Evaluate Any State Financial Awards You Receive

Many states offer additional financial assistance to students who submit a FAFSA. Any award you receive from the state is subject to the same federal income tax treatment as awards from the federal government. For example, if you receive a grant from your state that you dont repay, you treat it just like a Pell grant, which requires you to use the funds a certain way. All state-sponsored student loans are excluded from your taxable income as well.

Is Loan Forgiveness Considered Taxable Income

If loans arent considered income because you have to pay them back, what happens if you qualify for student loan forgiveness and dont need to repay the loan. Is the forgiven amount considered taxable income? The answer depends on the type of forgiveness you qualify for.

Generally, any loan that is forgiven or discharged is considered income in the eyes of the IRS. But there are eligibility exceptions specifically related to student loans.

Loans forgiven under the Department of Educations public service loan forgiveness program arent considered taxable income. If your loans are forgiven thanks to your participation in this program, you wont need to pay tax on the forgiven amount.

But, qualifying for forgiveness for another reason may leave you with a tax bill. For example, forgiven student loans under an income-driven repayment plan, you will likely need to pay taxes on the forgiven amount.

Does Work Study Money Count As Income For Taxes

If you earn wages as part of a work study program, you are typically required to report this money as income on your federal tax returns. There are a few exceptions for work performed as part of the Armed Forces Health Professions Scholarship and Financial Assistance Program or the National Health Service Corps Scholarship Program.

If you are currently working in a work-study position less than half time and enrolled in college full-time, then your earnings may be exempt from Medicare and Social Security payroll taxes. You will still owe federal and state tax, though.

Don’t Miss: Home Equity Loan Vs Home Equity Line Of Credit

Are Student Loans Taxable

There are multiple types of student loans each with their own unique terms. As noted earlier, though, student loans are not taxed as income.

This is true of other types of loans generally as well, like credit card spending, mortgages, and personal loans basically most credit that needs to be repaid. The IRS considers student loans a form of debt not income therefore, it is not taxed.

The only time that student loans can be taxed is if they are forgiven during repayment. If you are eligible for a federal student loan forgiveness program and have met the requirements , the remaining balance on your student loans may be taxed as income, depending on the repayment plan. This could amount to a hefty tax bill.

How To Lower Your Tax Bill

Regardless of whether or not your student loan forgiveness ends up being deemed as taxable income, there are still plenty of ways to reduce your taxable income level before the end of the year, all while helping you invest for the future.

If you currently have private student loans, which are not eligible for forgiveness or payment pause, you can still deduct up to $2,500 in interest paid from your taxable income. Additionally, to save some more money in interest payments consider refinancing your private student loans with a lender like SoFi Student Loan Refinancing or Earnest Student Loan Refinancing.

-

Retirement planning tools

Terms apply.

Next, you could contribute more money to a Health Savings Account, which would allow you to save pre-tax money for qualified medical expenses, or invest the funds in a brokerage account within that Health Savings Account, which would help lower your taxable income for the year. Note, however, that you’ll need to have a high deductible health plan in order to enroll in an Health Savings Account.

Lastly, if you have purchased stocks that aren’t performing well, you could consider selling them and writing off the loss. This is known as tax-loss harvesting, which essentially means you’d only have to pay taxes on the net profit you made from your investments.

Don’t Miss: How Much Is Va Loan Entitlement

How Do Student Loans Factor Into Your Taxes

Student loans can reduce your tax bill if you’ve been paying interest

Student loans and taxes: Two subjects that few people enjoy thinking about however, if you have student loans, they are likely to impact your tax bill. Here’s what you need to know.

Student Loans Are Subject To Interest

You can count student loans as income if you have a federal loan or a private loan. There are many different types of student loans, and each has its own interest rate that varies based on the type of the loan. For example, graduate student loans may have higher rates than undergraduate loans, which would mean your monthly payments would be higher. Additionally, private parent loans may have lower rates than federal parent loans or private student loans.

