When It Makes Sense To Consolidate Your Debt

The most common reason to consolidate your debt is to save money on interest. If you can consolidate your debt and get a lower interest rate, you could save hundreds or even thousands of dollars in total interest.

Another popular reason to consolidate debt is to simplify your monthly payments. If you struggle to pay your bills on time because of different due dates, consolidating could make it easier to manage your finances.

It Could Cause Hard Inquiries On Your Credit

Every time you formally apply for credit, the creditor makes a hard inquiry, also known as pulling your credit, to check your creditworthiness. Each hard inquiry generally reduces your credit score by a few points. If you are shopping around and applying for debt consolidation loans at multiple banks at once, your credit could take a temporary hit. Fortunately, numerous hard inquiries within a set period, anywhere from 14 to 45 days, are typically combined into one when your credit score is calculated.

Remember that a hard inquiry isnt necessary every time you talk to a lender or visit a website. Its possible to do your research and get prequalified for a loan without having to go through the hard inquiry process. Many lenders will let you shop for rates and prequalify online by doing a soft credit check, or soft pull, that does not affect your credit score. This enables you to take the first steps to see if you qualify for a loan, but without dinging your credit.

Before deciding to move forward with a lender, read the fine print and make sure you understand whether or not you are ready for your credit to get checked with a hard inquiry as part of the loan application process.

Does Debt Consolidation Affect Your Credit Score

Do you find yourself juggling multiple debt repayments each month? What if you could merge these all together into one single outgoing? That is exactly what debt consolidation loans are designed to do.

But with so many factors at playlike existing debts, repayment history, or applying for a new loanyou might be wondering how debt consolidation will affect your credit score.

In this guide, we explore how you can take back control of your finances with a debt consolidation loanand what impact this may have on your credit score.

Also Check: Best Student Loan Refinance Companies

Q4 Is Getting A Large Loan Possible With Bad Credit Loan Providers

Getting a large loan with a bad credit score is not easy. Thus, you must work hard to improve your credit score if you need a huge loan. You must reduce the number of loans you have already taken and make payments on time to improve your credit score. To get a loan with a bad credit score, you must prove that you have a stable monthly income, this way the lender will understand that providing a loan is not very risky.

How A Debt Consolidation Loan Can Help Your Credit

Ideally, your debt consolidation loan will have a lower interest rate than your original debts, which means interest will accrue less quickly and you will be able to get debt-free sooner. Paying off your debts in full will increase your credit score.

In addition, every month as you make payments on your debt consolidation loan, the lender will report information about the loan to the credit bureaus. If you always pay on time, you should see your credit score steadily increase over the life of the loan. If you miss payments or default on the loan, that would hurt your credit.

Don’t Miss: Payday Loans With No Credit Check

Borrow Against Your Home Equity Or Retirement Savings

Loans taken out against your home or retirement account are secured by real assets.

Benefits of home equity or retirement loans

- Because they’re secured, these home equity or retirement loans typically have very competitive interest rates and often also allow for higher loan limits.

- Home equity loans and retirement fund loans can have longer repayment periods than personal loans, giving you more timeand therefore lower monthly paymentsto tackle your debt.

Drawbacks of home equity or retirement loans

- Home equity or retirement loans often come with origination fees.

- There may be restrictions on how retirement loans can be used, so be sure to read the conditions associated with your retirement loan.

- If you fail to repay a retirement loan, you will be charged hefty penalties that will reduce the value of your nest egg.

- If not paid on time, you may have to pay tax on the interest on your retirement loan.

- If you fail to repay a home equity loan, you could lose your home.

Alternatives To Debt Consolidation Loans

If debt elimination is your goal but youd rather not take out a debt consolidation loan, there are a few alternatives you can consider:

- Debt management plan: These are offered by nonprofit credit counseling agencies who will attempt to negotiate more favorable terms on your behalf. And instead of making payments to your lenders directly, youll make one monthly payment to the agency, which will then pay your creditors.

- : You could save even more in interest with a balance transfer credit card. These cards come with a balance transfer fee of 2 to 5 percent, but the cost savings are still likely greater than if you took out a personal loan.

- Budget overhaul: Create a realistic spending plan incorporating your debt payoff goals. Trim expenses where you can, search for ways to earn more and allocate those extra funds towards your debt balances.

