Myth: A Home Equity Line Of Credit Is A Reliable Rainy

Home equity lines of credit can be yanked away at any moment. Unlike a mortgage, which is there as long as you keep making the payments, home equity loans shift power to the lender.

“A home equity line is basically a personal loan securitized against your house,” Conarchy says. “It has all these outs where the banker can freeze the loan or call the loan. We saw this happen all the time in 2008. We teach people: You can’t use a home equity line of credit as your rainy-day fund, because it might not be there when you need it.”

If you lose a job, or your home value falls, the lender can end the loan.

Home Equity Loan With Low Income

The ability to repay is dependent on income, so it is going to be difficult to get approved for a home equity loan with low income.

Having a cosigner would help your case. A cosigner is someone with good credit and high income that agrees to pay your debt in case you default on your loan. It also helps to have a large amount of equity in your home, and really good credit is required.

If you are in between jobs, and plan to use a home equity loan to pay for bills, there is a chance you can be approved if you have other revenue streams like rental properties. File for unemployment income and use that to build your case.

A home equity loan is a risky venture if youre able to get approved, especially for someone with low income. The lender has the right to foreclose on your home if you cant make payments.

Repaying A Home Equity Loan

After you receive your loan amount, get ready to start paying it back. Your monthly payments will be a consistent amount throughout the term of your loan and include both principal and interest.

You may think its best to choose a shorter loan term, so you can pay off your debt faster. Remember, a 10-year term will have higher monthly payments than a 15- or 30-year term.

Don’t Miss: Will Va Loan On Manufactured Homes

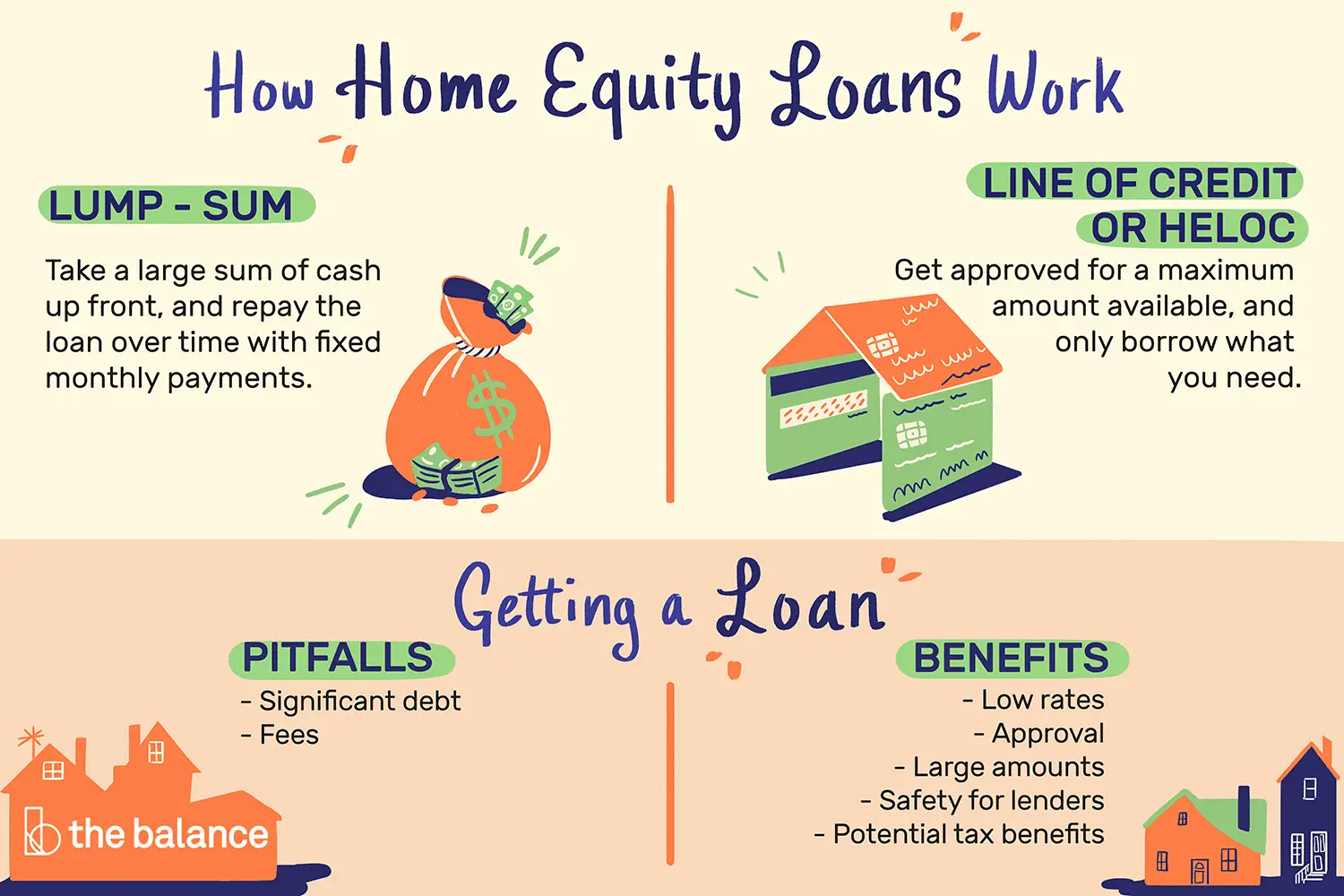

What Is A Home Equity Line Of Credit

A home equity line of credit or HELOC is a loan that uses your homeâs equity as collateral, but instead of issuing the loan in a lump sum, the lender would extend a line of credit based on your equity.

In that way, HELOCs are similar to credit cards. Like a credit card, you have a certain spending limit and when you reach that threshold your credit stops.

The period when you can spend money through your HELOC is called the draw period. After the draw period ends, you can longer access the credit, and you enter your repayment period. HELOC draw periods are usually between five and 10 years.

Underwriting Commitment And Closing

- A loan underwriter will review your financial profileThe underwriter will compare it to the home equity loan requirements and guidelines for your chosen loan or line of credit. If approved, you will receive a written commitment of terms and conditions

- With the written commitment, we can process your lending optionProcessing may include: the verification of your financial information, collection of documents to satisfy conditions of the commitment, and a review of the appraisal of the property

- Closing on your TD Bank Home Equity Loan or Line of CreditYou’ll meet with the lender and anyone else needed to finalize the transaction to sign paperwork and arrange for the loan to be disbursed to you. You must close at a TD location of your choice

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Do Banks Use Zillow For Appraisals

What is a Zillow Zestimate? A Zestimate is Zillows automated home valuation tool. Its also important to note that automatic valuations such as a Zillow Zestimate are not used by banks or lenders to estimate a propertys value for a mortgage. Only an appraisal from a licensed appraiser can be used for a mortgage.

Do All Home Equity Loans Require An Appraisal

In a word, yes. The lender requires an appraisal for home equity loansno matter the typeto protect itself from the risk of default. If a borrower cant make his monthly payment over the long-term, the lender wants to know it can recoup the cost of the loan.

An accurate appraisal protects youthe borrowertoo. An inflated appraisal value can leave you owing more than a home is worth, which can cause a borrower to go underwater financially when it comes time to, say, relocate for a job promotion or repair damage after a natural disaster.

That said, there are several different types of home appraisals. Some are cheaper, faster, and easier to obtain than others. Its up to your lender and in certain circumstances federal law which one is required. So, if you familiarize yourself with these different appraisal types, you could get ahead of the game.

Recommended Reading: How Can I Get An Rv Loan With Bad Credit

Determining How Much Equity You Have

How do you know how much equity you have? It’s an inexact science, but you should be able to find an answer that’s close enough. First, you need to know how much you owe on your mortgage. If you receive monthly statements from your lender or servicer, this figure should be updated every month. If not, contact your loan servicer and inquire about your balance. Next comes the slightly trickier part: You need to know how much your home is worth. You could spend several hundred dollars for a full appraisal, but there’s an easier way to find an estimate. Zillow.com and Redfin.com both offer so-called automated valuation models.

Redfin says its estimates for homes not on the market typically land within 6 percent of the actual value. Another reliable estimate comes from your local property appraiser, a public official who estimates your home’s value for the purposes of collecting property taxes. Bear in mind, though, that these values can be a little quirky, with many property appraisers aiming for a market value that’s somewhere below full value. And they’re usually updated once a year, so they don’t capture swings throughout the year. If you’re still in doubt about your home’s value, you might check in with the Realtor or loan officer you worked with when you bought.

Learn More About Home Equity

ADVICE

ADVICE

ADVICE

TOOLS

1 Less what you currently owe on your home under all encumbrances. For non owner-occupied rental properties of up to four units you can access up to 80%.

2 To qualify for a CIBC Home Power Plan Line of Credit, you must have more than 35% equity in your home. Minimum Line of Credit amount is $10,000. Available on residential properties only.

3 Automatic rebalancing of the line of credit component of your CIBC Home Power Plan may take up to 60 days and is subject to your maximum PLC rebalancing limit, as such term is defined in your CIBC Home Power Plan Agreement. The credit limit on the line of credit component of your CIBC Home Power Plan cannot exceed an approved percentage of the value of the property held as security for your CIBC Home Power Plan at time of application.

You May Like: Car Refinance Rates Usaa

Home Equity Line Of Credit Combined With A Mortgage

Most major financial institutions offer a home equity line of credit combined with a mortgage under their own brand name. Its also sometimes called a readvanceable mortgage.

It combines a revolving home equity line of credit and a fixed term mortgage.

You usually have no fixed repayment amounts for a home equity line of credit. Your lender will generally only require you to pay interest on the money you use.

The fixed term mortgage will have an amortization period. You have to make regular payments on the mortgage principal and interest based on a schedule.

The credit limit on a home equity line of credit combined with a mortgage can be a maximum of 65% of your homes purchase price or market value. The amount of credit available in the home equity line of credit will go up to that credit limit as you pay down the principal on your mortgage.

The following example is for illustration purposes only. Say youve purchased a home for $400,000 and made an $80,000 down payment. Your mortgage balance owing is $320,000. The credit limit of your home equity line of credit will be fixed at a maximum of 65% of the purchase price or $260,000.

This example assumes a 4% interest rate on your mortgage and a 25-year amortization period. Amounts are based on the end of each year.

Figure 1: Home equity line of credit combined with a mortgage

| $260,000 | $260,000 |

Buying a home with a home equity line of credit combined with a mortgage

- personal loans

- car loans

- business loans

Who Pays For The Appraisal

Appraisal fees vary by state, but appraisers must charge customary and reasonable fees for the area. Expect to pay the lender $300 to $500 for an appraisal of a standard single-family home. More complex properties are more expensive because the inspection takes more time, says Erin Benton, vice president of Decorum Valuation Services, an appraisal management company in Ellicott City, Md.

You must pay for the appraisal regardless of whether your loan closes because the appraiser still did the work. While the fee may seem worthwhile if it enables you to get the refinancing terms you want, it can seem like a waste of money if a low appraisal means you cant refinance.

Since lenders cannot discuss a homes value or anticipated target value with an appraiser at the time of assignment, homeowners are not able to get an appraisers ballpark estimate of whether their home is likely to appraise high enough for them to refinance before they pay for the service, as they could before the new regulations. At best you can search for recent comparable sales on websites such as Zillow and Redfin, but these records may be inaccurate or incomplete.

Also Check: Does Va Loan Work For Manufactured Homes

Harmful Home Equity Practices

You could lose your home and your money if you borrow from unscrupulous lenders who offer you a high-cost loan based on the equity you have in your home. Certain lenders target homeowners who are older or who have low incomes or credit problems and then try to take advantage of them by using deceptive, unfair, or other unlawful practices. Be on the lookout for:

- Loan Flipping: The lender encourages you to repeatedly refinance the loan and often, to borrow more money. Each time you refinance, you pay additional fees and interest points. That increases your debt.

- Insurance Packing: The lender adds credit insurance, or other insurance products that you may not need to your loan.

- Bait and Switch: The lender offers one set of loan terms when you apply, then pressures you to accept higher charges when you sign to complete the transaction.

- Equity Stripping: The lender gives you a loan based on the equity in your home, not on your ability to repay. If you cant make the payments, you could end up losing your home.

Using Home Equity For Renovations

If youre wondering how to use home equity for renovations, you have a couple of choices, considering the scope and timeline of those projects.

Home renovation projects with long flexible timeline requiring many smaller building supply purchases could be funded through a home equity credit line. With a credit line, you only pay interest on the amount you borrow. Then as you pay it down you can reborrow back up to your set limit.

If, however, you need a larger lump sum to make one large supply purchase, a fixed-rate mortgage or loan component could be a better option due to lower interest rates and lower payments. Some construction companies require deposits and periodic payments as renovation projects progress, so ask about payment timelines when youre making a list of questions to ask when hiring a contractor.

Read Also: How Do I Find Out My Auto Loan Account Number

Minimum Appraisal Type Needed

Your home serves as collateral for a HELOC, therefore lenders must ensure that your home’s worth is sufficient to recover any outstanding balance should you fail to make payments. An appraisal allows lenders to “see” your home and determine whether its value and condition meet HELOC underwriting guidelines. Lenders may ask for a full appraisal by a certified or licensed appraisal company, a drive-by appraisal or a computerized appraisal method known as an automated valuation model, or AVM. The minimum appraisal type required depends on the loan amount and lender preference.

Video of the Day

If You Secure A Good Appraisal

Congratulations! You have completed a major step toward refinancing your mortgage and saving money. Now its time to go through the next series of steps with your loan officer. If youve secured a favorable appraisal, use a tool such as the Consumer Financial Protection Bureau’s mortgage calculator to research interest rates on a refinanced mortgage for a home of your value. Being armed with these figures can give you some bargaining power when you meet with your lender.

If you want to appeal a low appraisal, you will have a better chance of succeeding if you offer strong data to support your case.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Percent Intro Apr Credit Cards

When you use a 0 percent intro APR credit card, you can avoid paying interest on purchases during a promotional period that often lasts between 12 and 21 months. If you have a short-term home renovation project, using this option instead of a home equity loan can help you avoid interest charges altogether.

Qualifying For The Heloc

The appraisal is just a small part of the qualifying factors necessary for HELOC approval. Youll also have to prove that you can afford the loan. Just like you had to do with your 1st mortgage, youll have to show the lender that you deserve the loan.

Most lenders require:

- Last 2 paystubs covering the last month of employment

- Last 2 years W-2s showing your income over the last 2 years

- Last 2 years tax returns if you are self-employed or work on commission

- Proof of any assets if you need them for qualifying purposes

- Proper credit score based on the lenders requirements

In general, lenders allow as much as an 85% LTV for a HELOC. But, there are some lenders that will go higher. In this case, though, they usually require a full appraisal. If a lender is going to lend you as much as 95% of the value of your home, it just makes sense that theyll need to verify your homes value.

You have the option to shop around for appraisers when you get a HELOC. The key factor, however, is that the appraiser is on the lenders approved list. If he isnt, you may not be able to use him. Some lenders may allow the use of the appraiser, but then theyll require one of their own to review the report. This could cost you more money in the long run.

Whether or not your lender requires an appraisal, consider if its in your best interest. If nothing else, it gives you proof of the current value of your home. This way youll know the true value of one of the largest investments in your life.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Understanding Home Equity Loans

With a home equity loan, you borrow a fixed sum of money that’s secured by your home. The bank lends you the cash, and you repay it in monthly payments. Home equity loan rates are typically fixed.

There also are home equity lines of credit , which work more like credit cards and have variable rates. You’re approved for a certain amount of money and can borrow up to that amount by writing a check or using a credit card connected to the account. They can also be interest-only loans, so making the minimum payment means you’re repaying only the interest but not paying down the principal. If you take an interest-only loan, though, you might face a large “balloon payment” of the outstanding principal at the end of the loan term.

Not every financial institution makes home equity loans, but large banks and credit unions tend to offer a menu of home equity loans and HELOCs. Unlike mortgages, which often are resold as investments and therefore tend to vary little from one lender to the next, home equity loans tend to stay in the lender’s portfolio. As a result, terms on home equity loans can vary widely by lender. The choices can become dizzying. For instance, Navy Federal Credit Union offers a selection of five-, 10-, 15- and 20-year home equity loans. For each term, the credit union has a variety of options, including loan-to-value ratios ranging from 70 percent to 100 percent and maximum loan amounts of $100,000, $250,000 and $500,000.

How Much Equity Could You Borrow?

Can You Influence The Outcome

Before the financial crash of 2007-08, many appraisers felt pressure to inflate their valuations. Subsequent state and federal legislation sought to put an end to that. Many property professionals misinterpreted the 2010 federal law and now believe theyre not allowed to interact with appraisers. Thats not true.

Writing for Huffington Post, The Appraisal Foundation President David S. Bunton says the legislation contains exclusions that specifically allow for communication with the appraiser.

For example, the laws specifically permit a party to the transaction requesting an appraiser to correct errors in an appraisal report and to provide additional clarification or explanation for information in an appraisal report.

In addition, these laws allow a party to the transaction to request that an appraiser consider additional information about the property, including additional comparable sales information.

Also Check: Usaa Auto Loan Credit Score