When Your Payment Is Due

You have a few options for making your capital one auto loan payment. You can pay online, by phone, or by mail. If youre not sure when your payment is due, you can find that information online. Well go over all the details of how to make your payment so you can choose the option thats best for you.

Capital One Auto Purchase

Pick a car

Get prequalified

If you want to get a prequalification , you can apply on your phone or computer for the Capital One Auto Navigator program. Youll need:

- Personal details: Name and email address

- Residence: Home address, length of time at residence and your rent or mortgage payment

- Employment: Your employers name and address

Apply at the dealership

Once at the dealership, youll go for a test drive or two, finalize which car you want and apply for financing. Even if you received a prequalification, youll need to complete the final application paperwork with the salesperson.

How To Pay Your Capital One Auto Loan

Pay capital one car loan with debit card. In addition to income from credit card account interest capital one makes a tidy sum from late fees. By transferring your auto loan s balance to a 0 apr credit card you could save hundreds in interest charges. It s important to note that this method transforms your auto loan from a secured loan into an unsecured loan as revolving credit.

Most lenders won t allow you to use a credit card to pay your loan directly but you know those convenience checks your credit card company sends in the mail encouraging you to transfer a balance you can use one of those in a pinch just be prepared to bite the bullet and pay whatever fee it entails. Set up one time and recurring payments in minutes. Checking or savings accounts.

The capital one mobile app ranked 2 in overall satisfaction in j d. Pros of paying a car loan with a credit card. Well yes technically you can.

The capital one mobile app has a 4 7 5 star customer rating on apple s app store and is in the top 10 in the finance app category as of 5 12 2020. The payment phone number to call at capital one is 1 800 946 0332. Not only that but you get to pay off your car faster too.

Capital one can help you find the right credit cards. And other banking services for you or your business. Power s most recent u s.

Pay capital one auto finance with a credit or debit card online using plastiq a secure online payment service.

Pin On Nigeria Website Design

Business One Credit Card

Recommended Reading: How Long Does Sba Loan Take After Approval

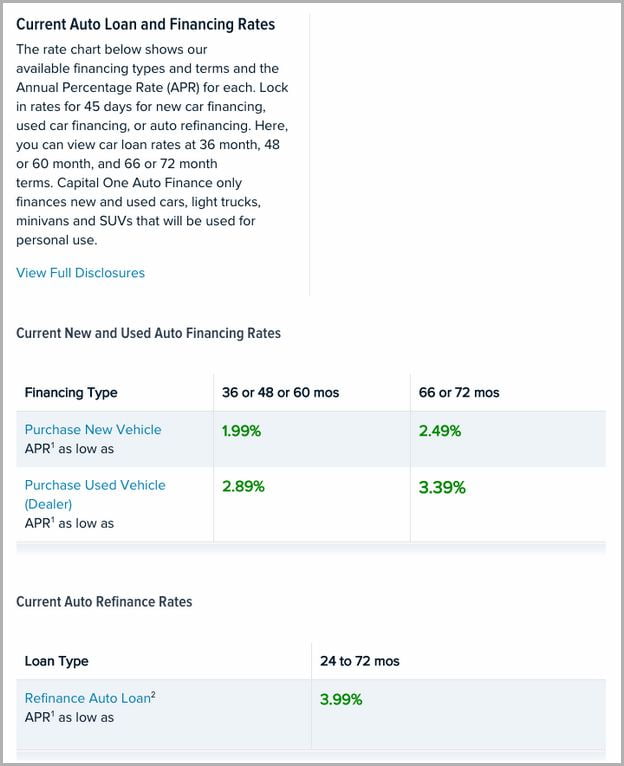

How Do Auto Loan Rates Work

Auto loan interest rates are determined through risk-based pricing. If a lender determines youâre more at risk of defaulting on your loan because of your credit score and other factors, youâll typically be charged a higher interest rate to compensate for that risk.

Factors that can impact your auto loan interest rate include:

Whatever auto loan interest rate you qualify for, itâll be represented in the form of an annual percentage rate , which may include the cost of both interest and fees. The lender uses your interest rate to amortize the cost of the loan. This means that youâll pay more interest at the beginning of the loanâs term than at the end.

