How Important Is Your Credit Score When Getting A Va Loan

With any loan, including a VA mortgage, your credit score definitely comes into play. It is a significant factor in determining your strength as a borrower and your ability to repay the loan. If you have a history of foreclosure, collections, or late pays you will need to re-establish your credit. It may be challenging for you to get any mortgage. With persistence, it can happen. Your interest will likely be higher, but you can always refinance later when youve improved your score even more.

Remember, stay on top of your credit, pay on time, and dont over-leverage yourself with too much debt. Most importantly start planning on your home purchase early. A VA loan can make the dream of homeownership come true for veterans and their families.

To learn more about PenFed VA loans or what loan is right for you:

Effects Of Spouses Credit Usage

Your spouses credit usage can affect you in multiple ways. First, if you open any joint accounts, such as a joint credit card, the account will show up on both of your credit reports. If the bill gets paid on time each month, it helps you both. But, if you pay late, it shows up on both of your credit reports and dings both of your credit scores.

Second, when you go to apply for a joint loan, such as a mortgage, both of your credit scores will be considered. For example, you might have an 800-credit score, but if your spouse has a 600-credit score, its going to be much harder to get approved for a joint loan.

Disposable Income Helps Matters

The VA loan program has one of the lowest levels of default. The VA credits the success to their focus on disposable income. When you originated your VA loan, the lender verified your disposable income. You have this money left after paying your monthly bills. This only includes bills reporting on your credit report. Car loans, credit cards, and student loans are a few examples. The lender totals up these minimum payments along with your mortgage payment. They then subtract this amount from your gross monthly income. This number should meet the disposable income requirements for your area and family size.

As an example, lets look at a family of 3 throughout different areas of the United States:

- Northeast $909

- South $889

- West $990

The differences arent incredible, but they exist. The cost of living is higher in the West, which is why the requirements increase in that region. With each additional family member, you need more disposable income.

The VA assumes if you meet the disposable income requirements, you can comfortably afford your bills and daily life. Borrowers that dont meet the requirements may default on their loan. If they must sacrifice daily living expenses, they may regret their home purchase. This focus helps the VA stay afloat. Its also the reason they dont focus on your credit score during the original VA loan or the VA IRRRL.

Read Also: Does Va Loan Cover Manufactured Homes

Can You Get A Va Loan With Bad Credit And Low Scores

According to an article from Experian on fixing bad credit, one of the three main credit bureaus in the U.S., the FICO score system has a scale of 300 to 850.

- Poor credit: 300 to 579

- Fair credit: 580 to 659

- Good credit: 660 to 719

- Very good: 720 to 759

- Exceptional: 760 +

Our experience has proven over and over again, that borrowers who have poor credit need coaching to improve their scores before buying a home. However, VA borrowers who have fair credit, as measured above, typically CAN qualify, using one of two underwriting types: Automated and Manual Underwriting

Many lenders require a minimum FICO score of 620 to qualify to buy a home. But again, the VA does not set a minimum score and if the Veteran is applying for a VA loan with bad credit, they should still call a lender and explore their options. VA lenders which perform manual underwriting on their VA loans, might be more inclined to approve an application that demonstrates higher income, yet shows fair credit.

Each lender sets their own so be sure to check with the lenders as you shop around.

At SoCal VA Homes, we consider each applicants full situation on a case-by-case basis.

Va Loan: When In Doubt Ask A Lender

If you’re navigating the process of re-establishing your credit after a bankruptcy or foreclosure or simply aren’t sure if your credit will suffice for a loan, the best way to get an answer is to use our VA loan finder to see if you qualify for a loan. If so, the lender will be happy to address your questions and guide you through the process.

Read Also: Capital One Auto Pre Approval

Va Loan Requirements: Why Your Fico Score Matters

Low credit scores are a major problem for Americans. In fact, an estimated 68 million people have scores below 610. This makes it almost impossible to qualify for a traditional mortgage. Most mortgages prefer borrowers to have scores over 620 to qualify for a loan in the first place. VA loan requirements are much more relaxed. Youre able to buy a house even if your credit score isnt great. However, your FICO score can still influence your ability to get a loan. Heres why its important to keep your score as high as possible.

