Buy From Online Dealers

No haggling with a dealer and explore vehicles virtually and buy on your own time. Online-only dealers such as Carvana and Vroom have pioneered this buy-from-your-couch car-buying process.

In addition to helping you find a car, they can finance it for you. Carvana, for instance, has an in-house financing program. The lowest advertised rate is 6.85%, but many customers have reported getting much lower rates, sometimes under 4%.

What Are Other Important Car Ownership Costs To Consider

Beyond the cost of monthly car loan payments, vehicle ownership costs can add up.

Car insurance is one of the more significant costs that come with owning a vehicle. Make sure you understand car insurance rates and the best car insurance companies available in order to select the best car insurance coverage for your needs.

Also, consider maintenance and repair costs, which can start at around $100 per visit but vary by the make and model of your vehicle. Use Edmunds car maintenance calculator to get an estimate of how much youll spend to maintain your vehicle.

Fuel expenses are another cost to keep in mind as you search for a new vehicle. If youre unsure of how much to budget, visit FuelEconomy.gov to view the fuel economy or gas mileage and projected annual fuel costs for the year for the make and model of the vehicle you select.

There are also registration fees, documentation fees and taxes that youll pay when you purchase the car. Youll also pay to renew your registration every one, two or three years. Renewal fees and cycles vary by state.

Estimate your monthly payments with Bankrates auto loan calculator.

Ready to compare rates from top lenders?

Best For Refinance: Autopay

- As low as 2.99%

- Minimum loan amount: $2,500

AUTOPAY offers several different refinance options, competitive rates, and has flexible credit requirements. Borrowers can easily compare offers from different lenders on AUTOPAY’s site and choose the best deal.

-

Considers all credit profiles

-

Excellent credit required for the best rates

While AUTOPAY’s rates start at 2.99%, only those with excellent credit will qualify. According to AUTOPAY, they can, on average, cut your rate in half on a refinance.

AUTOPAY offers more refinance options than many lenders. In addition to traditional auto refinancing, borrowers can choose cash-back refinancing and lease payoff refinancing.

AUTOPAY is a marketplace that makes it easy to shop around for the best deal. It caters to individuals who are rebuilding credit or improving their credit.

Also Check: Does Va Loan Work For Manufactured Homes

What Information Will I Need To Apply

To apply for an auto loan, you will need the following information:

- Whether the vehicle is new or used

- The estimated loan amount

- The desired term of the loan

- Your personal information , if requested

- Physical and mailing address

- Personal identification

- Co-applicant information

To finalize and fund your auto loan, you will need to do the following:

- Become a DCU member, if not already a member

- Submit copy of the purchase & sale agreement

- Submit verification of income, if requested

- Submit any additional requested documents

- Finalize funding details

- Sign the Note & Loan Agreement

Should You Get An Auto Loan From A Bank Or Dealership

It’s worth shopping at both banks and dealerships for an auto loan. New car dealers and manufacturers, just like banks, can have attractive loan products. Depending on the borrower’s credit score and market-driven circumstances, the interest rate offered by a car dealer can be as low as zero percent or under the going rates offered by banks.

It’s important to keep dealership financing as a possibility, but make sure to look for auto financing before deciding where to buy a car. Know your credit score and search online for bank and other lender rates. This should give you a range of what you can expect in the open market and help you determine if seller financing is a better deal for you.

Don’t Miss: Bank Of America Home Loan Navigator

How Will Your Credit Score Affect Your Car Loan

With a higher credit score, less of your paycheck will do a vanishing act. Since the lowest APRs are offered to the borrowers with the highest credit scores, improving your credit score before applying for an auto loan can really be worth the effort.

The difference between the highest and lowest used-car APR in Q2 2022 was nearly 17 percentage points, according to Experian. On a 5-year loan for $25,000, for example, you could save nearly $12,700 over the life of the loan if you applied with a higher credit score.

