How Long Does It Take To Pay Off $30000 In Student Loans

This mainly depends on your interest rate and whether you can afford to pay extra on the loan.

For example:

But if you increase your monthly payments by $50, you could pay off your loan almost two years earlier. This would also save you $1,344 in interest over time.

You could also consider refinancing your student loans to get a lower interest rate or to shorten your repayment term. While this might increase your monthly payments, youd save money on interest and be able to pay off your loans sooner.

You can use our calculator below to see how much you can save by refinancing your student loans.

Step 1. Enter your loan balance

Checking rates wont affect your credit score.

Emily Guy Birken is a Credible authority on student loans and personal finance. Her work has been featured by Forbes, Kiplingers, Huffington Post, MSN Money, and The Washington Post online.

Student Loan Debt The Fastest

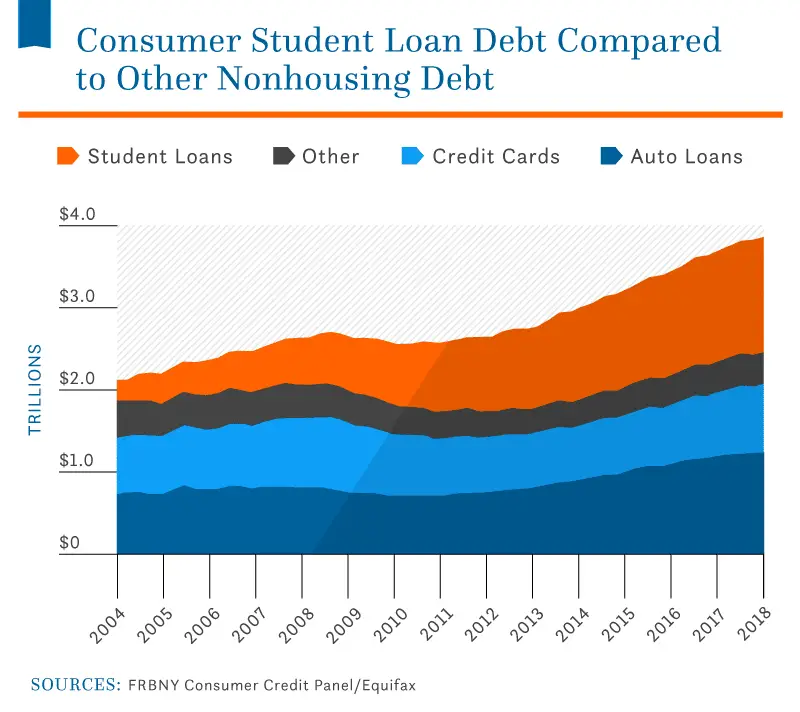

Student loan debt, the fastest-growing debt in the U.S, is currently the second largest slice of household debt trailing only mortgage debt and surpassing credit card and auto loan debt.

Apparently, obtaining a four-year Bachelors or Masters degree and furthering your education is sure to cost a pretty penny.

Total student loan debt over the years

Average Student Loan Debt Statistics

- Among borrowers with outstanding student debt, the median debt amount in 2021 was between $20,000 and $24,999.Go to footnote

- In 2020, bachelor’s degree earners from public and private nonprofit four-year schools who graduated with student debt had an average debt of $28,400.Go to footnote

- Among those who earned their bachelor’s degree from private and public nonprofit schools in 2020, the average student debt ranged from $18,344 in Utah to $39,928 in New Hampshire.Go to footnote

- The average student debt among all bachelor’s earners from nonprofit public and private schools increased at an average rate of 4% per year between 1996 and 2012. It leveled off around 2016.Go to footnote

Also Check: What Do I Need To Get Personal Loan

How To Pay Off Law School Debt

Dont let the size of student loan debt for law school scare you away from pursuing your dreams of a career in the courtroom. Paying off debt requires smart budgeting and taking advantage of every available option to save money. Consider some of these strategies:

- Research loan forgiveness options: If you have federal student loans, there are two repayment plans that could forgive a portion of your debt: income-driven repayment plans and Public Service Loan Forgiveness.

- Find loan repayment assistance programs: Some states offer assistance for repaying loans, and the American Bar Association highlights more than 100 institutions that offer loan repayment assistance for working in public service. These programs typically have income thresholds you cannot exceed in order to qualify.

- Refinance your debt: Depending on your credit, you might benefit from refinancing your loans. Doing so could net you a lower interest rate or monthly payment, though its usually not the best choice if you have federal loans.