Why This Is Important

Each lender has its own formula for determining where the cutoff point is in a credit score. As the experts will tell you, the better your credit rating, the more likely you are to get a low-interest rate and favorable terms when you apply for a mortgage. Someone with a credit score of 850 is very likely to find they will pay less per month than someone with a comparably priced home but a lower score of 680.

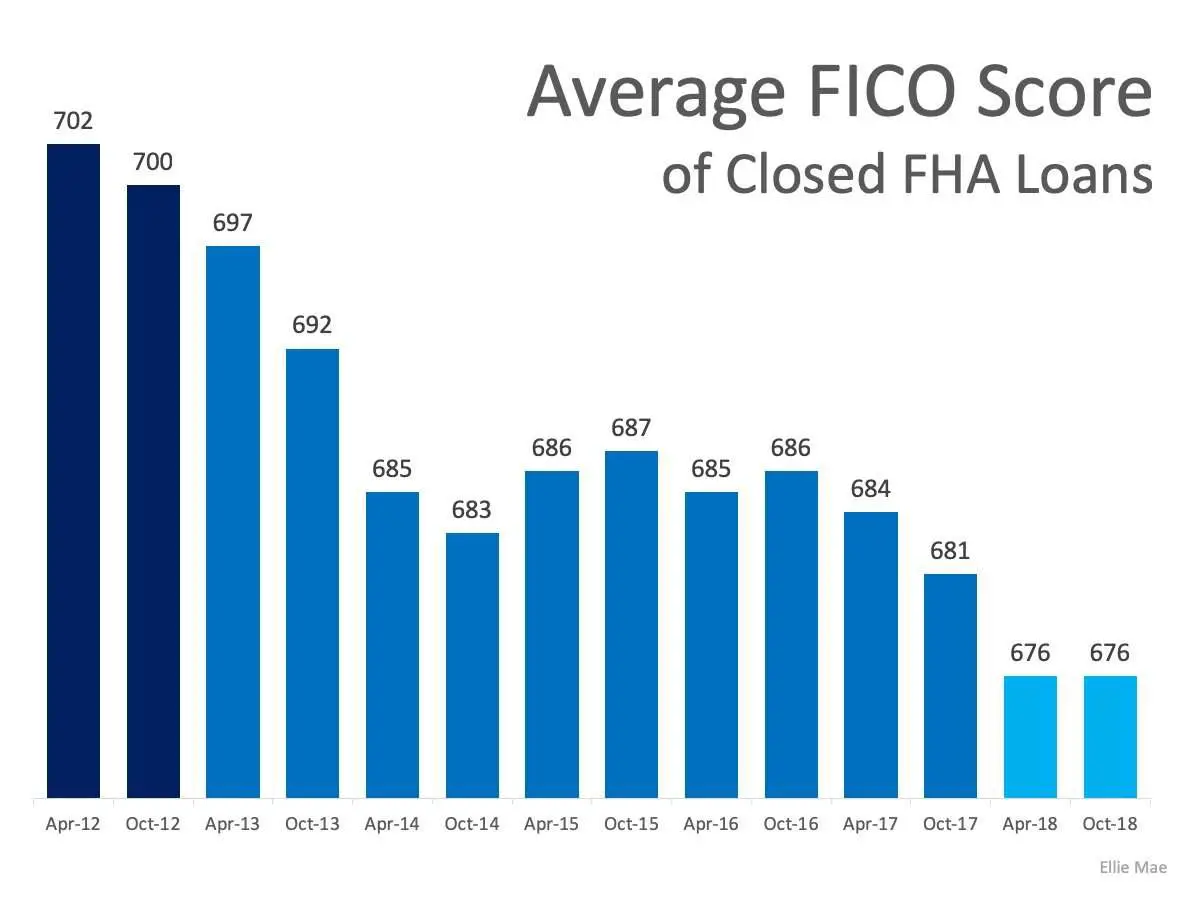

Take steps to improve your credit score. Improving your score will help you thrive financially when you find the house of your dreams. If you are credit-ready, dont let the news of higher credit standards scare you from buying now. No one knows if, or when, lending standards will change again. These standards may be the new normal.

