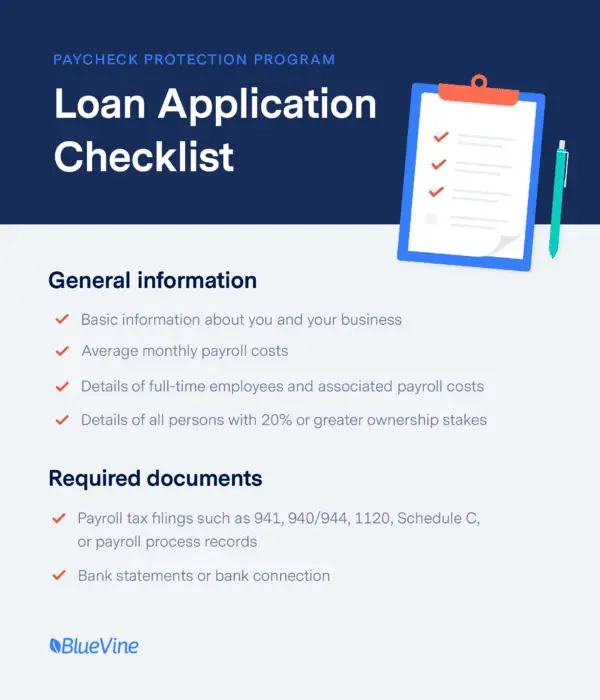

Ppp Loan Checklist: Here Are The Key Documents Youll Need

The Paycheck Protection Program is designed to help small businesses and independent contractors who have been negatively impacted by the coronavirus pandemic. The PPP can provide 1% interest loans that are potentially forgivable if borrowers use the money according to the program rules. As of December 27, 2020, Congress has approved additional funds for the PPP until May 31, 2021, or until funds run out. Fundbox is no longer accepting PPP applications, however, the SBA can help you find a PPP lender.

While the PPP promised a streamlined, low-documentation process, some business owners may still face confusion over what they need to provide their prospective lender. These include payroll calculations and supporting documents. To help maximize your success, we have prepared a list of possible documents that you may want to have at your fingertips when its time to apply to your lender. Please note that specific requirements and acceptable documents may vary depending on the lender.

Documents Needed For Proof Of 25% Revenue Reduction

If youve received and exhausted a previous first-time PPP loan, you may now qualify for a second draw PPP. In addition to the documents listed above, you will need one of the following to demonstrate your revenue reduction:

-

2019 and 2020 tax forms .

-

2019 and 2020 quarterly income statements

-

If the business started between 1/1/2020-2/15/2020, quarterly income statements or bank statements for Q2, Q3, or Q4 compared to Q1.

-

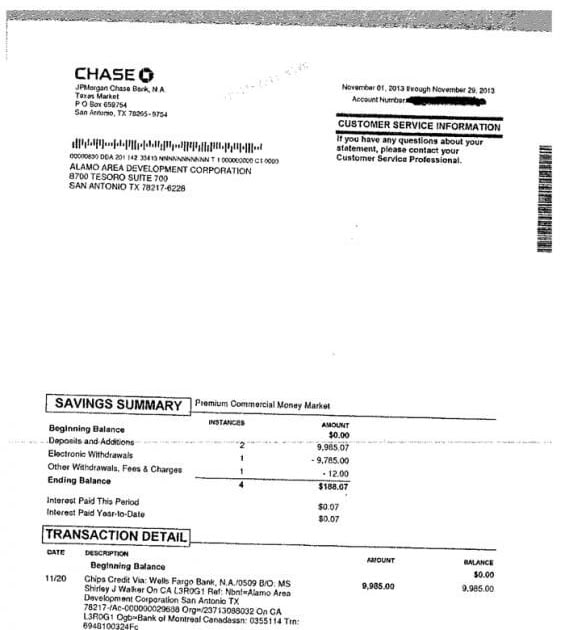

2019 and 2020 bank statements .

