How Many Years Should You Finance A New Or Used Car

Depending on multiple factors, such as , some consumers may qualify for financing of 84 months an eight-year term or more. The average loan term at the start of 2021 was 69 months for new and nearly 66 months for used vehicles, according to Experian data.

Short vs. long-term car loans

There are several things you should keep in mind when considering how many months you should finance your vehicle for. Increasing the car loan term is an effective way of getting an affordable monthly payment. While a low payment is always appealing, a longer car loan period typically comes with higher interest costs.

Consider someone who takes out a loan for $29,039 the average amount for a new SUV says Experian over 60 months with a four percent interest rate. Their monthly payment is $534.80 and they pay $3,048.84 in interest by the end of the contract. Extend the loan to 84 months and the car payment falls to $396.93, but the total interest charge is $4,302.99 an extra $1,254.15.

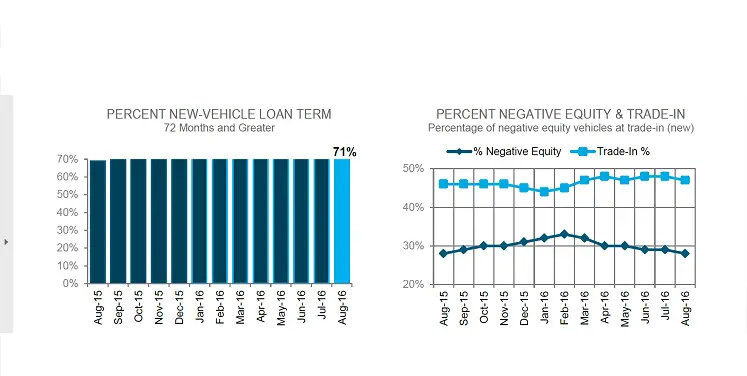

Theres also the increased risk of negative equity, when you owe more than the vehicle is worth. With a lengthy loan, for example, you might still be making payments on an older, high-mileage vehicle thats fallen greatly in value. Taking into account the average length of new vehicle ownership is nearly seven years, you could find yourself changing cars without enjoying the benefits of debt-free driving, or face trading in while upside down.

Financing A Car With An Auto Loan

Unless youre buying an early 2000s vehicle, chances are youre going to end up financing your car with an auto loan. You can finance a car at many different places a bank, credit union, or through the car dealership. As with any type of loan, its best to shop around and compare different interest rates before taking the leap. Weve compiled the below questions to give you a glance at the ins and outs of financing a car with an auto loan.

test

Which bank has the best auto loan rates?

Bank of America is known for having some of the lowest auto loan rates. Depending on your credit score, you can get a new auto loan for as little as 3.44% and a used one for 4.29% APR.

How do I get the best auto loan rate?

You can get the best auto loan rate by using a comparison tool that lets you view multiple quotes at once. Dont go with a loan just because it was offered by the dealership take time to shop around.

What is a bad interest rate on a car loan?

A bad interest rate on a car loan depends on your credit score. If you have excellent credit, an APR over 5% would be bad. On the other hand, someone with subprime credit should not pay over 18%.

After approval, how long to receive rates on car loan?

After being approved for an auto loan, you typically find out the interest rate right away. In fact, there are some lenders that instantly approve you and subsequently inform you of the rates.

What is a good APR rate for a car loan?

Can you pay off a car loan early?

Save Up For A Larger Down Payment

Instead of jumping into an 84-month loan right away, you should spend some time building up your savings in a high-yield account.

That way youll be able to make a larger down payment and take out a smaller loan with a lower monthly payment.

Plus, while youre saving, the money in your account will collect interest and grow, so youll have even more cash available to put down once youre ready to buy and borrow.

Also Check: Usaa Car Loan Pre Approval

You May Owe More Than Your Car Is Worth

Since a new car starts losing value the moment you drive it off the lot, an 84-month auto car loan can also put you at higher risk of going upside down on your loan.

That means you may end up with negative equity owing more than your car is worth. In that case, if you want or need to sell your car before its paid off, you may not break even, much less turn a profit.

And if your car gets totaled in an accident before its paid off, the insurer may only cover the book value of the car very possibly an amount less than what you owe. Even if the car isnt drivable, you could still be responsible for making the monthly payments until its paid off.

How To Move Forward

After understanding the risks of a 72 month auto loan and a 84 month auto loan term, you should proceed with caution. Its best to avoid extending your loan term unless you can put down a sizable down payment. That would help you address the negative equity issue. Ideally, you have a plan to start accelerating your payments to help pay off the loan early, which can save you thousands in interest costs and out-of-pocket money should you want or need to trade in your car early.

You May Like: What Car Loan Can I Afford Calculator

Make A Higher Down Payment

The larger the down payment, the lower your loan amount. Consider dipping into your savings or waiting until you have saved a little more before buying a car. A significant down payment can help you get a lower payment and, possibly, a lower APR and term. Dont dip so far into your savings that you cant pay other bills on time. Here are eight ways to make extra money.

