan from the car seller.

When a matching service successfully prequalifies you for a loan, it then finds one or more lenders/dealers in its network that indicate their willingness to work with you. If you agree to it, the lender/dealer will perform a hard pull and then possibly offer you a loan. The lender/dealer sets the loan term and rate based on the information it receives from you and from the credit report it pulls.

The other two lenders, Carvana and Capital One Auto Finance, also perform prequalifications, but they are the lending entities as well. They are not matching services rather they finance your loan internally. If you prequalify for a loan, these two lenders will perform a hard pull before rendering a final decision on your loan offer, including loan term and rate.

What Will I Need To Get An Auto Loan Preapproval

Application requirements for car loan preapproval are often the same or looser than a regular car loan application.

- Loan information: How much you want to borrow and the loan term

- Personal information: Name, contact details, date of birth, Social Security number

- Residence information: Address, length of residency, whether you rent or own, rent or mortgage payment

- Income information: Gross annual income, employer name and contact details

The lender may ask about the car you want to purchase. You could always change the vehicle by contacting the lender if you change your mind after test driving.

You May Like: What Is The Fha Loan Requirements

How To Get A Preapproved Auto Loan

Plenty of financial institutions offer car loan preapprovals, but some of the most common are:

- Your local credit union could be a great first place to check. Credit unions tend to offer lower auto loan rates than banks and many have lenient membership requirements, such as a one-time, nominal donation to a nonprofit.

- Banks: National banks offer convenience, providing additional services like credit cards, saving and checking accounts in addition to auto loans. Keeping all of your financial transactions with one entity makes it easy to stay organized, and may even qualify you for bundles and discounts.

- Online lenders: Without the overhead that credit unions and banks face, online lenders can offer competitive rates. If youre comfortable completing the car loan process entirely online, an auto loan preapproval from an online lender could be the best choice. You could fill out an online form at LendingTree and get up to five auto loan offers at once.

It doesnt harm your credit score to apply to multiple lenders any more than it does to apply to one. As long as you do all your applications within a 14-day window of time, the three major U.S. credit bureaus count multiple inquiries for the same type of loan as one hard pull against your credit.

It Helps You Plan Your Money Moves

Budgeting before you hit the blacktop is a great plan, and getting a preapproval can help you eliminate the guesswork by providing estimates on monthly payments. Dont forget: When youre looking at car prices, leave at least a 10% buffer to account for taxes and fees. Use a car affordability calculator to help you plan your purchase.

Don’t Miss: Guaranteed Loan Approval Bad Credit

Reasons To Apply For Auto Loan Pre

Applying for pre-qualification with multiple lenders has the following benefits:

- You can determine if your credit is sufficient enough to get good APRs

- It allows you to skip dealership lending which usually only gives you one option and one rate

- It gives you the upper hand when negotiating with other lenders