Ppp Loan Forgiveness Gaap Guidance

A common inquiry we are receiving relates to how and when the income should be recognized related to the loan forgiveness. Accounting standards clearly say that you only derecognize debt if the debtor legally releases itself from being the primary obligor. Based on this guidance, GAAP does not allow recording this income until you have received documentation that the loan is indeed forgiven. At that point, you would debit the loan account for the amount forgiven and credit an income account for that same amount.

The next question that comes up is, how do we show this on the income statement? In reading and interpreting appropriate sections of GAAP, it would not be appropriate to net the income with the related expenses. This situation does not meet the criteria to net items together on the income statement. So, then we have the question of whether it should be included in operating income or other income. While GAAP is less clear here, the general rule of thumb is that if the activity is more of a financing activity , we would include it in other income, grouped with interest income and interest expense below operating income. Based on this guidance, it would be appropriate to record the income below the line as other income.

If you have any further questions, please reach out to our team of financial advisors at Wipfli.

Also make sure to visit our COVID-19 resource center, where you can find more resources to help navigate the impact of the coronavirus.

Related content:

Don’t Miss: Bank Of America Car Loan Refinance

Do: Keep Separate Bank Accounts And Consider Getting A Second Business Bank Account For A Ppp Loan

Commingling business and personal expenses generally isn’t a good practice. And it can really muddy the water when you apply for a PPP loan, says Ken Alozie, managing director of Greenwood Financial Advisors in Washington, D.C.

A bank statement from an established small-business checking account can easily show that your company was in operation on Feb. 15, 2020, which you need to show to qualify for a PPP loan. If your business runs through your personal checking account, its harder to prove, Alozie says.

Beyond that, Barry recommends opening a second business checking account specifically for your PPP funds. That way you can easily show how the money was used when it’s time to apply for forgiveness.

Plaid Bank Connection: Bank Not Listed Or Im Not Comfortable Connecting

If your bank is not available with Plaid or if you dont want to connect your bank with Plaid, you will need to go back on your application and select the manual option to add your bank.

You will need to update your bank information directly into your application for security purposes.

Your routing number will be a 9 digit number which is specific to your bank or credit union. Your account number will be a specific number assigned to you from your bank or credit union institution.

You can find your routing and account number on your voided check to help you with the manual bank upload process.

Also Check: What Kind Of House Loan Can I Get

Documents You Must Submit

- You must submit the following documents:

- If you are applying for forgiveness for a Second Draw PPP loan, and you did not previously submit documentation to support the gross receipts reduction certification with your Second Draw loan application, you will need to submit them with your forgiveness application. See our Revenue Reduction Information page for specific details.

- PPP Loan Forgiveness Calculation Form3508EZ or lenders electronic form equivalent

- Employee Payroll: Documentation verifying the eligible cash compensation and non-cash benefit payments from the Covered Period consisting of EACH of the following:

- Bank account statements and self-prepared payroll reports or third-party payroll service provider reports documenting the amount of cash compensation paid to employees.

- Tax forms for the periods that overlap with the Covered Period:

- i. Payroll tax filings reported, or that will be reported, to the IRS and

- ii. State quarterly business and individual employee wage reporting and unemployment insurance tax filings reported, or that will be reported, to the relevant state AND proof of payment such as bank statements, receipts, or cancelled checks.

Documents You Must Maintain But Do Not Need To Submit

- Applicants must maintain several other documents detailed on Page 4 and Page 5 of the Form 3508EZ instructions.

- Records Retention Requirement: The Borrower must retain all such documentation in its files for six years after the date the loan is forgiven or repaid in full, and permit authorized representatives of SBA, including representatives of its Office of Inspector General, to access such files upon request. The Borrower must provide documentation independently to a lender to satisfy relevant Federal, State, local or other statutory or regulatory requirements or in connection with an SBA loan review or audit.