Ford Is Removing The Credit

That could make new car loans accessible to more people, but here’s why you should be careful before signing on that dotted line.

Think things through before you commit to a seven-year car loan.

For most of us, buying a car involves getting a loan, whether from a bank, a credit union or an auto manufacturer’s captive finance company. Whether or not we’re approved for that loan is determined by our credit score — except, in one case. According to a report published by CarsDirect on Friday, Ford has removed the minimum credit score requirement for its 84-month car loans.

This can be considered problematic for a few reasons. Typically, a minimum FICO score is taken as an indicator, along with other factors like debt-to-income ratio , to determine a buyer’s ability to repay the loan. Removing that score makes it easier to buy a new car, but it also has the potential to let people get themselves into loans with higher interest rates, which ties that customer to a lengthy repayment plan for an asset that’s very likely to depreciate faster than they’re paying it down.

Get the Roadshow newsletter

It’s possible that this change in loan practices could be construed as somewhat predatory, particularly since the change doesn’t apply to any of the company’s other loan products. We reached out to Ford Credit representatives for comment, and they had this to say:

You May Like: Can I Refinance My Car Loan With The Same Lender

Can You Sell A Car With A Loan

It is possible to sell a vehicle when you still have a loan, but it adds a few extra steps. There are a few different options in this situation. One option is to pay off the loan in full before selling the vehicle, which involves contacting your lender to determine your payoff amount. After paying off the loan, your lender will release the lien.

You can sell a vehicle that’s financed without paying it off by selling it to a private buyer or trading it in with a dealer.

More Interest Paid Over The Life Of The Loan

Because you’ll be paying off the loan for a longer period, interest will have a longer time to accrue. Consider the following numbers using the loan for $20,000 at a five-percent APR mentioned earlier:

- Five-year loan at $377/month: $2645 total interest paid

- Six-year loan at $322/month: $3191 total interest paid

- Seven-year loan at $283/month: $3745 total interest paid

This is a difference of more than $1000 in interest from a 60 month to an 84-month auto loan.

Don’t Miss: When Can I Apply For Grad Plus Loan

Alternatives To An 84

There are a number of alternatives to 84-month car loans that could help you save money in the long run. Lets take a closer look at some of them.

- Lease a car. If youre thinking about taking out an 84-month car loan because youd like lower monthly payments, leasing from a car dealer could be the way to go. Since lease payments are based on a cars depreciation during the time youre driving it instead of the purchase price, leasing may come with lower monthly payments.

- Select a more affordable used car. It may be tempting to take out an 84-month loan for your brand-new dream car but if that means big financial hardship, you should consider a used car that costs less.

- Save for a larger down payment. The more money you put down on a car, the less youll have to finance and the lower your monthly loan payments may be. Taking the time to save for a larger down payment could allow you to take out a shorter loan term and still enjoy lower monthly payments.

Where Can I Buy A 6 Volt Car Battery

Category: Cars 1. Traveller Heavy-Duty Battery, 1-6V Tractor Supply Co. Buy Traveller Heavy-Duty Battery, 1-6V at Tractor Supply Co. This quality automotive battery is reliable, compact and compatible with a range of makes Rating: 4.5 · 139 reviews · $99.99Reviews · Questions & Answers Shop for Duralast Battery 1-6VOLT

Recommended Reading: How Do I Refinance My Car With Bad Credit

When They May Be An Acceptable Option

As you can see from what you’ve read so far, I’m not a big fan of 84 month auto loans. There are times though, when I feel you could consider them.

One key here is to make absolutely sure that this is the right vehicle for you and you know that your needs won’t be changing in the near future.

Also be sure the vehicle has everything that you could imagine yourself wanting for at least the next 5-6 years.

Another key is to be extra sure that the payments are very easy for you.

I’ve seen customers completely max themselves out on payment thinking that they could do it, but six months to a year down the road they realize it’s hard to make $500 a month payments when they only earn $2,000 a month.

Do yourself a favor and really think this through before you get locked into an 84 month car loan.

If you are going to finance for a longer term I’d highly recommend purchasing GAP Insurance from the dealership. This will protect you in the event of a total loss of the vehicle. Just be sure to not over pay.

Your Credit Score And Apr

The APR you get on an auto loan is heavily determined by your credit score. Someone with a 550-credit score could end up paying 10% more than someone with a credit score of 710. As you can imagine, this could end up being several thousands of dollars more throughout the life of the loan. While a credit score of 713 is considered to be a good score, youre not out of the running if you have a score that is lower. The below questions will give you an indication if youre score meets the mark or not.

test

What is a good interest rate on a car loan?

A good interest rate on a car loan would be one that falls between 3 to 4%. To get an interest rate in this range, you would need a credit score in the good category.

What are current auto loan rates?

According to market data, the current rate for a 60-month new car loan is 4.93%, 4.87% for 48 months, and 5.57% for a 36-month used car loan. The exact rate you pay will vary by your location and credit score.

What is the average interest rate on a car loan with a 700 credit score?

The average auto loan interest rate with a 700-credit score is 4.68% for a new vehicle. Used cars have a slightly higher interest rate because the resale value is harder to predict.

Can I get a car loan with a 670 credit score?

Yes, you can get a car loan with a 670-credit score. Since this is considered to be a fair credit score, you could secure an interest rate of about 7% or less.

Is 692 a good credit score?

You May Like: Loan Originator License California

Average Rates For Auto Loans By Lender

Auto loan interest rates can vary greatly depending on the type of institution lending money, and choosing the right institution can help secure lowest rates. Large banks are the leading purveyors of auto loans. , however, tend to provide customers with the lowest APRs, and automakers offer attractive financing options for new cars.

Buying More Car Than You Can Afford

The primary reason car buyers take out extended term loans is to make their payments more affordable. As car prices have continued to increase, wages in the U.S. have remained flat. Extended term loans can make new cars more affordable based on consumers monthly budget.

According to Experian, the average amount financed for new cars has reached a record of nearly $31,000. For consumers to continue to buy new cars without blowing out their monthly budget the options is to extend the loan terms. Car dealers, which are having a more difficult time moving new cars off their lots, are only too happy to oblige. They know that many car buyers are shopping monthly payments versus shopping car prices.

Extended term loans allow car buyers to enjoy that new car smell, even though it can cost them hundreds or thousands in interest over the term of the loan. If you finance $25,000 for a new car at 4 percent over a more conventional 48-month term, your monthly payments would be $564, and your total costs would be $27,100.

However, if you finance the same amount at the same interest rate over 84 months, your payment would only be $342, but your total costs would be $28,700. That may not seem like much of a cost to incur in order to drive off with the latest model, but it doesnt account for the hidden risks of extended term financing.

Read Also: Becu Lienholder Address

What Tires Should I Buy For My Car

Category: Cars 1. How to Choose the Right Car Tires Consumer Reports Oct 7, 2016 All-season car tires deliver a good, well-rounded performance but are never outstanding in any way. Summer tires deliver on handling and dry/wet To maintain your vehicles original handling attributes, replacement tires should match

Best Bank For Auto Loans: Bank Of America

Bank of America

- As low as 2.39%

- Minimum loan amount: $7,500

Bank of America auto loans come with the backing of a major financial institution. Low rates and a big selection of loan options make it a major competitor in the auto loan landscape. In J.D. Power’s 2020 Consumer Financing Satisfaction Study, which deals with auto loans, Bank of America ranked seventh out of 12 in its segment and scored equal to the average.

-

Offers new, used, and refinance auto loans

-

Transparent rates and terms online

-

Well-known financial institution

-

Restrictions on which vehicles it will finance

-

High minimum loan amount

Bank of America is a large financial institution offering a number of auto loan options, including new, used, refinance, lease buyout, and private party loans.

For the most creditworthy borrowers, APRs start at 2.39% for new vehicles. Used vehicle loans start at 2.59% APR, while refinances start at 3.39% APR. Customers of the bank who are Preferred Rewards members can get up to a 0.5% discount on their rate.

BofA provides a no-fee online application that it claims can offer a decision within 60 seconds. You can choose from a 48-, 60-, or 72-month term online, but there are additional options ranging from 12 to 75 months if you complete the application process at a branch or over the phone.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Average Interest Rates For Car Loans

The average APR on a new-car loan with a 60-month term was 4.96% in the first quarter of 2021, according to the Federal Reserve. But as mentioned above, your credit scores and other factors can affect the interest rate youre offered.

|

Loan type |

Note: Experian doesnt specify which credit-scoring model it uses in this report.

The table above isnt a guarantee of the rate you may be offered on an auto loan. Instead, it can help you estimate an interest rate to enter into the auto loan calculator, based on the average rates people with various credit scores received on auto loans in the first quarter of 2021.

Keep in mind that there are different and that various lenders use may different ones. For example, auto lenders may look at your FICO® Auto Scores. And available interest rates and APRs can vary by lender, so be sure to shop around and compare both across your loan offers.

Monthly Payment And Loan Length

If you are looking to minimize your monthly payment, the 84-month plan is a winner. Whats not to love about a monthly payment that is half the size of a 36-month loan? But you probably also notice that there is not a huge difference between the payment you will be making once the number of years increases: what is the big difference, you will wonder, between a 60, 72, and 84-month loan?

| Term | |

|---|---|

| 84 | $139.00 |

The reason banks, car dealerships, and other financial institutions are willing to lend you money is because they make money off of you doing so. The longer you stretch out the length of your loan, the longer you will be paying someone else to be able to do soand the more you will end up paying in total. While an 84-month loan might seem like a great deal if you are looking at the monthly payment, it will cost you interest.

Read Also: Usaa Auto Loan Refinance