What Is An Investment Property Loan

An investment property loan is money you borrow to buy or build a property that has the potential to produce income for you by leasing the space out to a tenant, or by re-selling it after you increase its value.

Investment property loans include construction, purchase, and rehab. Investment property loans are not just for single-family homes. If you want to buy an apartment building or an office tower, you would use an investment property loan.

Can I Use A Va Loan For An Investment Property

No. You cannot use a VA loan for an investment property, but you can turn your current home into a rental property while using a VA loan to purchase a new primary residence. You can also use your VA loan to purchase a multiple-unit property so long as you intend to make one of the units your primary residence. This scenario allows you to rent out the other units.

About The Va Home Loan Guaranty

The VA Home Loan Guaranty program assists eligible Veterans, Servicemembers, and certain surviving spouses obtain, retain, and adapt homes. The VA Guaranty acts as a government backing to insure a portion of your loan and provide assistance in some difficult circumstances. If you experience temporary financial difficulties, VA stands ready to work with your servicer to mitigate delinquencies, avoid foreclosures, and provide alternative options if your financial difficulties become long term.

Recommended Reading: Loan Officer Commission Percentage

Other Sba Loans For Veterans

There are other SBA resources for Veterans wishing to start a business or for those in need of working capital and you can find out more about those programs from The Office of Veterans Business Development at: https://www.sba.gov/offices/headquarters/ovbd

Please contact us at 1-800-414-5285 if you need help with a VA business loan. We have had much more success helping existing veteran business owners with commercial property loans that may or may not include additional funds for working capital, business debt consolidation, inventory, etc., and we have helped a lot of veterans get loans at or above 100% of the value of their business property, but if we are unable to help we will do our best to point you in the right direction.

“I am extremely pleased with the loan you helped me obtain. Your service, rates, terms and professionalism impressed me.“

Mike J.

-

100% Financing for Established Businesses plus Doctors, Dentists, Veterinarians, Funeral Homes, Pharmacies

-

SBA 504 Refinance Program 2018

-

Self Storage & Mini Storage Businesses Eligible for SBA Financing

-

SBA Loan Rates

How Long Do You Have To Occupy A Va Loan Home Before Renting

There is no specific rule from the VA determining how long you must occupy a VA home before refinancing, although you will likely sign paperwork at closing indicating an intention to stay in the home for at least 12 months after closing.

These documents and the guidelines from your individual lender will offer information on what to do if you decide to stop occupying the home, or sell it, earlier than that.

Read Also: Usaa Refinance Rates Auto

What To Know Before Getting A Va Loan For A Rental Property

VA loan programs help veterans and active duty service members to afford a home of their own. What many people are surprised to learn is that a VA loan may also be used to finance the purchase of a rental property, provided that certain guidelines are followed.

Key takeaways

- VA loans are originated or backed by the U.S. Department of Veterans Affairs.

- The benefits of a VA loan include no minimum credit score and a 0% down payment.

- People eligible for a VA loan include veterans, service members, National Guard and Reserve members, and surviving spouses.

- VA direct home loans are those where the Veterans Administration serves as the mortgage lender.

- VA-backed home loans are obtained through conventional lenders and partially guaranteed by the Veterans Administration.

- Borrowers using a VA loan must occupy part of the property as a primary residence.

- A VA loan for rental property may be used for 2-4 unit properties, and in some cases a single-family home.

What Does The Va Do

You might wonder what the VAs role in all of this is if the lender funds the loan and makes up their rules.

The VA plays a vital role, though. They guarantee the loan for the approved lenders on their list. This means the VA promises to pay the lender back a portion of your loan if you default. This is why lenders are able to provide such flexible guidelines.

If you think about it, lenders can provide you with 100% financing for a property you are going to rent out, as long as you live in one unit. Thats a big risk for lenders. With the VAs guarantee, though, the lender can rest assured that they will see at least a portion of your loan amount if you default on it.

However, the VA does pride themselves on their low default rate. As of right now, they have the least amount of defaults out of any government-backed program.

Before you take out a VA loan for an investment property, really think about the risks. Can you handle being a landlord? This means both financially and physically. Can you handle the costs of maintaining other units? You will be in charge of all maintenance and repairs. Youll also have to hold insurance that covers each unit.

