What Are Todays Refinance Rates

Just like rates for homebuyers, mortgage refinance rates are low across all loan types right now, including rateandterm and cashout refinances.

Its a great time to lock in a low interest rate on your new loan, and many homeowners can choose to refinance with no closing costs.

Check your refinance options to see if a refi is worth it for you at todays rates.

Read Next

How To Know If Refinancing Is Worth The Cost

When you add up all of the fees and costs associated with refinancing your mortgage, you could be looking at paying thousands of dollars. So, how do you know if refinancing your mortgage is worth it?

Although this answer will vary depending on your unique situation, it really boils down to what you hope to get out of refinancing your home loan.

See How Better Mortgage Can Help You Save

Before you close on a loan, make a point to shop around for homeowners insurance, and investigate whether buying points would be a good financial decision for you. When you lower the cost of your homeowners insurance, youll reduce the monthly amount youll need to pay into escrow.

To get an idea of what your monthly mortgage payment will look like if you buy points or accept credits, take a look at the Better Fixed-rate loan comparison calculator. It will help you see how much money you stand to spend or save.

Whether you are purchasing or refinancing, we will help you choose the best mortgage for you by seeing how the cost of a home changes based on your loan costs.

Get started to find out your estimated closing costs in as little as 3 minutes and discover how Better Mortgage can help you save on your homebuying or refinance journey.

Don’t Miss: Does Applying For Personal Loan Hurt Credit

Can You Roll Closing Costs Into A Mortgage

See Mortgage Rate Quotes for Your Home

Closing costs can be expensive, and rolling those costs into your mortgage may seem like an attractive alternative to paying them out of pocket. However, this isn’t a universal solution. The type of loan, loan-to-value ratio , and debt-to-income ratio all play a part in determining if you can roll your closing costs into a mortgage.

Can I Refinance My Mortgage With No Closing Costs

Every borrower wants to save money when they’re refinancing their mortgage, often by securing a lower interest rate that drives down their monthly mortgage payments and saves them thousands over the life of the loan.

But does a no-closing-cost refinance fit into the money-saving category? Sure, this type of refinance might sound appealingafter all, the average closing costs for a single-family home in the U.S. were $5,749 in 2019, according to real estate data firm ClosingCorp. Yet even though a no-closing-cost loan lets you refinance without any upfront fees, it could very well trigger a rise in your interest rate or loan balance. That, in turn, could cause your monthly mortgage payments to climb and increase the total cost of the loan.

That said, a no-closing-cost refinance might be a good option if you don’t have enough money saved up to cover the closing costs or you’d rather spend that money on a home remodeling project.

Read on to understand the ins and outs of no-closing-cost mortgage refinance loans.

Read Also: How Much Can I Borrow Personal Loan Calculator

Options For Home Buyers

If you are purchasing a home, you likely wont be able to roll the closing costs into your mortgage. This option is typically only open to those refinancing an existing home loan.

When buying a home, borrowers usually have four ways to cover the closing costs:

There are exceptions for certain fees.

For instance, if youre using an FHA loan, the 1.75% upfront mortgage insurance premium is typically rolled into the loan amount. The same goes for VA loan funding fees.

You could also pay closing costs with gift money from a relative or friend, or a grant from a public agency if youre unable to pay them out of pocket.

Fha Home Loan Rules For Closing Costs

The Mortgagee must document all funds that are used for the purpose of qualifying for or closing a Mortgage, including those to satisfy debt or pay costs outside of closing.For a purchase transaction, the amount of cash needed by the Borrower to close an FHA-insured Mortgage is the difference between the total cost to acquire the Property and the total mortgage amount.…the difference between the total payoff requirements of the Mortgage being refinanced and the total mortgage amount.Where real estate taxes are paid in arrears, the sellers real estate tax credit may be used to meet the MRI, if the Mortgagee documents that the Borrower had sufficient assets to meet the MRI and the Borrower paid closing costs at the time of underwriting.

Read Also: Is Homeowners Insurance Included In Fha Loan

Rolling Closing Costs Into The Irrrl

The most popular loan here at Low VA Rates is the Interest Rate Reduction Refinance Loan, or IRRRL. With an IRRRL, the VA allows borrowers to roll every single closing cost into the loan balance. Heres how it works:

Lets say youve got $5000 in closing costs. If your loan amount is $100,000 at the time of refinance, and you want to roll your closing costs, youll borrow $105,000 in total. That way, the $5,000 in closing costs will be paid through monthly mortgage payments just like the rest of the loan. Youll also be doing this at a lower interest rate, and your payment could still go down, even though your balance is increasing.

Understanding Mortgage Refinance Closing Costs

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Ready to replace your existing mortgage with a better one? Youll need to look beyond the potential of a lower interest rate and monthly payment. Make sure you pay attention to your estimated refinance closing costs.

Also Check: What Size Mortgage Loan Can I Qualify For

Average Cost Of A Mortgage Refinance: Closing Costs And Interest Charges

See Mortgage Rate Quotes for Your Home

The average closing cost for refinancing a mortgage in America is $4,345. These costs may vary depending on the lender and location of the mortgaged property. Additionally, the amount you borrow will impact the cost of the refinance. Refinances advertised with “no closing costs” or “no fees” often fold those charges into the interest rate, amount borrowed, or monthly payments of the new mortgage.

Will I Have To Pay The Va Funding Fee

If youre using a VA home loan to buy, build, improve, or repair a home or to refinance a mortgage, youll need to pay the VA funding fee unless you meet certain requirements.

You wont have to pay a VA funding fee if any of the below descriptions is true. Youre:

- Receiving VA compensation for a service-connected disability, or

- Eligible to receive VA compensation for a service-connected disability, but youre receiving retirement or active-duty pay instead, or

- The surviving spouse of a Veteran who died in service or;from a service-connected disability, or who;was totally disabled, and you’re receiving Dependency and Indemnity Compensation , or

- A service member with a proposed or memorandum rating, before the loan closing date,;saying you’re eligible to get compensation because of a pre-discharge claim, or

- A service member on active duty who before or on the loan closing date provides evidence of having received the Purple Heart

You may be eligible for;a refund of the VA funding fee if you’re later awarded VA compensation for a service-connected disability. The effective date of your VA;compensation must be retroactive to before the date of your loan closing.;

If you think you’re eligible for a;refund, please call your VA regional loan center at . Were here Monday through Friday, 8:00 a.m. to 6:00 p.m. ET.

Read Also: How To Return Ppp Loan

How Much Does It Cost To Refinance

Homeowners typically refinance to save money. Refinancing can result in a lower interest rate and monthly payment and it could save you thousands over the life of your loan.

However, refinancing your mortgage isnt free. The process involves paying closing costs again, which average between 2% and 5% of the loan amount.

The good news is refinance closing costs are negotiable. And its often possible to refi with no closing costs at all if you play your cards right. Heres how.

In this article

How To Reduce Or Avoid Closing Costs

When youve spent months or even years saving for a down payment, searching for a property, negotiating a purchase price, going through due diligence and securing financing, paying closing costs can be an unwanted surpriseand they can make it that much harder to afford your new property.

With that in mind, a lot of people want to try to reduce or avoid;closing costs. While its impossible to eliminate closing costs entirely, there are;some things you can do to reduce your expenses, including:

Additionally, certain closing costs can sometimes be added to a buyers loan amount, rather than paying it in cash at closing. What costs can be rolled into your loan vary by lender, but may include origination fees, appraisal and inspection fees or title fees. While this can lead to some initial cost savings, it will actually increase the total mortgage cost, as youll pay interest on these expenses over the life of the loan.

You May Like: How To Apply For Fha Loan In Illinois

Refinancing: When Are Closing Costs Due

If youre refinancing an existing mortgage, your closing costs are due at least one day before the loan is funded. This gives the lender enough time to disburse all the proceeds when the mortgage is funded. As your closing date approaches, your lender will tell you how and when to pay your closing costs.

You don’t need to pay a down payment because you made your down payment when you initially purchased the home. Other differences include the cost of title feesthese are lower when you refinance because the owner of the property isnt changing.

Can You Finance Closing Costs With An Usda Loan

October 4, 2018 By JMcHood

The USDA loan provides you with 100% financing on a rural home. You may be surprised to learn what the USDA considers rural, though. Its not always homes out in the middle of cornfields. They are often neighborhoods right outside of the city lines that have low population that qualify. As with any mortgage, though, its not just the down payment you have to worry about. You also have to figure out how you will pay for the closing costs.

What if you dont have the money to pay the USDA closing costs at the closing?

