Sign And Refinance Later

If you arent able to secure the lowest interest rate possible that doesnt mean you shouldnt take out a car loan at all.

One great strategy is to take your less-than-ideal loan rate and refinance later. Having an auto loan can help you build good credit and ensure that you get a better rate later. After a few months of timely payments, you may see your credit score improve, and you may qualify for better rates than when you first bought your car.

You can refinance your new car loan in two or three months from the time you sign on, but it may be more beneficial to wait until youve boosted your credit history and score so you secure a lower rate.

Plus, if the interest rate savings are large enough, you may even end up paying less for the car by the time youve paid off the loan, just by getting a lower rate Use an auto refinance calculator to see how much you can save with a better interest rate.

Average Interest Rates For Car Loans With Bad Credit

Experian, one of the country’s three main credit bureaus, issues quarterly reports that study data surrounding the auto loan market. Their State of the Automotive Finance Market Report from the first quarter of 2022 found that the average interest rates for both new and used auto loans look like this:

| $8,720 | $22,720 |

Using the average used car loan interest rates from the first table, you can see that as credit scores drop and the interest rate increases, the total cost of financing goes up dramatically.

What Criteria Financial Institutions Use To Determine Interest Rate

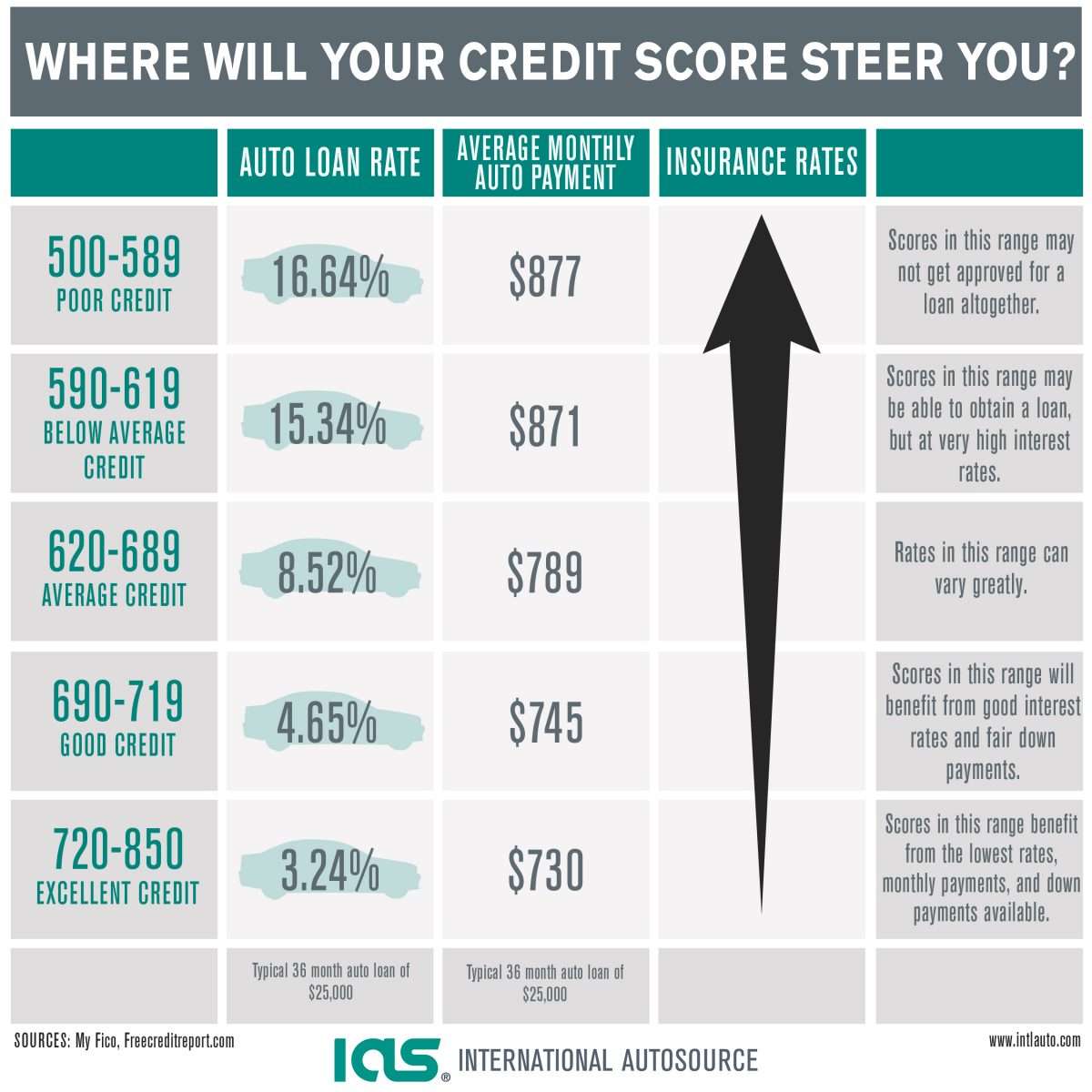

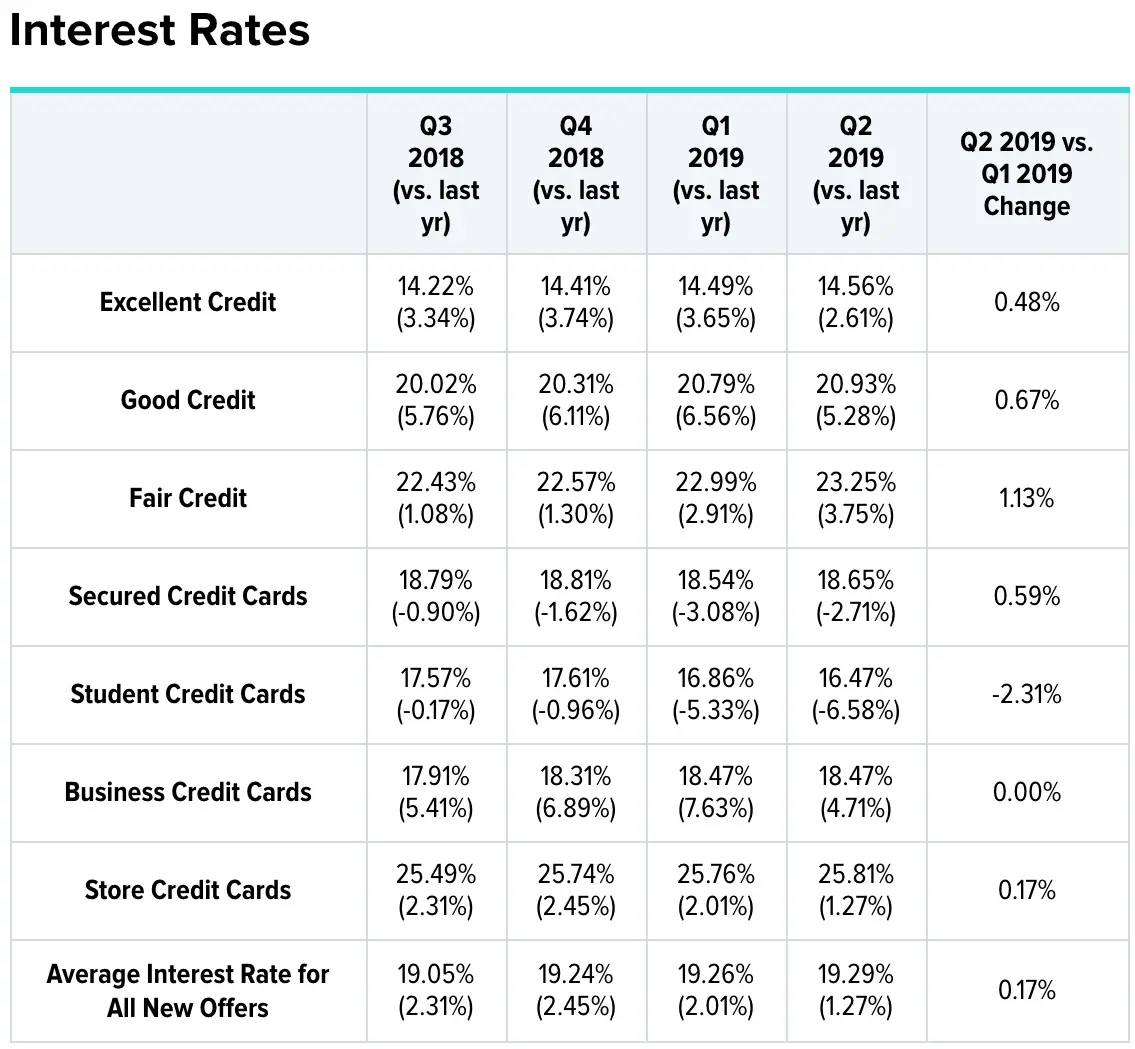

Financial institutions such as banks and credit unions determine loan rates based on a borrowers credit. Lenders give borrowers with better credit ratings a lower interest rate because they are considered lower risk and theyre much more likely to pay back the loan in full. Every financial institution uses different criteria to determine whether someone is creditworthy.

