Factor #: What Is Your Debt

Current income and debts can drastically impact the amount service members can borrow. A yardstick known as the debt-to-income ratio helps lenders decide how much additional debt a veteran can handle.

Lenders start calculating the DTI ratio by tabulating monthly debts. Only significant items will figure into that equation. The monthly debt total is then divided by total monthly income to result in a final DTI ratio.

DTI guidelines can vary by lender. Generally, the lower the better, but you could have a high DTI and still be able to obtain a VA loan.

You Can Better Navigate A Competitive Market

Living in a competitive housing market can present challenges to the no-down payer. Places like San Francisco, Dallas, San Diego, Denver, and even Columbus, Ohio, have too many buyers chasing too few sellers.

Having some skin in the game by putting in some money upfront shows sellers youre a serious buyer.

Having some skin in the game by putting in some money upfront shows sellers youre a serious buyer. Plus, a portion of your down payment might be allocated to earnest money cash you put in escrow to help seal the deal with a seller.

Make as large an earnest money deposit as possible with the offer, says Joe Parsons, a senior loan officer with PFS Funding in Dublin, California. Even though dont have to make a down payment and closing costs might be just $5,000, a $10,000 deposit would not be out of line and the veteran will get a refund of any excess funds at closing. It creates real credibility.

Advantages Of Making A Down Payment On A Va Loan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Mortgages from the Department of Veterans Affairs are known for not requiring a down payment. So why in the world would you make one? Here are five good reasons to put some money down on a VA loan.

You May Like: How To Get An Aer Loan

What Should Agents Know About Va

When you work with any client, its essential that you go into each pitch or interview feeling prepared. Therefore, you may be wondering if working with VA-loan clients is any different than working with clients who obtain convention loans.

Francine Viola, REALTOR® with Coldwell Banker Evergreen Olympic Realty, has experience living and working in a military community, and she believes that VA clients may have slightly different expectations.

The only difference I see when working with VA buyers is they confuse a 0% down loan with a 0% cost loan. When the topic of closing costs comes up, many are very surprised, she says. In our current steep sellers market, sellers are not very willing to cover a buyers closing costs, so the VA buyer should be prepared to cover their own loan costs, or be prepared to go above their offer price to include their closing costs.

Therefore, when working with VA clients, you should be prepared to explain finances immediately, so they have a clear understanding of the true costs of purchasing a home. As Kraft explains, Most VA buyers dont have a lot of cash reserves to spend on things like a down payment. For that reason, a lot of people using their VA loan will need closing cost assistance. This is something an agent can plan and account for when they show homes and submit offers.

Conventional And Fha Loan Down Payments

Conventional lenders require down payments of at least 3 percent, and more commonly lenders require 5 percent down or more. Borrowers with bad marks on their credit can struggle to qualify for conventional financing. A mediocre credit history can negatively affect interest rates and other loan terms available through conventional mortgages.

Ultimately, to get the best terms for the life of a traditional mortgage loan, borrowers may need excellent credit and to make a down payment in the 20-percent range. Unless borrowers put down such a large sum of money, their conventional loan will feature private mortgage insurance .

When you compare FHA loans to conventional mortgages, the government-insured loan does provide a much better down payment minimum of 3.5 percent. But mortgage insurance for FHA loans is usually the highest in the housing market. Mortgage insurance figures into the monthly payments for the life of a loan, and it can make the loan substantially more expensive in the long run.

Veterans: No Need for Big Down Payment

Read Also: Aer Loan Requirements

Pay A Lower Funding Fee

A funding fee helps to keep the VA program self-sustaining, which encourages lenders to offer VA loans with easier qualifying guidelines and lower rates. Borrowers typically roll the funding fee into their loan although it can be paid upfront at closing.

With some exceptions , borrowers need to pay 1.4 percent to 2.3 percent of the loan amount if with no down payment for a first-time homebuyer and 3.6 percent for second-time buyers.

Reducing Your Va Funding Fee

- If youre a first time homebuyer and your down payment is less than 5%, youll pay a funding fee of 2.3% of the loan amount. On a $200,000 home, that amounts to $4,600 at closing.

- If youre using the VA loan benefit for a second time and put less than 5% down, the funding fee will be 3.6%.

- With a 5% or higher down payment, the funding fee goes down to 1.65% and if you pay 10% or more the fee goes down to 1.4% regardless of whether you have used the benefit before.

