Interest Rates And Fees If You Borrow On Amounts You Prepaid

You pay either a blended interest rate or the same interest rate as your mortgage on the amount you borrow. A blended interest rate combines your current interest and the rate currently available for a new term.

Fees vary between lenders. Make sure to ask your lender what fees you have to pay.

You may not have to make any changes to your mortgage term.

What Is A Cash Out Refinance

When you get a cash out refinance, you get a new mortgage. You pay off your current mortgage and replace it with a new one for a higher amount, taking out the difference in cash as a lump sum at closing. You get all the money at one time with a cash out refinance and cannot get additional money in the future from the loan. Because a cash out refinance involves getting a new mortgage, you will need to complete a new application, document your current finances, and pay a new set of closing costs.

Cash out refinances can be good choices if you know how much money you need. If you want to consolidate higher interest debts and loan payments you might choose a cash out refinance. If you are planning to complete home renovations and improvements, and know how much they will cost, you might also choose a cash out refinance. You may pay for college with cash out refinances too.

An advantage of cash out refinances is that you can also change the terms of your mortgage with them. For example, when interest rates are falling, you can use a cash out refinance to get money from your home equity and change your interest rate at the same time. You can switch from an adjustable rate to a fixed rate mortgage or change the number of years you have to pay back your mortgage with a cash out refinance too.

Pros of a cash out refinance:

Cons of a cash out refinance:

Be Warned Not All Lenders Accept Customers With A Help To Buy Mortgage

This all depends on what remortgaging option you’re going for. If you’re remortgaging your standard mortgage to include the equity loan, you’ll have more lenders to choose from.

But if you’re just remortgaging your standard mortgage and keeping the equity loan separate, some lenders won’t lend to you.

Even if you’re able to remortgage, you’ll have to meet the lender’s affordability tests before being approved.

C. Don’t want to pay back the equity loan or sell up? You can stay put

Remember you don’t have to repay the equity loan until you sell up OR you reach the end of your main mortgage term. This means that if you’re not able to pay off the equity loan , and you’re not intending on moving home, you can simply stay put and hold on to the equity loan.

You’ll need to take into account though that you’ll be charged interest on the equity loan from year six onwards, and the rate will increase each year until you repay the loan. And as we’ve said, keeping the equity loan for roughly 10 years or more can increase its overall cost.

MSE weekly email

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Paying Off Your Help To Buy Equity Loan: Step

Whichever way you decide to pay off your loan, youll need to follow these steps:

Can I Use A Home Equity Loan To Buy Another House

If you have a significant amount of equity in your primary residence, you can tap into it through a home equity loan. You can then use that money for any purpose that you wish, including buying a second home or an investment property. Using a home equity loan to buy another house is not without risks, however, so its smart to understand the pros and cons before you proceed.

Also Check: Va Mobile Home Loans

Alternatives To Home Equity Loans

If your house is fully paid off but you dont want to move, you might consider a reverse mortgage a mortgage where the lender pays you to get money during retirement. To qualify for a reverse mortgage, you have to be at least 62 years old.

Before you decide to pursue a reverse mortgage as an option for using home equity for retirement, remember that the money the lender pays you will be due once you move out, sell the property or pass away. High fees can also reduce the amount of cash you can borrow. Because of this, you may want to consider alternative ways to get money for retirement, such as:

- Downsizing. To reduce your expenses in retirement, you could sell your home and purchase a cheaper one. The money you get from the sale can be used to pay for everyday expenses. In addition, you could invest a portion of the proceeds to create an additional income stream.

- Moving to an area with a lower cost of living. If you live in an area with a high cost of living, consider selling your home and moving to a cheaper area. By moving, you could save a lot of money and stretch your retirement dollars further

Conversion And Security Options

If your credit is good, you may have a shot at convincing the lender to convert the unpaid balance of your loan or HELOC into an unsecured loan or line of credit. So, if you can sell your house for $50,000, you have enough to pay off the first mortgage of $40,000, but the remaining $10,000 will only pay half of the $20,000 home equity lien. The lender accepts the $10,000 and has you sign a new unsecured loan or line of credit for $10,000 payable upon terms that are mutually agreeable.

Or, you secure it with other collateral, such as a car or boat. This gives the buyer clear title to your house.

Also Check: Does Va Loan Work For Manufactured Homes

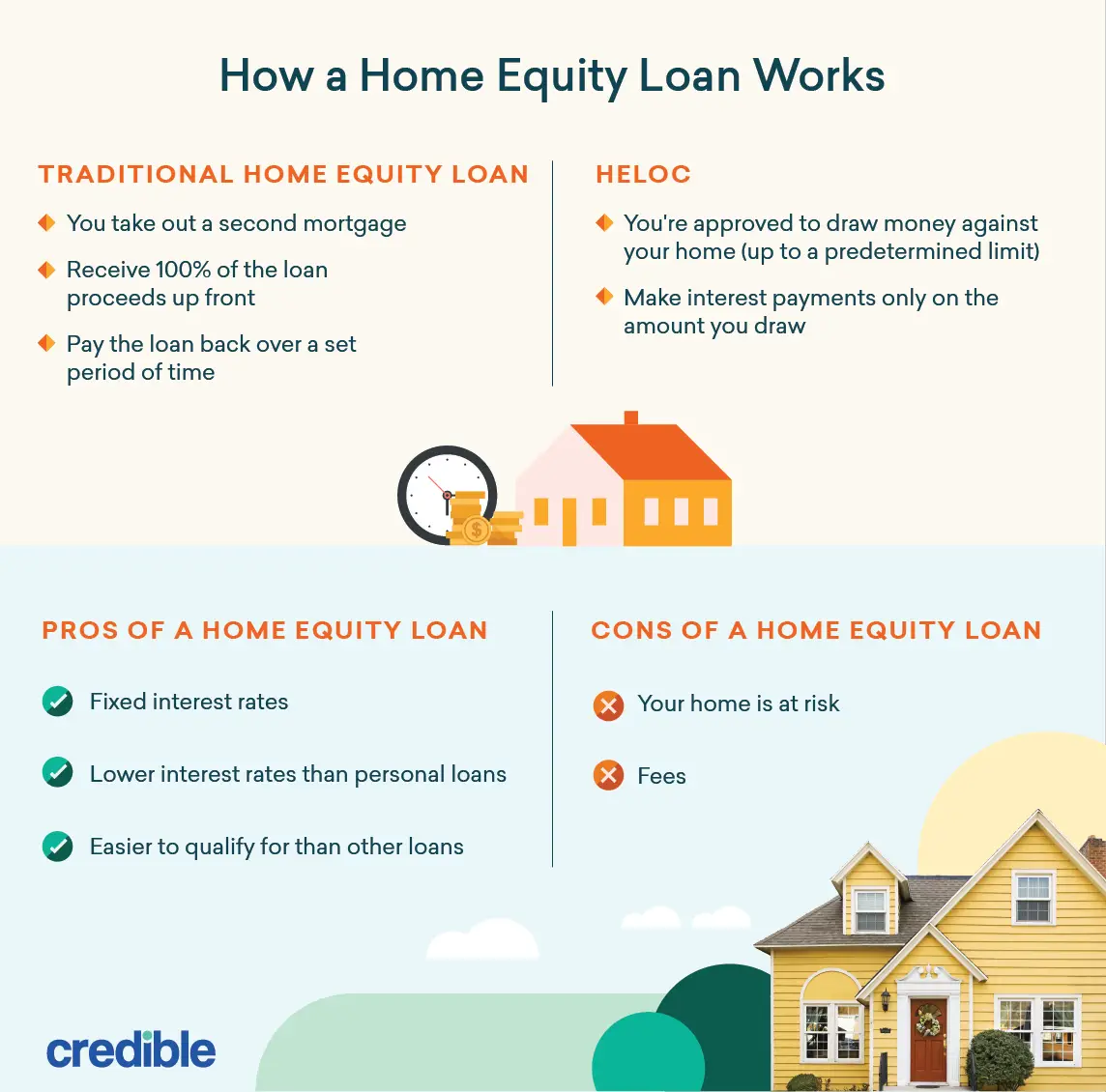

Are Home Equity Loans A Good Idea

Whether a home equity loan is a good idea or not depends on your financial situation and what you plan to do with the money. Using your home as collateral carries substantial risk, so it’s worth the time to weigh the pros and cons of a home equity loan.

PROS:

-

Fixed rates provide predictable payments, which makes budgeting easier.

-

You may get a lower interest rate than with a personal loan or credit card.

-

If your current mortgage rate is low, you dont have to give that up.

-

If you use the loan for home improvements or renovation, the interest may be deductible.

CONS:

-

Less flexibility than a home equity line of credit.

-

Youll pay interest on the entire loan amount, even if youre using it incrementally, such as for an ongoing remodeling project.

-

As with any loan secured by your house, missed or late payments can put your home in jeopardy.

-

If you decide to sell your home before you’ve finished paying back the loan, the balance of your home equity loan will be due.

» MORE: The best home equity loan lenders

Are There Closing Costs On A Home Equity Loan

Yes. Closing costs are highly variable, but are typically between $500 and $1,000. The closing costs on home equity lines of credit may be lower.

Common closing costs include:

- Title search and escrow fees

Whilst these closing costs are typically lower than on a first mortgage, these can still amount to a noticeable sum of money on larger loans.

Recommended Reading: Can I Refinance My Car Loan With The Same Lender

We Hope To See You Again Soon

Youre about to leave Regions to use an external site.

Regions provides links to other websites merely and strictly for your convenience. The site that you are entering is operated or controlled by a third party that is unaffiliated with Regions. Regions does not monitor the linked website and has no responsibility whatsoever for or control over the content, services or products provided on the linked website. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information.

Home Equity Lines Of Credit

A home equity line of credit, or HELOC, works like a credit card. You can withdraw as much as you want up to the credit limit during an initial draw period that is usually up to 10 years. As you pay down the HELOC principal, the credit revolves and you can use it again. This gives you flexibility to get money as you need it.

You can opt for interest-only payments or a combination of interest and principal payments. The latter helps you pay off the loan more quickly.

Most HELOCs come with variable rates, meaning your monthly payment can go up or down over the loans lifetime. Some lenders offer fixed-rate HELOCs, but these tend to have higher initial interest rates and sometimes an additional fee.

After the draw period, the remaining interest and the principal balance are due. Repayment periods tend to be from 10 to 20 years. The interest on a HELOC that is used for a substantial home improvement project may be tax-deductible.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Does A Home Equity Loan Require An Appraisal

While not every home equity lender requires a full appraisal, all lenders need to determine the value of your home in order to calculate your available equity. If your lender doesnt require a full appraisal, it may obtain these estimates by looking at county assessments, using automated value models or even driving by your home and taking photos. If youve had a full appraisal done within the last six months, the lender may also be able to use that information.

How To Decide If You Should Take Out A Home Equity Loan

First of all, youll need to decide how much house you want to buy. If it is $300,000, would you like to take out a loan for $150,000? If that is the case, your monthly payment will be $1,500. Many people will try to get a mortgage for less than what theyre buying their home for but that isnt always possible. Next, think about who else will be living in the home with you. If everyone else is going to be working in the house and you wont have any children, then a loan sounds like a good idea.

If you are considering taking out a home equity loan, it is in your best interest to consider all of the factors that go into it. You should look at your present situation, what you can afford to borrow, long term plans and what the potential return on the investment would be.

Also Check: How Do You Find Your Student Loan Account Number

Refinancing To Get Cash Out

With a cash-out refinance, you refinance your existing mortgage and also borrow an additional sum from your equity at the same time, giving you cash that you can use for whatever you want. There is also potential to combine a cash-out refinance with getting a lower payment or interest rate. How much you can refinance for depends on the value of your house and the lenders maximum allowed loan-to-value ratio. The LTV ratio is the percentage of the homes value that is financed. For example, if the lender has a maximum 85% LTV ratio, you can borrow up to 85% of the homes value.

Is A Home Equity Line Or Loan Right For You

A HELOC gives you the flexibility of a financial backstop thats there when you need it. If your roof needs repair or a tuition bill comes due when youre short of cash, drawing on a home equity line of credit can be a convenient solution. You decide when to use the funds, and you pay interest only on the money you actually use. On the flip side, with a HELOAN, you get a lump sum of cash at loan closing, and know how much your monthly payments will be and how long it will take to pay off the loan.

With either, the amount you can borrow will depend on the value of your home and the amount of equity you have available. And with both, its important to remember that youre using your home as collateraland it could be at risk if its value drops or theres an interruption in your income.

But if you qualify and your financial situation is stable, a home equity line or a home equity loan could be a helpful, cost-effective tool for making the most of your homes value.

Ready to apply? Apply online now

Don’t Miss: Can You Refinance An Fha Loan

How Much Equity Is Needed To Get A Reverse Mortgage

Home equity is derived by subtracting any outstanding secured debts against the home from the appraised value of your home. The total amount that you can borrow must be greater than or equal to any outstanding secured debt on the home. To get a reverse mortgage, your home must be valued at a minimum of $200,000.

What Are The Disadvantages Of A Home Equity Loan

The main disadvantage of taking out home equity loans for home improvement projects is that your borrowing power is limited by the amount of tappable equity that you have available.

If youre a recent homeowner who has not built enough equity, an alternative type of home equity loan such as a RenoFi Loan could help you to borrow enough to undertake your full renovation wishlist.

Read Also: What Do Loan Officers Look For In Bank Statements

There Are Different Ways To Pay Back Your Equity Loan

The rules are clear: you don’t have to repay the equity loan itself until you come to sell your property, OR at the end of your main mortgage term whichever of these comes sooner. However, you don’t have to wait until either of these points. You can pay back the equity loan at any point you want.

So when should you repay the equity loan? Unfortunately, there are just too many variables for us to say exactly when the best time is to repay. We’ve already shown how an equity loan might compare with a normal mortgage in terms of total interest paid, but even this relies on a number of variables staying fairly constant.

If you’ve already got enough savings to repay the equity loan, and your finances elsewhere aren’t stretched, you might consider it a good option to repay the equity loan sooner than later. This may particularly be the case if your equity loan has decreased in value, or if you think that property prices are about to shoot up.

Whenever you’re thinking of repaying your equity loan, here are a few things to consider:

A. You can repay it but there are rules, eg, the minimum you can repay is 10% of your property’s value

Whether paying off the loan in part or in full, you’ll need to have the outstanding loan amount assessed. This must be done via a valuation by a surveyor accredited by the Royal Institution of Chartered Surveyors, which’ll cost you a fee.

B. You can pay off the equity loan by remortgaging

Using A Home Equity Line Of Credit For A Remodel

A home equity line of credit is a revolving line of credit thats borrowed using your homes equity as collateral. You can use this like a credit card, taking out how much you want when you want. Just like home equity loans, HELOCs are secured and act as a second mortgage.

Youre being given access to a pool of cash that you can dip into and use as and when you need it. And just like a credit card, as you pay it back, its available again to draw.

You have a set length of time when you can draw on your line of credit. This is known as the draw period, and during this, payments that you make are only for the interest on the loan.

After the draw period ends, youll have a repayment period of a further 10 to 20 years, during which you make monthly payments that repay the loan amount and interest.

A HELOC is similar to a home equity loan in many ways, but there are two distinct differences:

- A home equity loan is paid as a lump sum, whereas a HELOC gives you a revolving line of credit. This means you only pay interest on what youve drawn and as you make payments and repay the line, its available to draw again should you need it.

- A home equity loan has a fixed interest rate, but a HELOC typically comes with a variable rate.The money from this can be used to pay for pretty much anything, but common uses include home improvements, education costs, consolidating other debt or similar.

Again, for this guide well assume that its being used to finance a remodeling project.

Read Also: How To Get Loan Officer License In California

Costs And Fees Of Home Equity Loans

Its important to be prepared for closing costs and fees when taking out a home equity loan. While these will vary from lender to lender , theyll typically be somewhere between 2% to 6% of your loan amount.

For example, on a $100,000 loan, you could expect to pay $2,000 to $6,000 in closing costs and fees.

Some common expenses include:

- Appraisal fees: A home appraisal determines how much your house is worth and affects your homes equity. A typical appraisal fee is $300 to $400.

- Origination fees: An origination fee is what some lenders will charge to issue you a loan. These can range from $0 to $125.

- Preparation fees: Some lenders will charge you for preparing your loan documents, which might include hiring lawyers and notaries. Preparation fees can range anywhere from $100 to $400.

- Lenders will run a credit check to get your credit score. The fee is usually about $25.

- Title search fees: The lender will do a title search to ensure you own the home and search for liens and other issues with title. The title search fee is usually $75 to $100.

Read more: Fixed-Rate HELOCs: A Cross Between HELOCs and Home Equity Loans