Why Might My Line Of Credit Be Frozen

One way this might happen is if you have a HELOC and the value of your home drops in price, reducing the value of the collateral used to secure your HELOC. When your HELOC gets frozen, you can’t withdraw more funds. If you have deposited your paycheck in the HELOC, and don’t have access to other funds, are you prepared to be without electricity, heat, food, etc.?

Note that I’m not talking about “credit freeze” in the sense of purposefully freezing your credit with the credit agencies to protect against identity theft. I’m talking about something happening like a lawsuit against you, failure to make debt payments or pay your taxes, or perhaps some catastrophe in the economy that causes banks to freeze your credit.

Other Considerations When Applying For A Heloc

Applying for a HELOC could potentially affect your credit score . It acts as a revolving line of credit, similar to a credit card, and a high utilization rate can negatively impact your credit score. If used correctly , however, it can decrease your total credit utilization rate and act as a positive indicator of good borrowing behaviour.

Benefits And Risks Of Consolidating Debt With Home Equity

The main benefit of HELOCs and home equity loans is that interest might be lower than unsecured personal loans and credit cards. If you consolidate high-interest debt with a low-interest home equity product, your new payments might be lower, and you might be able to pay off debt faster.

That said, there are some disadvantages to taking equity out of your home, and the main one is that the loan is secured by your house. If you dont make mortgage or home equity loan payments, your home could go into foreclosure.

In contrast, lenders dont put a lien against your home for unsecured loans, so you might take a credit hit, but you dont have to worry about foreclosure if you default on unsecured debt.

Another major risk of borrowing from equity is that you could end up underwater if the value of your home drops and the balance of your mortgage and home equity loan exceeds what the home is worth.

If you sell your home, youll have to pay the home equity loan or HELOC back with the proceeds from the home sale, netting you less profit. And taking out a home equity loan typically comes with closing costs, such as appraisal, origination, and application fees.

Auto Refinance Calculator

Read Also: Can I Refinance My Mortgage And Home Equity Loan Together

How To Get A Home Equity Loan

Youll generally be eligible for a home equity loan or HELOC if:

-

You have at least 20% equity in your home, as determined by an appraisal.

-

Your debt-to-income ratio is between 43% and 50%, depending on the lender.

-

Your credit score is at least 620.

-

Your credit history shows that you pay your bills on time.

» MORE:Five ways to get the best home equity loan rates

Home Equity Loan Calculator

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Use this home equity loan calculator to see if a lender might give you a home equity loan and how much money you might be able to borrow. Home equity refers to how much of the house is actually yours, or how much youve paid off. Every time you make a mortgage payment, or every time the value of your home rises, your equity increases. As you build equity, you may be able to borrow against it.

» MORE:See todays mortgage rates

You May Like: Why Are Home Equity Loan Rates Higher Than Mortgage Rates

Understand Your Mortgage Payment

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest.

Keep in mind that you may pay for other costs in your monthly payment, such as homeowners insurance, property taxes, and private mortgage insurance . For a breakdown of your mortgage payment costs, try our free mortgage calculator.

Paying Off A Home Equity Loan

The faster pay off your loan, the less interest youll pay. You might even be able to reduce your interest rate by refinancing your loan to a shorter term. Often, lenders will reward shorter terms with lower interest rates, so its worth investigating if you want to pay off your loan faster.

Before you get the loan, find out if theres a penalty for paying it off early. If there is a penalty, factor that amount into your calculations.

You should also note any balloon payments that are included in your contract. These are large lump sums owed at the end of your home equity loan term. Some loans are not amortized, which means you could end up making interest-only monthly payments only to have the full principal balance due on a specific date.

This could mean trouble for homeowners who havent prepared. If your loan has a balloon payment, set aside enough money each month to make that payment when it comes due.

