Parent Plus Loan Forgiveness With An Income

The federal government offers four types of income-driven repayment plans for student borrowers, but ICR is the only one that accepts Parent PLUS Loans. This is a federal program that can lower your monthly payments and offer loan forgiveness after 25 years for eligible applicants. Your loan will need to be consolidated by the Department of Education first to apply. Loans you refinance or consolidate with a private loan servicer are no longer eligible.

According to the Federal Student Aid website, the loan payment amount will be the lesser of the following:

- 20% of your discretionary income or

- What you would pay on a repayment plan with a fixed payment over the course of 12 years, adjusted according to your income

Under the ICR Plan, your payment is based on your income and family size, not just the specific borrows income. This means that if your income increases over time, in some cases your payment may be higher than the amount you would have to pay under the 10-year Standard Repayment Plan. As most salary growth for an individual occurs before 40, this is a larger factor for student borrowers considering ICR.

Something parents should be aware of when considering this option is that the interest payments will likely be higher over the life of the loan than you would be through the Standard Repayment Plan.

Cons Of A Parent Plus Loan

Fees on PLUS Loans are also higher than on the other Direct Loans. Most income-driven repayment plans are unavailable to parent PLUS loan borrowers, although they may be eligible for an Income-Contingent Repayment Plan under certain circumstances.

And youll have to start making payments on the loan as soon as it is disbursed though you can request a deferment while your student is in school, but the interest on the loan will still accrue and add up. Of course, the loan is taken out in the parents name, so responsibility for paying the loan back is on you, not on your kid.

You May Like: What Do Mortgage Loan Officers Do

Parent Plus Loans Application Process

You can apply for the Parent PLUS loan online through the Federal Student Aid website in about 20 minutes. You can also download and print a copy of the application and submit it by mail.

To apply youll need:

- Your own verified Federal Student Aid ID , which youll set up on the Federal Student Aid website

- Name of the school your child will attend

- Your personal information, such as your name and address

- Information about the student, including Social Security number and date of birth

- Your employment information

Also Check: Usaa Personal Loan Credit Score

Federal Direct Parent Plus Consolidation

If you meet the requirements, you can actually consolidate your Parent PLUS loans using the Income-Contingent Repayment plan, which is the only income-driven plan compatible with PLUS loans.

Using federal consolidation isnt true refinancing.

You arent going to get a lower interest rate, and you arent using a new loan to pay off current debt. However, with ICR you can get a lower monthly payment. If youre hoping for more affordable monthly payments and better cash flow, and a lower rate isnt as important for you, this can be a decent choice.

With ICR, your payments are capped at 20% of your discretionary income or the amount of your payments on a 12-year plan, whichever is lower. Plus, you get a loan term extension to 25 years.

If youre struggling and Parent PLUS loan refinancing isnt a viable option, this could at least help you afford your monthly obligation.

Penfed Student Loans Powered By Purefy

- Refinance federal and/or private student loans at lower rates with no fees.

- Choose a 5, 8, 12, or 15 year term to best fit your needs.

- Each applicant receives a personal loan advisor to help them through every step in the process.

- Spouses can refinance their loans together. Parents can refinance their loans too.

- Show more info »

1Rates and offers current as of April 1, 2021. Annual Percentage Rate is the cost of credit calculating the interest rate, loan amount, repayment term and the timing of payments. Fixed Rates range from 2.99% APR to 5.15% APR and Variable Rates range from 2.15% APR to 4.45% APR. Both Fixed and Variable Rates will vary based on application terms, level of degree and presence of a co-signer. These rates are subject to additional terms and conditions and rates are subject to change at any time without notice. For Variable Rate student loans, the rate will never exceed 9.00% for 5 year and 8 year loans and 10.00% for 12 and 15 years loans . Minimum variable rate will be 2.00%.

Also Check: What Is The Commitment Fee On Mortgage Loan

Danger : Plus Loans Aren’t Eligible For Most Income

The federal government offers four different income-driven repayment plans for student loans. They limit monthly payments to a percentage of the student’s discretionary income . If the student makes those payments for a certain number of years , any remaining loan balance will be forgiven.

Parent PLUS loans, however, are eligible for only one of these plans, Income-Contingent Repayment , and only after the parent has consolidated their parent loans into a federal direct consolidation loan. An ICR plan limits payments to no more than 20% of discretionary income, to be paid over a term of 25 yearswhich is a long time horizon for the average parent.