You May Like: Usaa Auto Loan Apr

Va Loans With No Credit Score And Dti Requirements: High Dti

Many borrowers do not realize that the VA does not have a minimum debt to income ratio requirement. However, many lenders will have VA Overlays on debt to income ratios where they cap it between 41% to 50%. Gustan Cho Associates has gotten approve/eligible per automated underwriting system on VA borrowers with DTI exceeding 60%. As long as borrowers have strong residual income, the automated underwriting system will render an automated approval with higher DTI. Residual Income is very important when it comes to getting an approve/eligible per AUS for higher DTI borrowers. Gustan Cho Associates is one of the few national lenders with no overlays on debt to income ratios on VA Mortgages.

How To Improve Your Credit Score

Here are some of the best ways to improve your credit score:

-

Make payments, including rent, credit cards and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for any errors on your credit report, and work toward fixing them.

-

Shop for mortgage rates within a 30-day period — too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

The number one way to improve your credit score is to look at your balance-to-limit ratio, Keller says. For example, if you had a credit card with a 10,000 limit, and I pull your credit and youve got 8,000 charged on that and your credit score is a 726, if I can get you to pay down that credit card to 30% or less — down to 3,000 — your credit score would jump substantially.

Michael Burge is a staff writer at NerdWallet, a personal finance website.

Recommended Reading: Do Loan Companies Verify Bank Statements

How Can You Raise Your Credit Score To Qualify For A Va Loan

- Looking at reports from the three credit reporting agencies and disputing any errors

- Paying down balances on accounts, especially if you’re using lots of the available credit

- Paying your bills on time

- Keeping credit cards open, even if they’re paid off

So don’t think it’s the end of the world if your credit score is preventing you from getting a VA home loan there are ways to improve it.

| Label |

|---|

| View Rates |

Why Newday Usa Is Different

NewDay USA created Operation Home to help more veterans and service members achieve the American Dream of homeownership. NewDay USA not only helps you buy a home with no down payment, we also work with your seller and your realtor to help you reduce or even eliminate the out-of-pocket closing cost. With a conventional loan, you could be paying thousands of dollars in closing costs. Watch Operation Home stories and find out how NewDay USA helped veterans get their dream home.

You May Like: California Loan Officer License

Qualifying For Va Loans With No Credit Score And Dti Requirements With Direct Lender With No Overlays

Borrowers who are having a hard time finding a lender licensed in multiple states with no lender overlays on VA loans, look no further. Contact us at Gustan Cho Associates at 262-716-8151 or text us for a faster response. Or email us at Gustan Cho Associates has a national reputation of being able to close VA loans other lenders cannot. We only go by agency lending guidelines and have zero lender overlays. All of our pre-approvals will close due to our smooth and streamlined verification and mortgage process. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.

This BLOG On VA Loans With No Credit Score And DTI Requirements Was PUBLISHED and UPDATED on September 15th, 2021

What Are The Va Loan Terms For 2022

As of 2020, VA loan no longer have value limits for qualified borrowers. That means first-time VA loan borrowers will have no cap on the size of $0 down VA loans. The VA funding fees, which most borrowers have to pay when they close on their mortgage, remain the same as they were in 2020.

The funding fees range from 0.5 percent on some refinances to 3.6 percent for some home purchases. The exact fee varies depending on the value and type of your loan, how much you put down, and whether its your first VA financing.

These one-time fees help keep the loan program running. However, some borrowers may have to pay slightly more than the published rates in 2021. Veterans and service members will be charged the higher rates though National Guard and Reserve members will have their funding fee lowered to the same level as other military borrowers.

Veterans with service-related disabilities and some surviving spouses dont have to pay a funding fee. Purple Heart recipients on active duty are also exempt from the fee.

Recommended Reading: Usaa Auto Refinance

Is It Possible To Obtain A Va Loan With Bad Credit

Bad credit and thin credit can make home loan approval difficult, whether you need a VA purchase loan or a mortgage with an Energy Efficient Mortgage option. Your participating VA lender will review your assets, debts, income, payment history, and employment history. Your credit score does matter, but it isnt the only deciding factor.

What Numbers Do Mortgage Lenders Look At

Lenders use credit scores to determine a borrower’s level of risk.

Three credit bureaus Equifax, Experian, and TransUnion calculate an individual’s credit score. The higher your credit score, the better interest rate you’re likely to get which also means you’ll have a lower monthly mortgage payment. Before you apply for a mortgage, it’s a good idea to check your credit score and review your credit report to make sure everything is correct.

Read Also: Fha Limits In Texas

Obtaining Certificate Of Eligibility

Only active and/or retired members of the United States Military with Certificate Of Eligibility can qualify for VA Loans. Gustan Cho Associates will assist borrowers in obtaining their Certificate Of Eligibility through the Department of Veterans Affairs. This can be done in a matter of hours and the assigned loan officer and/or mortgage processor will handle it on behalf of our borrowers.

Ways To Monitor And Improve Your Credit Score

- Check your credit report. You can get a free report on www.annualcreditreport.com or contact each of the credit bureaus, Experian, Equifax and TransUnion, to receive your information.

- Look for mistakes. If you find an error in your credit report, work to have it fixed. This can improve your and help you qualify for a VA loan.

- Don’t max out your credit limits. Pay down as much credit card debt as possible and keep a low debt utilization ratio. This ratio compares how much credit you are using to the amount of credit you have available. For example, if you have a credit card with a $10,000 credit limit and a balance of $2,500, your debt utilization ratio is 25%.

- Track your bills. Keep a calendar or set up reminders for when bills are due. Paying your bills in full and on time can improve your credit score.

You May Like: Usaa Personal Loan With Cosigner

Lenders Set The Requirements

The VA doesnt determine the terms for your loan. They just guarantee it. This means if you default, the VA pays the lender a portion of the loans value to settle your debt. Its up to the lender to set certain VA loan requirements. If they determine that your credit score is too low, theyre not required to issue you a loan. Youll have to search for a different lender thats willing to work with your credit score.

Getting A Better Rate

When your credit score is high enough to get approved, theres only one other thing to worry about: mortgage rates.

Mortgage rates arent set in stone. Not only do they change every day, but the rates that lenders give change from borrower to borrower. Two people can apply for a mortgage at the same time and get two very different rates.

In fact, lenders have a specific chart that categorizes what mortgage rate a buyer will get depending on what their credit score is. This also takes into account the loan to value , or how much money is being borrowed.

So, to get the lowest mortgage rates available, VA buyers need to have higher credit scores, a higher downpayment or both.

Also Check: Why Are My Student Loans On My Credit Report

If You Have To Do A Hard Pull Mix It Up

Having a different mixture of credit will also help you in obtaining a higher credit score.

Loans, credit cards, lines of credit, home loans and auto loans are all seen as different types of credit and having a good mixture will aid in helping your score.

If you are going to have a few hard hits on your credit, make them worth it.

Hopefully these few tips will help you with increasing your score in the immediate future.

How Is A Credit Score Calculated On A Joint Mortgage

When two people decide to buy a house together, they have a lot to consider. You and your partner have likely talked about how you’ll combine your finances, share expenses and save for major purchases.

Buying a home is one of the biggest decisions people will make. You’ve probably kept careful track of your credit score and made sure not to do anything that could lower it.

But what about your partner’s credit score? If you and your partner decide on a joint mortgage, both of your credit scores will come into play. This guide will review how credit scores work, how they affect mortgage applications, how to calculate credit score on a joint mortgage and what to do if your partner has bad credit.

Recommended Reading: Fha Refinance Lenders

But First About Your Credit Score

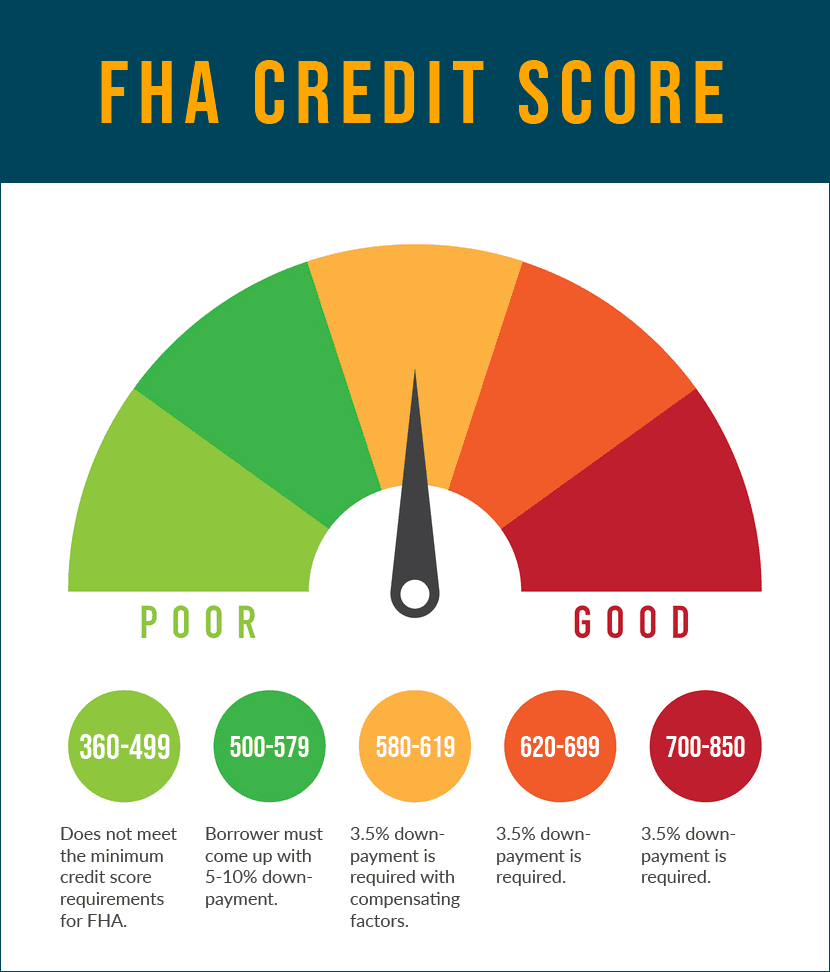

Before applying for any type of mortgage, you’ll need to make sure that your credit score is ready for homeownership. A low credit score can prevent you from meeting VA loan requirements for a loan program. According to Experian, one of the three major credit bureaus, youll want to make sure that your score is at least above 500:

FICO Scores range from 300 to 850, which are then divided into five score ranges:Very Poor: 300 – 579Very Good: 740 – 799Exceptional: 800 – 850The higher your score, the more options you’ll have for credit, including home loans. If your score is below 500, you might not be able to get approved for a home loan and may have to focus on building your credit first.

If you have bad credit, consider waiting to purchase your home until after you build better credit, which could take anywhere from a few months to a few years, depending on your situation. Having better credit could save you thousands of dollars over the lifetime of your loan, so sometimes it’s worth the wait. Or, if youre looking for ways on how to build your credit fast, a from Self might be a great option for you.

The first step to building better credit? Check your credit report to understand why your credit is bad in the first place.

If your credit score is in shape though, a VA or FHA loan could be just what you need to gain access to your own real estate.