Buying Amidst A Military Transfer

Transfers are a way of life in the military, and they can derail the home buying process if one spouse gives up a job to move.

This wife or husband who follows the transferred individual is called a trailing spouse. Mortgage guidelines specifically address trailing spouse income within written guidelines. Lenders count income in one of two cases.

- The employer confirms that moving will not affect income

- The spouse secures employment at the new location

In the second scenario, the company must verify employment via a letter describing the job title, start date and salary. The new job can only be counted if the spouse has at least a two-year history in that line of work.

Still, these rules can make the difference when VA loan applicants plan to buy a home in the military members new location.

Can My Dad Use His Va Loan To Buy Me A House

The joint VA loan program allows Veterans and/or active-duty military members to use a joint borrower who is not a spouse or other Veteran. Most lenders won t allow these kinds of loans and will block Veterans from buying a home with a sister, brother, mother, father, son, daughter, or someone who is unrelated.

Website Of The Charity Organization

Anyone can co-sign or co-borrow on your VA loan, depending on the lenders policies, but the VA may not guarantee the entire loan. While the VA guidelines may allow a non-spouse, non-veteran to co-sign for a mortgage, they will not fully guarantee the loan.

Contents

Read Also: How To Get Loan Originator License

Option : Use Remaining Entitlement To Use The Va Loan Twice

In the section on VA loan entitlement above, we explained that eligible veterans have enough VA loan entitlement to borrow up to a $510,400 loan with no down payment. So, what happens if a veterans first VA loan is for less than $510,400? This scenario creates the next major option for using your VA loan twice: using up your remaining entitlement.

When a veteran uses the VA loan, a portion of his or her entitlement becomes tied up in the mortgage. Recalling that the VA guarantees 25% of the loan amount, this means that, if a veteran purchases a $200,000 home, $50,000 of entitlement is committed . But, as we discussed, total entitlement is $127,600 . In this scenario:

- Total guaranteed entitlement: $127,600

- Minus 1st loan entitlement: -$50,000

- Equals remaining entitlement: $77,600

Next, veterans need to multiply their remaining entitlement by four to determine the loan amount they can still borrow without needing a down payment. For the above scenario, $77,600 x 4 = $310,400, which means that this veteran could use the VA loan a second time to purchase a $310,400 home without a down payment.

However, veterans need to note that, just because they have entitlement remaining does not mean that they will actually qualify for a second VA loan. They still need to meet the credit, income, and asset requirements necessary to qualify for a loan.

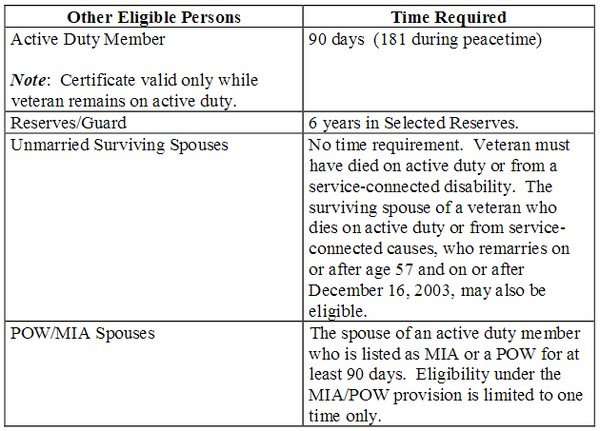

Are Surviving Spouses Eligible For Va Loans

Surviving spouses of veterans and military personnel can be eligible for a VA loan. To be eligible, at least one of these conditions should be true:

- The veteran is missing in action

- The veteran is a prisoner of war

- The veteran died while in service or from a service-connected disability and the spouse didn’t remarry

- The veteran died while in service or from a service-connected disability and the spouse didn’t remarry before they were 57 years old or before December 16, 2003

- The veteran had been totally disabled and then died, but their disability may not have been the cause of death

To buy or refinance a house, the surviving spouse will need a Certificate of Eligibility . The Department of Veterans Affairs website has more information on how to get a COE.

You May Like: How To Get Loan Originator License

Va Home Loans For Unmarried Couples: A Guide To Co

Buying a house is a big investment in your future, but it comes with a lot of potential financial liability. If you fail to make payments on your mortgage or have to declare bankruptcy, you risk losing the house entirely.

Thats why lenders, even those who issue VA home loans, put such a heavy emphasis on your household income levels when deciding how much theyre willing to lend you. Thats why many people choose to use a co-borrower when trying to buy a house.