Student loan interest is typically charged as an annual percentage rate instead of just a flat amount per month like credit card debt. This means that youll pay more in total over time compared with other types of debt and can get into serious financial trouble if you dont pay off your debt quickly enough.

You May Like: What Is Equity Loan On House

Do Student Loans Count As Income Check Out Here

Do Student Loans Count As Income?

Most if not all students, resume school with the hope that things would just go smoothly and without stress for them which is just what is necessary for a maximum focus on school work.

Gradually, things begin to get bad financially, the income begins to depreciate__of course you how important it is to have just enough cash to take care of necessary things in school as a student.

When things get from bad to worse, most people do not wait for it to get worst they resort to taking loans so as to help themselves move on with school work.

Others get the loan enough to see them through school even before enrollment and resumption making sure that they have acquired just enough to see them through .

Channels through which students could possibly acquire their financing include scholarships and fellowships, federal student loans, from unsubsidized to subsidized loans, to Direct Consolidation Loans and Direct PLUS loans, etc.

What Is The 28 36 Rule

A Critical Number For Homebuyers One way to decide how much of your income should go toward your mortgage is to use the 28/36 rule. According to this rule, your mortgage payment shouldn’t be more than 28% of your monthly pre-tax income and 36% of your total debt. This is also known as the debt-to-income ratio.

Also Check: How To Apply Loan For New Business

Include Your Earnings From A Work

Many students are provided part-time jobs working at their college as part of their FAFSA award. Although this money you earn is intended to ease the financial burden of attending college, the income is fully taxable on your tax return just like any other employment earnings.

When you prepare your tax return, you must include these amounts on the appropriate line for wages and salary.

How Other Forms Of Financial Aid Affect Your Income

Alright, so we know that student loans dont count as taxable income. But what about other types of financial aid?

It turns out that some types of financial aid are likely to count as income, so be sure you understand what to expect on your tax bill.

Lets talk about the two other primary types of financial aid: work-study and grants / scholarships.

Also Check: How To Get Mobile Home Loan

Do Student Loans Count As Income Heres What You Need To Know

Pareeshti Rao

If youre going to college, theres a decent chance youll get some financial assistance. Scholarships, grants, federal student loans, and private student loans are all possibilities. Borrowers typically do not pay taxes on student loans, although they may owe on portions of scholarships and grants. The amount of financial help you get might total tens of thousands of dollars every year. And this begs the question: Do student loans count as income?

The answer to this question may be significant for a variety of reasons. For example, if you want to apply for a credit card, you might worry whether financial aid counts as income for credit card approval. However, for many students, the most essential question is Is financial aid considered income?

Do Student Loans Count Towards Credit Score

Yes, having a student loan will affect your credit score. Your student loan amount and payment history will go on your credit report. … In contrast, failure to make payments will hurt your score. Establishing a good credit history and credit score now can help you get credit at lower interest rates in the future.

Also Check: How To Calculate Loan To Debt Ratio

If You Are Paying For College From Different Sources Its Best To Know Which Ones Are Considered Income For Tax Purposes

Some sources of student aid are considered income by the IRS. Image courtesy of U.S. News Money.

While student loans are not considered income, there are some student aid sources that areâwhich means that theyâre also taxable.

Student athlete stipends

Sometimes student athletes are given a stipend that is a part of their scholarship. If this applies to you, and youâre using this stipend to pay for your room and board this is considered income by the IRS. Stipends operate much like any scholarships or grants you have if youâre using to pay for anything other than tuition, books, and other required school supplies.

Work study programs

If you have been offered a work study program, this is considered income and taxable since you can choose to use this money for a variety of different things. Even if youâre using the money you earn from a work study program to strictly pay for your tuition, it is still considered income and will need to be reported.

