Factors That Impact Your Home Loan Interest Rate

There are many factors that affect Housing Loan interest rate, including external market conditions, such as the repo rate and inflation. Some of the other factors that affect Home Loan interest are in your control. These depend on your eligibility for the loan and aspects such as your income, credit score, and more. Apart from these, the LTV and tenor you choose are also important factors that affect the Home Loan interest rate offered to you. Take a look at important ones that can help you save more during repayment.

How To Reduce Home Loan Interest In India

You can reduce your Home Loan interest rates in 3 ways.

Improve your credit score: In India, the Credit score ranges from 300 to 900 with a score above 750 considered good enough. The closer your credit score is to 900, the lower your interest rates would be up to a point that you bag a Home Loan at the lowest rate offered by the lender.

Balance transfer: If your current lender is charging a higher interest rate, you can switch to Bajaj Housing Finance to enjoy lower interest rates and better loan terms.

Negotiate: Lastly, if you have a good credit score and are confident to pay back the EMIs on time, dont be shy to negotiate with the lenders. If you have exhibited stable financial behavior in the past, lenders will be more than happy to hand you the loan at a better interest rate.

Home Loan Interest Rates_RelatedArticles_WC

Borrowers Struggling To Manage Their Household Budget And Pay The Higher Emis Are Actively Looking For A Solution That Can Help Them Reduce The Impact Of The Sharp Rise There Are Many Variants Of Home Loans That Offer Easy Emi Facilities For A Limited Period Let Us See What These Options Are And Whether They Really Help Struggling Borrowers

home loaninterest rateeasy EMIWhat are easy EMI home loan options?home loan EMIState Bank of IndiaThe adverse side of these easy loansLow EMIShould new borrowers go for such easy EMI loans?Should old borrowers facing temporary income stress go for a transfer to such loans?Who should avoid these easy loans?

Dont miss out on ET Prime stories! Get your daily dose of business updates on WhatsApp.

You May Like: How Do You Figure Loan To Value Ratio

Nri Loan Against Property

- Get loan against property up to INR 400,000,0001

- Enjoy flexibility of tenure up to 15 years

- Transfer your existing Loan Against Property to HSBC to reduce EMI or the loan tenure through HSBC’s Balance Transfer proposition

- Enjoy HSBC Premier globally by taking LAP greater than INR11,500,000

- Enjoy zero prepayment and foreclosure charges

Attractive Interest Rates starting at

9.65% p.a.*

Visit fees and charges page for more details.

How Can I Apply For A Home Loan

Applying for a home loan is easy and it takes less than an hour if you are applying online. You can also apply by visiting the nearby bank branch or call the customer support for helping with the application process. Before applying for the home loan, check your eligibility, interest rates and other features related to the loan. It helps you secure the best deal.

You can check your eligibility and apply for a home loan by signing up with CreditMantri. It is quick, simple and above all, free. You can compare the interest rate for home loan offered by different lenders on a single page and make an informed decision.