Set A Timeframe To Search

Whether your last car broke down yesterday or youre simply looking for an upgrade in the upcoming months, give yourself a set timeframe to get a new car loan.

Depending on how a lenders decision process works, your prequalification or preapproval may require a hard inquiry on your credit report.

When comparison shopping for the same type of loan over the course of a month or so, each inquiry will likely be lumped together as one. This wont have much of an impact on your credit history. However, if its spread out too long, your credit score could take a big hit. Each inquiry lowers your credit score around five points.

Read Also: How To Pay Off Home Loan Faster Calculator

Do I Need To Have A Vehicle Selected Before I Apply For A Loan

Noyou do not need to have a vehicle selected before submitting your auto loan application. Some members choose to initiate their application before deciding on a vehicle, so that they know their exact budget and can complete the transaction quickly once they find the right one.

When you apply, you have the option to indicate you dont yet know the make and model of the vehicle. However, you will be asked to provide an estimate of your loan amount . If approved, your loan offer will be good for up to the stated amount pending verification of all required documents. When you finalize your loan, you can specify the exact dollar amount you wish to fund.

How To Get The Best Auto Loan Rates

There are a few different ways to save money and find the best auto loan rates. Below, well outline some simple ways to reduce your interest rate for a new car, a used vehicle, or a lease buyout.

Remember that you may pay a higher APR if youre looking to purchase a used car or if youre hoping to buy a vehicle from a private party. Before you go searching for the best auto loans, make sure that repayment is possible based on your current financial situation.

Read Also: What Is The Ppp Loan Forgiveness

Best Online Auto Loan: Lightstream

LightStream

- 5.99% to 11.99%* with Auto Pay & Excellent Credit

- Minimum loan amount: $5,000

LightStream offers a fully online process for its extensive list of vehicle loan options. It’s very transparent about its rates and terms, and it has few restrictions on what kind of car it will finance. However, it scored below average marks in the J.D. Power 2022 U.S. Consumer Lending Satisfaction Study for personal loans.

-

No restrictions on make, model, or mileage

-

Offers unsecured loans to borrowers with excellent credit

-

Prefers borrowers with good credit

LightStream is a division of Truist Bank. It stands out for its online lending process. Borrowers can apply online, e-sign the loan agreement, and receive funds via direct deposit as soon as the same day.

LightStream also offers a remarkably wide range of auto loan options, including new and used dealer purchases, refinancing, lease buyouts, and classic cars. It even offers unsecured loans for those with excellent credit.

Rates from the lender start as low as 5.99%, which includes a 0.5%-point discount for autopay. The maximum APR on a LightStream loan is 22.99%.

Average Interest Rate For Car Loan: Conclusion

Average interest rates for car loans are determined by a variety of factors, the most impactful thing being your credit score. Depending on your credit score and if you are buying a used or new car, auto loan rates can vary. Before financing a car, we recommend that you look at all of the providers available so you can get the best rates possible.

Also Check: Where To Get Fast Loan Online

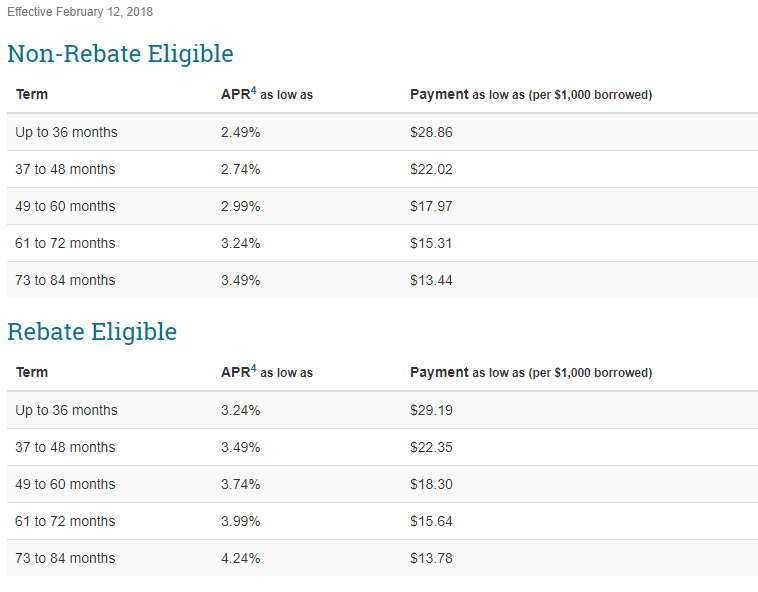

What Is A Good Auto Loan Interest Rate

A good auto loan interest rate is usually 4% or lower, but typically the best auto loan rates are for new cars. According to the 2022 report from the National Credit Union Administration , the average 60-month new car loan from a credit union has an interest rate of 2.78%. From a bank, the average rate is 4.69%. So, if you find these rates or lower, you know youre getting a fair rate on your car loan.

To put this in perspective, below are average car loan rates for new and used vehicles with different term lengths for both credit unions and banks according to the NCUA.

| New or Used Vehicle Loan | Loan Term |

|---|---|

| 5.03% |

Consider The Application Decision Timeline

Finally, remember to consider how long the application decision takes and how long it takes to get your funds in the bank.

Even if youre not buying a car right away, this information is vital for you to plan when you can actually get the keys to your new vehicle.

Most online lenders boast a quick application process, so delve a little deeper to get the actual details. Even if you get a credit decision within moments, find out how long the underwriting process takes.

If the lender boasts same-day or next-day funding, figure out what you need to do on your end to make that happen. In most cases, youre responsible for providing income verification documents and signing a loan agreement before the lender can release any funds.

You May Like: How To Get Home Loan From Bank

Penfed Credit Union Reviews

PenFed is not accredited by the Better Business Bureau but is rated A+ by the organization.

Customer ratings for PenFed Credit Union are among the highest in our research. The organization has an impressive 4.6-star rating out of 5.0 on Trustpilot. Customer ratings are considerably lower on the BBB website, however, where reviewers give PenFed 1.2 out of 5.0 stars.

Positive reviews consistently mention a smooth and easy loan application process and low rates. Customers reporting negative experiences tend to mention slow processing times for loan applications.

Our team reached out to PenFed Credit Union for a comment on these reviews but did not receive a response.

Why Are Car Loan Companies Useful

Transportation is crucial for working professionals, parents, and people young and old alike. Imagine how limited ones money-making potential would be if they could only rely on their own two legs to deliver them to work. People would need to live in an urban environment for proximity to jobs, and would not be able to leave the public transportation network. Parents could not pick their kids up from school or drive them to soccer practice, and families would not be able to easily visit relatives in faraway places. Vehicles are necessary for giving people the freedom of mobility to get where they need to go with little effort.

Despite their importance, even the cheapest cars still require an investment of thousands of dollars. This is the main reason why auto financing companies are particularly useful. They provide customers with a loan for the explicit purpose of buying a vehicle, and can do so with affordability and flexibility.

You May Like: Are There Student Loan Forgiveness Programs

Can You Refinance A Car Loan

Yes, many lenders offer auto loan refinance opportunities, and several promise to make the process quick and easy. It can pay to refinance your loan in several different circumstances. For example, you might be able to improve your rate and monthly payment, shorten the term of your loan repayment, or extend the term if you’re having trouble making payments.

How Do Lenders Decide What Interest Rate To Charge You

When it comes to deciding the interest rate for a car loan, lenders will consider many different factors, including:

Car Loan Terms

When buying a new car, lenders often offer longer loan terms to accommodate new buyers. However, the longer loan term will certainly be accounted for in the interest rate. Generally, a longer loan term equates to a higher interest rate and a higher overall price.

Vehicle Status

If you opt for a secured personal loan, your car will act as security or collateral in the event that you cannot pay the lender back. Cars are quickly depreciating assets so, lenders will account for that throughout the term of the loan. If you cannot pay your loan and your car has depreciated or malfunctioned, the lender takes a risk. They may increase the interest rate after some time has passed. Furthermore, old cars tend to encourage higher interest rates. New cars may encourage lenders to offer lower interest rates.

Experts recommend knowing your before you apply for a car loan. Your credit score is important to a lender, as it lets them look at your history of debt repayment. If you have a lot of debt and expenses, lenders will see you as a higher risk borrower, resulting in a higher interest rate. If you have a great credit score, you have a higher chance of securing a lower interest rate.

Down Payment

Also Check: How Do I Find My Student Loan Id Number

Improve Your Credit Score

Improving your credit score comes with tons of benefits, so there’s no reason not to pursue this endeavor. You’ll find it easier to rent an apartment, buy a home, qualify for lower credit card interest, and, yes, obtain better auto loans. Bouncing back from a low credit score might seem challenging, but it’s far from impossible.

Start by pulling your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. Fair credit borrowers can review items to determine what is helping or hurting their scores. You might even notice errors that you can fix by contacting the agency.

You can also improve your score by budgeting accordingly so you can pay off your debt as fast as possible. Additionally, you can lower your credit utilization by spreading out payments across accounts or requesting a higher credit limit. Other effective strategies include limiting your requests for hard inquiries and keeping old accounts open to improve the age-of-credit portion of your score.

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You will need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you will use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

You May Like: How Soon Can I Refinance My Car Loan

Where Can You Get The Best Auto Loan Interest Rates

Lenders dont all offer the same auto loan interest rates by credit score. Youll likely find a range of rates available to you if you compare auto loan offers. Thats why its good to shop around. There are a number of places you can find auto loans. Some may have better loan options than others, depending on your circumstances.

Best For Bad Credit: Myautoloan

MyAutoLoan

- As low as 3.99%

- Minimum loan amount: $8,000

myAutoloan not only offers reasonable low rates, but it also has lenders that work with people who have a history of credit problems. The marketplace provides a great opportunity for borrowers with poor credit to shop deals from multiple lenders at once.

-

Accepts borrowers with poor credit

-

Offers new, used, and refinance loans

-

Higher minimum loan amount requirements

-

Not available in Hawaii or Alaska

myAutoloan is a marketplace that allows you to compare multiple offers from lenders based on your credit profile. This type of company can help you cast a wide net and get the best offer available. It offers new, used, refinance, private party, and lease buyout loans.

Speed is one of myAutoloan’s benefits. Its online form takes just a couple of minutes to fill out and, once submitted, matches you with up to four lender offers. After you choose a lender, you can receive an online certificate or a check within as little as 24 hours.

Requirements in myAutoloan’s market vary by lender, but they say they have lenders who work with borrowers with lower scores.

Read Also: Can I Give My Car Loan To Someone Else

What Lender Has The Best Auto Loan Rates

It’s hard to say what lender has the best auto loan rates, as it largely depends on your financial situation. For instance, a lender might advertise a low APR you might not be eligible for because of bad credit. If you have a less-than-stellar credit score, dealerships, credit unions, or online lenders will probably work best. You might have to pay more in interest, but it’s better to qualify for these offers than none at all. Those with better credit tend to get the best auto loan rates from banks.

Note that a good auto loan goes beyond its interest rates. You’ll want an offer that allows you to pay back the amount on your own terms. For instance, you might ask for lower monthly payments to keep your budget in check. Higher monthly payments are ideal for those who want to get out of debt faster.

Additionally, consider what fees the lender has. Hidden fees might offset the benefits of a loan’s APR. Finally, you’ll want to consider how reputable the lender is. Institutions with good ratings from the Consumer Financial Protection Bureau and Better Business Bureau are often safe bets.