Physically, youll have to be able to maintain the properties and collect the rent. Youll need the wherewithal to have proper leases drawn up and executed. Of course, if you have the finances you can hire people to do this for you. Its also possible to hire people to do the maintenance and repairs for you.

Recommended Articles

Don’t Miss: Can I Use A Va Loan For A Second House

Can I Buy A Mobile Home With A Va Loan

Technically, youre able to buy a mobile home and the property you put it on with a VA loan. However, these mortgages are tricky, and youll have a difficult time finding a lender thats willing to approve you for this.That being said, these programs are available with a few VA lenders. If you are looking for this type of loan, the best thing to do is get in touch with multiple lenders.

Can I Buy A Multi

Yes but with some stipulations.

The U.S. Department of Veterans Affairs intends the VA home loan program to give qualifying homebuyers the chance to afford a home to live in. With your loan, you can purchase a property that has up to four units. To meet the VA occupancy requirements, youre going to have to make one of the units your permanent residence. This is fairly standard with other mortgage types, such as FHA loans.

You dont have to live in the building the entire time you own it, though. Once you pay off your VA loan, youll now own a fourplex that can generate rental income.

Don’t Miss: Leads For Loan Officers

Benefits Of Va Home Loans

VA loans allow qualified borrowers to put no money down toward the purchase of a home. That flexibility could come in quite handy if you have the income to support ongoing mortgage payments but don’t have enough money in savings to come up with a down payment. Additionally, if you have generous friends or relatives, you can use a down payment gift to cover your down payment.

Also, VA loans don’t charge private mortgage insurance, or PMI, which is a penalty of sorts that buyers face when they can’t make a 20% down payment on a home. PMI generally gets tacked on as an added premium to your monthly mortgage, making it more expensive.

VA loans are also easier to qualify for than traditional mortgage loans, since they’re backed by a government agency. As such, lenders take on less risk and are therefore more lenient with their borrowing requirements.

Finally, VA loans tend to offer competitive interest rates. The exact rate you qualify for, however, will depend on factors like your loan amount and your .

Sba Loans For Veterans Benefits

Read Also: Usaa Approved Dealerships

How To Apply For A Va Loan

Before you apply for a VA loan, you’ll need a Certificate of Eligibility, which you can get through a lender or through the VA’s eBenefits portal.

Once you have that paperwork, you can apply for a mortgage online. You’ll find that many of the best mortgage lenders offer VA loans, though not all do. In fact, it pays to shop around for a VA loan, because one lender may be able to offer a more competitive mortgage rate than another.

After serving your country, you deserve to have an easy time buying a home. A VA loan could be your ticket to an affordable mortgage and a place to call your own.

Va Loan Entitlement On Second Homes

When youre buying your first home, you can pretty much forget your entitlement amount and worry about things like your credit score and debt-to-income ratio.

But your level of remaining entitlement could come into play when youre using a VA loan to buy a second home.

But the way entitlement limits your home buying budget for a second home isnt always simple.

Don’t Miss: Do Mortgage Loan Officers Get Commission

How Many Times Can I Use A Va Loan

VA loans are not a one-time benefit you can use them multiple times so long as you meet eligibility requirements. You can even have multiple VA loans at the same time. Heres how it might work:

You sell your home and pay off the existing VA loan. Then you can either restore your entitlement or use your remaining entitlement to cover a new VA loan.

You can keep your current home and rent it out as an investment property. You could buy a second home using your remaining entitlement. This results in having two VA loans outstanding at the same time.

Youve repaid your previous VA loan in full but kept the sold the home you bought with it. In this case, you restore your entitlement, but you can only do this one time.

Are Investment Properties A Good Idea

The ability to earn income from the home you call your principal residence is a huge benefit for a multifamily home. You can get the same benefit from a home that you dont want to sell, even if you move somewhere else. That investment is made even better when you can use your VA benefits to purchase these types of homes with no down payment. That means you can earn income on an investment property for just the amount of your closing costs and those can often be paid by the seller!

If you were to buy real estate as an investment without the benefit of a VA loan you would usually have to make a down payment of 20% to 25% or more. This dramatically affects the return on your investment which is the key metric for evaluating whether an investment is a good use of your money. VA loans to purchase investment properties are a great idea for veterans interested in earning income from real estate.