You May Like: How To Get An Unsecured Loan

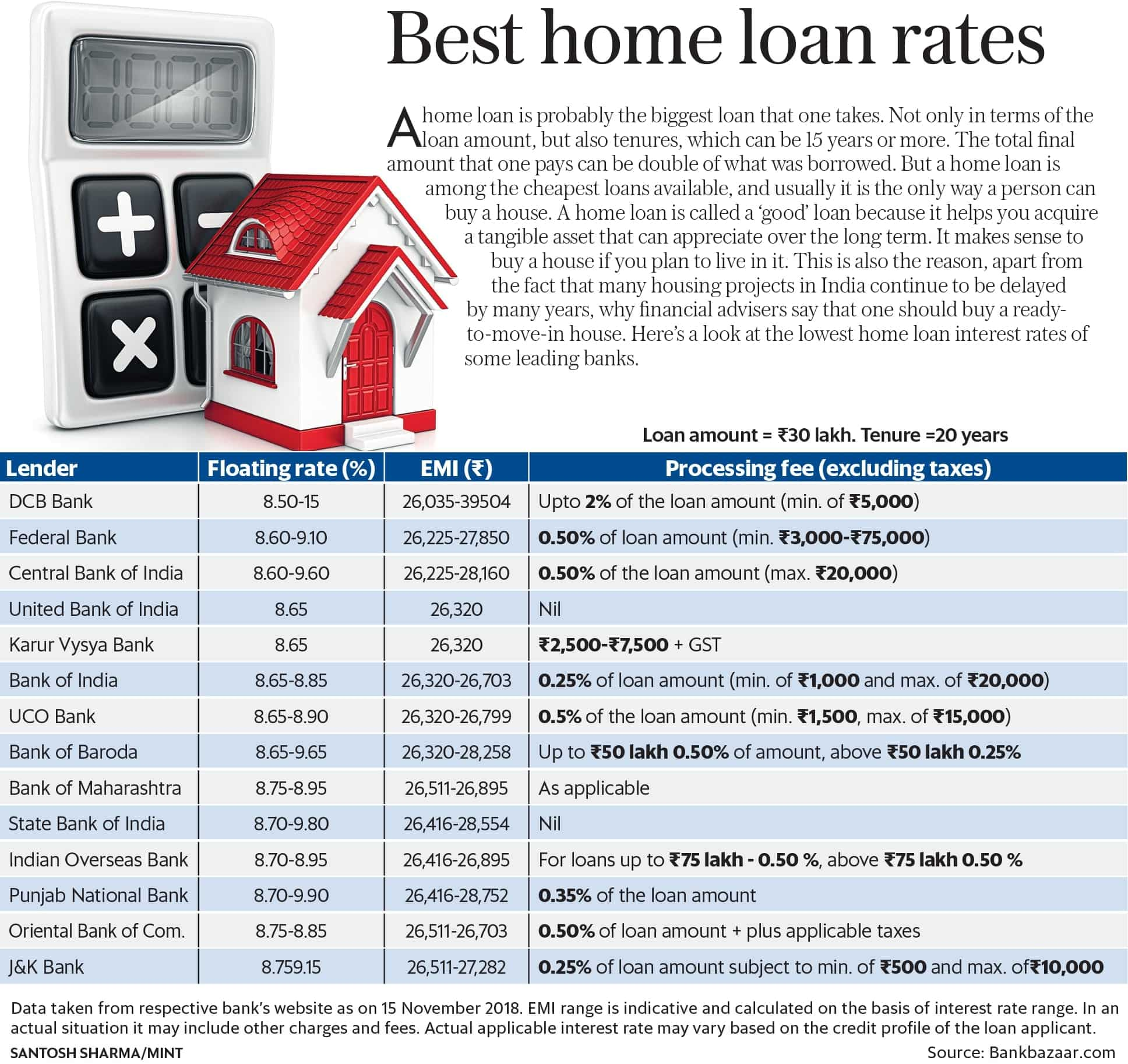

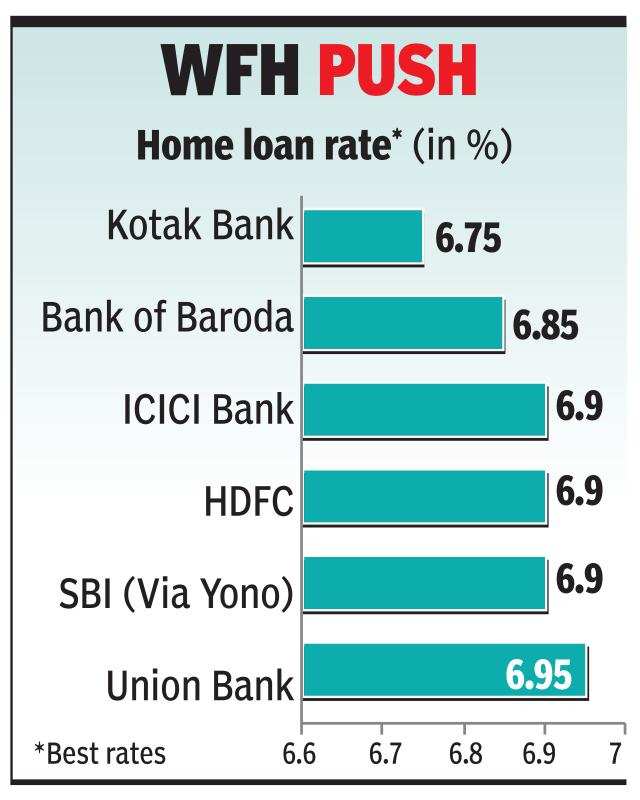

Hfcs And Banks Have Revised Home Loan Interest Rates After Repo Hike

The Governor of the Reserve Bank of India on Wednesday announced a hike in repo rate by 40 basis point. This will affect all floating rate home loans. The public sector bank Bank of Baroda hav increased its interest rate on home loan from 6.5% to 6.9%. Bank of India, on the other hand has also increased its home loan interest rates from 6.5% to 6.9%.Indias largest mortgage lender, HDFC has increased its prime lending rate by 30 basis points. Federal Banks home loan interest rate has gone up from 7.65% to 8.05%.

13 May 2022

Home Loan Interest Rates Are Rising How Does It Affect You

New Delhi, January 13: With rising costs, different financial institutions have increased the interest rate on home loans.

This can turn out to be an additional burden on your finances and lead to disruption of your monthly budget.

This can lead your family to compromise on their current lifestyle.

Home Loan Interest Rates Are Rising. How Does It Affect You

You May Like: How To Get Best Auto Loan

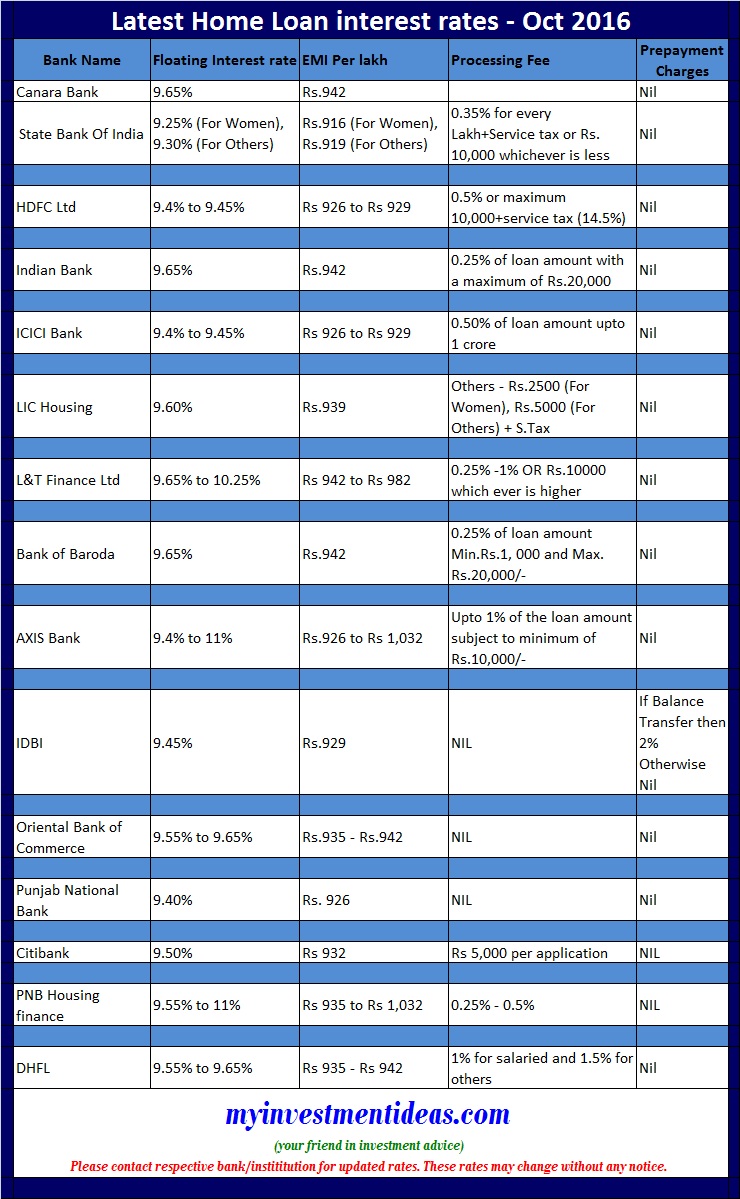

How Does Base Rate Affect Home Loan Rates

As said that base rate is the minimum interest rate, changing in base rate always affects the home loan interest rates. If the base rate cuts down the interest rate for home loan lowers down too. Generally banks reset the interest in every three months according to the home loan agreement. For the existing customers cutting down the Base Rate will be good news whereas increase in Base Rate increases their interest payment in three months. Same happens with new borrowers. At the time of borrowing if RBI cuts down the BR then they get a chance to avail a home loan in much lower interest rate.

Federal Bank Home Loan

Federal Bank offers home loans amounting up to Rs 15 crore at low interest rates starting at 8.60% p.a. for tenures of up to 30 years.

Types of Federal Bank Home Loan:

- Federal Housing Loan Customers can avail this home loan product for buying/constructing/repairing/renovating/extending a residential property. The loan can also be availed for reimbursing the debt obtained for purchase/construction/furnishing/plot purchase/balance transfers/supplementary housing loans for employees of well-established companies.