Recommended Reading: Can You File Bankruptcy For Student Loan Debt

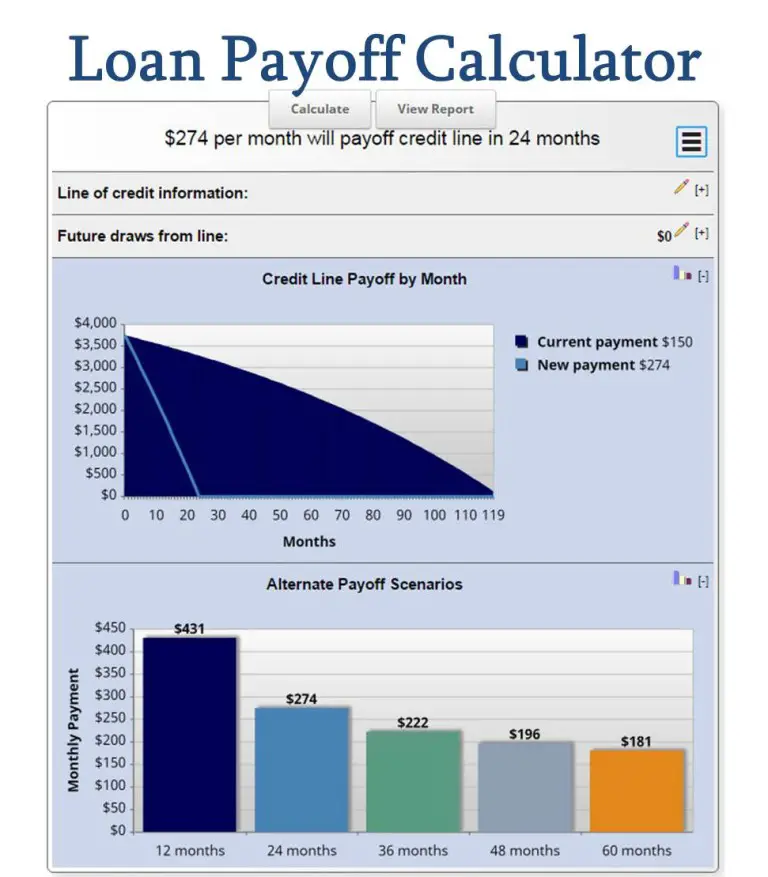

Using The Line Of Credit Payoff Calculator

The calculator is fairly straightforward. However, some of the terms used may not be self-explanatory. So to use the calculator, enter the following

- Current balance: The amount you presently owe on your line of credit

- Interest rate: Where the interest rate on your line of credit currently stands

- Rate change: How much you expect your rate to increase or decrease per year

- Payoff goal: How quickly you’d like to pay off your loan balance.

- Current monthly payment: How much you’re presently paying toward your line of credit. This will be used to show how much faster your new payments would pay down the loan.

- Additional monthly charges: How much extra you’re paying toward the loan each month on top of your minimum payments .

- Annual fee: What your lender charges each year to maintain your line of credit.

Below this is another section, labeled “future draws from line.” You may need to click the plus symbol to make this window open up. When you do, you will be presented with options for entering amounts for up to four additional draws against your line of credit, of varying amounts and at different times.

When all your information is entered, the monthly payment required to pay off the line of credit will show at the top of the page. The graph will illustrate how fast you’d pay off the loan with the new payment compared to your current payments.

How Do You Calculate A Home Equity Loan

To determine how much you may be able to borrow with a home equity loan, divide your mortgages outstanding balance by the current home value. This is your LTV. Depending on your financial history, lenders generally want to see an LTV of 80% or less, which means your home equity is 20% or more. In most cases, you can borrow up to 80% of your homes value in total. So you may need more than 20% equity to take advantage of a home equity loan.

An example: Lets say your home is worth $200,000 and you still owe $100,000. If you divide 100,000 by 200,000 you get 0.50, which means you have a 50% loan-to-value ratio, and 50% equity. Lenders that allow a combined loan-to-value ratio of 80% may let you borrow another $60,000. That would bring the amount you owe to $160,000, which is 80% of the $200,000 home value.

» MORE: What is LTV?