So, can unmarried couples be co-borrowers when financing a home with a VA loan?

You May Also Be Determined Eligible If:

Note: A surviving spouse who remarries on or after age 57 and on or after December 16, 2003, may be eligible for the home loan benefit. However, a surviving spouse who remarried before December 16, 2003, and on or after age 57, must have applied no later than December 15, 2004, to establish eligibility. |

Don’t Miss: Can I Roll My Closing Costs Into My Va Loan

Does Va Allow Non Occupant Co Borrowers

According to the VA, a non-occupant co-borrower often called a co-signer in this case is not allowed. In order to co-sign a VA loan, the person needs to live in the property and use it as their primary residence.

Co Borrower Rules When Buying A Home

There are so many reasons to buy a home. Reasons include building wealth through equity, potential tax deductions, avoiding rent increases, making the home your own, and buying a vacation spot. Even just pride in ownership is high on the chart. Yet with rising home prices and dwindling savings for down payment, many wonder if home ownership is possible. Each year, more and more single buyers purchase a home. Although, most purchases involve a borrower and co borrower.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

How Do Va Loans Work

The VA doesnt make loans, so borrowers must find a private lender that is part of the VA loan program and willing to offer affordable financing.

Different lenders have different qualifying criteria. But the VA encourages lenders to make VA loans available to all qualified veterans that apply. The government guarantees a portion of the loan to pave the way to easier approval. In most of the U.S., the government guarantees loans of up to $510,400 as of 2020 the guarantee means that if you dont pay, lenders are unlikely to lose money.

But that government guarantee doesnt protect you, the borrower, if you dont pay your mortgage. You can still lose your home to foreclosure if you dont repay your loan. If you do run into trouble as a VA mortgage holder, theres a dedicated VA staff to help.

Using The Va Loan A Second Time

Due to the VA loan programs zero-down, low-interest terms, eligible borrowers frequently ask about using the VA loan a second time. In this article, well explain how veterans can use their VA loan benefits a second time.

Specifically, after using this outstanding program once, multiple ways exist for veterans to use the VA loan again to buy a second home, and well cover how to do so by diving into the following topics:

- VA Home Loan Overview and Advantages

- VA Loan Entitlement

- Option 1: Restore Entitlement to Use the VA Loan Twice

- Option 2: Use Remaining Entitlement to Use the VA Loan Twice

- Final Thoughts

The VA Home Loan offers $0 Down with no PMI. Find out if youre eligible for this powerful home buying benefit. Prequalify today!

You May Like: What Credit Score Is Needed For Usaa Auto Loan

The Issue With A Fianc

The VA looks at spouses of veterans as equals. If you apply for a VA loan with a spouse, you still get the full guaranty, which means you dont have to put any money down on the home. If you buy the home with anyone other than a spouse, though, you only get half of the guaranty .

When it comes to a fiancé, you are kind of caught in the middle. Yes, you arent married, so it would put you in the 50% guaranty category, but you are about to be married, which would make you husband and wife. At that point, you should get a full guaranty.

The problem is that you arent married yet, so technically, the lender should treat it as a veteran and non-veteran purchase. This means that you would have to come up with a down payment equal to 25% of half of the purchase price of the home.

Considerations Before Bringing In A Co

Before bringing in a co-borrower, youll want to get a handle on their credit and overall financial picture. If they have lots of debts, late payments, or a low credit score, bringing in a co-borrower could actually hurt your chances of getting a VA loan. It could also mean a higher interest rate and a much more expensive loan in the long run.

You should also think about their VA eligibility. If they dont meet the military service requirements set out by the VA, youll likely need to make a down payment to purchase your home. The VA will only guarantee the VA-eligible borrowers portion of the loan, leaving a large share of the loan uninsured . Most mortgage companies will require a down payment in this case to offset the risk.

You May Like: Creditloancompare

Can I Keep My Spouses Name Off The Title

If you live in a common-law state, you can keep your spouses name off the title the document that says who owns the property.

The title doesnt have much to do with the mortgage. The names on the mortgage show whos responsible for paying back the loan, while the title shows who owns the property. You can put your spouse on the title without putting them on the mortgage this would mean that they share ownership of the home but arent legally responsible for making mortgage payments.

What To Do If Youre Not Married

If youre not married but really want a co-borrower on the loan, youll need to look at different financing options beyond VA home loans. If youre buying your first house, an FHA loan can help you lock in a low interest rate and give you flexible down payment requirements. If youre planning on buying a home in a rural area, a USDA loan may be a good fit.