What Is Gethuman’s Relationship To Capital One Auto Finance

In short, the two companies are not related. GetHuman builds free tools and shares information amongst customers of companies like Capital One Auto Finance. For large companies that includes tools such as our GetHuman Phone, which allows you to call a company but skip the part where you wait on the line listening to their call technology music. We’ve created these shortcuts and apps to try to help customers like you navigate the messy phone menus, hold times, and confusion with customer service, especially with larger companies like Wells Fargo or DISH. And as long as you keep sharing it with your friends and loved ones, we’ll keep doing it.

Capital One Auto Finance Contact Info

Recommended Reading: Bank Of America Auto Loan

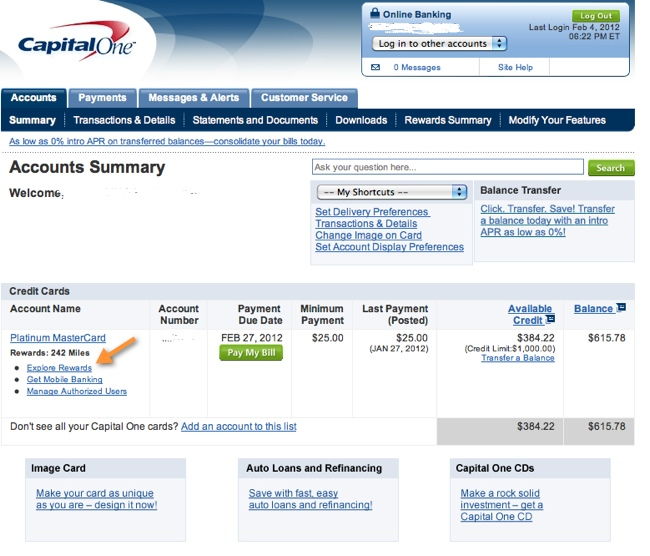

Re: Capital One Debit Card Payment Online

I donât see that option on my end, both webpage and mobile app. Also, the FAQ specifically states they donât accept debit cards. Got a screen shot? Perhaps something new being tested? It would help with some of these CUâs that require some amount of debit card usage.

wrote:

I donât see that option on my end, both webpage and mobile app. Also, the FAQ specifically states they donât accept debit cards. Got a screen shot? Perhaps something new being tested? It would help with some of these CUâs that require some amount of debit card usage.

I just checked, and the only payment option I have is a bank checking account my FAQ also states that payment by debit card isnât available online.

Perhaps they are rolling this out only to select customers?

Auto Credit Express: Best Customer Ratings

Auto Credit Express is another online lending marketplace that specializes in car loans for bad credit. The company has helped millions of customers since its founding in 1999. There are no credit score requirements for securing a loan through Auto Credit Express, and loan amounts can range from $5,000 to $45,000. Here are a few more highlights:

- Customer service: Auto Credit Express has a 4.7-star rating from customers on Trustpilot, and the company has an A+ rating with accreditation from the BBB.

- Good option for during or after bankruptcy: You can find lenders that specialize in auto loans after bankruptcy and even some that provide options during bankruptcy.

- Resource center: Auto Credit Express provides a variety of resources for shoppers, including information on credit reports, auto insurance, and refinancing, plus a loan estimator and payment calculator.

Recommended Reading: How To Apply For Fortiva Personal Loan

What Is A Bad Credit Score

Lenders use credit scores to determine the level of risk associated with lending to individuals. Credit scores are determined based on payments you make on things like loans, utilities, and medical bills, among other expenses.

The range of , and this number essentially measures how good you are at paying your bills on time.

Hard times come when they are least expected. And sometimes that can lead to you falling behind on debt obligations, which result in late payments, repossessions, and defaults all of which can harm your credit score. But there are also ways to raise your credit score or establish credit if you have none.

Applicants who fall in the poor category are unlikely to get a loan, and if they do, they usually are charged a very high interest rate.

Applicants in the fair category may also have a hard time getting a loan. However, options are still available with interest rates slightly lower than those available for consumers with e a very poor credit rating.

Credit scores that fall into these bottom two tiers are typically what people consider bad credit scores.

How To Apply For An Auto Loan With Capital One

You can start your application by getting prequalified without a hard credit pull. If theres a match, you can view the monthly payment and interest rate on specific cars youre considering. You will also have the luxury of changing the loan term or down payment to create a deal that works for you.

The next step is to visit the dealership and complete a credit application. Capital One will pull your credit report and score to issue a final approval. The last step is to upload any requested documents and e-sign your contract to seal the deal.

You could also be asked by the lender or Capital One to provide these documents during the application process:

- Copy of your current drivers license.

- Proof of residence, such as a utility bill within 60 days thats in your name, bank statements, insurance billing statements or current lease agreement.

- Proof of income, such as your most recent pay stub, an offer letter for new W-2 employment income or three months of personal bank statements if you are self-employed.

Read Also: Ppp Loans For New Businesses

What We Love About Capital One Auto Navigator

Capital One Auto Navigator makes it easy to get pre-approved for a car loan before you visit a car dealership. You can also set your desired terms for an auto loan. The tool can pre-approved you without affecting your credit and will direct you to a participating dealership. You can also view dealer inventory online so you can do most of the car buying through the internet. All you have to do in-person is test drive the car and fill out an official loan application.

Average Interest Rates For Car Loans

The average APR on a new-car loan with a 60-month term was 4.96% in the first quarter of 2021, according to the Federal Reserve. But as mentioned above, your credit scores and other factors can affect the interest rate youre offered.

|

Loan type |

Note: Experian doesnt specify which credit-scoring model it uses in this report.

The table above isnt a guarantee of the rate you may be offered on an auto loan. Instead, it can help you estimate an interest rate to enter into the auto loan calculator, based on the average rates people with various credit scores received on auto loans in the first quarter of 2021.

Keep in mind that there are different and that various lenders use may different ones. For example, auto lenders may look at your FICO® Auto Scores. And available interest rates and APRs can vary by lender, so be sure to shop around and compare both across your loan offers.

You May Like: What Loan Can I Get With Bad Credit

Don’t Miss: Chase Auto Loans Phone Number

What Does Auto Navigator Show

Auto Navigator clearly shows various specifications of vehicles like the model, mileage, kilometers covered, etc. from its inventory. It also indicates payment options so that you can plan your expenses and savings accordingly before deciding to buy your dream car. It shows monthly payment amount, APR, and other personal terms so that there is transparency in the selected offer.

The Problem With Paying Your Auto Loan With A Credit Card

While saving money is almost always a good thing, paying your auto loan with a credit card isnt the no-brainer it sounds like. For starters, this financial move changes the nature of the loan itself. By transferring your auto loan to a credit card, youre taking a secured loan and turning it into revolving credit. On the upside, this means your car cant be repossessed if you quit paying your bill. However, simply moving the debt can wreak havoc on your credit score in a number of ways.

For starters, credit scoring companies view revolving debt very differently from installment loans and not in a good way. In general, steady installment loans are better for your credit score.

Another impact on your credit score could be the result of increased . By transferring your car loan to a credit card, youre charging up a huge balance that wasnt there before. Since how much you owe on your credit cards helps determine your score, increasing your credit utilization could cause your score to drop.

Another important drawback to consider is the precedent set by paying your auto loan with a credit card. While moving balances around might make you feel like youve paid off debt, you havent really accomplished much yet. In reality, balance transfers are really nothing more than a shell game if you dont take your debts seriously. And if you let your balances grow as you bounce them around, you wont end up any better off.

Don’t Miss: How To Assume An Fha Loan

Must Buy A Car From A Participating Dealer

Capital One only finances auto loans with participating dealers in its car dealership network.

Although there are over 12,000 eligible dealerships across the country, this may be a limiting factor for customers who prefer to shop at dealerships that fall outside of the Capital One Network.

However, there are benefits to shopping within the Capital One Network because you know that you will be working with one of the most reputable banks on the market since the dealership has an existing relationship with them.

Capital One Auto Finance Review: 35 Stars

Capital One has a convenient prequalification process that does not require a hard credit check. Its auto loan terms are reasonable, and the lender can be a good option for those with poor credit. Overall, we give Capital One auto loans 4.1 stars.