Getting Your Name Off A Cosigned Loan

Newsa Catastrophe Is Looming For Us Colleges This Analysis Shows Just How Bad It Is

I don’t think these loans should be presented with the financial aid offer at all, said Amy Laitinen, director for higher education at New America. I think it speaks more to the schools desire to bring in the students than to whats best for the family. To present it as if its really a way for paying for college when theres no way for those parents to pay it back is shameful and harmful.

In 2011, the Obama administration set restrictions on who could borrow through the Plus program, imposing credit and income requirements. But an outcry from colleges caused the administration to reverse course the following year, making it even easier for parents to borrow.

Related: Universities that boost the poorest students to wealth are becoming harder to afford

Critics compare the governments loans to those given out by banks to people who couldnt afford to repay in the lead-up to the 2008 financial crisis. Unlike student loans, parent loans offer no easy option for an income-based repayment plan. If a parent defaults, the federal government can garnish wages and Social Security checks to force repayment.

Rep. Marcia Fudge, D-Ohio, introduced a bill last year that would cap Parent Plus interest rates, allow for income-based repayment plans and mandate counseling for all borrowers, but it has been stuck in committee. Biden has not announced any plans regarding the program.

Sign up for The Hechinger Report’s higher education newsletter.

Also Check: How Do I Find Out My Auto Loan Account Number

Should You Transfer Parent Loans To Your Child

It’s not uncommon for children to repay parent loans. A 2020 report from private lender Sallie Mae found that 45% of students expected to share this responsibility and 16% planned to pay their parents’ loans all on their own.

Still, you may wonder whether you should refinance parent PLUS loans in your child’s name. Here’s when it can make sense:

-

Your child can afford the loan payments. Look at your child’s current student loan payments and add the potential amount for the parent loan. The loan should be affordable if that total is between 10% and 20% of your child’s net income. More than that, and they may struggle to pay for necessities or achieve other financial goals.

-

You can’t afford the loan payments, but your child can. Perhaps an unexpected expense like a major medical bill made your parent loans unaffordable. Or maybe you’re falling behind on saving for retirement because of the payments. If your child is in a better long-term financial situation than you are, see if they’ll take on your loans.

-

This was always your plan. Ideally, you discussed repayment with your child when you borrowed parent loans. That way, you could both make smart borrowing and spending decisions while the child was in college. Don’t just spring an extra five or six figures of debt on your child and expect them to pay. If the loan is in your name, you’re ultimately responsible for it.

Use Other Federal Student Loans First

Before we get started with this comparison, its important to point out that its generally not a smart idea to use either Graduate PLUS Loans or private student loans made to grad students unless youve exhausted your other federal loan borrowing ability first.

Specifically, graduate and professional students can obtain Direct Unsubsidized Loans that are, in virtually all ways, far superior to PLUS Loans or anything available in the private market.

I wont get too deep into a discussion of the advantages, but here are a couple of reasons:

- Direct Unsubsidized Loans have lower fees and interest rates than PLUS Loans. In fact, the origination fee, or loan fee on a Direct Unsubsidized Loan is one-fourth of the fee youll pay for a PLUS Loan.

- Direct Unsubsidized Loans arent credit-based, unlike private student loans. Even with Grad PLUS Loans, while theres no credit score requirement, you cant have an adverse credit history.

However, the biggest downside to Direct Unsubsidized Loans is the borrowing limit. Under the current program rules, the maximum amount of Direct Unsubsidized Loans you can borrow is $20,500 per school year. While this is certainly higher than undergraduate borrowing limits, it isnt enough to cover the entire cost of attendance at many graduate and professional programs.

Meanwhile, Grad PLUS Loans and private graduate student loans can generally be made for a students entire cost of attendance, minus any other financial aid received.

Don’t Miss: How To Get Loan Officer License In California

Featured Student Loan Provider

Citizens

Citizens offers loan options for undergrad, grad students and parents with competitive rates, flexible terms and interest rate discounts.

Multi-year approval option available for qualified applicants. Multi-Year approval provides an easy way to secure funding for additional years in school without completing a full application and impacting your credit score each year.

Choose between our student or parent loan options with competitive interest rates and flexible payment terms.

Limits

Loans from $1,000 to $295,000 depending on education level.

Rates

Variable rates as low as 1.03% APR* and fixed rates as low as 3.49% APR* including all available discounts.

Fees and Terms

No application or origination fees. 5, 10, or 15 year options available. Rate and Repayment Examples.

Please be advised that the operator of this site accepts advertising compensation from companies that appear on the site, and such compensation impacts the location and order in which the companies are presented.

Look Into Student Loan Forgiveness

As with the ICR plan, parents can also qualify for the Public Service Loan Forgiveness program, PSLF for short, if they consolidate their loans through the Direct Loan Consolidation program.