- Make debt part of your interview discussions: Once you are far enough along in the job hunt that youre starting to receive offers from firms, ask about employer contributions to your monthly debt payments. As law school continues to get more expensive, some firms are opting to help offset some of the recurring costs to reduce the financial stress on young employees.

Student Loan Debt By School Type

Graduates from private, non-profit colleges have more debt than those who attended public colleges.Go to footnote Graduates of for-profit colleges are most likely to have high debt and difficulty repaying.

Federal student loans are more widely used among public and private non-profit college students, suggesting that students who attend for-profit colleges may rely more on private loans, which have higher interest rates.

- As of the end of the first quarter of 2022:Go to footnote

- 25.3 million students who attended public colleges owed $705.7 billion in federal student loans.

- 13.7 million students who went to private non-profit colleges owed $552.9 billion in federal loans.

- 12.4 million students who attended private for-profit schools owed $277.3 billion in federal loans.

Recommended Reading: Why Is Conventional Loan Better Than Fha

Extreme Student Loan Debt

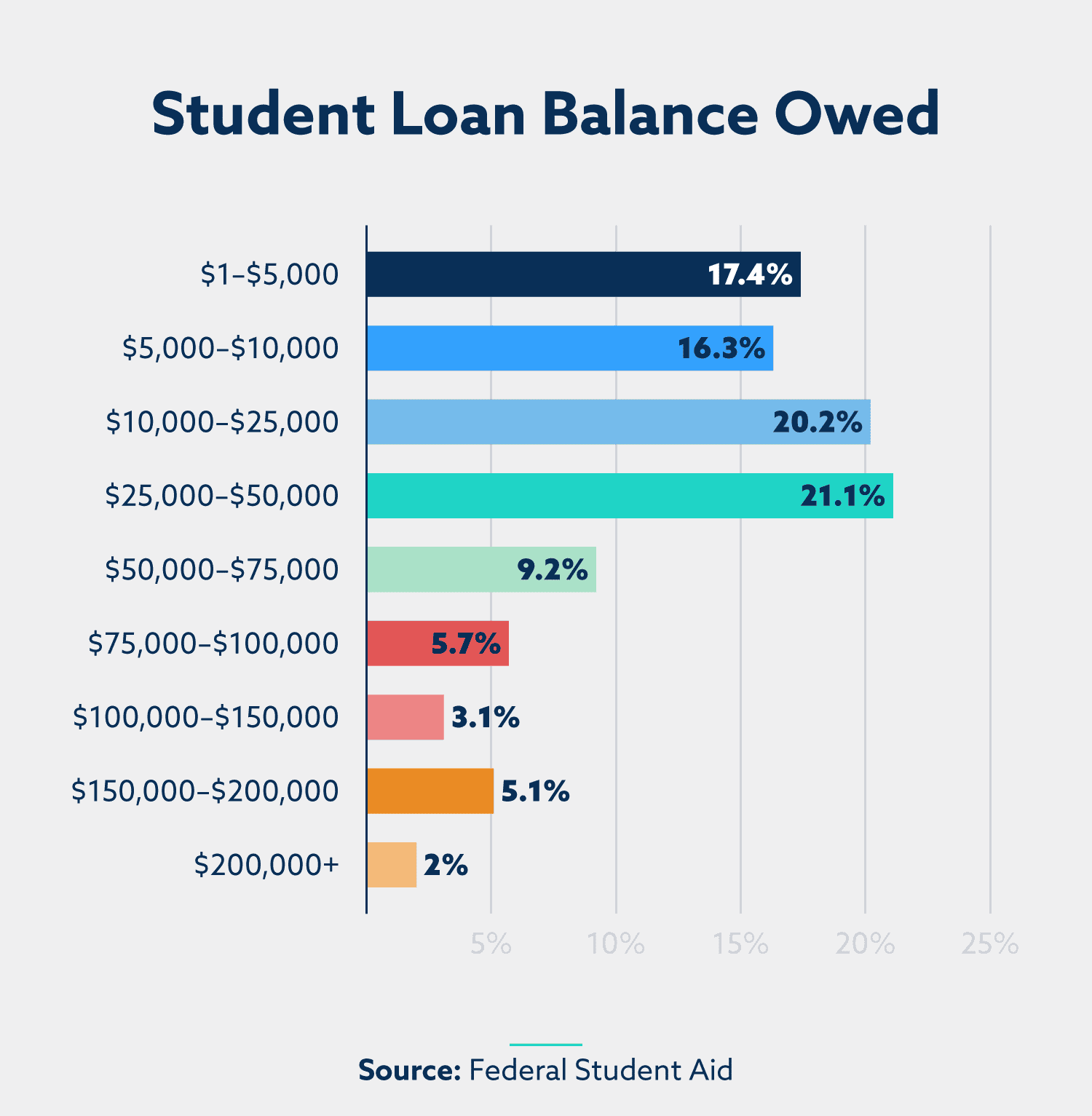

Among federal student loan borrowers, there are relatively few who have six-figure debt:

| Percentage of borrowers who owe less than $40,000 | 75% |

| Percentage of all student loan debt held by those who owe $100,000 or more | 37% |

While only a small fraction of borrowers owe $100,000 or more, that group owes a disproportionate amount of total student loan debt: $580.3 billion. Thats more than a third of all outstanding federal student loan debt.