How To Get A VA Loan For An Investment Property

You May Like: Usaa Boat Loan Credit Score

Closing Costs And Fees

Home loans generally come with closing costs and fees, and VA loans are no exception. You may be able to roll your closing costs into your mortgage and pay them off over time, rather than up front. Your closing costs may include, but aren’t limited to:

- Courier fees

- Recording fees

VA loans also come with a funding fee. If you’re applying for this type of loan for the first time and you’re not planning to make a down payment on your home, that fee will equal 2.3% of your home’s purchase price. For subsequent applications, it’s 3.6%.

If you’re able to make a down payment, your funding fee will be lower. For a down payment of 5% but less than 10%, you’re looking at a fee for 1.65%, regardless of whether this is your first VA loan. For a down payment of 10% or more, it drops to 1.40% for a first or subsequent application.

How Many Times Can You Use A Va Loan

Getting a VA loan isnt a one-time deal. After using a VA mortgage to purchase a home, you can get another VA loan if:

-

You sell the house and pay off the VA loan.

-

You sell the house, and a qualified veteran buyer agrees to assume the VA loan.

-

You repay the VA loan in full and keep the house. For one time only, you can get another VA loan to purchase an additional home as your primary residence.

Don’t Miss: Refinancing Fha Loan

On Using Anticipated Rental Income To Qualify For A Va Loan

If you want to buy a multi-unit home and rent out the unused units, you may wish to speak to your loan officer about what it takes to get anticipated rental income counted as potential qualifying income for the purpose of loan approval.

Your experience as a landlord and other variables will apply herethe lender may or may not approve this depending on that as well as the lenders standards and state law. It is possible in some cases, and not possible in others, but it never hurts to ask.

Va Mortgage Rules About Buying Property

Before we can address the specific rules about buying investment properties, we need to look at the overall VA loan approachknowing how this program works will help you navigate it.

VA mortgages are offered with a zero down payment option and have no VA-established mortgage insurance requirements. There is a VA loan funding fee that applies to all transactions but borrowers who receive VA compensation for service-connected disabilities are exempt. This exemption must be applied forask your lender about the procedure.