Although every lender is different, they typically evaluate a borrowers creditworthiness based on their credit report, which takes into account things like total debt in loans, credit cards, mortgages, and more as well as payment history, credit usage, and other factors. The average loan rates vary widely depending on where a borrowers credit score falls.

Every financial institution evaluates credit differently and may provide you with a rate thats higher or lower depending on many unique factors.

Also Check: Can I Use Va Loan To Buy Rental Property

Tips For Finding The Best Car Loan

If youre looking for a new or used car, its wise to take some time to find the best car loan rates in Canada. Here are some tips to help you save money:

- Save as much as you can for a down payment.

- Try to improve your credit score by paying bills on time, clearing debts, and reducing your debt-to-income-ratio before you apply for a car loan.

- Compare deals and offers from different lenders.

- Negotiate prices with dealers.

Maintain Good Credit For Future Auto Purchases

While improving your credit for your next car purchase can save you money in the short term, maintaining good or excellent credit can provide even more savings in the long run, on future auto purchases as well as other financing options.

Make it a goal to monitor your credit regularly to keep an eye on your credit score and the different factors that influence it. Keeping track of your credit can also help you spot potential fraud when it happens, so you can address it quickly to prevent damage to your credit score.

Also, look for other ways to save money on the cost of ownership. With Gabi®, a part of Experian, you can compare auto insurance rates with top providers to ensure that you’re getting the cheapest premiums available to you.

Don’t Miss: What Is An Interest Only Loan Called

Buying Used Could Mean Higher Interest Rates

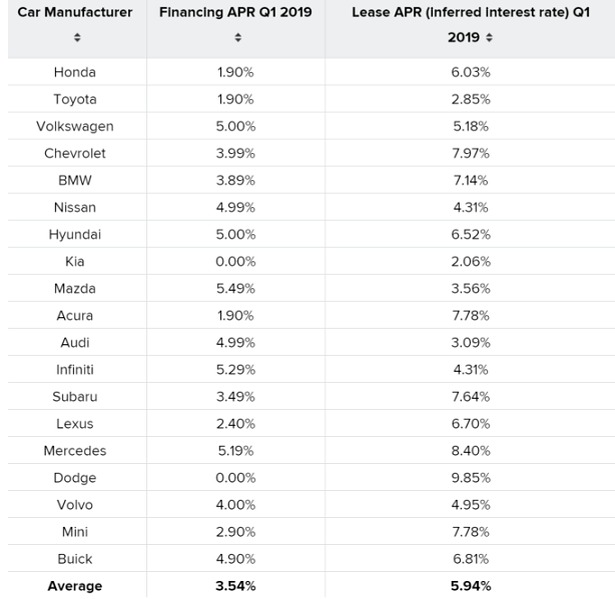

Buying a new car may be more expensive, all in all, than buying used. But, new and used auto loan interest rates are significantly different, no matter your credit score. Based on Experian data, Insider calculated the difference between new and used interest rates. On average, used car financing costs about four percentage points more than new financing.

| Super Prime | 1.31% |

The gap between how much more a used car costs to finance shrinks as credit scores increase, but even for the best credit scores, a used car will cost over 1% more to finance than a new car.

Used cars are more expensive to finance because they’re a higher risk. Used cars often have lower values, plus a higher chance that they could be totaled in an accident and the financing company could lose money. That risk gets passed on in the form of higher interest rates, no matter the borrower’s credit score.

What Is A Good Mortgage Interest Rate

Mortgage rates are typically based on the prime rate. The prime rate set on March 16, 2020, for example, was 3.25%. That rate for a mortgage right now would be considered a good mortgage interest rate.

However, if a lender is using the prime rate as an index, it would add on fractions of percentage points or more based on factors in your specific credit profile. Those factors can include your credit, how much you are borrowing, the value of the home, and other data.

The prime rateand mortgage rates in generalcan rise or fall on average for many reasons. At one point during the COVID-19 pandemic, for example, the Federal Reserve lowered the federal funds rate to 0 to 0.25%, which could have impacted mortgage loans issued during that time.

The Consumer Financial Protection Bureau provides a tool that lets you explore what the average lender is offering at various times. You enter a credit score range, state, home price, down payment amount, and terms of the loan. The CFPB uses its database of lenders to let you know what rates banks are offering on those loans at that time.

You May Like: What Loan Can I Get With Bad Credit

Average Auto Loan Interest Rates: Facts & Figures

The national average for US auto loan interest rates is 5.27% on 60 month loans. For individual consumers, however, rates vary based on credit score, term length of the loan, age of the car being financed, and other factors relevant to a lenders risk in offering a loan. Typically, the annual percentage rate for auto loans ranges from 3% to 10%.

What To Look For When You Apply

Agreeing to the wrong car loan can cost you money and damage your credit score if you cant make payments on time. Before signing for a loan, you need to consider a few critical details.

Type of car loan

Do you want to purchase a brand new car or are you in the market for a used car? Are you dissatisfied with your current loan and want to refinance? You should know the type of auto loan youre looking for before starting your search for companies that offer new car loans, used car loans or auto refinancing companies.

Estimated loan interest payment

Calculating how much interest you will pay on a car loan will help determine whether its worth purchasing. If you end up paying more in interest than the cars value, you may want to reconsider if the purchase makes financial sense.

The following calculation will help you determine the interest payment on your car loan:

- Interest rate ÷ 12 months x the loan balance = Monthly interest

For example, the monthly interest payment on a $10,000 loan with a 7% APR is calculated as follows:

- 0.07 ÷ 12 x $10,000 = Monthly interest payment of $58.33

Using this example, you would pay nearly $700 in interest over the first year of your loan.

Auto loan pre-approval

Pre-approval means that a lender has examined factors like your credit history and income and determined your eligibility to receive a loan.

Getting pre-approved for a loan offers several advantages:

- You can easily calculate your monthly payment to ensure you can afford the loan.

Recommended Reading: How To Apply For Small Business Loan From The Government

Best For Fair Credit: Carvana

Carvana

For fair credit borrowers in the market for a used vehicle, Carvana provides the ability to shop online for financing and a vehicle at the same time. It has no minimum credit score requirement, providing a financing solution for those with damaged credit.

-

Entirely online dealer and lender

-

Minimum income requirement of $4,000 annually

-

Only for used vehicles

As with most lenders, borrowers with the best credit get Carvana’s most competitive rates. Carvana does not advertise its rates or publish a table, but you can estimate your monthly payment with an online calculator. That said, even the calculator does not reveal the rate it is using. You must prequalify to know what your interest rate will be.

Carvana is a completely online used car dealer that also provides direct financing. It makes it possible to secure financing, shop for a vehicle, and get a used vehicle delivered without leaving your house. There is no credit score minimum for its financing program, making this an attractive option for fair credit borrowers. However, you must have an income of at least $4,000 annually and no active bankruptcies.

What Does This Mean For Monthly Payments

A low car loan rate can save you some money in the long run, especially with lower payments. Your loan payments will be much lower if you have good or excellent credit and choose a shorter term.

When you receive the conditions of your loan, you will get information about the specific payments you’ll make each month.

If you’re unsure of how long you want your loan term to be, spend some time thinking about the total interest you’re going to pay.

While you might have significantly lower payments each month, the amount you save could be completely negated by the fact that you could be paying thousands of dollars more over the loan term.

Don’t Miss: What Is An Interest Only Home Loan

What To Know When Applying For An Auto Loan

While car loans usually have fixed interest rates and loan terms, they can often be negotiated, depending on your lender. Your loan rate will generally depend upon your — the higher your credit score, the lower your annual percentage rate. A higher credit score may also give you access to a larger loan amount or more favorable repayment terms.

Next, you should consider loan terms. Let’s say you qualify for a 2.5% APR loan. You’ll pay less interest over time with a shorter term loan, but your monthly payments will be higher. Similarly, you’ll pay more in interest over time with a longer loan term, but your monthly payments will be lower. Consider your budget and financial goals to determine which loan term will work best for you.

As you consider lenders, find out if they offer a preapproval process. Preapproval allows you to see the rates you qualify for without a hard inquiry — when a creditor pulls your credit history — which can cause your credit score to slightly dip. It also allows you to review options upfront without having to commit to a particular lender.

Best For Excellent Credit: Lightstream

- Loan amounts range from $5,000 to $100,000

- Loan term lengths range from 24 months to 84 months

- Rate discount of .50% when you sign up for AutoPay

- No restrictions on age or mileage of your car

- Loans made by Truist Bank, member FDIC

If you have a good or excellent credit score, you might want to consider LightStream in addition to Bank of America. A part of SunTrust Bank, Lightstream focuses on auto loans to customers with good or better credit.

Because it focuses on a narrow subset of customers, its rates dont go too high For a 36-month loan for a new car purchase between $10,000 and $24,999, interest rates range from 2.49% to 6.79%. However, borrowers with lower credit scores may find better rates elsewhere.

Don’t Miss: Capital One Refinance Car Loan

Recommended Auto Loan Providers

While no one lender offers the best rates for everyone, some offer better auto loan interest rates by credit score than others. The only way to know whether youre getting the best auto loan rates for your credit score is to source loan offers from several lenders and compare them. We recommend myAutoloan and Auto Credit Express as good places to start your search.