The good news is that you may be able to wrap the fees into your USDA loan. The bad news is that it only applies to certain borrowers.

Read Also: What’s Better Refinance Or Home Equity Loan

Fha Mortgage Insurance Premium

FHA loans require you to pay an upfront and annual mortgage insurance premium .

The upfront fee is 1.75% of the loan amount and is due at closing, but you also have the option of rolling it into the loan.

Doing so increases your loan amount, so youll pay more over time. But if youre worried about having enough to close, this can be a good way to give yourself some breathing room.

The annual MIP rate depends on your down payment and loan amount. Most FHA borrowers pay 0.80-0.85% in annual MIP. The yearly fee is paid in 1/12th installments along with your monthly mortgage payment.

How To Pay Less Up Front

If youre trying to get around paying closing costs up front, there are a;couple of;things you can do. For one, you can ask your seller to pay for part of your closing costs. The percentage of your closing costs that your seller can cover depends on the type of loan that youre applying for.

If the seller is reluctant to cover the closing costs, you could try raising the purchase price to seal the deal. But that means youll end up paying more over the life of the loan.

Related Article:;What Is a Seller Concession?

Recommended Reading: What Is The Role Of Co Applicant In Home Loan

Escrow And Title Fees

The escrow and title fees will include both the lender and the owner policy of title insurance, as well as the escrow fee itself. The title insurance will protect not only the owner, but also the lender by insuring a clear title, and also that the people with a legal right to convey title to the property are the people who will actually do so. In some cases, the policy also protects against an occurrence of forgery or fraud.

Most homeowners who refinance have already paid for a policy of title insurance during the initial property purchase, and do not want to pay for it a second time. Also keep in mind that lenders as well as owners are insured. The new mortgage created during the refinancing process brings about the need for a new policy. Many title companies can offer a substantial reduction in both the escrow fees and title policies to borrowers needing to refinance.

Escrow fees are service fees that are charged by the title company for assuming the role of an independent third party, insuring that those involved in the transaction perform as agreed, as well as facilitating the transaction itself.

Other title costs include the miscellaneous drawing, express mail, and courier fees, as well as the recording fee, the county recorder office’s fee to record the deed of trust, mortgage document notarization fees, and the notary’s fee.

Should I Finance My Closing Costs When I Refinance My Mortgage

When refinancing your mortgage, you may have the option to finance your closing costs instead of paying them out of pocket. What does it mean to finance your closing costs? Its when you add the expense associated with your refinance into your new loan amount.

When does rolling this expense into a new loan make sense? If youre doing a cash-out refinance, your closing costs are generally included in your new loan. And when you dont have the cash on hand to pay your closing costs, then financing them is likely an easy decision. But there are other times when it may benefit you to dig into the details before making your decision. Lets start by discussing closing costs and where you can find the ones associated with your refinance.

Also Check: How To File Bankruptcy On Car Loan

Closing Costs You Can Deduct In The Year They Are Paid

- Origination fees or points paid on a purchase. The IRS considers mortgage points to be charges paid to take out a mortgage. They may include origination fees or discount points, and represent a percentage of your loan amount. To be tax-deductible in the same year they are paid, you have to meet the following four conditions.

Should You Roll Your Closing Costs Into Your Mortgage

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

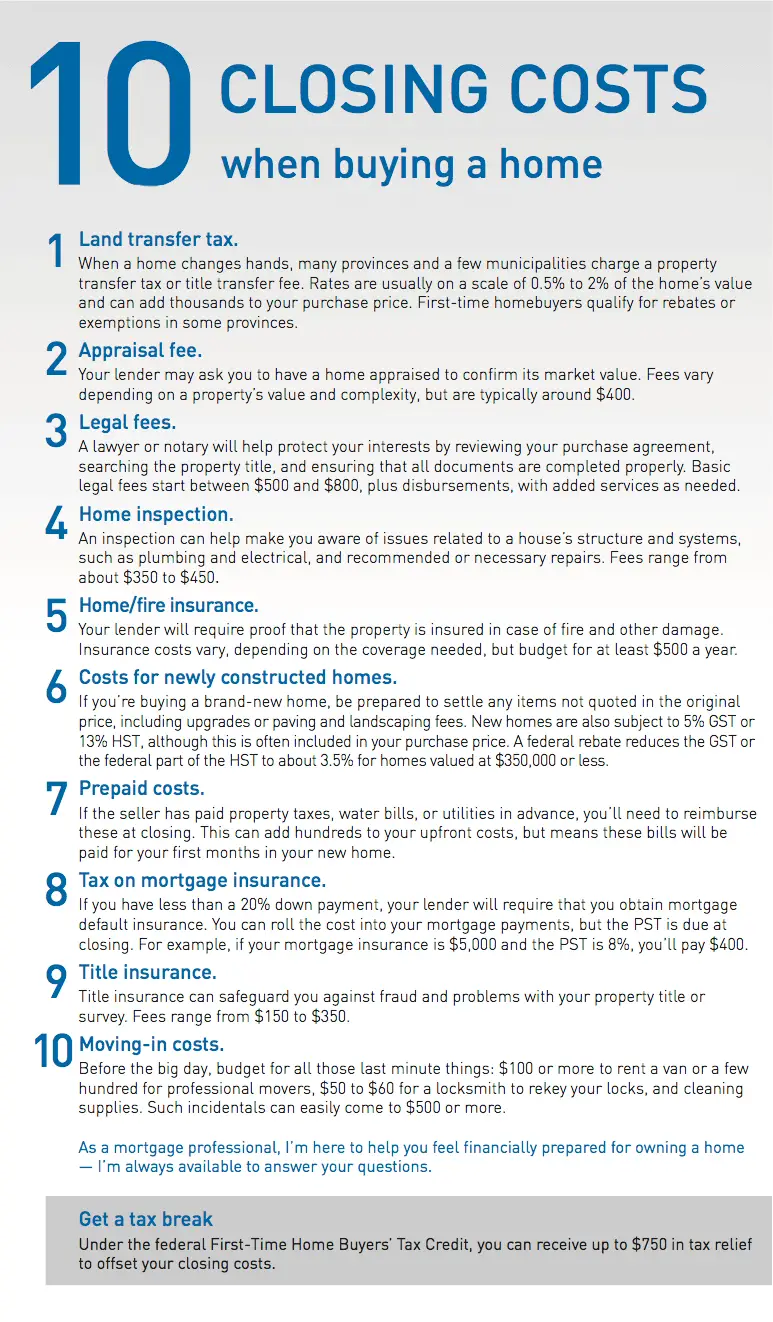

Buying a home is an expensive prospect. You have to come up with a down payment, pay for movers, and buy furniture for your new home. But there’s another expense many home buyers forget to account for: closing costs on a mortgage.

Closing costs aren’t universal. Each mortgage lender sets its own fees that are then passed on to borrowers when they finalize their home loans. Typically, closing costs range from 2% to 5% of a borrower’s loan amount. Nationally, they average $5,749. Your loan estimate should include your closing costs so you know what fees to expect. In fact, your lender should break down each fee for you in your closing disclosure so you know everything you’re paying for.

The good news is that as a borrower, you usually don’t need to come up with a check for your closing costs when you sign your mortgage. You could go that route, but you often get the option to roll those fees into your mortgage and pay them off with the rest of your loan. This applies to new home purchases and refinances. The question is: Which is the better choice?

Don’t Miss: How To Lower Car Loan Payments

Closing Costs V Concessions

One of the big benefits of VA loans is that sellers can pay all of your loan-related closing costs. Again, theyre not required to pay any of them, so this will always be a product of negotiation between buyer and seller.

In addition, you can ask the seller to pay up to 4 percent of the purchase price in concessions, which can cover those non-loan-related costs and more. VA broadly defines seller concessions as anything of value added to the transaction by the builder or seller for which the buyer pays nothing additional and which the seller is not customarily expected or required to pay or provide.

Some of the most common seller concessions include:

- Having a seller cover your prepaid taxes and insurance costs

- Having a seller provide credits for items left behind in the home, like a pool table or a riding lawn mower

- Having a seller pay off your collections, judgments or lease termination fees at closing

In some respects, as long as you stick to that 4 percent cap, the skys the limit when it comes to asking for concessions.

VA buyers are also subject to the VA Funding Fee, a mandatory charge that goes straight to the VA to help keep this loan program running. For most first-time VA buyers, this fee is 2.30 percent of the loan amount, provided youre not making a down payment. Buyers who receive VA disability compensation are exempt from paying this fee.