Recommended Reading: How To Get Fixer Upper Loan

Common Home Equity Loan Uses

Homeowners tap home equity for a wide variety of reasons. Some of the most common uses are:

- debt consolidation: consolidating high-interest credit card balances & other debts

- home improvement: repairs & additions

- vehicle purchase: less common when auto manufacturers offer low loan rates, but when auto rates are higher than equity rates it can make sense

- education: paying for a child’s college tuition

Other less common uses include funding other investments, business expenses, medical bills & emergencies, and vacations.

| Type of Use |

|---|

| 9% |

Ad Put Your Equity To Work

. To calculate your homes equity divide your current mortgage balance by your homes market value. Ad Todays Best Home Equity Rates. Home Equity Calculator Index A home equity loan or home equity line of credit HELOC allow you to borrow against your ownership stake in your home.

Minimum monthly payment The minimum monthly payment for the balance on. Year Dollars Home Equity Line of Credit Payoff Schedule Interest Paid. A HELOC From Forbes Can Help.

Get an estimated payment and rate for a home equity line of credit Use this calculator to estimate monthly home equity payments based on the amount you want rate options and other factors. Put Your Home Equity To Work Pay For Big Expenses. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100.

The line of credit is based on a percentage of the value of. Your Approximate Monthly Payment. Looking for a different.

Home Equity Loan Calculator Reduce Your Monthly Debt Payments This calculator will show you how consolidating high interest debt into one lower interest home equity loan can reduce your. The number of years over which you will repay this equity line. Find The Best Home Equity Mortgage Companies.

Apply Online For A HELOC Loan Today. This calculator will determine your. Ad Monthly Payment Calculations.

Values may decrease or increase. Available Home Equity at 80. Get Pre Approved In 24hrs.

How Much Home Can I Afford Mortgage Affordability Calculator

You May Like: How To Get Student Loan Statement

What Will Your Home Equity Loan Payment Amount Be

Repayment of a home equity loan requires that the borrower makes a monthly payment to the lender. That monthly payment includes both repayment of the loan principal, plus monthly interest on the outstanding balance. Loan payments are amortized so that the monthly payment remains the same throughout the repayment period, but during that time, the percentage of the amount that goes towards principal will increase as the outstanding mortgage balance decreases. Use this First Merchants home equity loan payment calculator to help you to estimate the monthly payment amount of a home equity loan to the lender.

The Heloc Stress Test

Although you could potentially qualify for a credit limit of up to 65% of yourhome’s value, your real limit may be subject to a stress test similar to themortgage stress test. Banks and other federally regulated lenders will use the higher of either:

- theBank of Canada five-year benchmark rate, currently set to 5.25%, and

- your negotiated interest rate plus 2%.

Read Also: New Conventional Loan Limits 2022

Payments On Home Equity Loans Vs Helocs

A home equity loan is a lump sum of money with a fixed interest rate, so your monthly payments stay the same for the loans lifetime. Its best if you need a large sum with predictable payments.

A HELOC is a line of credit you can draw from as needed, so your monthly payment fluctuates based on how much you borrow. Its best if you want the option to borrow small amounts over time.

With most HELOCs, you make interest-only payments during the draw period, but you are free to add to that as you are able. Once the repayment period starts, your loan amount is amortized to include interest and principal so that you can pay it off within the term.

How Can We Help

Routing Number: 074900657

First Merchants Private Wealth Advisors products are not FDIC insured, are not deposits of First Merchants Bank, are not guaranteed by any federal government agency, and may lose value. Investments are not guaranteed by First Merchants Bank and are not insured by any government agency.

FIRST MERCHANTS and the Shield Logo are federally registered trademarks of First Merchants Corporation

Recommended Reading: How To Lower Car Loan Payments

What Is The Difference Between Getting A Heloc And A Second Mortgage

While both a HELOC and asecond mortgageuse your home equity as collateral, a second mortgage can offer you access to a higher total borrowing limit at a higher interest rate. This can be up to 95% of your home’s value compared to the 65% limit for a HELOC. The differences between the HELOC as a line of credit and the second mortgage as a loan still apply: with a HELOC, you are free to borrow and repay on your schedule while you can only borrow a fixed lump-sum from a second mortgage and have to makepayments for the second mortgageon a fixed schedule.

