Ology: How We Chose The Best Low Credit Score Lenders For 2022

In choosing the best mortgage lenders for low credit scores, Personal Finance Insider looked for lenders that:

- Offer mortgages that allow scores below 620, including FHA mortgages.

- Have flexible credit requirements on one or more of their mortgage products this could include accepting non-traditional forms of credit or considering borrowers who have negative events on their credit reports.

FHA mortgages can be a great option for those with lower scores, but some lenders that offer these mortgages require higher scores than the minimum of 580 . Some lenders, for example, require scores of 620 across the board, regardless of the specific loan type. All of the lenders on this list allow scores of 600 or lower on their FHA mortgages.

Many of the lenders we included also have their own specialty mortgage products that allow scores below 620, such as Carrington’s Flexible Advantage mortgage.

We also looked at the following:

- Customer satisfaction. If the lender appeared in the J.D. Power 2022 Mortgage Origination Satisfaction Study, we looked at its ranking. If it wasn’t in the survey, then we read online customer reviews.

- Ethics. Most our top picks received an A+ from the Better Business Bureau, which measures companies’ trustworthiness. The exceptions are Guild Mortgage, which has an A rating, and Citibank, which has an F. We also researched and considered any scandals in the past three years.

What Is A Mortgage For Bad Credit

In general, lenders require a minimum credit score of at least 620 for most mortgages.

Borrowers with a score below that number may struggle to qualify for conventional mortgages. However, they may qualify for other mortgage products with lower credit requirements.

For example, a popular mortgage for bad credit is an FHA loan. Borrowers can qualify for an FHA loan with a score as low as 500.

How Can I Buy A House With Bad Credit And No Deposit

Its not unusual for folks with bad credit to have no money set aside for deposits or down payments. However, several lenders offer 100% financing that requires no out-of-pocket expenditures.

Bank of America Mortgage and CitiMortgage offer 100% financing, and Bank of America Mortgage has a loan option to reduce the amount of upfront cash youll need.

USDA Rural Housing Loans and the VA-Guaranteed Home Loan Program also offer loans with no down payment and/or 100% financing.

FHA-guaranteed loans have special provisions that allow you to use gifts to pay the down payment on their loans. You can get quotes from several FHA lenders through the FHA Rate Guide.

Recommended Reading: Money Loans With Bad Credit

How To Get A Mortgage With A Low Or Bad Credit Score

Lenders consider four primary factors when reviewing a mortgage application:

Your credit score.

The amount of debt you carry compared to the income you receive, also called your debt-to-income ratio or DTI.

Your employment history.

The size of your down payment.

Two or three positive factors might outweigh a negative one. Here’s what you can do to improve each of them and bolster your chances of getting approved for a mortgage.

Check Your Credit Report For Free

Obtain your free credit reports from AnnualCreditReport.com and review them carefully. More than one-third of participants in recent Consumer Reports research found errors on their reports, and these mistakes can be costly. There are many issues that can drag down your credit score, such as an incorrect open loan attached to your name or an incorrectly-filed late payment.

If you see a mistake or outdated item generally seven years, but sometimes longer for bankruptcies, liens and judgments contact Equifax, Experian or TransUnion. Each of the credit bureaus has a process for correcting errors and out-of-date information.

Read Also: Fifth Third Bank Auto Loan Payment Login

How To Buy A House With Bad Credit But Good Income

A home is one of the largest purchases a person will make in their lifetime. Most people cant afford to pay cash for a house, which means using a mortgage loan to borrow money to fund the purchase.

If you have bad credit, it can be hard to qualify for a loan. However, if you have good income, there may be options for you if you want to buy a home.

You May Like: Can I Transfer My Car Loan To My Business

Fha Loan: 500 Credit Score

FHA loans have the lowest credit score requirements of any major home loan program. Most lenders offer FHA loans starting at a 580 credit score. If your score is 580 or higher, you can put only 3.5% down.

Those with lower credit scores may still qualify for an FHA loan. But theyd need to put at least 10% down and its more difficult to find a willing lender.

Another appealing quality of an FHA loan is that, unlike conventional loans, FHA-backed mortgages dont carry risk-based pricing. This is also known as loan-level pricing adjustments . Risk-based pricing is a fee assessed to loan applications with lower credit scores or other less-than-ideal traits.

There may be some interest rate hits for lower-credit FHA borrowers, but they tend to be significantly less than the rate increases on conventional loans. For FHA-backed loans, this means poor credit scores dont necessarily require higher interest rates.

Keep in mind, though, that FHA requires both an upfront and annual mortgage insurance premium which will add to the overall cost of your loan.

Recommended Reading: What Do I Need To Apply For Personal Loan

Increase Your Available Credit

Once you get a better handle on things and have started improving your score, increasing your available credit can help raise it a little faster. You can do this by either paying down balances or making a credit limit increase request. This effort helps increase your credit score because you will decrease your credit utilization, which is a huge factor in determining your score. Remember, its best to have a higher and apply for mortgages.

And guess what: Most credit card companies allow you to request as many increases as you like without it causing a hard pull on your credit.

Rocket Mortgage: Best For An Easy Online Process

Rocket Mortgage is a name you probably know its Americas largest mortgage lender. Whether youre a seasoned real estate buyer or a first-time home buyer, Rocket Mortgage can help you secure financing for the home of your dreams, even without good credit.

| 5 minutes | 9.5/10 |

A home equity line of credit works similarly to a credit card. Youll be issued a line of credit from a bank that is secured by your home. You can use the line of credit to pay for home improvement projects or any other large expense and make payments over as many as 30 years to satisfy the loan. Equity loans are also called second mortgages.

Also Check: Bank Of America Ppp Loan Forgiveness

Can I Refinance A Bad Credit Home Loan

Yes, you can refinance a bad credit mortgage, but be sure to familiarize yourself with your specific loan terms. If your credit has improved since buying a home with bad credit, you may qualify for a lower rate or a mortgage with better loan terms. Keep in mind that youll have refinance closing costs, so youll need to consider whether a refi makes financial sense.

Can I Get A Student Loan With Poor Credit

Having poor credit or no credit is not a barrier to obtaining a student loan from the federal government. Thats because the Federal Unsubsidized Student Loan Program is based on financial need, not your credit score.

To qualify for the loan, you fill out the Free Application for Federal Student Aid form. Your college or university evaluates the information to set the size of the loan.

Private student loan providers are quite different in that they evaluate your creditworthiness before approving your loan request. Often, a parent, relative, or friend will have to cosign for a private student loan, which doesnt offer many of the perks you receive from a federal student loan.

One such federal perk is loan forgiveness, which allows you to cut the amount you owe by working in specified public service jobs after you graduate. The Public Service Loan Forgiveness forgives your loan balance after you make 10 years of payments under a qualifying plan.

The offer extends to students who become government employees or who work for qualifying non-profit organizations.

In addition, the Teacher Loan Forgiveness Program forgives up to $17,500 of your student loan when you teach full time for five consecutive years at qualifying schools.

Both forgiveness programs are available for federal direct subsidized and unsubsidized loans.

Don’t Miss: First Time Buyers Home Loans

Does A Low Credit Score Mean I Have No Chance Of Home Loan Approval

Should the bank deem your credit score too low and reject your home loan application, you have two options:

- Apply to a different bank.

- Focus on improving your credit score, and apply again within 6 to 12 months.

Different banks have different lending criteria, and some may be less strict than others. So, another bank may be willing to accept a lower credit score.

This is where employing the services of a home loan comparison service like ooba Home Loans can be a big help. We submit your home loan application to multiple banks, increasing your chances of getting approval.

Home Loans For Low Credit Scores

Home loans are available to low-credit-score consumers looking to buy a new home or refinance their current one. In either case, the home serves as collateral for the loan, meaning the lender can foreclose on your home if you default on the loan.

A foreclosure will remain on your credit report for seven years, although the bulk of the damage to your credit score begins to dissipate after a few years. The lenders reviewed here all offer home loans to folks with bad credit.

| 5 minutes | 9.5/10 |

Homeowners can also arrange a home equity line of credit that acts much like a credit card cash advance. Both are revolving loans that charge daily interest until repaid.

You only pay for the money you borrow, but you can vary your repayment amounts as long as you meet the monthly minimum payment requirements.

Recommended Reading: Can You Take Out More Than One Student Loan

Improve Your Odds Of Qualifying With Bad Credit

You can improve your chances of qualifying for a mortgage with these tips:

- Save a larger down payment: Although borrowers with excellent credit may qualify for a conventional mortgage with as little as 3% down, borrowers with poor credit may need a larger down payment. To give yourself the best chance of qualifying for a loan, aim to save 10% of the home value.

- Review your credit reports: Review your credit reports at AnnualCreditReport.com to see if there are any errors bringing your score down. If there are, dispute them with the credit bureaus.

- Pay down debt: You can improve your debt-to-income ratioand your odds of getting a loanby paying down your existing debt, such as your credit card balances.

- Apply with a cosigner or co-mortgagor: You may be able to qualify for a mortgage if you add a cosigner to your loan application. Requesting someone to be a cosigner is a huge ask, especially when it comes to a significant purchase like a house, so make sure you can comfortably afford the loan payments before going this route.

What Mortgage Lenders Look For When Approving A Home Loan

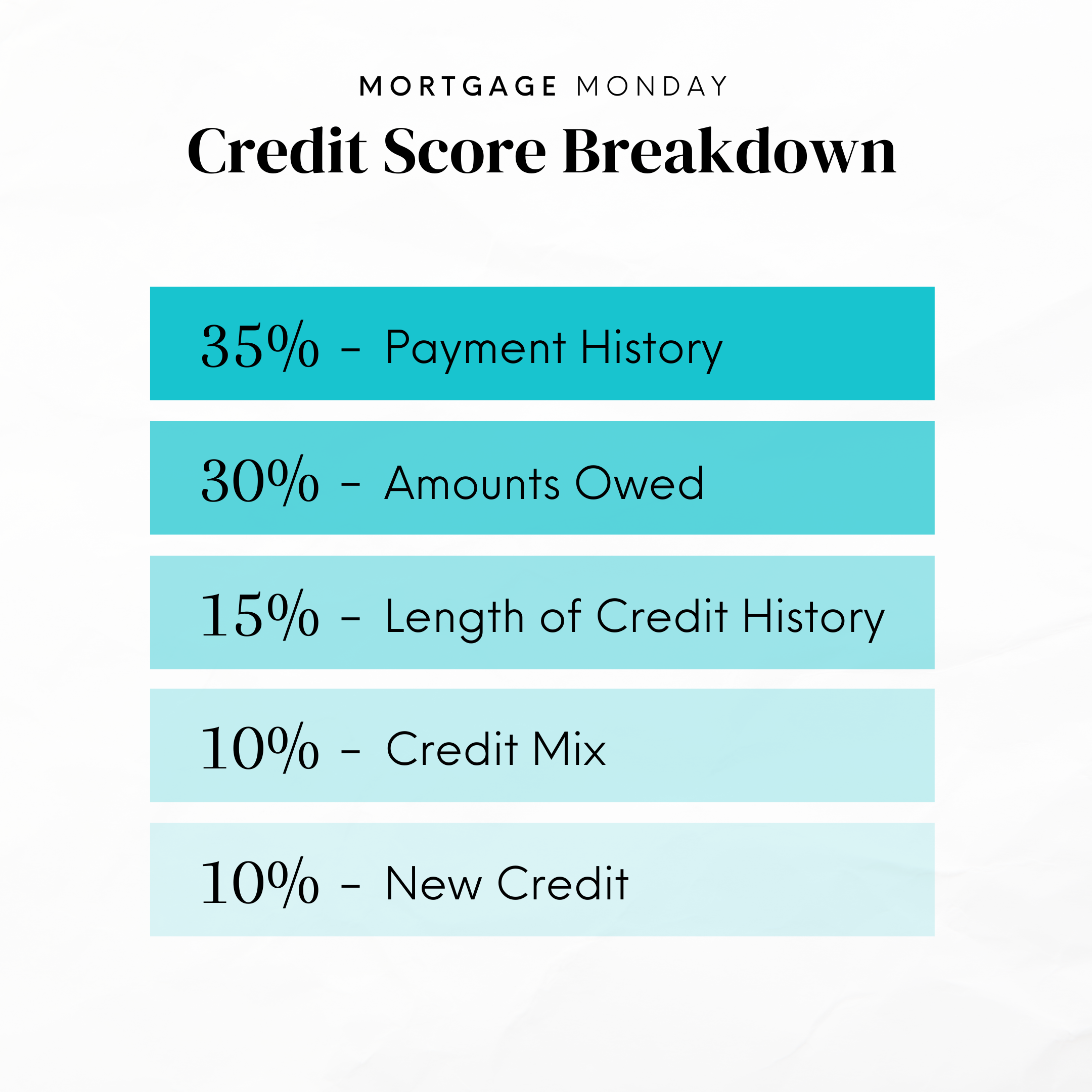

When you apply to get pre-approved, your lenders will review your credit history and consider your current credit outlook. This includes looking at:

- How on-time have you been with your payments and obligations?

- What does your current debt load look like, and how is it spread out?

- How much experience do you have managing credit?

- Have you been recently trying to acquire access to new sources of credit?

- Do you let items go into collections?

- Have you previously filed for bankruptcy?

Lenders ask these questions to get comfortable with you. Your financial health isnt the only consideration lenders make, but how you manage your bills tells a large part of your story.

Lenders also look for specific credit events known as derogatory items, like bankruptcy or delinquent accounts.

Derogatory items dont disqualify a mortgage approval. Generally, its only required that theyre historical events and not current ones. For example, you can get approved for a mortgage if youve declared bankruptcy in the past, or if youve lost a home due to foreclosure.

Lenders know that life is unexpected and bad things happen. Whats important is whats happened in the time since the derogatory event occurred.

You May Like: How Often To Refinance Home Loan

Research Home Loans For Bad Credit Online

Home loans for bad credit are available to consumers with . This article makes it easy to find out more about our recommended lenders by clicking on the START NOW link in each summary box.

While government-guaranteed loans may be your best choice, they are not your only choice. Banks and credit unions are now offering home loans that directly compete against guaranteed loan programs and, in some ways, beat them.

Homeownership remains the American dream. If you have a job or another source of steady income, you may qualify for a mortgage despite your bad credit score. The nice thing is, it costs nothing to find out.

How A Low Credit Score Affects Your Mortgage

The lowest interest rates go to borrowers with the strongest credit scores. Borrowers with lower scores have higher rates, and potentially pay steeper financing costs, since they present more risk to the lender. If you have a lower score, you could spend several thousand more in interest over the life of your mortgage.

Assume you get a $350,000 30-year mortgage with a fixed 4.5 percent rate. Your monthly payment would be $1,773, and you would pay $288,583 in interest over the 30-year loan term.

If you were able to improve your credit and secure a rate of 3.75 percent instead, your monthly payment would drop to $1,620, and youd pay $233,800 in interest for the duration of the loan. Thats a cost savings of approximately $54,800. You can use Bankrates mortgage calculator to compare different scenarios with higher and lower rates.

You May Like: Financial Aid Vs Student Loans

What Is The Easiest Mortgage To Qualify For

If you have a low credit score, its hard to beat a government-guaranteed home loan for ease of qualifying.

As previously mentioned, FHA mortgage loan offerings are available to folks with scores as low as 500. VA loans are very easy to get, as long as you are active duty, a veteran, or a surviving spouse.

In some ways, the private lenders have an advantage not available to the government loan agencies in that they can change their programs as often as they want to respond to shifting conditions in the local marketplace. Agency programs, by contrast, are usually locked in by regulations and may require an act of Congress to change.

The upshot is that private lenders can tailor their conventional loan programs to compete directly with FHA loans. In addition, these lenders set their own terms for FHA-guaranteed loans within the overall constraints of the agency.

The best advice for low credit score consumers looking for home financing is to shop around. If you cant find a conventional loan that beats the competition, you can fall back to an FHA loan.

Boosting Your Credit Score

If you have bad credit but are a first-time home buyer, start maximizing your score before you begin house hunting. Check your credit score so you know where you stand, review your credit history to make sure itâs accurate and remember to consistently pay your bills on time. You can check your credit score for free with our tool if youâre a current U.S. Bank customer.

When lenders see multiple applications for credit reported in a short period of time, it can discourage them from giving you a loan. So hereâs a short list of things to try to avoid when applying for a mortgage so that you can keep your options open.

- Avoid opening new credit cards.

- Avoid closing credit cards .

- Avoid applying for new loans.

- Avoid co-signing on any new loans.

Looking for more ways to improve your credit score? Here are some .

You donât have to have a top credit score to get a mortgage, but it will help you compete for the house you want by potentially giving you more financing options. So, take steps to try to boost your credit, avoid applying for credit products at the same time youâre house hunting and talk over your options with a mortgage loan officer who can help.

Recommended Reading: What Is Escrow In Mortgage Loan

Tips To Improve Your Credit Score Before Buying

Bad credit doesnt necessarily mean you wont qualify for a mortgage. But borrowers with good to excellent credit have the most loan options. They also benefit from lower rates and fees.

If you can polish up your credit report before shopping for a mortgage, youre more likely to qualify for the best loan terms and lowest interest rates. Here are a few tips to improve your credit report and score before applying:

Removing inaccurate information can increase your credit score quickly. Developing better credit habits will take longer to produce results.

If youre looking to buy or refinance and know you may need to bump your credit score, it can be helpful to call a loan advisor right now even if youre not sure youd qualify.

Most lenders have the ability to run scenarios through their credit agency providers and see the most efficient and/or cost-effective ways to get your scores increased. And this can be a much more effective route than going it alone.