- Plot Purchase Loan This home loan product can be availed for buying a plot of land for residential purposes.

Apply for Federal Bank Home Loan Online

Read Also: What’s An Interest Only Loan

What Is The Floating Rate Of Interest On Home Loans

If the interest rate is linked to an external benchmark rate it is known as floating interest rate. Banks in India consider the repo rate declared by the RBI. This benchmark rate changes from time to time. So, the rate of interest of the housing loan changes in accordance with the repo rate.

As a result, the EMI or the tenure of the loan increases or decreases depending on the repo rate. Any increase in the repo rate will increase the interest charged by the bank on any kind of loan and decrease will make the loans cheaper for the customers.

Lic Housing Finance Home Loan

LIC Housing Finance Limited’s affordable home loan options range from Rs. 1 lakh to Rs. 15 crores, with flexible 30-year terms and attractive interest rates starting at 6.90% p.a. Depending on the circumstances, the processing fee is up to 0.5% of the loan amount plus GST.

FIC HFL provides the best housing loan programs for NRIs and retirees t competitive interest rates.

You May Like: Get Pre Approved For Home Loan

Benefits Of Taking Fixed Rate Home Loans:

- There is no change in the rate of interest, irrespective of market fluctuations

- A fixed-rate home loan assists in long-term planning and budgeting by enabling a fixed monthly repayment schedule, which is easy to budget and doesn’t fluctuate

- It ensures financial security since customers need not expect any future risks.

Why Should I Pay Stamp Duty

When a customer is buying a house it is required to be registered properly under the court of property law. Paying the stamp duty ensures that the property deal is legal and the property is registered under the name of the correct owner. If the stamp duty is not paid then the owner might face devaluation of the property in future.

Don’t Miss: Do You Have To Repay Ppp Loan

Kotak Mahindra Home Loan

Kotak Mahindra Bank offers home loans starting at 8.65% p.a. onwards for tenures up to 30 years and for loan amounts of up to Rs. 10 crore.

Types of Kotak Home Loan:

- Kotak Housing Loan This loan is for borrowers who want to buy/construct/renovate a house.

- Home Loan Balance Transfer This home loan facility is for transfer of existing home loan from other financial institutions to Kotak Mahindra Bank at lower interest rates.

- Home Improvement Loan The bank offers this home loan product for renovating or making other improvements in an existing house.

- NRI Home Loan This home loan scheme is for meeting housing finance requirements of NRIs.

- NRI Home Improvement Loan This home loan is for NRIs who need funds to cover expenses related to their homes renovation or improvement.

Apply for Kotak Bank Home Loan

Ways To Calculate The Interest Rate On Home Loan Taken Some Time Back

Irrespective of what was agreed as interest rates for a home loan, it is important that the borrower should be conducting periodical check of interest rate on home loan taken some time back. This is possible through various online applications called Loan repayment calculator. It also helps in clarifying, how much percentage of amounts is totally paid towards interest vs. loan amount and the total time required paying off the debt. This will help in understanding the interest rate moved over the period of time when the borrower started repayment of the loan.

a. In case of Fixed Rate Loan: All you need to do is to give the outstanding loan amount, interest rate and EMI amount, this will auto-calculate the total interest due and how much of your amount has moved towards the principal of the loan amount.

b. In case your of Floating Rate Loan: in this case, you need to share the same information as in the case of fixed rate loan like outstanding loan amount, interest rate and EMI amount. This information will be used to calculate the interest paid and due and how much is the total percentage of interest paid by the borrowers for total due amount.

Recommended Reading: How To Calculate Income For Home Loan

How To Calculate The Effective Interest Rate

The applicable interest rate on home loan consists of two components, the base rate and markup rate. The combination of two is what you will be paying on the loan. Let’s explore these components to give you a better understanding.

- Base Rate: It is the standard lending rate of the bank, applicable for all retail loans. This rate is subject to frequent changes on the basis of multiple inputs.

- This component of a small percentage is added to the base rate to arrive at the EIR for a specific type of home loan and varies from one type to another.

Effective Interest Rate = Base Rate + Markup

- From April 2016 onwards, the Reserve Bank of India has mandated a new method for computing lending rate to replace the base rate system. The is aimed at bringing more accountability and flexibility to the way rates are published by banks and financial institutions in India. RBI mandates banks to fix the interest rate after studying the risk factor associated with lending to borrowers. It takes into account various factors involved such as repo rate, deposits etc. This MCLR-based computation works out to be slightly lower than the erstwhile base rate.

S To Close Your Home Loan Smoothly

You can close your home loan account in a systematic way without complications. Read on to find more.

The satisfaction of building a lifetime asset for oneself comes with an obligation in the form of a mortgage. You put off saving money for years to buy the home of your dreams. You can realize this desire with the aid of a mortgage. Nevertheless, regardless of their financial situation, every person who takes out a home loan wants to pay it off to get the home in their name and be free of debt.

To enable this, the Reserve Bank of India has waived all prepayment fees for any number of prepayments made by borrowers during the loan tenure, thereby assisting Indians in repaying their debts as quickly as feasible. Some people keep their loan open for the whole term they were given and allow it to mature naturally. To have hassle-free ownership and future ease of transfer in either of the scenariospre-closure or natural closureyou need to take care of a few crucial elements.

No-Objection Or No-Dues Certificate Or Proof Of Loan Closing

Original Documents Of The Mortgaged Property

Unused PDCs For Security

Updates To Credit Bureau Records

The four different credit bureaus in the nation track your whole loan history, from disbursement to closure. Within 30 days after the loan’s completion, make sure the lender updates the information.

Acquire A Current Non-Encumbrance Certificate

Track Your Repayments

Legal Verification From Your Attorney

Don’t Miss: Small Business Loans For Minorities

What Is The Gst On Home Loans

GST refers to the goods and services tax. GST on home loans is 18% and it is charged on each payment that one makes to the company like paying EMIs, processing fees, among others.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First, we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers offers appear on the site. This site does not include all companies or products available within the market.

Second, we also include links to our advertisers offers in some of our articles. These affiliate links may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the listings or commentary our editorial team provides in our articles or other impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof

How To Get Lowest Home Loan Interest Rates

There are certain factors based on which a home loan interest rate is offered which are as follows:

- Property in a good location Property in a approved society has more chance of getting loan amount up to 75-90% of the property value.

- Make use of your good credit score You must have CIBIL score of 650 or above to get approval for it.

- Apply at existing bank A good understanding with the bank help you avail a high loan amount and that too at competitive rate of interest on your home loan without any hassle.

- High Income A person earning high income has more chances of getting lower rate and higher amount.

- Keep all property related documents It is very important to maintain and keep all the property documents with you. As it helps the lender identify your property and its worth properly and thus trust your profile.

- Make sure you have income proof Many people do not know that your loan application may be rejected. If you do not have a income proof or salary slip. Only a few NBFCs accept such cases but then they give high rates.

- Apply at young age If you age at the time of applying is in early 30s or late 20s. You are more eligible for a higher loan amount as you have less financial liabilities.

- Transfer your home loan to a lower EMI You can transfer your existing home loan to a lender offering a lower rate on your home loan to save your money.

Read Also: Is It Hard To Get Sba Loan

Best Home Loan In India 2023

For most people, owning a home is one of the most significant accomplishments they will ever realize, and it is also an expensive endeavour. Giving such a dream life requires a lot of work on the buyer’s part, and the only way to fit the home into their budget is by taking out a Home Loan.

A home or housing loan is a sum of money a person borrows, typically from banks and other lending institutions. Depending on the loan’s terms, the borrower must repay the loan balance plus interest ranging from 10 to 30 years in Easy Monthly Instalments, or EMIs.

The 10 Best Home Loans and their Interest Rates in the Indian Market for 2023 are discussed below to help you make your home-buying decision so that you can choose the best Home Loan in India for yourself.

How Can You Make The Most Of Lower Home Loan Interest Rates

If you are eligible for lower interest rates, not only should you grab it at the earliest. But also make sure the loan tenure is optimized to save you more. An optimized tenure means neither too short nor too long. An example below can help you understand it better.

Example You are earning INR 80,000 in a month. A lender has come with a loan offer of INR 40 lakh at 7.60% per annum. Now, you are looking for a 20-year deal. But what if you curtail it to 15 years? Lets check out the table below to know the differences of payment between these two tenure options.

| Tenure Options | |

|---|---|

| INR 37,308 | INR 27,15,497 |

So, you can see a savings of around INR 10,76,956 on reducing the tenure to 15 years instead of continuing it for 20 years. Yes, the EMI will rise by around INR 4,839 when you choose a tenure of 15 years. Despite that, the EMI constitutes below 50% of your net monthly income. The lender can approve such a repayment tenure if you dont have any other obligation.

Read Also: How To Find Your Student Loan Account Number For Irs