Recommended Reading: How To Transfer Car Loan To Another Person

What Is A Va Loan

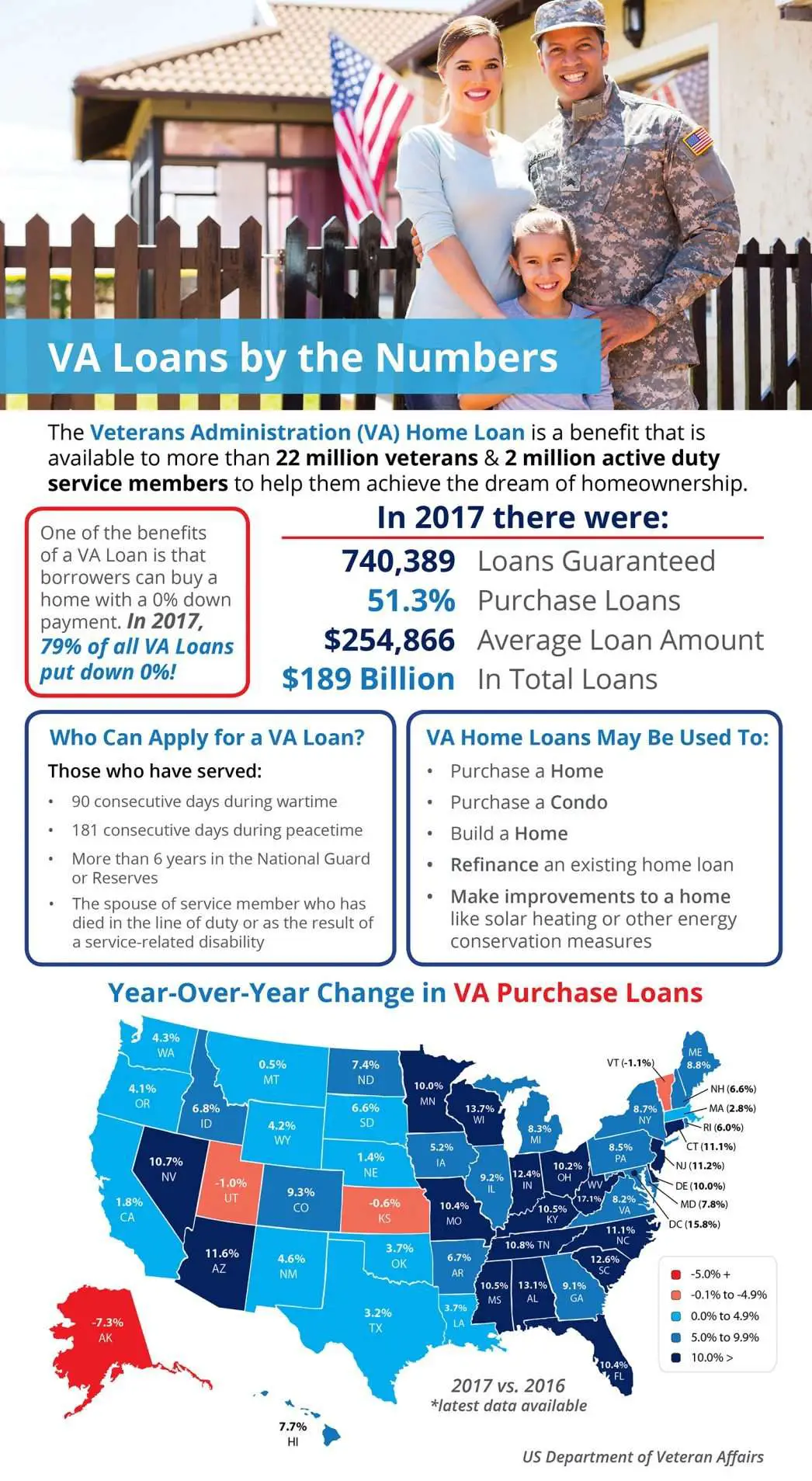

A VA loan is a mortgage loan thats issued by private lenders and backed by the U.S. Department of Veterans Affairs. It helps U.S. veterans, active duty service members, and widowed military spouses buy a home.

VA loans were introduced as part of the GI Bill in 1944, but theyve become increasingly popular in recent years. In the first quarter of 2019, 8% of home purchases were made with a VA loan.1 This type of loan is an attractive option because its pretty easy to qualify for and doesnt require a down payment.