Do You Qualify For An Interest

Not everyone can qualify for an interest-free loan. In fact, lenders or dealerships might review several requirements, including:

-

You might need a credit score of at least 740 to be considered for a 0% APR loan. The minimum credit score depends on the dealership and the car you’re interested in purchasing. If your credit score is lower than this, you might still gain consideration if other elements of your credit history are positive.

-

Outstanding debts: Some lenders might review your outstanding debts to ensure you can pay back your car loans. They might also check your debt-to-income ratio, which can demonstrate your ability to make a monthly payment based on your income.

-

Monthly income: A stable monthly income can help make you a better candidate for a 0% APR deal because it suggests you’ll have the money to make your car loan payments. This means individuals with full-time jobs or a history of adequate monthly earnings from several sources might qualify more easily than those without.

-

Employment history: Even if you have a full-time job that can offer you a stable monthly income, that doesn’t mean the income will continue if you leave that job. For this reason, lenders might check to ensure you have a stable employment history.

You can also review your preapproval options from outside lenders and financing options. This might give you better context for your loan options and prepare you to negotiate for the best possible deal when you arrive at the dealership.

Recommended Reading: Can I Use 529 To Pay Student Loans

What Are The Average Auto Loan Rates By Credit Score

Experian’s quarterly State of the Automotive Finance Market takes a look at the average auto loan interest rate paid by borrowers whose scores are in various credit score ranges.

As of the second quarter of 2022, borrowers with the highest credit scores were, on average, nabbing interest rates below 3% on new cars. Used car interest rates were slightly higher on average, bottoming out at an average of 3.68%. Here’s what you can expect from auto loan rates for new and used cars:

| Average Auto Loan Interest Rate by Credit Score | ||

|---|---|---|

| Average New Car Rate | ||

| Deep subprime | 12.84% | |

| Super prime | 2.96% | 3.68% |

Note that your interest rate can also vary if you finance a vehicle purchased through a franchise dealer versus an independent dealer. In general, franchise dealers can get you a slightly lower rate with in-house financing known as captive financing.

Save Up For A Down Payment

While the safest car-buying option is to pay in cash, thats not always an option for everyone. Its possible to get a car loan without a down payment, but having one will help keep monthly payments lowand cut down on how much you need to borrow.

You could also consider trading in your current car to lower your auto loan payments.

Also Check: Can Parent Claim Student Loan Interest For Non Dependent

How Much Does It Cost

Alliant does not charge application fees, origination fees, or early repayment penalties.

Your individual APR will depend on your creditworthiness.

| 4.8/5 on TrustPilot and 4.5/5 on BBB |

This auto loan marketplace offers matching services for a variety of auto loans and refi options, including 3rd party sales and lease buyouts.

It is also worth noting that they are part of The Savings Group, which includes auto loan refi matching companies RateGenius and Tresl.

Auto Loan Interest Rates By Credit Score: The Bottom Line

Nearly all lenders set auto loan interest rates by credit score to some extent. While other factors affect the rates available to you, your credit score typically plays the most influential role. Between banks, credit unions, online lenders, loan marketplaces and car dealerships, you have plenty of options for auto loans. Depending on your situation, one may offer you better rates than others.

Read Also: How Much Is The Ppp Loan

How Can I Get The Best Car Loan Interest Rate

If your credit score is on the lower end 580 or lower some lenders may offer higher interest rates or longer loan terms, which can be a risk. Taking steps to improve your credit score can go a long way toward getting a better interest rate and saving you hundreds or thousands of dollars if you are not in a rush to purchase a vehicle.

Getting The Best Car Interest Rates

Ultimately, the most useful thing that you can do to get the best interest rate on a car is to come prepared. The best way to do this is to look up your credit history and subsequent credit score. A higher credit score signifies to lenders that you have a history of paying your bills on time, which results in a lower interest rate and vice versa.

Middletown Honda continues to explain that aside from checking your credit score, you should also prepare for your search for the best car loan by shopping around and getting pre-approved by several lenders. This will allow you to get quotes on different interest rates and make an informed choice when comparing your options. Additionally, per U.S. News, preapproval simplifies the entire negotiation process because it allows you to avoid one of the car salesman’s favorite tactics: confusing buyers by breaking the loan down into monthly payments. There are several strategies that will help you come prepared and ensure that you are getting the best interest rate on your car, such as:

Once you are armed with this information, you are better equipped to negotiate because you know what you can expect and what’s fair.

You May Like: Can My Son Use My Va Loan