Employer-sponsored tuition

If you are returning to school and have enrolled in classes and are receiving tuition reimbursement from your employer, this can also be taxable. Any amount over $5,250 that you pay towards school is considered taxable.

Is Student Loans Forgivable

Wondering if students loan are forgivable? Of courseYes! it is forgivable but, must meet the criteria your lender must have put in place before granting you the loan.

Loans are not totally forgiven, the lender would only decide on what amount to get back on returns which is usually lower than what was borrowed.

Note that when some part of loans have been forgiven, the borrower will have to still pay taxes on the amount forgiven since the forgiven amount is considered a Taxable Income.

Also Check: How Can I Get 50000 Loan

Financial Aid & Medicaid

College financial aid can sometimes affect eligibility when applying for Medicaid. Of course, the student must support themselves without a parent claiming them as a dependent on their taxes.

Medicaid provides free dental insurance and healthcare to low-income families. However, the qualification rules vary by state for work-study programs and student loans.

Public Service Loan Forgiveness

Those who qualify for Public Service Loan Forgiveness don’t have to worry about paying taxes on the amount forgiven. As long as you meet the eligibility requirements of working for a qualified employer and make 120 qualifying payments, you can have your loan balance forgiven without a tax consequence.

Borrowers who have worked for eligible employers and have either FFEL, Perkins Loans, or Direct Loans, need to submit a PSLF application by Oct. 31, 2022, to take advantage of a limited PSLF waiver that gives borrowers credit for pay periods that would normally not count toward the 120 qualifying payments they need to receive loan forgiveness.

Read Also: How Long Does It Take To Get Loan From Bank

Do Student Loans Affect My Tax Returns

If youre still in school and receiving money from student loans, this is not considered taxable income, since youre obligated to pay it back.

If youve graduated and are making payments on your student loans, you may be able to deduct some of the student loan interest youve paid. Whether or not you can take the student loan interest deduction will depend on your income and tax-filing status.

Dont Fear The Marriage Penalty

The marriage penalty is what happens when filing taxes jointly with a spouse results in a higher total tax bill than if the couple filed their taxes separately.

However, there arent any situations where being married filing separately would be beneficial while deducting student loan interest on taxes. In fact, married couples filing separately are not eligible for the student loan interest deduction.

Recommended Reading: Fannie Mae Loan Look Up

Do Student Loans Count As Income On My Taxes

Generally, debt of any kind that must be paid back doesnt count as income on your taxes, including student loans.

However, if some or all your student loans are canceled or forgiven, it might be considered income that youll have to pay taxes on with some exceptions.

If youre wondering whether student loans count as income, heres what you should know:

-

Student aid that does NOT count as income

-

Student aid that DOES count as income

-

Tax benefits and deductions for students

Qualifying To Rent An Apartment

Although students may use the proceeds from their student loans to pay for their apartment rent, it does not qualify as income on a rental application. Although requirements will vary depending on the landlord, typically the only source of income you will be able to claim for an apartment rental is employment income that you can verify with a pay stub or an income tax return. If you dont have any verifiable income other than your student loan, youll likely need to get a parent to co-sign your apartment rental application.

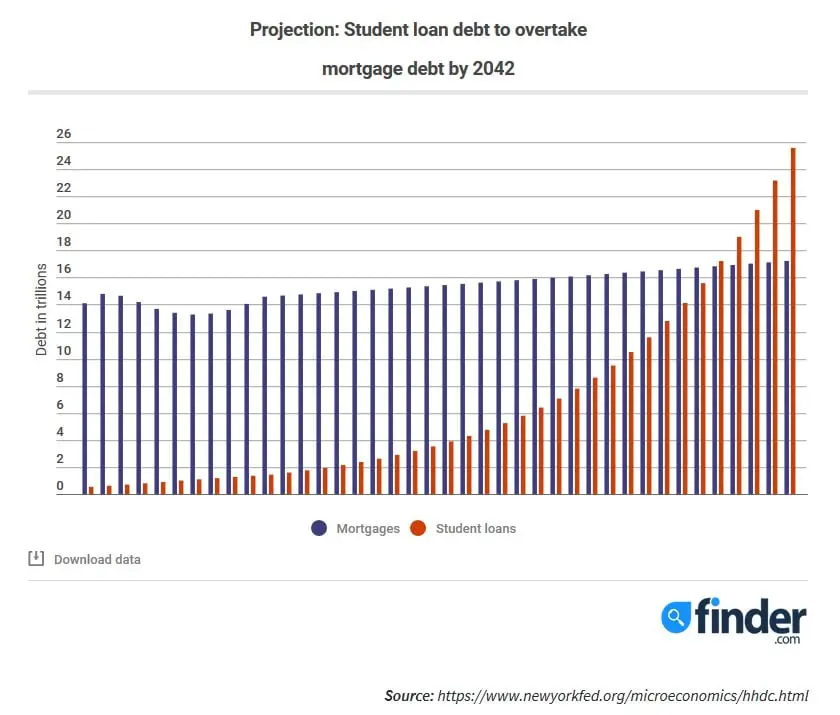

Once you are out of school and begin repaying your student loan obligation, the debt can actually hurt your chances of getting an apartment. Typically, a landlord will evaluate the information on your application along with your credit score and credit report. They will also look at your total monthly debt obligations relative to your monthly income and evaluate whether youll be able to make your monthly rent payments.

If you have a lot of student loan debt , you have less money available every month to pay for housing. Student loans and other forms of debt can also prevent you from getting an apartment after graduation without a co-signer.

Also Check: How To Calculate Car Loan

Final Thoughts On Financial Aid And Taxable Income

For many people, paying for college without taking on federal aid or student loans is extremely difficult. That means its important to understand how your financial aid and student loans impact the rest of your life, including your taxes.

In most cases, your financial aid and student loan debt wont be taxed as income, and you may even benefit from the student loan interest deduction or another tax credit. But keep in mind the situations when you could face a tax bill for your aid or loans. That way, you can prepare for a potential tax bill long before its due.

So the IRS does not regard student loans as a repayable income. Students usually do not keep their students loan. So it is wrong for it to be referred to as income.

But things can get a bit dicey when your loans are forgiven or you receive grants or Grants , Academic Competitiveness Grant, SMART Grant).

Though, the IRS student loans do not place student loans in the category of income that can be taxed. Financial aid loans have a lot of tax and credit consequences.

Is Financial Aid Taxable Income How About Student Loans

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Financial aid that you receive for college is usually not taxable, but there are exceptions. If youre a non-degree student, for example, or if you spend financial aid on non-qualified expenses, you might have to pay taxes on it.

Fortunately, student loans are not taxable. Lets take a closer look at the tax implications for different types of financial aid and loans and other key issues by answering the following questions:

You May Like: When Does Student Loan Come In

There Are Plenty Of Other Factors To Consider When It Comes To Getting A Loan

While the income you receive from a student loan is not taxable, there are plenty of other factors to consider when it comes to getting a loan.

