Best Bad Credit Auto Loans For 2021

Whether you need an auto loan for a new or used car, you can run into difficulties getting approved at a local bank or credit union when you’ve got a bad credit score usually one that falls below 600 or 580. While you can expect a credit check for many auto loans, you can find lenders that offer bad credit auto loans as long as you’re willing to pay a higher interest rate, prove a certain amount of income and possibly put down more money on your vehicle. Going with such lenders could help you avoid needing a co-signer, and you can even rebuild your credit as you make timely payments. Check out these five bad credit auto lenders to consider for your vehicle purchase.

How Auto Navigator Works

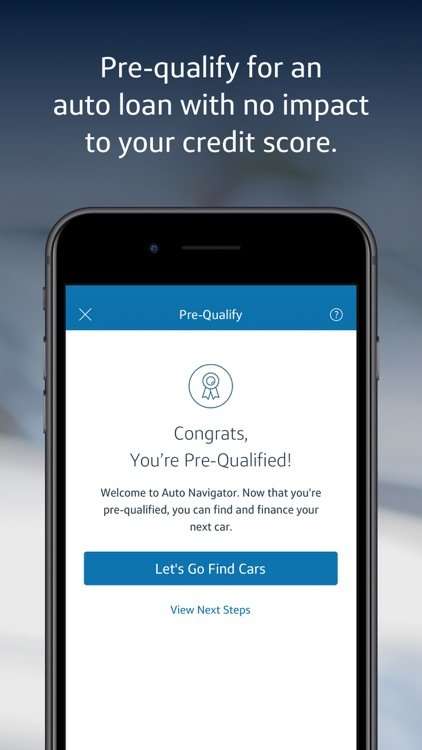

I filled out some basic information and Capital One pre-approved a loan limit before I began shopping. This gave me the confidence that I could be flexible and not stuck negotiating small points to get to a set monthly payment or price. And, it was not a hard credit approval which dings your credit score if I changed my mind or went with another lender my credit would be unaffected.

I was able to weigh the terms of different loan lengths in the app I could see and adjust the downpayment, trade in value, price of the car, interest rate and loan length of 4 year, 5 year or 7 year loan and pick the one that was the best fit for me. 7 year loans are the max that Capital One will finance, but 4 or 5 are best longer loans will have you owing money on a car that is worth less than your loan iswhich is financially unhealthy.

One great feature in the Capital One Auto Navigator is that you can shop from dealers that accept the loan.

What Sets It Apart

Capital One is known for its credit card options, but the company also offers tools to help you find and finance your next vehicle. Not only can you filter your search by dealer and car, but loan terms could include the price of the car as well as the tax, title and other relevant fees, lowering your total out-of-pocket cost.

Not all dealerships work with Capital One and if you dont already have an account, you wont be able to apply. You can compare more car loan options to see what other rates you might qualify for.

Recommended Reading: What Happens If You Default On Sba Loan

Loans Have To Be Used At A Participating Dealer

It’s not uncommon for auto loans to require your car be purchased through a network of dealerships the bank works with. However, that could limit your options for which car you can buy. Make sure that the vehicle you want to finance can be purchased through one of the available dealership partners before pre-qualifying.

Buyer Beware Caveatsyes There Are Some

From there the dealership finished the loan process by completing my credit report and printing out all the paperwork for me to sign. One buyer beware note: Make SURE the dealer processes the loan terms you selected our dealership tried to process a 6 year loan which had a higher interest rate. We insisted they re-work the paperwork with the loan terms I found on the Auto Navigator app, and they did.

Also be aware that not all dealers participate in Auto Navigator, so if you find a car that isnt in their database you cant use the app for this purchase though you can visit your Capital One branch to ask about a traditional loan. Auto Navigators pre-approval looks for a minimum income and a minimum credit score . And, the Auto Navigator pre-approval doesnt mean you are fully approved. You still have to go through the loan approval process.

My new car! We got the 2016 Infiniti QX50 we were looking for. Scotty Reiss

Don’t Miss: What Car Loan Can I Afford Calculator

How To Shop With A Preapproved Loan

Once you’re approved, the lender will give you the total you can spend and the interest rate for which you were approved. What you do next will depend on whether you are buying a new or used car.

If you know the exact new car you want to buy, you negotiate for the car as you normally would and the dealer will get in touch with your lender to arrange payment. Some lenders have a list of approved car dealers, so make sure you verify that the dealership at which you’re shopping is on it.

If you are undecided about what new car you want, many lenders will give you a sort of “blank check” that isn’t limited to a certain car or dealer. The check isn’t truly blank: Its maximum amount will be the one for which you qualified. With this check in hand, you can visit multiple dealerships and test-drive as many cars as you want before making a decision to buy. Once you’ve found the right car for you, hand over your check and the dealer will make the arrangements with your lender.

The requirements for buying a used car are slightly different. Most lenders will specify that the car must be purchased at a franchised dealership. This rules out buying from private-party sellers and independent dealerships. There are also restrictions on the age and mileage of the vehicle. Capital One, for example, says borrowers can only finance up to $40,000. The vehicle must be 10 years old or newer and can’t have more than 120,000 miles on the odometer.

How To Use Capital One

The best way to register would be to visit your local branch of the bank and talk to the agent about opening an account and sending money internationally. That way, you will get all of the necessary and up to date information. There is an attractive account offer – 360 accounts, which seems like a good option to handle your money online.

Recommended Reading: How Long For Sba Loan Approval

What Credit Score Is Needed To Buy A Car

There is no official one-size-fits-all credit score needed to buy a car. Instead, each lender sets its own criteria, so there may be different cutoff points for different lenders.

That said, its definitely easier to get approved for a car loan if you have a good credit score. The lower your credit score, the harder it may be to find a lender, and if you do, youll usually pay a lot more for financing. Thats why most people who end up taking out an auto loan have a good or excellent credit score.According to Experians State of the Automotive Finance report from the second quarter of 2021, heres how many people got car loans within the different credit score ranges:

| Deep subprime | 1.98% |

The lower your credit score, the lower your chances of you being able to buy a car. If your credit score needs a lot of work, it may be hard to find a lender who will approve you for a car loan.

Capital One Auto Loan Details

Capital Ones Auto Navigator program offers APRs for new cars as low as 3.24% and used cars as low as 4.14%. The rate you receive will depend on the loan term, your credit history and loan-to-value ratio. Financing terms range from 36 to 72 months , and youll need to take out a minimum of $4,000. The maximum amount you can finance depends on the value of the car you intend to purchase, up to $40,000. This amount could include the sales price, tax, licensing fees and other optional products like an extended warranty from the dealer.

Capital Ones loan program serves people who want to purchase a new or used vehicle, including minivans, SUVs and light trucks intended for personal use. It does not allow borrowers to finance other types of vehicles such as RVs, boats or motorcycles, as well as certain makes of vehicles. The car you intend on purchasing must have less than 120,000 miles on it, and the model year has to be 2006 or newer, with the exception of some states where it needs to be at least a 2008 model.

To get a loan, first request prequalification, and if you get it, present this offer to the dealer. Youll then fill out a credit application at the dealer so Capital One can match the loan terms, once the participating dealer submits it. To prequalify, you need to be at least 18 years old with a valid U.S. address and a minimum monthly income of $1,500 or $1,800, depending on your credit situation.

Recommended Reading: How Can I Refinance My Car Loan With Bad Credit

Capital One Auto Loans Summary

All in all, Capital One Auto Finance offers some excellent rates and terms for new and used vehicles. You can feel confident in knowing that you are getting a very competitive rate, especially if you are able to get rates in the mid 4% to low 5% range.

You can access the Cap One website here. Don’t forget to bookmark this site so that after you get your approval you can learn some very valuable time and money saving car buying tips.

Rates for Capital One auto loans aren’t bad for used vehicles, but with good credit you may be able to do better. Check out my Bank Auto Loan Rates page to compare auto lenders rates.

Many lenders are hopping on the “green” car bandwagon and are offering additional discounts for buying hybrid cars. I have not seen anything yet from Cap One, but it’s something you may want to inquire about.

If you’d like to learn more about alternative fuel cars – technology and tax credits, then take a look at new hybrid automobiles.

There are no Capital One auto loans for private party and/or lease buyouts, so you will have to look elsewhere however, they do offer auto loan refinancing with competitive rates.

How Do Repayments Work

Although the dealership you buy from will be the primary lien holder on your vehicle, Capital One will still service your loan. To make a repayment, you can log in to your Capital One account online or through its mobile app. From there, you can schedule a one-time payment or set up recurring payments. If needed, you can also change your due date but it isnt clear how many times you can do this.

You can also make payments by mailing a cashiers check, money order or personal check to Capital One or by sending a payment through Western Union or MoneyGram.

Recommended Reading: Usaa Car Loan Reviews

Apply Online Or In Person

Eventually, you’ll settle on one personal loan. At that point, you can apply either online or at a bank branch. Applying online typically gives you the fastest decision, since it’s automated. But applying in-branch may plug you right into an automated system, too. And you’ll have the expertise of a banker with you.

Easy Online Application For Pre

Shopping around for an auto loan and comparing offers is the best way to know that you’re getting a good deal. With Capital One, it’s easy to pre-qualify online and walk into a dealership with an idea of what you might pay.

If you pre-qualify in advance, you have more bargaining power with the dealership when it comes to talking interest rates. The interest rate on your auto loan is negotiable, and you could use your pre-qualification offer to beat an offer or be confident that you’ve got the best deal.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Preapprovals Make Car Shopping Easier

In a perfect world, we could all pay cash for our cars and never have to worry about debt or monthly payments. We would likely negotiate the sale price more aggressively because the salesperson would know that we had the money and could take our business elsewhere at a moment’s notice. In the real world, however, only a few of us are able to save up enough cash to pay for a car in full. The rest of us have to finance.

The problem with starting your car financing at the dealership is that you don’t know whether the loan you’re being offered is the best financing you can get. It can also complicate the negotiations and limit where you can shop to get the best price. A better way is to get preapproved for your car loan. Getting preapproved is the closest you can come to the perks of paying with cash while not having to save up for months or years in advance.

You can get preapproved for a car loan at a bank, credit union or online lender.

Should You Get An Auto Loan Through Capital One

A Capital One auto loan might be for you if you have a nonprime or subprime credit score. In these credit categories, borrowers may be rejected by many lenders or offered high interest rates.

Capital One works with borrowers with credit scores as low as 500. Auto loan interest rates at Capital One tend to start lower than the typical interest rates, and could help people in this credit category get lower interest rates, too.

Recommended Reading: Mortgage Loan Officer Salary Plus Commission

How To Sign Up

After you open an account in Capital One Bank, you will be able to manage and handle your money online through their website and app.

Compared to other US banks, they arent the customers first choice. However, their online services work very well and with a neat design it may be one of the best on the financial-banking market. You can read in a ValuePenguin.com review that:

Capital One’s higher interest rates and fewer account fees makes it a strong candidate for your online banking, even compared to competitors who focus exclusively in that area.

Where Capital One Falls Short

- Low maximum loan amount: Other competitors offer loans up to $100,000, which could come in handy if youre looking to purchase a pricy vehicle.

- Financing only valid at eligible dealers: Capital One doesnt finance vehicles bought through private party sellers or auto brokers. You also cant use financing for a lease buyout.

- Can only borrow a maximum of 80% of the vehicle value: Borrowers need to have a loan-to-value ratio of 80% or less.

- Not all vehicles qualify: You cant finance recreational vehicles, including motorcycles, ATVs and RVs. Capital One also doesnt finance vehicles for commercial use.

Read Also: Genisys Auto Loan Calculator

What Do You Need To Qualify For Capital One Auto Finance

To qualify for auto loans with Capital One Auto Finance, applicants need a minimum annual income of $18,000 or higher. Capital One Auto Finance only considers borrowers who are employed and meet the minimum income requirement. Note that borrowers can add a cosigner to either meet eligibility requirements or qualify for lower interest rates.

The Military Lending Act prohibits lenders from charging service members more than 36% APR on credit extended to covered borrowers. Active duty service members are eligible to apply for a loan via Capital One Auto Finance. Their rates fall within the limits of The Military Lending Act.

Permanent resident / green card holders are also eligible to apply.

To qualify, applicants may need to provide the following documentation:

- Recent pay stubs

- Proof of citizenship or residence permit

Is Cap Onethe One For You

Capital One auto loans are, quite frankly, some of the most difficult loans to figure. Their computer scoring system either likes what it sees or it doesn’t.

If you don’t meet certain requirements, then it may be best to save yourself the credit inquiry. On the other hand, if you do meet their minimum requirements, they could very well be your best approval.

Capital One Auto Finance had recently gotten out of the prime lending business and were not loaning money for auto loans to A+, A, and B tier credit customers.

Apparently their losses far exceeded their gains for these credit tiers and they backed off for nearly 6 months. Well, guess what?…They’re Back!!! But only at participating dealerships. Again, a bit confusing!

Here’s what’s below

To compare auto lenders rates visit: Current Auto Loan Rates

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Consider A Down Payment Or Cosigner

Sometimes, no matter how perfectly you crafted your budget, your perfect loan simply isnt attainable, often due to a less-than-great credit history. If youre turned down for a loan because the lender simply wont let you borrow the amount you requested, you may have a couple of options.

First, you can consider putting down a cash down payment or providing a trade-in vehicle at the dealership. Either of these steps can reduce the amount you need to borrow, as well as improve the loan-to-value ratio of your vehicle. A lower LTV is better for lenders, as it means they have a better chance of recovering the full value of their loan through repossession if you default.

In many cases, you can get a better value out of a previously owned vehicle by selling it yourself than you will when you trade it in at a dealership. Of course, doing it yourself means youll be putting in the work of finding a buyer and dealing with all that entails.

Another way to improve the loan youre offered is to apply with a cosigner. A loan cosigner is essentially someone with good credit who agrees to take responsibility for the loan in the event the primary borrower cant repay it.