Recommended Reading: Fha Loan First Time Homebuyer

How To Consolidate Debt Without Hurting Your Credit

Some lenders will pay your credit cards off for you when they approve you for a debt consolidation loan. If not, your best choice is to pay them yourself immediately. Get the money out of your hands before you spend it on something it wasnt intended for. In some cases, there will be a few dollars left over when youre done. Spend that if you like.

The next step, if you want to avoid hurting your credit score, is to put your credit cards away. Dont cut them up because you may need the security codes on the back to contest fraudulent purchases or identity theft. Hide the cards in a drawer and make a commitment not to use them until the loan is paid off. As the loan balance comes down, your credit score will go up.

Other Ways To Consolidate Your Debt

Debt consolidation usually involves getting a loan, but other options include refinancing with a 0% interest balance transfer credit card, tapping into your homes equity or using your 401 savings.

Refinancing your debt with a 0% interest balance transfer card can be useful for smaller debts that you think you can pay off during the cards no-interest promotional period, which usually lasts 15 to 21 months. Youll likely need good or excellent credit to qualify.

If you own a house, you could also borrow against your home’s equity to pay off your debts. Home equity loans and home equity lines of credit may have lower interest rates, but if you stop making payments, you could lose your home.

Some people choose to take a loan from their employer-sponsored retirement account, known as a 401 loan. This option usually gives you access to lower interest rates, but it also cuts into your retirement funds.

Don’t Miss: Can You Apply For Fha Loan More Than Once

Your Credit Utilization May Change

If your credit utilization ratio moves higher after debt consolidation, it could negatively impact your credit score. Using the example above, if you transfer the balance of $4,500 from your existing credit card with a limit of $15,000 to a new credit card with a credit limit of $7,500, your credit utilization ratio on that new card will be 60%, potentially causing a hit to your credit score.

On the other hand, if you consolidate multiple credit card debts into one new personal loan, your credit utilization ratio and credit score could improve. Credit cards and personal loans are considered two separate types of debt when assessing your credit mix, which accounts for 10% of your FICO credit score.

For example, lets say you have three credit cards. Once again, using the example above:

- The first card has a $4,500 balance with a $15,000 credit limit.

- The second card has a $2,000 balance with a $10,000 credit limit.

- The third card has a $5,000 balance with a $10,000 credit limit.

You would have credit utilization ratios of 30%, 20% and 50%, respectively, for these three cards. If you combine all three of those debts into one new personal loan of $11,500, the credit utilization ratios for each of those three cards will drop to zero , which could improve your credit score.

Stick To A Repayment Plan

Once you’ve completed the consolidation process, stick to the plan you made. For example, if you got a balance transfer credit card with the intent to pay down the balance before the introductory 0% APR period ends, make it a priority to stick to that goal. Otherwise, you’ll be assessed interest at the issuer’s standard rate on the remaining balance.

Sticking to your repayment plan is most important if you’re on a debt management plan. If you can’t keep up, your plan may be terminated, forcing you to deal with the debt on your own.

Also Check: How Long Does Car Loan Pre Approval Take

Is It A Good Idea To Consolidate Your Debt

With one debt and a single payment instead of multiple, whats not to like? Before jumping straight in, you need to ask a few questions.

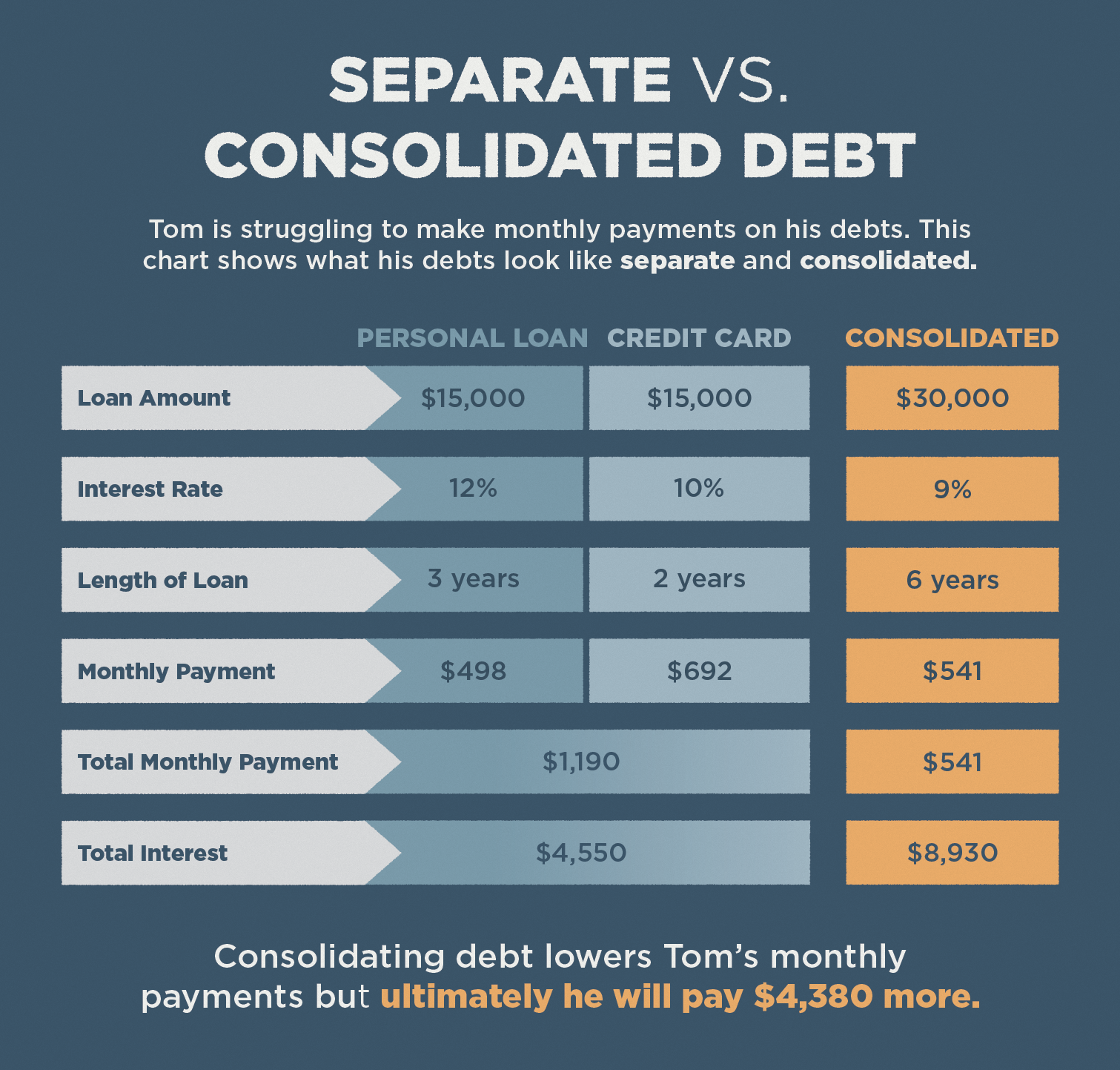

Will I actually be paying less money?

The first question is, how much interest will you end up paying with one new loan versus the current multiple ones you hold?

Remember that a lower interest rate doesnt necessarily mean you will pay less interest. If you end up paying the debt off over a longer period of time, you may ultimately end up paying a higher amount of interest.

Secondly, what other charges should you consider? Well, make sure you understand how much it will cost to set up the new loan and whether any penalties or charges exist if you choose to pay off the loan early.

Am I swapping my unsecured debts for secured ones?

So is it a good idea to consolidate your debt?

It completely depends on your circumstances. Always remember that the benefits can sound good but you need to understand the risks including the new arrangement terms, credit reporting and credit scoring. We recommend you seek advice about the best option for you before signing up. This might be guidance from a financial counsellor or your local community legal centre.

New Accounts Lower Your Average Credit Age

Opening a new credit card or taking out a loan for debt consolidation will lower the average age of all your credit accounts, which may also temporarily lower your credit score.

The length of your credit history makes up 15% of your FICO credit score and specifically factors in the age of your newest account. A brand new account doesnt yet have a positive credit history, so your score will benefit as you make on-time payments and the account ages.

Don’t Miss: How Do You Calculate Loan To Value Ratio

How Does Debt Consolidation Work

Debt consolidation is taking multiple loans and refinancing them into one loan with a new lender. There are multiple ways to consolidate your loans. The most popular way is to take out a personal loan and use those proceeds to pay off your other debts, but some consumers prefer to use home equity loans or HELOCs.

The process is largely the same regardless of the type of loan you choose. Youll start by comparing interest rates among a few lenders to see which offers you the best deal, and youll apply for enough money to cover your existing debts. Once you receive your loan funds, youll pay off your debt and begin making payments on your new loan.

-

Example

To illustrate with Bankrates debt consolidation calculator, assume you have the following outstanding balances:

- Auto loan: $12,500 balance, 6% interest rate, $350 monthly payment

- Personal loan: $4,000 balance, 11% interest rate, $250 monthly payment

If you take out a 48-month debt consolidation loan with an interest rate of 7.5 percent, your total monthly payment will drop from $1,265 to $943. Plus, youll save $5,164 in interest.

How We Made This List Of Online Payday Lenders Of Bad Credit Loans Guaranteed Approval

Before compiling a list of the best bad credit loans, we conducted thorough online research. This research enabled us to identify the most reliable and reputed bad credit loan providers. We looked for several factors to choose the lending platforms, such as the company’s reputation, customer reviews, funding times, approval process, and terms and conditions. There were a lot of lending platforms that didn’t meet our standard criteria, so we removed them from our list of reviews. After reading hundreds of customer reviews and evaluating dozens of loan providers, we decided that there are only five online companies that offer the best personal loans. We have reviewed these five lending platforms in our post so that you can pick any of them without any doubt.

Don’t Miss: Us Bank Loan Phone Number

Shop Around For Offers

Regardless of which type of consolidation you want to pursue, take some time to research and compare offers from several sources. This can help you narrow down the list of options to the ones that will best help you achieve your goals.

If you have great credit, you’ll be able to consider more than one approach to consolidating your debt, including balance transfer credit cards, personal loans and home equity products.

Other Options For Debt Consolidation

If those options dont seem like a good fit, there are other debt consolidation options. These also can affect your credit.

Keep in mind its generally not a good idea to replace unsecured debt with secured debt because you could lose your home or vehicle if you cant pay.

-

Home equity loan or line of credit: This will be reported either as an installment loan or revolving account, depending on which loan type you get. Youll also get hit with a credit check.

-

Debt management plan: Seeing a credit counselor and signing up for a debt management plan does not directly affect your credit score, but negotiating to pay less than the full amount due or closing credit cards can hurt your score. A DMP is noted on your credit report while it is in effect, but not after the plan is completed.

-

401 loan: This does not appear on your credit report, so it has no effect on your credit score. But you’re costing yourself investment returns, and the effect grows over time. This is best as a last resort.

About the author:Bev O’Shea is a former credit writer at NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Read Also: What Is An Interest Only Home Loan

Types Of Debt Consolidation

There are several ways to consolidate debt. What works best for you will depend on your specific financial circumstances. These include:

Debt consolidation loan. The most common of these are personal loans known simply as debt consolidation loans. Frequently used to consolidate credit card debt, they come with lower interest rates and better terms than most credit cards, making them an attractive option. Debt consolidation loans are unsecured, meaning the borrower doesn’t have to put an asset on the line as collateral to back the loan. However, borrowers will only be offered the best interest rates and other favorable loan terms if they have good credit scores.

Home equity loan or home equity line of credit. For homeowners, it’s also possible to consolidate debt by taking out a home equity loan or home equity line of credit . However, these types of secured loans are much riskier to the borrower than a debt consolidation plan, since the borrower’s home is used as collateral and failure to pay may result in foreclosure.

401 loan. You can also borrow against your 401 retirement account to consolidate debts. Although 401 loans don’t require credit checks, dipping into your retirement savings is a dangerous prospect, and you stand to lose out on accumulating interest.

Consolidation can certainly be a tidy solution to repaying your debt, but there are a few things to know before you take the plunge.

Will Consolidating My Debt Improve My Credit Score

In the long term, so long as you keep on top of your payments your credit score should see an overall improvement. Some factors that can boost this are:

- Lower credit utilisation ratio as you repay your loanproof you are using less of your available credit and managing your outstanding debt

- A fresh slate in order to build up an improved payment history

- You may pay less interest on a debt consolidation loan, meaning you can make larger repayments. This means you could pay off your debt quicker, therefore increasing your credit score

You May Like: Online Installment Loans No Credit Check

Factors To Consider When Choosing Bad Credit Loans With Guaranteed Approval

You must consider several factors for choosing the best bad credit loans. Selecting the best personal loan is not an easy task, as there are numerous loan providers that are ready to take advantage of your bad credit history. We know that only one unfortunate incident can impact your minimum credit score, such as one missed payment or not making payments on time. These financial mistakes occur daily, and anyone can suffer, but that doesn’t mean the lenders can exploit you for your mistakes in the past. To choose the best bad credit loans, you must be vigilant, and consider these factors before making a decision: