Connect On Social Media

Bank of America also provides customer support via Facebook and Twitter. Reach out anytime and a representative will contact you back during business hours.

This content is not provided by Bank of America. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by Bank of America.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Your Car Loan Questions Answered

You can get a CIBC Personal Car Loan directly through your local car dealership. When you buy a new or used vehicle, your dealership will help you complete your loan application on the spot. You don’t have to be an existing CIBC client.

If you buy a car outside of a dealership, you can still apply online for a CIBC Personal Car Loan Opens in a new window.. You can also finance the purchase of a car with a CIBC Personal Loan or CIBC Personal Line of Credit.

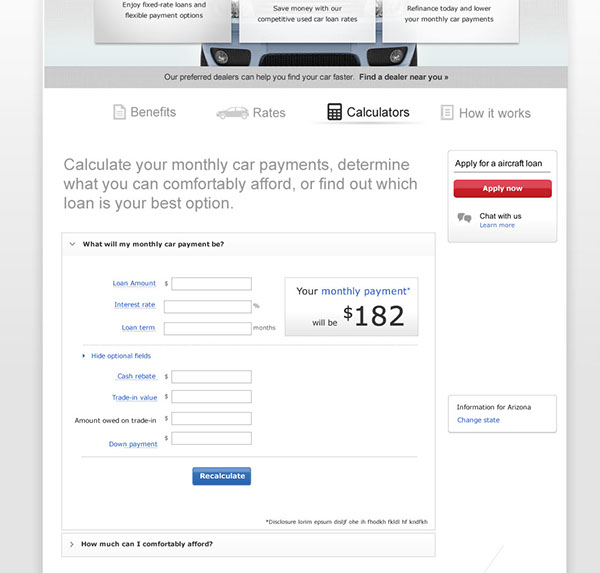

To estimate your car loan payments and how much you can borrow, use our car loan calculator.

Payment estimates are based on the amount you borrow, the term of your loan and your interest rate.

You can check the balance of your loan online or on the CIBC Mobile Banking® app. You can also visit any CIBC Banking Centre Opens in a new window. or give us a call at .

Yes, you can pay off all or part of your loan at any time without penalty.

Yes, you can skip up to two payments yearly3. Interest accrues during the payment holiday period. For more information about your loan options, give us a call at .

Bank Of America Banking Credit Cards Loans And

999-999-9999

For you and your family, your business and your community. At Bank of America, our purpose is to help make financial lives better through the power of every connection. Skip to main Or we can text a download link directly to your phone. Phone Number * In 999-999-9999 Format. Send . Auto purchase loans. Low rates on purchase and lease

See Also: Bank of america mastercard customer service Preview / Show details

You May Like: Interest Rate On Business Loan

How To Apply For A Loan With Bank Of America

- Joint applicant information, if applicable.

Tdaf Td Auto Finance Us Retail Consumer And Wholesale

800-556-8172

TD Auto Finance United States , is a financial-services provider for retail consumer and dealer services. Contact us at 1-800-556-8172 Monday through Friday 8AM to 10PM ET and Saturday 8AM to 7PM ET Customer Service, Hours of Operation, Toll Free Phone Number, Customer service phone number:1-800-556-8172, Customer service phone, TD Auto

See Also: Phone Number Preview / Show details

You May Like: How Much Will I Be Pre Approved For Home Loan

Bank Of America Auto Loan Application Process

Bank of America has a two-step application process for potential borrowers. The loan process is typically completed online but can also be completed by speaking with a Bank of America customer service representative.

Your loan approval and interest rate are locked in for 30 calendar days from when you submit your refinance application.

Change Your Car Securebankofamericacom

Contact you or receive a detailed message or messages at the telephone, email or direct mail contact data you provided above for purposes of fulfilling this inquiry about automobile loan financing even if you have previously registered on a Do No Call registry or requested Bank of America not to send marketing information to you by email and/or

See Also: Phone Number Preview / Show details

Recommended Reading: Interest Rates For Boat Loan

Is A Bank Of America Loan Right For You

Bank of Americas low starting interest rates for their auto loans make the products a good idea for most people. The loans get even more attractive if youre already a Bank of America customer. The extra discounts that can get tacked on will make your auto loan more affordable. If youre not a Bank of America customer and looking for a small auto loan you might want to look elsewhere, as Bank of Americas loans start at $7,500.

Make sure you shop around before making your decision about your auto loan. Look into at least three different lenders and see which product best fits your budget and needs.