You May Like: How To Negotiate Student Loan Debt

Required Documents For Ppp Loan Forgiveness

The documents you are required to provide will depend on what expenses you covered with your PPP funds. However, there are some documents and information requirements that are universal:

- Bank account statements

- Your SBA loan number

Below is all the documentation you need to provide if you used the PPP to cover any of the following.

Amending 2020 Tax Returns

Taxpayers do not need to amend their 2020 tax return just to attach the Rev. Proc. 2021-48 statement if they properly reported tax-exempt income from a forgiven PPP loan on their 2020 tax return in accordance with Rev. Proc. 2021-48.

Taxpayers who did not report tax-exempt income from a forgiven PPP loan on their 2020 tax return, but should have, need to file an amended 2020 tax return, or an Administrative Adjustment Request , if applicable, to report the tax-exempt income and include the Rev. Proc. 2021-48 statement.

Likewise, taxpayers who report tax-exempt income from PPP loan forgiveness prior to the year when forgiveness of the PPP loan is actually granted should consider filing an amended return for the year the tax-exempt income was reported if the amount of tax-exempt income reported is more than the forgiveness ultimately granted. The amended return should include a statement that contains the following information:

- The taxpayers name, address, and EIN or SSN

- A statement that the taxpayer is making adjustments in accordance with Section 3.03 of Rev. Proc. 2021-48 and

- The tax year in which tax-exempt income was originally reported, the amount of tax-exempt income that was originally reported in that tax year, and the amount of tax-exempt income being adjusted on the amended return.

For more information regarding these new reporting requirements, contact us. We are here to help.

Also Check: How To Calculate Car Loan Payments

How Does Womply Verify Bank Accounts

We have two methods for verifying bank accounts. You can use one or both methods for the same account to minimize errors.

Instant Verification : If you have the information you need to access your bank account online, you can securely connect your bank account to Womply. You will need to confirm the numbers for routing and the account you want to fund. In some cases, you might need to provide additional bank account information if its requested. Most banks support instant verification.

Manual Verification:Wherever possible, we recommend you use instant verification. If this isnt an option for you, you can manually verify your bank account. You will need to provide bank account details and pass our identity check. Manual verification is slower, but it works consistently if you provide the correct information.

Forgiveness Of Ppp Loans

A portion of the borrowers PPP loan will be forgiven, equal to eligible expenses, including payroll costs, interest payments on mortgages, and rent and utility payments, made during the loans qualifying period, provided that the borrower meets all of the loans employee-retention criteria.According to the SBAs rule regarding lender and SBA responsibilities, a borrower, in order to receive forgiveness on a PPP loan, must submit an application for forgiveness to the creditor. The creditor, in turn, issues a recommendation to the SBA within 60 days on whether the borrower is entitled to full, partial, or no forgiveness of the PPP loan, and requests payment from the SBA equivalent to the amount for which it recommends forgiveness . The SBA then has 90 days to review the request for payment from the creditor. If the SBA concurs with the creditors recommendation, the SBA pays the creditor for the amount forgiven, plus any interest that accrues through the date of payment. The borrower must then remit any amount not forgiven by the SBA to the creditor in accordance with the terms of the PPP loan. If the SBA subsequently determines that the borrower was ineligible for the PPP loan, the borrower must immediately repay the loan to the creditor.

Don’t Miss: What Would Be The Interest Rate For Car Loan

How To Report Ppp Loans On Financial Statements

A key part of the Coronavirus Aid Relief and Economic Security Act, the Paycheck Protection Program authorized banks to provide low interest rate loans to businesses with a guarantee from the Small Business Administration. Best of all, PPP loans may be eligible for tax-free forgiveness if the proceeds are used for certain approved expenditures. This raises questions about how to present PPP loans in year-end financial statements and how to treat a loan that was forgiven. While U.S. GAAP does not provide specific guidance for PPP loans, there are a couple of options available for reporting the PPP loan on financial statements.

How To Fill Out Sample Bank Statement With Pdfsimpli In Five Steps

Read Also: What Kind Of Car Loan Interest Rate Can I Get

Tips To Avoid Issues With Selfie Video Verification

During the verification phase, youll see the phrase, Lets make sure youre you. At this point, youll take a selfie video that will be compared with the picture on the government ID you uploaded. To make sure your verification is successful, please pay attention to these important details:

- Take the selfie video of yourself, not your government ID.

- Before you start the video, remove your glasses. The system needs a clear view of your face to compare it with the picture on your government ID.

- Reduce glare by moving away from direct light. If theres glare in the video, the system will have difficulty comparing your face with the picture on your ID.

- The lighting in your video should be as close to natural light as possible. If the video is too bright or too dark, the system will have difficulty recognizing your face.

- Point the camera at the center of your face and open your eyes.

- Center the camera on your nose. If the camera is centered below or above your nose, the system will have difficulty recognizing your features.

- Sit in front of a blank background. Make sure there are no other faces behind you . Other faces will confuse the system and will result in an error.

- When the system asks you to turn your face slightly from left to right, turn your entire head left and right according to the prompts on the screen.

- Fit your face to the frame by moving the camera closer or farther away.

- Keep the device steady to avoid blurring

Why Should I Use Plaid To Verify My Bank Account Information

Linking your bank account to your Funding Circle application is the fastest and most convenient way to provide verification of your bank account information. Linking your bank account helps to ensure that, if your loan application is approved, funds can be sent to you as quickly as possible.

We understand the importance of keeping your financial information safe and secure. That is why we have partnered with Plaid. Plaid is used by many major banks and credit unions, such as American Express, and financial apps, such as Venmo. With Plaid:

- Your data is encrypted using a combination of the Advanced Encryption Standard and Transport Layer Security, which helps keep your sensitive data secure and protected.

- Funding Circle can only view the information necessary to verify your account information, such as account owners name, account number and routing number.

- Funding Circle never has access to your login credentials.

If your bank does not participate with Plaid or if you would prefer to provide a voided check instead, you may verify your bank account information by providing us with a voided check that shows the business name, account number and routing number. Follow the steps below to provide us with a voided check:

Don’t Miss: Can You Switch From An Fha Loan To Conventional

The Paycheck Protection Program

The Paycheck Protection Program and SBA PPP Loan provides loans to assist businesses keep their workforce employed during the Coronavirus crisis. Further borrowers could also be eligible for PPP loan forgiveness.

In order to succeed in the littlest businesses, SBA will offer PPP loans to businesses with fewer than 20 employees and sole proprietors only from February 24 through Wednesday, March 31, 2021 at 5pm ET. Because President Biden has also announced additional program changes to form access to PPP loans more equitable.

What Is A Bank Statement

By definition, a bank statement is a rundown of exchanges which are monetary in nature and which have happened over some stretch of time. You can get a free bank proclamation layout from your bank or different kinds of money related establishments. The exchanges which show up on the announcement incorporate stores, withdrawals, charge, and credit.

Typically, financial institutions send these through the mail which is the reason they as a rule come as composed archives. In spite of the fact that we would now be able to get these through email, many individuals lean toward paper bank statements layouts so they can keep these in their records and allude to them varying.

Since bank statements originate from financial organizations straightforwardly, you wont see a ton of editable bank articulations except if youre intending to make one for your own establishment.

Read Also: What Credit Score Do You Need For Home Equity Loan

Ppp Loans: Proper Documentation And Accounting

At the center of the rush to submit Paycheck Protection Program applications, business owners main priority was obtaining the loan proceeds before funding ran out. And funding did run out less than two weeks after applications opened. Luckily for small businesses, additional funds were approved on April 24, 2020, providing $310 billion in addition funding.

For those business owners who have secured PPP loan proceeds, their focus should shift to properly accounting for the funds. We suggest the following accounting best practices to properly account for the loan proceeds and expenditures.