With PSLF, you can obtain forgiveness of the full balance of your student loans if you meet the following criteria:

- Work full-time for a qualifying employer, which includes government organizations at any level and not-for-profit 501 organizations. Volunteers for AmeriCorps and Peace Corps are also eligible.

- Get on an income-driven repayment plan for parents, thats the ICR plan.

- Make 120 qualifying monthly payments.

With this type of forgiveness, itll take about 10 years, which is 40% the amount of time required to get forgiveness through the ICR plan.

You May Like: What Kind Of Loan Do I Need To Buy Land

How Do I Qualify For A Plus Loan

To qualify for a PLUS loan, one needs no adverse credit history. Credit scores are very important in applying for this type of loan. The student needs to be enrolled at least half-time at an accredited institution. While a FAFSA is not necessarily required, it would be good to fill out since it will help to determine the expected family contribution.

Parent Plus Loan Repayment Terms

Only the parent borrower is required to pay back a Parent PLUS Loan, as only the parent signed the master promissory note for the Parent PLUS Loan. The student is not responsible for repaying a Parent PLUS Loan. Theyre under no legal obligation to do so.

If a parent has an adverse credit history, they must obtain an endorser who will agree to repay it if they dont. However, the U.S. Department of Education states that the child on whose behalf the loan is borrowed cannot be the endorser.

In other words, the parent is fully responsible for repaying the Parent PLUS Loan, and the child cant be forced to assume responsibility for the loan.

See also:Complete Guide to Parent Loans

You May Like: Va Loans On Manufactured Homes

Qualifying For A Parent Plus Loan

The first step to qualifying for any type of federal loan is to fill out the Free Application for Federal Student Aid . Its a required step to document your childs financial need. Colleges use the FAFSA information to determine a financial aid packagewhich could include grants, work-study, subsidized loans, and/or unsubsidized loans.

If your child is offered a financial aid package, you can then figure out how much of their tuition will be covered by financial aid vs how much you might need to take out additional loans to cover any remainder. At that point, you can start to weigh the benefits of private student loans vs. parent PLUS loans.

Parent Plus Loan Rates And Terms

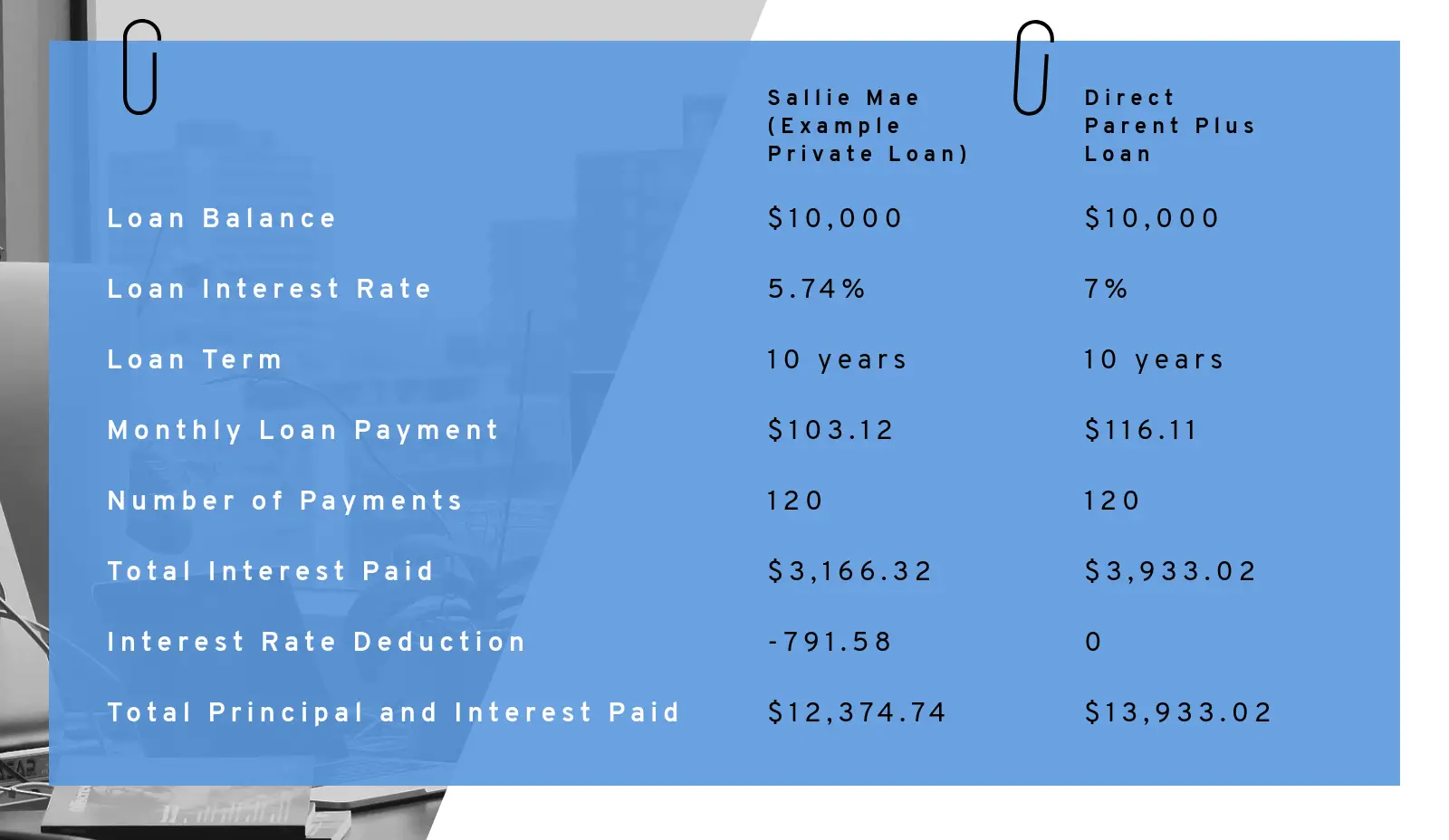

Parent PLUS loan interest rates are currently fixed at 7%. They are tied to the rate of the ten-year Treasury note, with a cap of 10.5%.

The PLUS loan is given for one academic year at a time. As a result, parents must qualify for the loan each year. In other words, the credit check at year one does not make parents eligible for four years worth of Parent PLUS Loans. The loan enters repayment once it is fully disbursed, and there are a variety of repayment options available to parents, including deferment.

Read Also: Where To Refinance Auto Loan

Refinance Parent Plus Loans Into Childs Name

Parents are not permitted to transfer Parent PLUS loans directly to their child. Of course, once a child gets a job after graduation, they can pay the parents each month, but the parents remain legally responsible. However, a student can take over the loan and legally free their parents of responsibility by refinancing the Parent PLUS loans in their own name. The lender pays off the original government loan, so the parents are no longer liable. The child then gets a private loan from the lender. The child could consolidate all their student loans and include the parent PLUS loans, so they have just one payment. A side benefit is that if the child makes their installment payments on time, putting the loan in their name can help them build good credit.

This brings us to a hurdle. For a student to refinance Parent PLUS loans in their own name, they must have an acceptable credit history, an income, and an employment history. Of course, a parent could co-sign on the loan. Then the parent would still be responsible for paying it off, but so would the child.

How To Refinance In The Parents Name

If refinancing into your childs name doesnt suit your needs, you could refinance the PLUS Loan while keeping it in your name. While youll still be responsible for the loan, you might save money on interest if you can get a lower interest rate through refinancing.

Or you could opt to extend your repayment term to reduce your monthly payments and lessen the strain on your budget. Just keep in mind that this means youll pay more in interest over time.

To refinance a Parent PLUS Loan in your name:

Learn More: Debt-to-Income Ratio for Refinancing Student Loans

Also Check: How To Refinance An Avant Loan

Parents With Student Debt Want A Do

Many parents who took on student debt for their kids regret the decision: Nearly 1 in 3 parents with federal parent PLUS loans say if they could do it over, theyd ask their children to rethink their education plans so they wouldnt have to take out the loans.

These results, part of a July 2021 survey conducted by The Harris Poll on behalf of NerdWallet, illustrate the burden shouldered by parents who amassed federal loans to help their children attend college.

Parent PLUS loans dont have strict credit requirements, so theyre easy for parents of undergraduate students to get. However, theyre more expensive than other federal student loans their children take on since they carry higher interest rates and higher origination fees.

PLUS loans also dont have the limits that undergraduate loans do. Parents can take on loans up to the total cost of attendance minus other financial aid like grants and scholarships. And they can take on loans for multiple children.

Around 1 in 5 parents borrow to help pay for their childs school, with 11% using PLUS loans, according to a 2021 report by Sallie Mae.

Over time, loans add up quickly for parents. According to 2021 federal College Scorecard data, the median parent PLUS loan debt is $29,945. Around 3 in 10 parent PLUS borrowers surveyed in the Harris Poll say they wish theyd taken out a lower PLUS loan amount.

Parents are expecting help from their kids

Whats affordable now might not be so for the future