Keep in mind that much of this extreme debt is made up of loans for graduate school or professional programs. In comparison, most federal student loan borrowers owe less than $40,000.

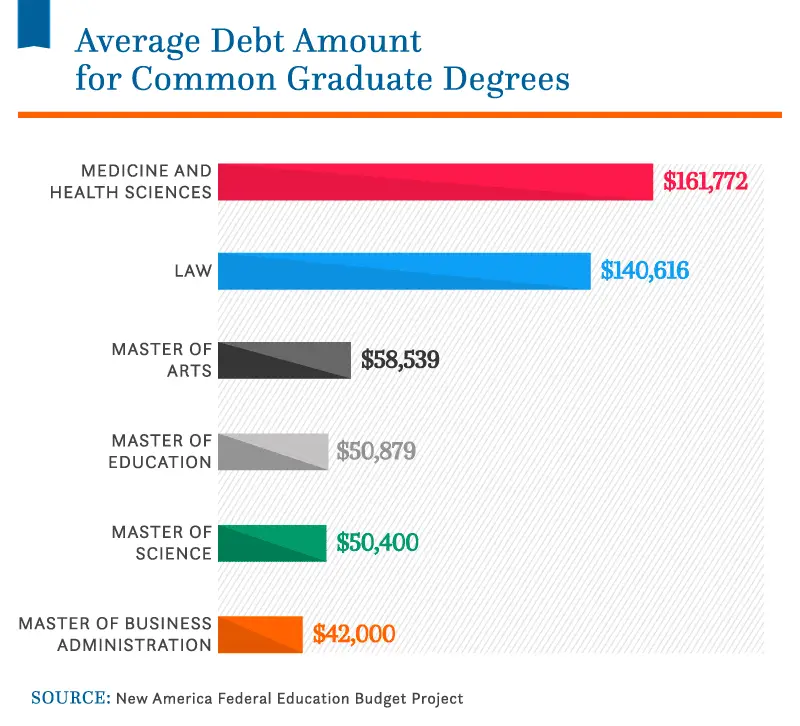

Which Graduate Degrees Are Students Most Likely To Borrow

A medical degree is the most time-consuming and expensive of all graduate degrees. Doctors graduate from medical school with an average debt of $161,772. Lawyers had an average of $140,616 in outstanding student loans, whereas educators had an average of $50,879 in outstanding loans. MBA graduates had the lowest average student loan debt of any degree candidate, with an average student loan debt of $42,000.

Read Also: What Is The Best Home Loan For Bad Credit

Average College Debt By State

When we look at the average student loan debt broken down by school and region, it also becomes clear there is a range of highs and lows across the country.

The Institute for College Access and Success puts together a comprehensive report on national student debt, using numbers self-reported to college guide publisher Petersons from thousands of colleges and universities.

The numbers reported by schools varywith average debt among graduating students ranging from $17,935 to $39,410but it does allow for a geographic look at the average student loan debt by state.

The highest debt states in 2019, the last year for reported numbers, were New Hampshire , Pennsylvania , and Connecticut . The states where college graduates had the lowest average debt were Utah , New Mexico , and Nevada .

Expected College Debt For A 2022 High School Grad

A 2022 high school graduate could expect to borrow $39,500 for their bachelors degree, according to a May 2022 NerdWallet analysis of National Center for Education Statistics data. Around 45% of high school graduates are expected to enroll in college, NerdWallet found. Among those students, around 42% are expected to take on student debt over an average five years to attain a bachelor’s degree.

Read Also: What’s Better Home Equity Loan Or Line Of Credit

How Are Student Loans Repaid

Slowly or in many cases, not at all. A sizable chunk of student loans are in limbo or totally abandoned.

- 3.3 million borrowers are currently deferring their federal student loans. In this instance, deferment means that interest doesnt accrue.

- 2.6 million borrowers currently have federal student loans in forbearance. Interest is still piling up for them.

- An astounding 4.7 million borrowers have their federal student loans in default. That means that 10% of all people with student loans havent made student loan payments on their debt in more than 9 months.

- Students that left college before completing their degree are more than twice as likely to eventually default on their loans compared to students that graduated.

- More than half of all defaulted debts are on loans that amount to less than $10,000.

Learn More About Managing Your Student Loan Debt With Nitro College

Managing your student loan debt can be stressful, especially for recent graduates. However, there are plenty of resources out there to help make paying back your student loans much less stressful. Nitro College aims to provide resources for high school students, college students, and graduates for the best ways to pay back their student debt.

With Nitro College, you can get advice on every step of your college career: from applications to student loan repayment. Visit our blog to learn about more useful resources and advice to help you throughout your college career and beyond.

Recommended Reading: How Much To Put Down With Fha Loan

Average Student Loan Repayment

Americans take an average of 20 years to pay off their student debts, while it can take up to 45 years or more. With an average student loan debt interest rate of 5.8 percent, many of those borrowers saw their loan debt increase over the first five years.

How does that appear in practice? If you make the average monthly payment of $393 on a $38,792 student loan with a 5.8 percent interest rate, it will take you 11 years to pay it off. Youll also wind up paying $14,052.09 in interest!

If you take 30 years to pay off the same loan , youll wind up paying $43,526.30 in interestmore than the initial amount borrowed! Ouch.

And if youre wondering whether student loan debt is worth it, consider this: 44 percent of high school graduates will attend a four-year college, but only around two-thirds will graduate. And if you take out a student loan but dont finish your degree, you still have to pay it backplus interest.

Federal And Private Loans

- Types of loans students opt for are categorized as either federal or private. About 92% of all student loans fall into the Federal category, making it the more prominent kind. To compare, Private student loans make up only 7.89% of all student loans in America, while the cumulative private student loan debt reaches $131.10 billion.

- The average debt for students who choose one or the other differs severely, while the average federal loan debt per student is $36,510, for private loans the number is much different. The average private loan debt per student is $54,921. The interest rates for private and federal loans also differ, with federal student loans having an interest rate ranging from 4.99% to 7.54% and private student loans having an interest rate from 3.22% to 13.95%.

- Scholarships are one of the most common means to help students afford their education. However by comparison to the cost of education, the average scholarship is less significant than one might hope hovering around only $7,400.

Federal Loan Debt by level of degree attained:

On average the private loan debt for students is roughly $54,921.

You May Like: Can You Include Closing Costs In Loan

Why Is American Student Debt So High

There are a few factors why American student debt is so high. These include the rising cost of tuition, the growing availability of federal loans, and wage stagnation. Between 1980 and 2019, college costs grew by 169%. For the same period, wages for adults between the ages of 22 and 27 increased by 19%.

Tepslf Application Denial Reasons

Congress passed the Temporary Extended Public Service Loan Forgiveness program as an attempt to fix the problems borrowers were having with the PSLF program.

Naturally, the TEPSLF process initially has been more complex than PSLF because you first must apply for PSLF, get denied, and then apply for TEPSLF.

The U.S. Department of Education is simplifying this process currently. Here are the reasons borrowers get denied for the Temporary Expanded PSLF.

You May Like: How Much Loan Can I Get On 60000 Salary

Size Of Student Loan Debt By Race

According to the Board of Governors of the Federal Reserve System, at $44,880 on average, Black borrowers took out the largest amount of federal student loan money in 2019. Although Other was technically the second highest, at $40,400, its unclear from the Feds website which groups comprise this category, which limits its effectiveness in comparisons. White borrowers accounted for the second-largest amount for a single group. Finally, Hispanic borrowers took out the smallest amount on average, at $30,890.

Of note: When the Fed began recording this data in 1989, Black borrowers had the smallest amount of student loan money. They overtook all other categories after 2010, with one dip in 2013.

A sobering statistic: In 2019, the Institute on Assets and Social Policy found that the average Black borrowers still owed 95% of their original loan amount after two decades, compared to white borrowers who, on average, have paid off most of their student debt.

Looking at the intersection of race and gender, the general trends are relatively similar to what the Fed reported. Heres what the American Association of University Women found:

Additional discrepancies can be seen in how loans are distributed, depending on both race and where the student studied. This is what the Student Borrower Protection Center reported :

Federal Student Loan Debt Freeze

Introduced between the second and third financial quarter of 2020, the CARES Act offered student loan debt relief that affected an estimated 35 million borrowers.

- Between 2020s 2nd and 3rd financial quarters, the amount of student loan debt in repayment decreased 82% while student debt in forbearance increased 375%.

- Between the 3rd and 4th financial quarters, student loans in forbearance declined 0.44%.