The lender for your second mortgage is not typically the same as your first lender who you would usually get your HELOC from. You will have to shop around to find the best terms.

What Is A Home Equity Loan And Home Equity Line Of Credit

A home equity loan, also called a second mortgage, is an installment loan product that usually has a fixed interest rate and offers a loan repayment term ranging from five to 30 years. With home equity loans, you get a lump sum of cash after youre approved, which you can use to pay off other debt.

A HELOC is a credit line thats backed by your home. With a HELOC, you get a credit limit that you can draw from as you need cash. Typically, interest rates on HELOCs are variable like a credit card, so the rate can increase if market rates fluctuate.

HELOCs might also have a draw period where you can take money from the credit line. Thats followed by a repayment period where you can no longer draw funds, and you have to pay back what you borrowed.

Don’t Miss: How Do You Calculate Loan To Value Ratio

Other Mortgage And Financial Calculators

In addition to the standard mortgage calculator, this page lets you access more than 100 other financial calculators covering a broad variety of situations. Choose from calculators covering various aspects of mortgages, auto loans, investments, student loans, taxes, retirement planning and more.

All rights reserved. Mortgageloan.com® is a registered service mark of ICB Solutions, a division of Neighbors Bank, Equal Housing Lender Member FDIC, NMLS # 491986 ICB Solutions or Mortgageloan.com does not offer loans or mortgages. Mortgageloan.com is not a lender or a mortgage broker. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. We do not engage in direct marketing by phone or email towards consumers. Contact our support if you are suspicious of any fraudulent activities or if you have any questions. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers.

Refinancing Your Heloc Into A Home Equity Loan

HELOC payments tend to get more expensive over time. There are two reasons for this: adjustable rates and entering the repayment phase of the loan.

HELOCs are variable rate loans, which means your interest rate will adjust periodically. In a rising-rate environment, this could mean larger monthly payments.

Additionally, once the draw period ends borrowers are responsible for both the principal and interest. This steep rise in the monthly HELOC payment can be a shock to borrowers who were making interest-only payments for the first 10 or 15 years. Sometimes the new HELOC payment can double or even triple what the borrower was paying for the last decade.

To save money, borrowers can refinance their HELOC. Here well take a look at two options and how they work.

Read Also: Can I Pay Off Personal Loan Early

We Hope To See You Again Soon

Youre about to leave Regions to use an external site.

Regions provides links to other websites merely and strictly for your convenience. The site that you are entering is operated or controlled by a third party that is unaffiliated with Regions. Regions does not monitor the linked website and has no responsibility whatsoever for or control over the content, services or products provided on the linked website. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information.

But I Can’t Qualify For A Heloc Or Ploc

Don’t worry. Thank goodness we just spent all this time explaining that making extra principal payments works just as well . This might be a situation where contacting a knowledgeable financial advisor could help – maybe they could coach you on how to build your credit score or help you submit a successful application.

Disclaimer

Recommended Reading: Can I Refinance My Navient Student Loan

A Word About Small Business Lines Of Credit

Owners of small businesses may want to consider a line of credit over a business loan as well, because access to credit may serve the business owner’s needs to a greater degree. On a $50,000 line of credit, the business may only use a portion of the available funds and, if that is repaid in full, the business can then have access to the full $50,000 once again.

In the case of a business loan, the loan would have to be repaid in full and a new loan application process would have to be pursued for an additional loan.

In most cases, the interest rate is lower on a credit line than it would be on a business loan, but Fundera reports that one late payment may result in penalties. For instance, that low interest rate will rise substantially. Also, borrowing over the established limit will result in similar penalties.

Unlike a term loan, a small business may want to establish the line of credit before it’s needed. The idea is to have it available when needed. In order to establish credit, the business has to do more than provide proof of the physical structure’s equity. A healthy, steady cash flow in the business is also required.

When might a business access a line of credit? Here are a few examples: