What Are The Different Types Of Home Loans Available In India

These are Loans availed for:1. The purchase of a flat, row house, bungalow from private developers in approved projects 2.Home Loans for purchase of properties from Development Authorities such as DDA, MHADA as well as Existing Co-operative Housing Societies, Apartment Owners’ Association or Development Authorities settlements or privately built up homes 3.Loans for construction on a freehold / lease hold plot or on a plot allotted by a Development Authority

Hdfc Home Loans Interest Rates 2023

HDFC Home Loans interest rates start at 8.60% p.a.There are a number of home loan offers provide by the institution which can be listed as follows:

| Loan Slab | Home Loan Rates of Interest |

|---|---|

| For Women up to Rs.30 lakh | 8.60% p.a. – 9.10% p.a. |

| For others up to Rs.30 lakh | 8.65% p.a. – 9.15% p.a. |

| For Women with loan amount between Rs.30.01 lakh and Rs.75 lakh | 8.85% p.a. – 9.35% p.a. |

| For Others with loan amount between Rs.30.01 lakh and Rs.75 lakh | 8.90% p.a.- 9.40% p.a. |

| For Women with loan amount Rs.75.01 lakh and above | 8.95% p.a. – 9.45% p.a. |

| For Others with loan amount Rs.75.01 lakh and above | 9.00% p.a. – 9.50% p.a. |

What Are Different Types Of Hdfc Home Loan Interest Rates

There are two options to choose from: 1) HDFC Adjustable Rate Home Loan : This is floating rate or a variable rate home loan variant from HDFC Ltd. The rate of interest is linked to HDFCs internal benchmark i.e. Retail Prime Lending Rate . So rate will change following the change in HDFCs RPLR. 2) HDFC TruFixed Loan: This is combo rate home loan variant from HDFC. Herein, home loan interest rate will be fixed for initial 2 years and switch automatically to then applicable Adjustable Rate Home Loan.

You May Like: Fannie Mae Loans For First-time Home Buyer

Advantages Of Using Groww Calculator

- Its absolutely safe and does not compromise on the information that you provide.

- It is entirely free of charge for registered users.

- It lets you gauge the EMI amount beforehand, providing you with valuable information so that you can plan your finances with ease.

Home loans provided by authorized financial institutions have helped countless individuals realize their dream of owning a house. It eases the financial burden associated with the purchase of a new house significantly.

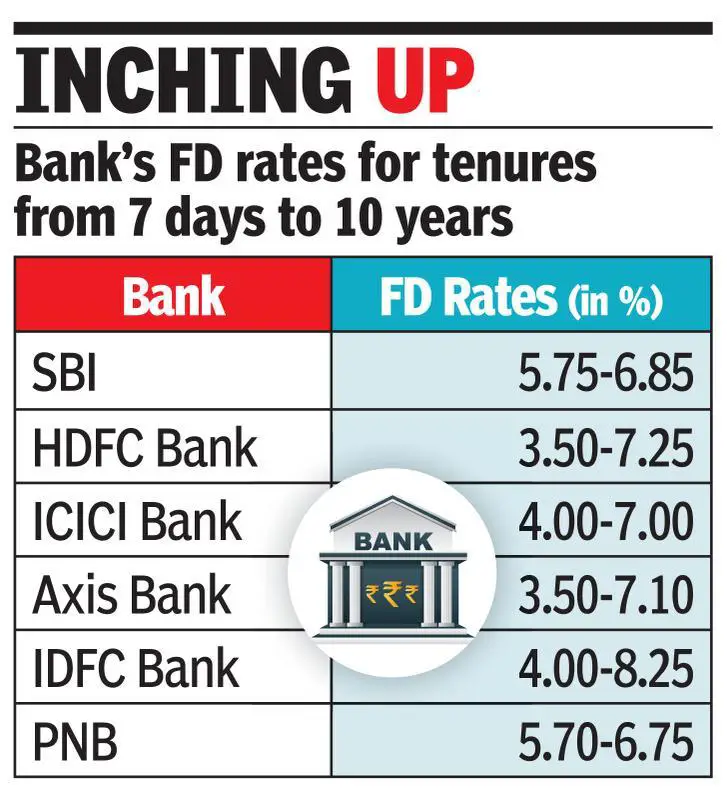

Interest Rates Are Set To Go Up With The Rbi Now Hinting At Withdrawing The Accommodative Monetary Policy To Rein In Inflation While The Rbi Retained The Repo Rate At 4 Per Cent In The Last Policy Review Policy Rates Are Likely To Go Up In The Coming Months

HDFC Ltd on Sunday raised its benchmark lending rate by 5 basis points, leading to an increase in equated monthly instalments for existing borrowers.

HDFC increases its Retail Prime Lending Rate on Housing loans, on which its adjustable rate home loans are benchmarked, by 5 basis points, with effect from May 1, 2022, the company said in a statement.

However, there is no change in the lending for new borrowers of HDFC. The rates for new borrowers range between 6.70 per cent and 7.15 per cent, depending on credit and loan amount. For new loans , the interest rate will be 6.7 per cent. The interest rate will be 6.8 per cent for other new loans up to Rs 30 lakh while women borrowers get the loan at 6.75 per cent interest. For loans between Rs 30 lakh and Rs 75 lakh, the rate will be 7.05 per cent while women will get it for 7 per cent.

Interest rates are set to go up with the RBI now hinting at withdrawing the accommodative monetary policy to rein in inflation. While the RBI retained the Repo rate at 4 per cent in the last policy review, policy rates are likely to go up in the coming months.

Read Also: Auto Loan Closed On Credit Report

Documents Required For Hdfc Home Loans

Heres a look at the documents required for availing of an HDFC home loan, both for salaried and self-employed individuals:

Common documents for both self-employed and salaried individuals

|

Type of documentation |

Heres a look at the different types of HDFC home loans:

HDFC home loan: This loan is provided for purchasing a residential house or property.

HDFC plot loan: This loan is provided for purchasing a plot for house construction.

HDFC Rural housing loan: Farmers, horticulturists, and other rural people employed in the agricultural sector can avail of this type of housing loan.

HDFC Reach home loan: This loan is provided for constructing a house on a plot or purchasing a new house.

HDFC home loan for improvement: You can use this loan to renovate your house.

HDFC home extension loan: You can use this loan to extend the existing area of your house.

HDFC top-up loan: This is an additional amount on your existing home loan.

HDFC balance transfer loan: This provision enables you to transfer your existing home loan, from other banks or NBFCs to HDFC.

HDFC NRI home loan: This loan is designed for NRIs.

HDFC Prime Minister Aawas Yojana Urban: Under the PMAS Urban, you can avail of an interest subsidy on houses for Economically Weaker Section , Lower Income Group and Middle Income Group .

Home Loan Amortization Schedule

These are Loans availed for:1. The purchase of a flat, row house, bungalow from private developers in approved projects 2.Home Loans for purchase of properties from Development Authorities such as DDA, MHADA as well as Existing Co-operative Housing Societies, Apartment Owners’ Association or Development Authorities settlements or privately built up homes 3.Loans for construction on a freehold / lease hold plot or on a plot allotted by a Development Authority

Also Check: How To Get Sba 7a Loan

Hdfc Ltd Offers Low Home Loan Interest Rates Starting From 820 Per Cent Per Annum The Statement Said For Those Who Do Not Have The Required Credit Score The Interest Rate May Vary Between 840 Per Cent To 890 Per Cent

| Edited by Sankunni K

New Delhi: Days after the Reserve Bank of India hiked its repo rate for the fifth time in seven months, the Housing Development Finance Corporation Ltd on Monday revised its retail prime lending rate on home loans. The HDFC said that it would increase its RPLR on housing loans by 35 basis points, on which its Adjustable Rate Home Loans are benchmarked.

Hdfc Bank Home Loan Faqs

1. What is a home loan?

When you seek financial assistance from banks to purchase a new home or existing property, it is called as home loan. This amount is borrowed from the banks at an agreed interest rates to be repaid within a certain period of time. Normally, banks offer funds upto 90% of the total property cost.

2. How will HDFC Bank decide the loan eligibility of an individual?

The bank will assess every application for home loan on the basis of age, income, qualification, repayment capacity like income source, company, , assets and liabilities.

3. How safe are the property documents with HDFC Bank?

Property documents with regard to home loans are kept in a safe and secure facility with the bank.

4. What are the different types of loan structure that I can use?

With HDFC Bank, one can structure the home loan as partly fixed or partly floating as per your convenience.

5. What is the maximum loan term avail with HDFC Bank?

The HDFC Bank home loan provides a maximum tenure of 30 years to repay the loan.

Thank you!

Don’t Miss: How Can I Get Out Of My Auto Loan

Hdfc Reach Home Loans

HDFC Home Loans also provides low cost affordable home loans which are specially designed for Indian residents who are salaried individuals and have a minimum income of Rs.10, 000 per month. These loans are also applicable to customers who are self-employed and have a minimum income of Rs.2 lakhs annually. Customers can use this loan amount for home construction also on a freehold plot or a leasehold plot. This loan can also be taken for plot purchase, home extension, home improvement or home renovation, and also a top-up loan for personal or professional needs.

Features For Hdfc Home Loan For Salaried And Self Employed Individuals

- Home Loan for Salaried Individuals: HDFC Housing Loan offers Home loans to salaried individuals employed with India public sector enterprises, Multinational companies, Private sector enterprises, Semi Government organization like schools colleges, NGOs etc. HDFC house loan offers very attractive interest rates to Salaried category of customers with one of the highest loan tenure which ranged from 1 year to 30 years.

- HDFC Home Loan for Self-Employed Business Owners: HDFC offers home loan to all type of self-employed business owners, Individuals running and managing own business of Trading, Manufacturing, providing services etc. to commission agents contractors and others with valid income and KYC documents are eligible to take a home loan from HDFC home loans.

- HDFC Home Loan for Self-Employed professionals: Self- employed practicing professional with a valid degree can apply for a home loan with HDFC housing finance, including Chartered Accountants, Doctors, Engineers, Company Secretaries, Management consultants and others.

HDFC loans are tailor made for salaried class of borrowers to meet every requirement. Following are key Features of HDFC Home Loan for salaried Individuals:

Don’t Miss: Can You Pay Off Lightstream Loan Early

Hdfc Rural Housing Loans

Purpose:

- For agriculturists, dairy farmers, planters and horticulturists can avail HDFC Rural Housing Loans for purchasing under construction, new or existing residential property in rural and urban areas

- For home construction on freehold/lease hold plot in urban and rural areas

- For home enhancement such as flooring, tiling, painting, internal and external plaster, etc.

- For addition in existing house

Loan Amount

- Tenure: Up to 15 years

Processing Fee:

- For Salaried/Self-employed Professionals: Up to 0.50% of loan amount or Rs 3,000, whichever is higher

- For Self-employed Non-Professionals: Up to 1.50% of loan amount or Rs 4,500, whichever is higher

What Is A Pre

HDFC also offers a facility of a pre-approved home loan even before you have identified your dream home. A pre-approved home loan is an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position.

Apply for a home loan online with HDFC, click Apply Online

In case you would like us to get in touch with you, kindly leave your details with us.

to know more about home loans.

Don’t Miss: Navy Federal Credit Union Home Loans

Hdfc Home Loans Schemes

HDFC Home Loans offers a plethora of home loan plans for salaried and self-employed individuals. Given below are the list of all the schemes which can be availed by the customers

Hdfc Home Loan Interest Rate And Other Charges

HDFC offers home loans to both salaried individuals and self-employed at a minimum rate starting at 8.60%. Apart from the interest rate, the bank also has various other charges such as HDFC home loan processing fee and foreclosure and prepayment fee for closing or prepaying the loan before the loan tenure ends.

- Current HDFC Bank housing loan interest rates range between 8.65% to 9.50% for male borrowers.

- HDFC home loan interest 2023 for women borrowers is less than the general housing loan rates and starts at 8.65%.

- Existing customers can get the lowest HDFC bank home loan rate by negotiation with the bank.

Read Also: Summarize The Differences Between Conventional Loans And Government Loans

Home Loan Fees And Additional Charges

Depending on the loan type you are applying for, a few charges may be levied. They are mentioned below:

- Processing fees: This is a one-time fee that is to be paid to the home loan provider after the loan application has been approved. The processing charge is dependent on the bank and the loan scheme you are applying for, the processing charge thus is a variable metric. This fee is non-refundable.

- Prepayment charges: This is the fee or the penalty you will have to pay the lender, should you plan to repay your home loan before the completion of the tenure of the loan.

- Conversion fees: Some banks might also charge a small conversion fee if and when you decide to switch to a different loan scheme or even a different loan provider in order to decrease the interest rate associated with your current scheme.

- Cheque dishonor charges: This type of fee is levied when the loan provider, like the Bank or NBFC, is provided that a cheque issued by the borrower is found to be dishonored due to reasons such as insufficient funds in the borrowers account.

- Home insurance: One of the best ways to protect the home is to insure it. The premium of this insurance should be paid directly to the concerned company during the insurance term to make sure that the insurance policy is running during the home loan tenure.

- Incidental charges: These charges cover the expenses and costs incurred by the bank to recover dues from a borrower who has failed to make his monthly installments on time.

Factors Affecting Hdfc Home Loan Rates

A wide variety of factors impact HDFC loan interest rates. Heres a look at the important variables:

Loan amount: The HDFC housing loan interest rate is directly dependent on your home loan amount. On a higher loan amount, the interest rates can increase.

CIBIL score: You can expect to pay reasonable HDFC home loan interest rates with a good CIBIL score, But if you have a poor CIBIL score, you can only avail of an HDFC home loan at higher interest rates .

Interest rate type: The HDFC Bank home loan interest rate depends on the type of interest rate availed. While the interest rate will remain fixed, throughout the loan tenure, in the case of a fixed interest rate, the interest payments can change in the case of a home loan availed at floating rates of interest.

Loan to Value Ratio: Expressed in percentage, this is the ratio of the home loan to the total value of the property. A higher loan to value ratio can indicate credit risk and thus increase the applicable interest rates.

Location of your property: If your house/property is located in a prime neighbourhood or a locality that has proper amenities, you can expect to pay a lower housing loan interest rate. This is because of the higher resale value of your house. Conversely, if your house is located in an area that lacks proper amenities, the applicable interest rates can increase.

Read Also: Can I Use Home Equity Loan For Anything

Hdfc Home Loan Emi Formula

The home loan calculator uses a standardised method to calculate the EMI amount that one has to pay every month.

E = P.r. n n-1, where

- P is the principal amount

- r is the applicable rate of interest

- n is the number of EMIs

For example, if you avail a loan worth Rs. 1 Crore for a tenure of 20 years with an interest rate of 10%, your EMI shall be

E= 1,00,00,000 x 10 240 240-1, which equates to Rs. 96, 502.

Do note that the EMI amount remains constant for home loans with a fixed rate of interest. For home loans with a floating interest rate, one has an HDFC housing loan EMI calculator every time the rate changes.

How Can The Hdfc Home Emi Calculator Help You

A home loan is secured credit. There are several aspects to this loan, which might confuse a borrower on the exact EMI amount that they need to pay towards its repayment. The HDFC housing loan calculator helps them by computing the EMI amount that borrowers need to pay every month to stay in tune with the repayment expectations of the lender.

- The calculator uses raw data to calculate the exact EMI amount to help borrowers.

- It is exceptionally fast. You can know your payable EMI amount in a few seconds, which saves you valuable time.

- It is always accurate to the last digit. You can bank on this information and plan your finances accordingly.

- It is a highly specific calculator for home loans.

Recommended Reading: Loan To Value Ratio Formula

Hdfc Home Loan Key Features

- The lender provides a loan to both salaried and self-employed. Also, special rates are provided for women borrowersInterest rates range from 6.70% to 7.40%.

- The tenure of the loan can range from 5 to 30 years.

- The age group for borrowers is from 24 to 60 years

- For security, one can keep the mortgage on the property they are planning to buy, renovate or construct.

- Loan to Value Ratio is 90%.

- The lowest HDFC home loan EMI starts from 645 per lakh. However, you can calculate the EMI amount on your loan anytime using the HDFC home loan calculator 2021.