- Also during that period, the number of loans in repayment grew 33.3%.

- The number of loans in default also declined by 1.79%.

- 56.65% of all debt from federal student loans remains in forbearance until September 2022.

- 22.2 million or 48.8% of borrowers have loans in forbearance.

- 400,000 or 0.88% of federal student loan borrowers have loans currently in repayment, which is a 97.8% decrease from the 2nd financial quarter when 40.1% of borrowers had loans in repayment.

- 8% of the student loan debt balance belongs to students who are still in school.

- 2.81% of the total federal student loan debt is in a grace period.

- 7.8% of federal debt is in defaulted loans.

| Year |

|---|

| 4.69% |

Read Also: Sba Loans For Self-employed

Average Number Of Student Loans Per Borrower

Of undergraduate students who borrow federal student loans to pay for a Bachelors degree, more than 95% borrow for at least four years.

On average, 85% of undergraduate students who borrowed a subsidized Federal Direct Stafford loan also borrowed an unsubsidized subsidized Federal Direct Stafford loan, based on data from the 2015-2016 NPSAS. Likewise, 85% of undergraduate students who borrowed an unsubsidized Federal Direct Stafford loan also borrowed a subsidized Federal Direct Stafford loan.

Thus, the typical student who borrows for a Bachelors degree will graduate with 7.5 or more Federal Direct Stafford loans, including both subsidized and unsubsidized loans.

About 11% also borrow institutional or private student loans and about 6% borrow institutional or private student loans without federal student loans. That brings the average number of student loans to 8.2 loans.

Thus, the typical number of student loans at graduation with a Bachelors degree will range from 8 to 12. This does not count Federal Parent PLUS loans.

Q Which Student Loan Borrowers Are Most Likely To Default

A. Accordingto researchby Judy Scott-Clayton of Columbia University, Black graduates with abachelors degree default at five times the rate of white bachelors graduates21%compared with 4%. Among all college students who started college in 200304 , 38% of Black students defaulted within 12 years, comparedto 12% of white students.

Part ofthe disparity is because Black students are more likely to attend for-profitcolleges, where almost half of students default within 12 years of collegeentry. And Black students borrow more and have lower levels of family income,wealth, and parental education. Even after accounting for types of schoolsattended, family background characteristics, and post-college income, however, thereremains an 11-percentage-point Blackwhite disparity in default rates.

Recommended Reading: What Bank Gives The Lowest Auto Loan Rates

Average Student Loan Debt In Us By Year

Federal loans account for over 90% of outstanding student debt, however, there are over six million borrowers who currently have nonfederal education loans. Currently, private loans comprise around 8% of total student loan debt.

- The average federal student loan debt per borrower is currently at $37,175, with a total of $1,591.1 billion in federal student loan debt nationwide.

- The private loan market was $92.6 billion in 2014 an amount that has shown a 47% increase, representing $136.3 billion today .

- In current dollars, the average borrower student loan debt has increased by 74% from the Class of 2000 to the Class of 2021, from $17,550 to $30,600 .

- Private student loan debt amounts for approximately $136.3 billion. When combined with the total federal loan debt, it reaches a total of approx. $1.73 trillion student loan debt.

- It will take the average student in debt around 20 years to pay off their loans.

- Currently, 2.6 million borrowers owe less than 5K in student loan debt meanwhile, less than 1 million borrowers owe more than 200K.

- The total federal and nonfederal loan amount has increased significantly, from 1971-71 to 2020-21 .

- The average starting salary for recent graduates is $55,260, which means borrowers have to pay anywhere from $461 to $921 per month, under income-driven repayment plans.

Only 32 People Got Their Debts Canceled Under Idr Programs By 2021

One of last years more embarrassing findings concerned the massive mishandling of the IDR program since its inception in the 1990s. To guarantee affordability, these plans base monthly payments on income. Furthermore, the government eliminates the remaining debt after 20 or 25 years. That was essential since the low payments sometimes did not even cover the interest, resulting in negative amortization for many borrowers.

These loans, by having an eventual cancellation, would prevent borrowers from being trapped in an infinite payment loop.

The IDR was great in theory but failed many people who should have benefited from debt forgiveness. Only 32 out of 4.4 million people with at least 20 years of payments had debt erased due to improper loans. Loan servicers have harmed millions of customers through long-term forbearance and misinformation.

The good news is that the administration is taking action to address the mismanagement. The Department of Education committed to addressing the issue in April, promising to erase over 40,000 peoples debts immediately and to grant 3.4 million borrowers three years worth of credit toward loan forgiveness.

Don’t Miss: Current Apr For Car Loan