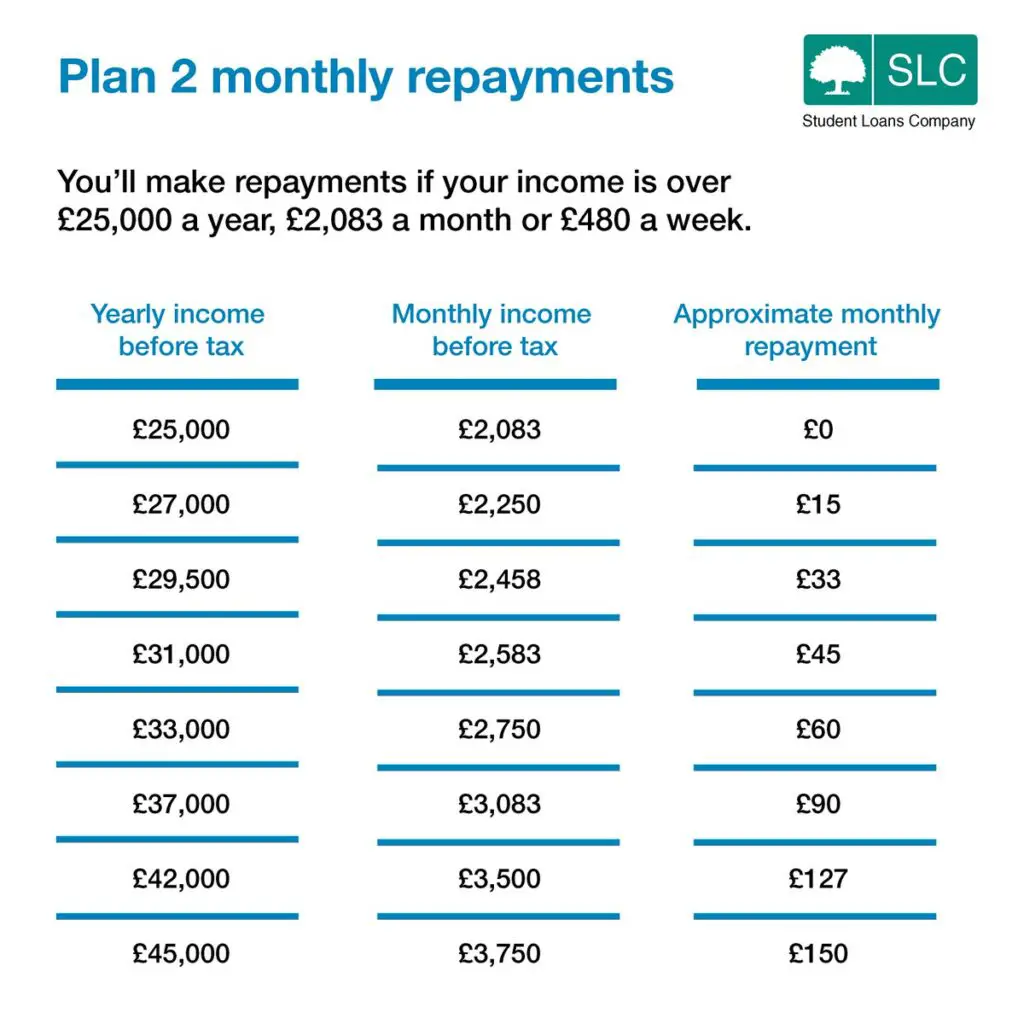

- You need to understand the terms of the loan and what youll be paying. The interest rate and repayment terms can substantially affect how much money you owe in total, so make sure you know what they are before agreeing to anything.

- You need to understand what happens if you default on your loans . If a creditor files a lawsuit against you or places liens against your property, that could have serious financial consequences down the road including damaged credit scores.

Student Loans On Credit Card And Loan Applications

You might actually be able to count your student loan money as income when you’re looking to qualify for a loan or credit card.

However, you cant count the money that goes directly to the school to pay for your tuition. To count your student loan as income, you have to receive it directly. So if you get a refund from your school after theyve used your loans to pay tuition and fees, that amount may be able to count as income.

Your student loans can also only count as income when youre actually receiving them. You cant use those same loans as income in future years.

Also, remember that while counting your student loans as income might help you get a credit card or loan, your student loan debt might count against you later on when trying to qualify.

When deciding whether to give you a credit card or loan, lenders use your debt-to-income ratio . Its the percentage of your gross income that goes toward debt. So once you start making payments on your student loans, theyll count toward your DTI.

With too high a DTI, you may not qualify for your loan or credit card or could end up paying a higher interest rate.

Recommended Reading: What Loan Offers The Lowest Interest Rate