Example Va Loan Limit Calculation

VA loan limits and entitlements are pretty confusing topics, so lets look at a real-life example. Lets say Sam is already using $50,000 of his VA loan entitlement but wants to use the remaining entitlement to purchase another property. In his county, the conforming loan limit is $548,250. Since the VA will guarantee a quarter of that amount , he has a maximum entitlement of $137,062.

When you subtract the amount Sam has already used , you get $87,062, giving him a VA loan limit of $348,248 .

If he were to purchase a home priced higher than that $348,248, he would need to make a down payment worth at least a quarter of the difference. On a $400,000 home, for example, that would mean a down payment of $12,938 .

Our LenderVeterans United Home Loans is a VA approved lender Mortgage Research Center, LLC NMLS #1907 . Not affiliated with the Dept. of Veterans Affairs or any government agency. Not available in NV. 1400 Veterans United Dr., Columbia, MO 65203. Equal Housing Lender

You May Like: How To Calculate Amortization Schedule For Car Loan

Va Renovation And Va Rehab Loans: Not To Be Confused With Other Va Programs

To start, VA renovation and rehab loans, in general, should not be confused with other VA programs such as the Specially Adapted Housing Grant which is intended to provide grant funds to those with qualifying VA-rated disabilities to help adapt or purchase an adaptable home.

These grant funds are not VA loans and generally, have no expectation of repayment.

VA Rehab Loans and Renovation loans are actual mortgage loan type transactions that have an application, credit check, appraisals where required, a mortgage term, and a monthly mortgage payment.

VA Rehab and Renovation loan options may vary depending on the lender, the housing market, and other factors. The basic availability of this type of transaction as a VA guaranteed mortgage loan depends on the willingness of the participating lender to offer the loan.

When Do Va Loans Require A Down Payment

Zero-down payment is the most popular feature of VA loans. But its not always possible. A guide to VA loans and down payments can help you get the most out of your benefit.

Its finally time to use the VA home loan benefit you earned serving your country. You qualify for a loan, you find the home of your dreams and youre ready to get to the nitty gritty details of your loan. Then your loan officer says you need to make a down payment. Wait, what? Since when do VA loans require a down payment?

Recommended Reading: Do Pawn Shops Loan Money

How Do You Apply For A Va Loan

How Much Is The Va Loan Funding Fee

VA loan funding fees fluctuate over time. Before 2020, the same fees were in effect from 2011 through 2019. The 2020 funding fees will be in effect through Jan. 1, 2022. After that point, they will be reviewed again.

The amount you are charged for the VA funding fee depends on how much money you put toward a down payment, as well as whether or not youve used a VA loan before. If youve used your full VA entitlement in the past, future uses are considered subsequent.

In general, VA funding fees arent huge, However, you can reduce how much you need to pay by putting down a larger down payment.

First-time VA mortgage borrowers who put down less than 5% are charged a fee of 2.30% of the total loan amount. Subsequent borrowers who put down less than 5% are charged 3.60%. Both first-time and subsequent borrowers who put down at least 5% but less than 10% pay a fee of 1.65%. Both pay a fee of 1.40% if they put down 10% or more.

| Down payment | |

|---|---|

|

1.40% |

1.40% |

Say, for example, you are a first-time VA loan borrower who puts no money down on a $250,000 loan. You can expect to pay a fee of $5,750 . If you put down 10% instead , you would be charged a fee of $3,150 on the remaining $225,000.

Keep in mind these fees apply to purchase and construction loans only. If youre doing a cash-out refinance of an existing VA mortgage, first-time borrowers pay a 2.3% funding fee and subsequent borrowers pay 3.6%.

Also Check: Does Fha Loan On Manufactured Homes

Factor #: The Va Guaranty

The VA stands behind every loan it makes.

The VA guaranty is the amount of each VA loan that is backed by the federal government. If the borrower defaults on the loan, that guaranteed amount is paid back to the VA lender by the Department of Veterans Affairs. Lenders are usually promised 25 percent backing on each VA loan.

Veterans with their full VA loan entitlement can borrow as much as a lender is willing to lend without the need for a down payment. In those cases, the VA pledges to repay a quarter of whatever the veteran can get.