Bank Of America Small Business Customer Service &

866.283.4075

Learn more about Mobile and Online Banking with videos and other resources to help you make smart decisions. Call us Open a new trng mc 866.283.4075 MonFri 8 a.m.-10 p.m. ET Remote Deposit Online support 877.270.1242 MonFri 8 a.m.-8 p.m. ET General servicing and PPP support 888.BUSINESS MonFri 7 a.m.-11 p.m. ET

See Also: Bank of america customer service line Preview / Show details

Recommended Reading: What Is Rushmore Loan Management

Who Is Bank Of America Best For

An auto loan with Bank of America is best for a driver that intends to finance their vehicle through a dealership rather than fully online. Although the rates offered are competitive, to truly benefit you would have to be a preferred rewards member which requires you to hold a high deposit or investment balance.

If youre looking to skip the dealership and dont have $20,000 to keep in the bank to get the rate discount, you may find better deals elsewhere.

A Closer Look At Bank Of America Auto Loans

Bank of America offers loans for new and used cars purchased from dealers. It also offers lease buyouts, refinancing loans and loans for vehicles purchased from private parties. The Bank of America auto loan site lists out the APRs for each product, but keep in mind that the interest rates listed are the lowest available. The rate that you ultimately receive will be based on a variety of factors, from the type of vehicle youre buying, to your , to where you live.

Interest rates for Bank of America auto loans are competitively priced. According to Experian, the average interest rate for a new car loan for consumers with prime credit scores is 4.68% Bank of Americas lowest APR offer for new vehicles purchased from dealers is just 4.34%.

If youre already a Bank of America customer, you could score some discounts on your loan. The bank offers discounts of 0.25%, 0.35% and 0.50% if youre a member of its Preferred Rewards program. Heres a quick breakdown:

Don’t Miss: How Much Is Va Loan Entitlement

Bank Of America Reviews

- BBB: 1 out of 5 stars and 5,510 complaints

- Wallethub: 3.1 out of 5 stars from 46 reviews

- Glassdoor: 3.7 out of 5 stars from 22,249 reviews

- and a few more.

- and a few more.

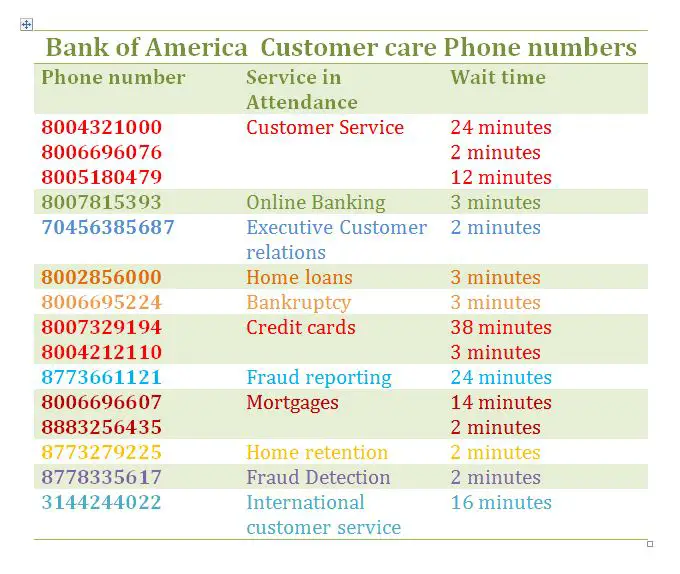

How Do I Speak To A Bank Of America Representative

When you visit the Bank of America website, the Contact Us button is located in the top left corner of the page. The contact page provides a listing of reasons you may need assistance. These quick links allow you to seek fast help. Below are links to additional pages with appropriate customer service phone numbers and email addresses.

Read Also: Where To Get Loan With Collateral

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Bank Of America Auto Purchase Refinance And Lease Buyout Loans: 2022 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Auto loan reviews

-

Auto lease buyout loan

The bottom line:

Best for borrowers who prefer working with a large, well-established bank that offers a rate discount based on high balances.

You May Like: Student Loan Monthly Payment Calculator

How To Refinance Your Bank Of America Auto Loan

- Pennsylvania State Employees Credit Union

- and a few more.

Auto Loan Faqs From Bank Of America

844.892.6002

You can also schedule an appointment at your local financial center to meet with us at your convenience or contact us at 844.892.6002 to apply over the phone. Does Bank of America charge a fee to apply for an auto loan? No. Bank of America does

See Also: Phone Number Preview / Show details

Also Check: Does The Va Home Loan Cover Closing Costs

Bank Of America Auto Refinance Review

We rate Bank of America auto refinance 8.9 out of 10.0 because of its customer service reputation and streamlined application process. While there are many negative customer reviews on the BBBs site, almost none of them have to do with auto loan rates or auto refinancing.

| Overall Rating | |

|---|---|

| Customer Experience | 7.0 |

Bank of America is the second-largest financial institution in the United States. It offers several banking and lending products, including auto refinance loans. With a positive customer service reputation and low rates, Bank of America may be one of the best options for borrowers who want to refinance their auto loans at a big bank.

We at the Home Media reviews team will provide you with a complete guide to Bank of America auto loan refinancing, including how it works, whos eligible and what the auto refinance application process is like. In addition to getting refinance rates from Bank of America, we recommend reaching out to providers with the best auto refinance rates or to those with the best auto loan rates if youre considering purchasing a vehicle instead.

Things To Consider Before Refinancing

Don’t Miss: Cc Connect Loan Payment Login

How Do I Set Up Autopay For My Credit Card Loan Lease Or Line Of Credit

Setting up autopay is easier than ever. When you’ve gone through the process, we’ll provide you a confirmation page to review. It’ll tell you when the first payment starts, how much is being paid, and what date it’ll be paid each month.

To get started, choose the experience that works best for you.

Online banking steps:

For the best online experience, we recommend logging in at usbank.com.

U.S. Bank Mobile App steps:

Bank Of America At A Glance

-

Origination fee: None.

-

Personal information needed: Name, address, Social Security number, employment information, income, U.S. citizenship status and email address. Depending on the specifics of the loan, additional documents and information may be required prior to loan closing. Refinance loans and lease buyouts require specific vehicle information such as make, model, year, mileage and VIN.

-

Pre-qualification available: No. Rate quoted upon loan approval valid for 30 days from the date of original application submission.

-

Online, in-person or both: Apply online, schedule an appointment at a financial center or call 844-892-6002.

-

Approval speed: Most decisions available within 60 seconds of application submission.

-

Funding: Amount of time to fund a loan varies.

-

Minimum FICO credit score: Did not disclose.

-

Minimum credit history: Did not disclose.

-

Minimum annual gross income: Did not disclose.

-

Maximum debt-to-income ratio: Did not disclose.

-

Bankruptcy-related restrictions: Did not disclose.

-

States covered: All 50 states.

-

Assistance provided: Borrower works with a loan specialist whose phone number is provided on loan approval.

-

Availability: New customers call 844-892-6002 – MonFri 8 a.m.-midnight, Sat 8 a.m.-8 p.m. ET.Existing customers call 800-215-6195 – MonFri 9 a.m.-8 p.m., Sat 9:30 a.m.-6 p.m. ET.

-

Contact options: Call or visit a financial center. Customers can also send secure email through online banking.

Don’t Miss: Army Student Loan Repayment Program

I Make My Auto Loan Payment Every Month Ahead Of My Due Date However I Dont Receive A Statement Reflecting This Why Am I Not Able To Receive A Statement

If the minimum payment due has already been made for the billing period, currently a statement is not generated. We do understand your concern and are looking into making a statement available regardless of whether a payment is due or not. We appreciate your patience as we continue improving the process.

Cibc Personal Car Loan At A Glance

Finance up to 100% of the cost of a new or used vehicle and take up to 8 years to pay.

Interest rateRate approval guaranteed for 30 days.4

Term512-month minimum, up to 96 months

Loan amount

Payment frequencyWeekly, biweekly or monthly. Its your choice.

Ask for a CIBC loan at your local dealership. The vehicle can be up to 10 years old.

Buying a car outside of a dealership? You can still get a CIBC Personal Car Loan by applying online Opens in a new window. or visiting a branch Opens in a new window..

You May Like: Grad Plus Loans Interest Rate

Auto Loans & Car Financing From Bank Of America

844.892.6002

Accessible vehicle loans Flexible financing terms for customers with disabilities or access needs. Learn more Small business vehicle loans Purchase or refinance cars, vans and light trucks to keep your business rolling. Learn more Connect with us Schedule an appointment Find a location 844.892.6002 Mon.- Fri. 8 a.m. midnight ET

See Also: Contact bank of america customer service Preview / Show details

Who Is Eligible For Bank Of America Auto Refinance

Anyone 18 or older with U.S. citizenship or residency can apply to refinance their current loan with Bank of America. The financial institution only provides auto financing for vehicles less than 10 years old and with fewer than 125,000 miles. Additionally, Bank of America doesnt cover:

- Vehicles valued at less than $6,000

- Vehicles used for commercial or business purposes

- Salvaged or branded-title vehicles

- Gray market or lemon law vehicles

- Conversion or delivery vehicles

- Motorcycles, recreational vehicles , boats or aircraft

Bank of America doesnt list any minimum income or minimum credit score requirements. Borrowers with good or excellent credit history are more likely to be approved for auto refinancing, while those with poor credit may be turned down.

Also Check: How Much Student Loan Can I Get Per Year