Va Loan Eligibility Standards

The VA loan has broad eligibility standards. Most active-duty servicepersons, veterans, National Guard members, Reservists and surviving spouses of deceased veterans are eligible to refinance with a VA loan. Discharged and retired servicepersons remain eligible, too.

Others, such as cadets at the U.S. Military, Air Force or Coast Guard Academy, midshipmen at the U.S. Naval Academy and officers of the National Oceanic & Atmospheric Administration, are also among those who are VA-eligible.

Normally, a minimum length of service is required.

What Do I Need To Convert My Fha To A Conventional Loan

You will generally need to present a complete picture of your finances to the lender for a refinance. You may need to gather tax returns, W-2s and 1099s, asset statements, and credit reports. In many cases, youll also pay for a home appraisal to satisfy the lender.

It would be helpful for borrowers to have the closing documents from their existing mortgage handy to help compare terms with the proposed new mortgage costs and payment, says Joseph.

To make sure you get the best refinancing option thats available to you, speak with a few different banks and lenders before settling. The right choice may not be the first that comes up.

Its important to do comparison shopping in the same way you would if you were buying a car or anything else, says Dworkin.

Take an honest look at your financial situation and what you expect the next few years will look like. Depending on what your goals are, sticking with the FHA loan could be the better bet.

Va Refinance Loans Give Lower Rates

Refinancing your mortgage can help your household in a myriad of ways.

A refinance loan can lower your monthly payment it can get you cash out for improvements or repairs and, it can provide some other tangible benefit such as reducing your loans term from 30 years to 15 years.

When you refinance into a new VA loan, though, you get extra benefits.

VA loans require no mortgage insurance, carry no prepayment penalty, and include an assumption feature that lets you transfer your VA loan to another VA-eligible borrower whenever you decide to sell your home.

VA mortgage rates are lower than rates for other loan types, too. For example, VA mortgage rates average around 20 basis points lower than comparable conventional rates and roughly 30 basis points lower than comparable FHA rates, according to loan software company Ellie Mae.

Best of all, you can refinance via the VA even if your current loan isnt a VA one.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Safety And Security Focus On Fha Appraisals Versus Conventional Appraisals

The difference between FHA appraisals versus Conventional loan appraisals is that FHA insured mortgage loan appraisals focuses on the way they view that all FHA insured mortgage loans needs homes that meets the minimum standards of standards of living.

- HUD requires that the home have minimum standards of living which involve the overall safety and security of the homeowner and its occupants

HUD requires that the home be free of the following:

- Peeling paint

- HVAC

- Electrical items

- No pending building violations that can affect the safety and security of the homeowner and its occupants

- The electrical, plumbing, and HVAC systems must be in working order during the FHA appraisal

Any FHA violations need to be addressed and corrected before a FHA appraiser can approve and sign off the appraisal.

How To Treat Canine Distemper

There is no cure for canine distemper. Veterinarians diagnose distemper through a combination of clinical signs and diagnostic tests, or through a postmortem necropsy. Once diagnosed, care is purely supportive. Veterinarians treat the diarrhea, vomiting, and neurological symptoms, prevent dehydration, and try to prevent secondary infections. Most vets recommend that dogs be hospitalized and separated from other dogs to prevent the spread of infection.

The survival rate and length of infection depend on the strain of the virus and on the strength of the dogs immune system. Some cases resolve as quickly as 10 days. Other cases may exhibit neurological symptoms for weeks and even months afterward.

You May Like: Refinance Car Usaa

Fha Loan Down Payment

You can put down as low as 3.5% for an FHA loan, but you need to have a credit score of at least 580. Youre required to put 10% down if your credit score is lower, in the 500 579 range.

Heres an example of how much youd pay for a down payment on both types of loans:

- Conventional loan down payment of 20% on a $200,000 house: $40,000

- FHA loan down payment of 3.5% on a $200,000 house: $7,000

What Is The Difference Between An Fha Loan And A Conventional Loan

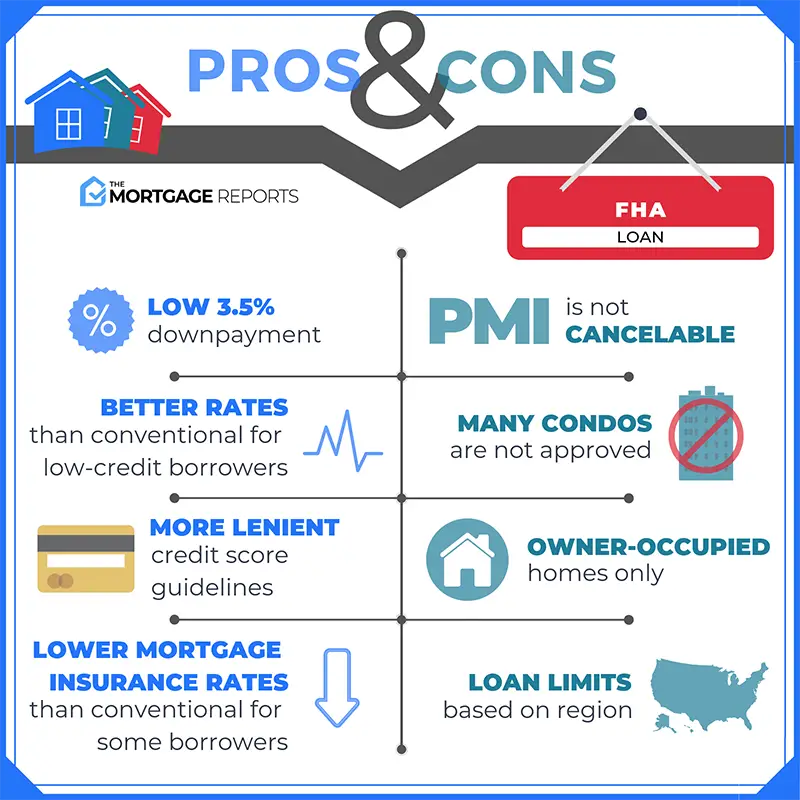

For many buyers, getting an FHA loan makes sense. These loans are designed to help people buy homes by removing some of the typical barriers to homeownership, such as the need to have a significant down payment and an excellent credit score.

Theres a common assumption that FHA loans are only for first-time buyers and that conventional loans are for people who have experience purchasing a property. The reality is that both first-time and repeat buyers can obtain either an FHA loan or a conventional loan. Learn more about the differences between the two types of mortgages.

Also Check: Is Bayview Loan Servicing Legitimate

Benefits Of Refinancing An Fha Loan To A Conventional Loan

One of the main advantages of refinancing from an FHA loan to a conventional loan is the ability to eliminate FHA mortgage insurance premiums .

With a conventional loan, once your balance reaches 80 percent of your homes original value, you can cancel private mortgage insurance . This option doesnt exist in most cases for FHA loans, so youll continue to pay premiums unless you refinance to another type of loan.

If you refinance your FHA loan to a conventional loan and still have to pay mortgage insurance due to your equity level, you may find that the premium costs more now than what it cost for your FHA loan. Refinancing, however, may have lowered your monthly payments enough to compensate, and the tradeoff is that youll be able to cancel PMI, eventually, on the conventional loan.

- Conventional PMI: 0.58 percent to 1.85 percent, according to averages from the Urban Institute

- FHA MIP: 0.75 percent upfront and 0.45 percent to 1.05 percent yearly

Another benefit to refinancing your FHA loan to a conventional loan is that conventional mortgages allow you to tap up to 80 percent of your homes equity through a cash-out refinance without paying mortgage insurance. Conventional loans also have higher loan limits, so you can take out a larger amount compared to an FHA loan.

Causes Of Canine Distemper

Canine distemper is caused by the paramyxovirus virus. Animals get infected from contact with infected urine, blood, saliva, or respiratory droplets. Of these, transmission usually happens through droplets. It can be spread through coughing and sneezing or contaminated food and water bowls.

Canine distemper can occur year round, but the virus is resistant to cold. The majority of cases in domestic dogs occur in the late fall and winter.

Read Also: Usaa Personal Loan With Cosigner

You Can Shorten Your Term

When you refinance, you could choose a shorter loan term than your original loan, letting you pay off your mortgage months or years faster. You could reduce your monthly payment or pay off the mortgage faster.

Thats the tactic recommended by financial expert and NextAdvisor contributor Suze Orman. For example, you may be able to trade a 30-year mortgage for a 15-year mortgage, which typically have even lower rates.

A lot of times people can refinance to shorter terms and keep their payments similar to what theyre paying now, except more of the payment is going toward the actual principal, continues Davis.

What Is A Conventional Loan

A conventional loan is a mortgage that is not guaranteed by a federal agency such as the FHA. Since conventional loans dont offer lenders the guarantee that the loan will get paid, they often have stricter requirements compared to FHA loans. Despite that fact, the majority of home buyers use conventional loans to purchase a home. In the first quarter of 2019, 69 percent of new houses sold used a conventional loan as the source of financing. Meanwhile, 17 percent of sales used an FHA loan.

Usually, if a person is interested in applying for a conventional loan, they need to make a down payment of at least 3 percent and have a credit score of at least 620. The more a person can put down, the better the terms of the mortgage. The higher a persons credit is, the lower the interest rate. While you can get a conventional loan with a lower credit score, many lenders offer the best rates to people with scores in the 700s.

You might have heard the traditional advice to put down at least 20 percent of the value of the home when you apply for a conventional mortgage. Generally, making a down payment of at least 20 percent eliminates the need to pay private mortgage insurance each month.

You May Like: Usaa Certified Dealers List

Fha Appraisals Versus Conventional Appraisals Guidelines

This Article Is About FHA Appraisals Versus Conventional Appraisals Guidelines

All home buyers who need financing on a home purchase will need a home appraisalrequired by their lenders. Lenders rely on the home appraisal to secured the mortgage they give borrowers.

- Home Appraisals are mandatory and required by lenders

- Appraisals are necessary for lenders to determine the value of the property they are loaning against

- Appraisals is used by lenders to determine value and protect their investments as well as the homeowners investments

- Home Appraisals come in different types depending on the loan program the home buyers chooses

There are FHA Appraisals and Conventional Mortgage Appraisals and they are differences between them. FHA Appraisals can be used if the borrowers transfers the FHA into a conventional loan. However, a conventional loan cannot be transferred if the borrower converts to an FHA loan.

Main Difference Between Fha Appraisals Versus Conventional Loan Appraisals

The Federal Housing Administration does not make loans but insures residential mortgage loans made by private mortgage lenders as long as it meets its guidelines and rules.

- Since HUD insures its mortgages on behalf of lenders, qualified and approved borrowers, it sets its own guidelines and rules pertaining to appraisals as well as other guidelines

- FHA as well as its lenders order appraisals to make sure the value of the subject property is in line with the purchase price

Special emphasis on subject property is safe and secure with no hazards nor building violations.

Also Check: Is Usaa Good For Auto Loans

How Is Canine Distemper Spread

Puppies and dogs most often become infected through airborne exposure to the virus from an infected dog or wild animal. The virus can also be transmitted by shared food and water bowls and equipment. Infected dogs can shed the virus for months, and mother dogs can pass the virus through the placenta to their puppies.

Because canine distemper also impacts wildlife populations, contact between wild animals and domestic dogs can facilitate the spread of the virus. Canine distemper outbreaks in local raccoon populations can signal increased risk for pet dogs in the area.

Can Fha And Conventional Appraisals Be Transferred

If a home buyer has a home appraisal and want to transfer their loan to another lender, can the home appraisal be transferred?

- A FHA home appraisal can be transferred from one lender to another in the event if the borrower decides to change lenders during the mortgage process

- A conventional home appraisal cannot be transferred from one lender to another if the borrower changes lenders during the home process

- A FHA appraisal can be transferred to Conventional home appraisal

- However, a Conventional Home Appraisal cannot be transferred to a FHA appraisal if the mortgage borrower decides to change loan program from Conventional Loan to FHA Loan

Read Also: Can You Refinance An Fha Loan

First Option Convert Heloc To Home Equity Loan

This is the most straightforward option, since you’re just switching one type of home equity loan for another. But with a standard home equity loan, you simply borrow a set amount of money and begin repaying it immediately at a fixed rate. A HELOC lets you borrow and repay as you wish during the draw period of up to 10 years, before you have to being repaying principle.

In this type of refinance, you simply take out a home equity loan and use it to pay off the balance on the HELOC as a single transaction. You don’t have to use the same lender that you have the HELOC through it’s a completely different loan. You will have to pay certain closing costs, including an origination fee based on the loan amount.

How Can I Prevent My Dog From Becoming Infected

Fortunately there are highly effective vaccines to prevent this deadly disease. These vaccines are given to puppies along with other routine vaccines at 8, 12, and 16 weeks of age. After the initial puppy vaccine boosters, additional distemper vaccine boosters should be given to adult dogs. Your veterinarian will help you determine how often your dog should receive booster vaccine. Recently, some distemper vaccines have become approved for a three-year booster interval, meaning that they are only required every three years.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

How Do Fha Loans Work

While the federal government doesnt make FHA loans, it does insure them. That means if a borrower has trouble making mortgage payments and falls behind, the lender can file a claim with the FHA. After the lender forecloses on the buyers home, the FHA pays the lender the loans balance. Since lenders know they are likely to get paid no matter what, they are more willing to lend money to people who would otherwise be considered too risky for a home loan.

The FHAs guarantee does come at a cost, though, and its usually the borrower who pays the price. FHA loans typically have two forms of mortgage insurance. The first is an upfront mortgage insurance premium payment typically around 1.75 percent of the loans principal amount. You pay this amount at closing.

The second form of mortgage insurance is a monthly insurance payment, which can be anywhere from 0.45 to 1.25 percent of the initial principal. The monthly insurance payment usually remains for the life of the loan, and can add several hundred dollars to a persons monthly mortgage payment.

Should I Refinance Va Loan To Conventional Loan

If you have a VA loan, you might be wondering should I refinance a VA loan to a conventional loan.

Theres a lot to consider.

First, consider your finances. Can you afford the conventional loan?

If you dont have at least 20% of equity in a conventional loan, youll pay private mortgage insurance .

And that may increase your payment, so make sure its affordable.

Next, look at your credit score.

Lenders typically require a higher credit score for a conventional loan.

Youll usually need a score of at least 660. However, some lenders may still approve your loan with a lower score, but you may end up with a higher interest rate.

Finally, look at the rates.

If interest rates dropped, it might make sense to refinance a VA loan to a conventional loan.

It doesnt have to be a drastic difference.

A rate thats just 0.25% lower can save you thousands of dollars over the life of the loan.

Also Check: Does Va Loan Work For Manufactured Homes

How Do I Convert An Fha Loan To A Conventional Loan

4.3/5convertFHA loanconventionalloanFHAFHA

Similarly, can I switch from an FHA loan to a conventional loan?

To convert an FHA loan to a conventional home loan, you will need to refinance your current mortgage. The FHA must approve the refinance, even though you are moving to a non-FHA-insured lender. The process is remarkably similar to a traditional refinance, although there are some additional considerations.

Similarly, is a conventional loan better than FHA loan? In sum, an FHA loan is more flexible to obtain, but no matter how large your down payment, you will have to pay mortgage insurance. A Conventional loan requires a higher credit score and more money down, but does not have as many provisions.

Similarly, how soon can you refinance an FHA loan to a conventional loan?

You must already have an FHA-backed mortgage. All of your mortgage payments must be up to date. You must wait 210 days, or have six months of on-time payments before applying. You cannot get a cash-out refinancing with the switch.

What is the difference between a FHA loan and a conventional loan?

The main difference between FHA and conventional loans is the government insurance backing. Federal Housing Administration home loans are insured by the government, while conventional mortgages are not.

The Cons Of Refinancing

If youre considering refinancing to a conventional loan, be aware of closing costs.

The pitfall is closing costs. Its important to talk to the bank or the loan officer about loan estimateswhat types of closing costs are involved in the transactionto get an idea of how much youre going to pay to get that refinance, says Davis.

The process isnt cheap. Expect to pay thousands of dollars during a refinance. You may be able to roll the closing costs into your new mortgage, but doing so increases what youll owe.

If the payment isnt coming down where you can recoup your closing costs within a 3 to 5 year period, I would suggest to just stay put with the FHA loan that you have, continues Davis.

If youre planning to sell your home soon, you may also think twice about refinancing. The equity you spend during the process means youll own less of the house when selling.

Prior to refinancing, borrowers should determine how long they intend to stay in the property. If they havent been in the home that long and havent established much equity, refinancing the home and rolling in closing costs for the transaction may complicate selling the home in the short term, says Joseph.

Also Check: What Credit Score Is Needed For Usaa Auto Loan