If any of the government subsidized loans arent great options, youll need to look at conventional mortgages through your preferred lender, bank, or credit union. These loans are the most flexible and allow unmarried couples to be co-borrowers without a problem. However, the qualification requirements are strict and you may have trouble qualifying for a low interest rate if your credit scores arent high.

Recommended Reading: Becu Autosmart

Can You Qualify For A Va Loan If Your Father Served

In that vein, we commonly get asked, If my father was a Veteran, can I get a VA loan? Or, Do you have to be a Veteran to get a VA loan? The short answer is, you cant get a VA loan as a non-Veteran. You must serve or previously served in the U.S. Military and meet the VAs length of service requirements.

Your Path To Buying A Home With A Va Loan:

Navy Federal makes the process easy for you. Were here to explore whether you meet VA home loan requirements and answer any questions along the way.

Read Also: Fha Loan Assumability

Va Loan Entitlement Options For Military Couples

Eligible spouses can decide to use all of one spouses entitlement for a VA loan, split their entitlement evenly for a VA home loan, or have one spouse use remaining entitlement from a previous VA home loan with the other spouse providing the rest for the new mortgage. Entitlement is basically the dollar amount the VA pledges to repay if the borrower defaults. On most loans above $144,000, the entitlement utilized is a quarter of the purchase price.

You can read our earlier post to learn more about VA loan entitlement in general. Now’s the time to get started on your VA home loan start today.

What Is A Co Borrower

Often, there is confusion between co borrower and cosigner. A co-borrower is on the loan just as much as the borrower. In the case of a mortgage loan, each has equal responsibility in paying back the loan. Plus, the co-borrower has equal ownership in the home. Additionally, it does not matter who is first borrower on the loan unless there is a non occupying co borrower involved or using a VA loan. VA loans require that the borrower using their VA eligibility is the primary borrower.

A cosigner is responsible for the debt along with the borrower, yet does not have ownership in the property. All in all, it comes as no surprise that many have questions about the co borrower. Popular questions include:

- Is a co borrower required?

- Who may be the co borrower?

- Do I have to be married to a co borrower?

- Does the co borrower have to live in the home?

- Who Can Be a Borrower on a Rental & Vacation Home Purchase?

Don’t Miss: Usaa Car Financing Calculator

Do You Have To Be Married To Have A Joint Va Loan

It Depends on the Co-Borrower If you are in a domestic partnership or a long-term relationship but arent married according to your states laws, your partner will only be able to be a co-borrower if theyre a qualified veteran or current servicemember. If theyre not, youll have to be the sole borrower on the loan.

What Is A Joint Va Loan

There are lenders out there that will make a joint loan for a veteran and a non-spouse, non-veteran co-borrower. Imagine a veteran getting a loan with their brother, or a parent, or an unmarried significant other — that’s a joint VA loan.

These kinds of scenarios are absolutely possible, but they look a bit different than a typical VA purchase loan. That’s because the VA’s guaranty extends only to the veteran’s portion of the loan .

With joint VA loans, the non-veteran co-borrower will often need to make a down payment to cover their portion of the loan. Just how much depends on a few different factors, and it can get complicated in a hurry.

Also Check: What Is An Rv Loan

Va Home Loan: Are You Eligible

In order to obtain a VA home loan, you must first get a VA Home Loan Certificate of Eligibility . This certificate is issued only through the Veterans Administration. Veterans, active duty, guard and reserve members, and military spouses all potentially qualify for this certificate. Keep in mind that the COE, while necessary, only allows an eligible individual to apply for a home loan it does not guarantee loan approval.

Eligibility for the COE is based on an individual’s military service. First, see if you are eligible based on the major categories below. If you are, follow these instructions to get your COE.

1. Wartime – Service During:

- Korean: 6/27/1950 to 1/31/1955

- Vietnam: 8/5/1964 to 5/7/1975

You must have at least 90 days on active duty and been discharged under conditions other than “dishonorable”. If you served less than 90 days, you may be eligible if you were discharged for a service-connected disability.

2. Peacetime – Service during periods:

- 7/26/1947 to 6/26/1950

- 5/8/1975 to 9/7/1980

- 5/8/1975 to 10/16/1981

You must have served at least 181 days of continuous active duty and been discharged under other than dishonorable conditions. If you served less than 181 days, you may be eligible if you were discharged for a service-connected disability.

3. Service after 9/7/1980 or 10/16/1981

If you were separated from service which began after these dates, you must have:

4. Gulf War – Service during period 8/2/1990 to date yet to be determined