If you are trying to purchase a car or refinance an existing vehicle, Capital One auto financing is worth a look, as there are no downsides to applying for auto loan prequalification.

| Motor1 Rating |

|---|

| Average customer service |

Read Also: What Is 30 Year Fha Loan

Capital One Auto Navigator Prequalification

A prequalification isnt necessary but estimates your monthly payment and lets you know how much you could borrow. It doesnt ding your credit because its a soft inquiry. Official car loan preapprovals provide hard numbers and can give you a leg up in negotiations, letting you act like a cash buyer.

Capital One Auto Loan Pre

Going through the pre-approval process is not the same as being approved for an auto loan. It starts with auto loan prequalification, which is done through the Capital One Auto Navigator app where you are asked short questions about your financial situation. After this is done, a soft credit check will be done, and soon after borrowers will be given a pre-approved auto loan offer.

Capital One says prequalified borrowers can see their estimated monthly payments, APRs, and loan terms. Prequalification offers expire 30 days from the date the loan application is received and There are no application fees to use the Capital One Auto Navigator app.

Be aware that though you can get approved for an offer through this route, participating dealers can still reject you if you do not agree to all of the terms. Make sure to read carefully and shop around before committing to a Capital One pre-approved auto loan.

Read Also: Which Is Better Parent Plus Loan Or Private Student Loan

Know When Your Payment Is Due

Pay just one day late and you may have to pay a fee, even if itâs your first time. Generally, the later the payment, the worse the effect could be on your credit. So know your due dates and stick to them. Late payments could affect your credit score based on a number of factors:

- How late was a payment?

- How recently was a payment missed?

- How often are payments missed?

Recommended Reading: What Does Full Coverage Auto Insurance Cover

Who Is Capital One Best For

Capital One is best if you want to view your approval odds and loan rates before formally applying for an auto loan. You can compare the loan quote you receive to estimates from other lenders to determine if youre getting a good deal.

Its also a good fit if you want to shop for cars online before heading to the dealership. Youre given the option to search for vehicles in your local area by the year, make and model and view actual rates and monthly payments without affecting your credit. This feature alone can help you decide if you can afford a particular vehicle or if you should hold off on a new car purchase.

Don’t Miss: How To Get An Sba Loan

Capital One Auto Finances 800

This Capital One Auto Finance phone number is ranked #3 out of 4 because 35,604 Capital One Auto Finance customers tried our tools and information and gave us feedback after they called. The reason customers call 800-946-0332 is to reach the Capital One Auto Finance Auto Loans department for problems like Recover Account, Update Account Info, Extension on Payment, Disputes, Cancel or Change Account. As far as we can tell, Capital One Auto Finance has call center locations in California or Minnesota or India and you can call during their open hours Mon-Fri 8am-9pm EST. Capital One Auto Finance has 4 phone numbers and 6 different ways to get customer help. Weâve compiled information about 800-946-0332 and ways to call or contact Capital One Auto Finance with help from customers like yourself. Please help us continue to grow and improve this information and these tools by sharing with people you know who might find it useful.

Donât Miss: Aer Loan Balance

How Bankrate Rates Capital One

| Overall score | ||

| Captial One’s minimum and maximum APRs aren’t available, and it doesn’t advertise a discount for autopay. | ||

| Customer experience | 4.6 | Prequalification rates are valid for 30 days, and Capital One offers an online chat function once you sign up. It also has an app, and customer service is available six days a week. |

| Transparency | 4.0 | While it does offer prequalification, Captial One doesn’t offer a ful APR range before you hand over your information. |

Read Also: What Type Of Mortgage Loan Should I Get

Exactly Just How The Charge Fees Function

Capital One Auto Finance assesses fees for refinancing your present auto lending, behind-time payment as well as altering your payment due date. Depending upon the information of your Capital One Auto Finance lending, you might be actually billed a safety and security down payment.

Re-financing fees -typical fees variety coming from $5 towards $65.Safety and safety down payment differs depending upon the problems of the lending.Behind-time payment fees cannot surpass $50 for every incident.Payment due date alter fees, as well as fees, differ.

Recommended Reading: Long Island Car Accident Attorney