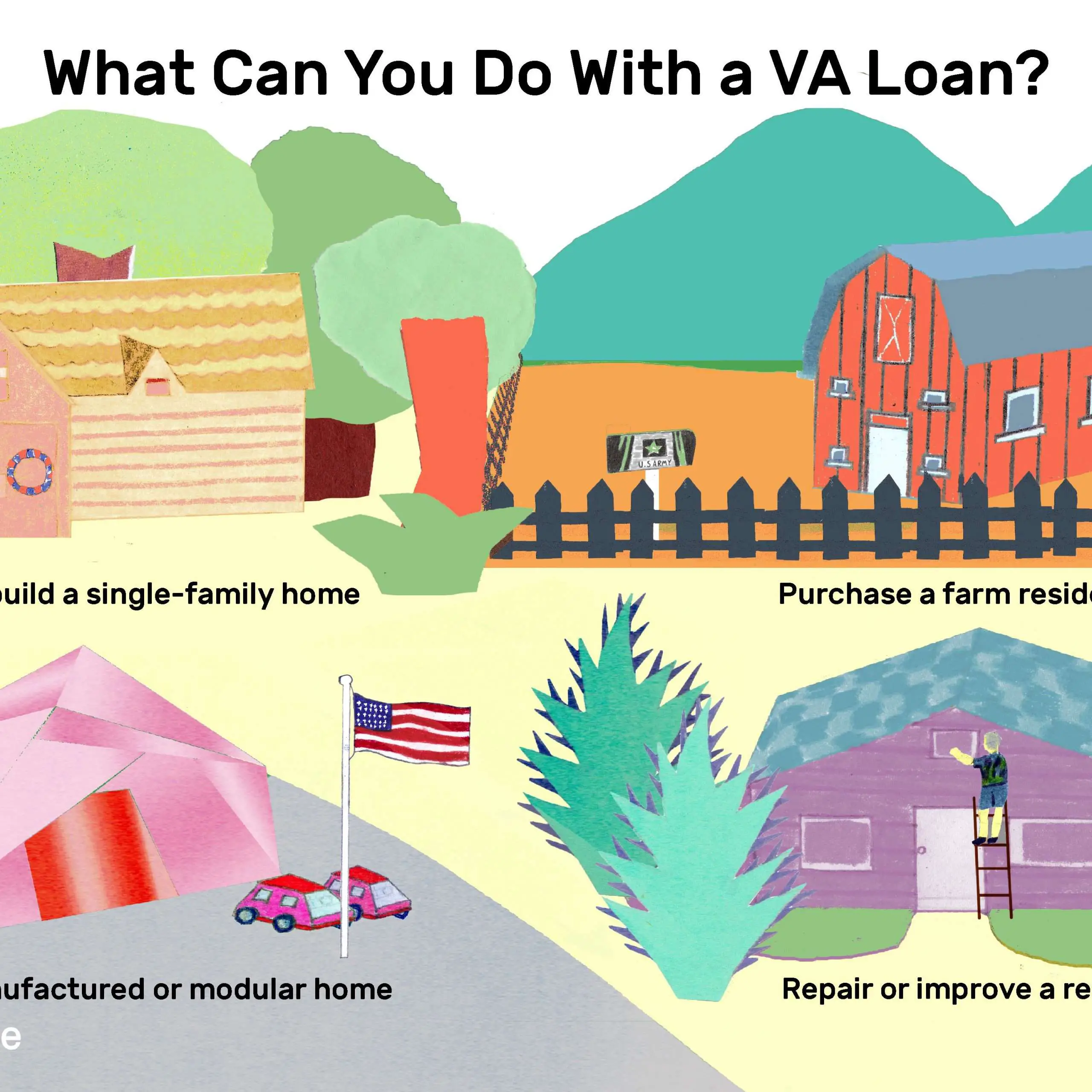

VA loans are for homesthey can be single-unit properties or as many as four units. You cannot buy anything with a VA mortgage that cannot be legally classified and/or taxed as real estate. No houseboats, RVs, or mobile homes that will not be fixed to a permanent foundation at loan closing time.

Mixed-use property purchases are permitted in certain circumstances. The rules say your purchase must be primarily residential and the non-residential nature of the property cannot detract from using the property as an actual home.

Read Also: Carmax Loan Approval

Best For Veterans: Veterans United Home Loans

Veterans United Home Loans

Why We Chose It: We chose Veterans United Home Loans as our best investment property lender for veterans because the firm specializes in VA-backed mortgages with experts who understand this loan program better than anyone else.

-

Offers 24/7 customer service over the phone

-

Has online application and pre-qualification

-

Employs advisors from each branch of the armed forces

-

Doesn’t offer home equity loans or HELOCs

-

Information on FHA, USDA, and conventional loans is harder to find on its website

Founded in 2002, Veterans United is a full-service lender that specializes in VA loans for qualifying veterans, active service members, and their spouses. They are one of the largest VA mortgage lenders in terms of volume in the United States.

Investors benefit from flexible qualification guidelines, lower rates, and monthly payments, no down payments, and no private mortgage insurance. Veterans United has VA loans for as little as 0% down, and they understand how to make the VA loan work for an investor and still remain within the programs guidelines.

Among the products offered are fixed and adjustable-rate mortgages, jumbo loans, refinance loans, and cash-out loans. Loan rates change dailyNovember 2021 rates ranged from 2.750% to 3.250%withAPRs between 3.049% and 3.558% depending on the loan product.

Can I Use A Va Loan For A Second Home

The VA home loan program exists to help active duty and retired military members buy homes to use as primary residences.

Because of this intent, borrowers cant use their VA loan benefits to buy a vacation home or rental property.

But it is possible to buy a second home if you have enough remaining entitlement and if you plan to move into the second home after buying it.

Recommended Reading: Does Carmax Pre Approval Affect Credit Score

Conventional Loans For Investment And Rental Properties

Whether the home you are looking to purchase will or will not be your primary residence, you may still qualify for a conventional or jumbo loan. Conventional loans are offered by private lenders without a government guarantee. They can have higher credit and financial requirements than VA and FHA loans.

Conventional loans also have limits on the amount of money you can borrow. The 2022 conforming loan limit is $647,200 in most parts of the United States. If you are looking to finance an investment or rental property for less than this amount, a conventional mortgage may be a good fit. Conventional loan limits can fluctuate each year and the loan limit is often higher in more expensive areas of the country like New York City and California.