» CALCULATE: Calculate your VA Loan savings

Building Home Equity Immediately

In addition to savings, a down payment means you have home equity immediately. If your home gains value, your equity will increase, and youll owe a smaller portion of your homes worth. If it loses value, its less likely that youll end up underwater .

Building up equity can also provide a financial cushion, allowing you to take out a home equity loan or line of credit if you needed to take care of unexpected repairs, medical bills or other expenses

Also Check: Is Bayview Loan Servicing Legitimate

Factor #: What Is The Propertys Appraised Value

VA loans cant be issued for more than a homes appraisal value. Should the appraisal value fall short of the purchase price, buyers have a few options to consider:

- Ask the seller to lower the purchase price

- Attempt to increase the size of the loan

- Make up the difference in cash

- Walk away from the purchase

Maximum Loan Amount For Manufactured Homes:

The maximum amount which can be received as a loan will be 95% of the total purchase price including VA funding fee. The maximum time or duration of a loan of a single wide unit or combination of single wide unit and lot is 20 years and 32 days. For a double wide unit only, it is 23 years and 32 days and for double wide unit and a lot is 25 years and 32 days. When you have a place to keep your manufactured homes then the duration is 15 years and 32 days.

Manufactured homes are very good to stay as they are manufactured by the engineers perfectly and can be moved in one or more sections so VA loans for manufactured homes gives good benefits to the veteran.

You May Like: Genisys Loan Calculator

Do You Have An Emergency Fund

You dont want to put all your savings into a down payment if thats going to leave you without enough money for an emergency. Ideally, homeowners should have enough cash to cover six months to a year of expenses in case of a job loss or unexpected home repair.

Also consider that you may have costs associated with moving into and furnishing a new home. When figuring out how much of a down payment to make, make sure you have some wiggle room for initial household expenses. You dont want to be house poor, says Langford.

If Youre In The Military An Eligible Veteran Or A Qualifying Spouse Of A Service Member You May Want To Look Into Getting A Va Loan When You Buy A Home

You can obtain a VA loan to buy a property thats your primary residence, even if youve already had a VA loan in the past. The government guarantees these loans, so its easier to qualify since theres little to risk for lenders. In fact, you can get a VA loan with no down payment and you may qualify even if your credit isnt very good and youve had a history of past foreclosures.

Unlike most mortgage options that dont require a big down payment, such as FHA loans, VA loans dont require you to buy mortgage insurance. There is a funding fee for most borrowers though, which adds to the cost of your mortgage.

While VA loans are often a great choice, the funding fee means these loans arent right for everyone. And since theyre issued by private lenders, youll need to shop around. If youre thinking about applying for a VA loan, heres what you need to know.

| Qualifying requirements |

- Purchase and improve a home

- Make energy-efficiency improvements to your existing home

- Buy a lot and/or a manufactured home

- Refinance an existing loan

If youre eligible, VA loans are fairly easy to qualify for, since theres no down payment required, no minimum credit scores, and no maximum limit on how much you can borrow relative to income.

You May Like: Aer Allotment

Making A Va Loan Downpayment To Increase Chances Of Approval

Theres another benefit to making a downpayment on a VA loan besides cost savings: easier approval.

VA buyers who are not initially approved should ask their lender to run their scenario assuming a small downpayment.

Just 1-2% down wouldnt reduce the buyers funding fee, but it might turn a denial into an approval.

Across all loan types, downpayments are one of the leading indicators of the borrowers commitment to repay the loan. Making a small downpayment can tip the scales for VA buyers who are on the edge of an approval.

This strategy works especially well for VA buyers with lower credit scores or past credit blemishes. Sometimes a downpayment can make up for a less-than-perfect credit profile.

Around 90 percent of veterans make no down payment whatsoever, and most are approved. But those who are not should consider a scenario that involves a small downpayment.

Become More Competitive In The Market

Borrowers who live in a competitive housing market can find that putting down some money upfront shows that youre a more serious buyer. Some of your funds could be put down as earnest money cash you have in escrow to show the seller you want to purchase the home. It could make you more competitive, especially when theres been more than one offer.

Private lenders who offer VA loans each have their own underwriting requirements. While there arent strict requirements for credit scores, you might want to make a down payment to strengthen your application and chances for approval. Making a down payment could also improve other factors lenders look at, such as your maximum debt-to-income ratio.

Don’t Miss: How To Get An Aer Loan