How To Lower Your Monthly Student Loan Payment

The average student loan payment of $393 might not be a problem for graduates who have earned a degree in a high-demand field that puts them in the running for a job with a good salary. But even if you land a job that doesnt pay well, the good news is that there are many ways to lower your monthly payments.

Here are a few ways to lower your student loan payment:

See: More Ways to Lower Your Student Loan Payment

What Is A Traditional Student Loan Repayment Plan

Traditional repayment plans are based on the loans principal balance. Your principal balance is just the amount of money that you borrowed to fund your education.

Traditional repayment options dont factor in things like your personal income or family size when working out how much you will be paying on a monthly basis.

Both traditional and income-driven repayment plans come with their own set of pros and cons including different repayment terms.

Traditional repayment plans include:

Already Borrowed Here Is How You Can Decrease Your Student Loan Rates

If youre one of the millions of borrowers who already has student loan debt, you are not out of luck in terms of managing your repayment effectively.

You may consider refinancing your federal or private student loans to obtain a lower interest rate on your debt through a private lender. Doing so creates a much rosier picture for your total student loan payments and it may help reduce your monthly obligation immediately.

However, refinancing federal student loans to a private loan removes all federal protections such as income-driven repayment plans, forgiveness opportunities, and more.

To help better manage your student loan payments for federal loans, consolidation may also be beneficial. The Direct Consolidation Loan from the federal government allows you to combine multiple loans under a single, new loan.

This will not lower your total interest, but it will allow you to take advantage of income-driven repayment plans or an extended repayment plan that can ease the cash flow burden each month.

Talk to your loan servicer to learn more about federal consolidation. To see what your payments would be under the most popular income-driven plan, the Income-Based Repayment Plan , check out our IBR Calculator.

If you are looking to refinance your student loans with a private lender to lower your interest rate, check out some of the following highly-rated partners of ours.

Compare Student Loan Refinance Companies

Also Check: Drb Student Loan Review

How Student Debt Affects Your Credit Score

Student loans and lines of credit form part of your credit history. If you miss or are late with your payments, it can affect your credit score.

Your credit score shows future lenders how risky it can be for them to lend you money. A poor credit score can also affect your ability to get a job, rent an apartment or get credit.

If You Have A Postgraduate Loan And A Plan 1 Plan 2 Or Plan 4 Loan

You pay back 6% of your income over the Postgraduate Loan threshold . In addition, youll pay back 9% of your income over the Plan 1, Plan 2 or Plan 4 threshold.

Example

You have a Postgraduate Loan and a Plan 2 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Postgraduate Loan monthly threshold of £1,750 and the Plan 2 threshold of £2,274.

Your income is £650 over the Postgraduate Loan threshold and £126 over the Plan 2 threshold .

You will pay back £39 to your Postgraduate Loan and £11 to your Plan 2 loan. So your total monthly repayment will be £50.

Example

You have a Postgraduate Loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Postgraduate Loan monthly threshold of £1,750 and the Plan 1 threshold of £1,657.

Your income is £650 over the Postgraduate Loan threshold and £743 over the Plan 1 threshold .

You will pay back £39 to your Postgraduate Loan and £66 to your Plan 1 loan. So your total monthly repayment will be £105.

Read Also: When Should I Refinance My Fha Mortgage

A Guide To Student Loan Interest And Calculations

When you apply for a student loan, youâre trying to borrow money to pay for your education. Like any loan, you usually have to pay that money back. But when you do, you may be responsible for more than just what you originally borrowed. Thatâs because of student loan interest.

Interest charges are something youâll probably deal with until your loan is paid off. But there are many variables that can affect when it accumulates and how much you owe. Keep reading to learn how interest is calculated and how it may influence your repayment schedule.

How Student Loan Payments Are Calculated

There are a number of ways that student loans are repaid. Among them are:

- Standard repayment

- Income-contingent repayment

- Pay As You Earn repayment

Regardless of the way your student loan repayment plan is set up, the way your payment is calculated may or may not be in line with the way your mortgage lender does it.

Mortgage guidelines regarding how student loan payments are calculated by lenders have changed a lot in recent months. Until recently, if a student loan was deferred for at least 12 months, that amount was not required to be part of your debt ratio calculations.

Unfortunately, this has now changed for most mortgage programs.

Recommended Reading: Golden1 Car Loan

How Does Student Loan Interest Work

When new student loans are issued, the borrower signs a promissory note that explains the terms of the loan. Every part of this document is important to read and understand, as it determines how much you owe and when your payments are due. This applies to parent PLUS loans and their interest as well.

The most important terms to look out for are:

- Disbursement date: The date the funds arrive and interest starts accruing

- Amount borrowed: The total amount borrowed in each loan

- Interest rate: How much you have to pay to borrow the funds

- How interest accrues: Whether interest is charged daily or monthly

- How interest capitalizes: When accrued interest is capitalized to your principal balance

- First payment date: When you have to make your first loan payment

- Payment schedule: How many payments you have to make

Lenders understand that most full-time students do not have an income, and if they do, it is not enough to cover payments while in school. As a result, its often possible to avoid making payments while youre in school.

If Youre Having Trouble Repaying

If you need help with repaying your Canada Student Loan, you may qualify for the Repayment Assistance Plan .

If youre having trouble repaying a provincial student loan, contact your student aid office. For repayment assistance with a loan or line of credit provided by your financial institution, contact your branch to determine what your options are.

Understand that by making your payments smaller, it will take you longer to pay back your loan. Youll end up paying more interest on your loan.

If you consider refinancing or consolidating your student loan, note that there are important disadvantages.

If you transfer your federal or provincial student loan to a private lender, you will lose any tax deductions on your student loan interest. You wont qualify for the interest free period while you’re in school and will end up paying more interest over time.

Also Check: Usaa Credit Score For Mortgage

When Are The First Payments Due

Not all loan payments are due on the same day so millions of people won’t all be making payments on May 1. Once the COVID-19 forbearance ends, borrowers will receive a billing statement or notice at least 21 days 3 weeks before the first payment is due. Some borrowers may not have to make their first payment until June. Borrowers should ask their loan servicers what date their first payment after the pause ends is due.

Convert It Into A Monthly Amount

Lastly, youll have to multiply that daily interest amount by the number of days in your billing cycle. In this case, well assume a 30-day cycle, so the amount of interest youd pay for the month is $41.10 . The total for a year would be $493.20.

Interest starts accumulating like this from the moment your loan is disbursed unless you have a subsidized federal loan. In that case, youre not charged interest until after the end of your grace period, which lasts for six months after you leave school.

With unsubsidized loans, you can choose to pay off any accrued interest while youre still in school. Otherwise, the accumulated interest is capitalized, or added to the principal amount, after graduation.

If you request and are granted a forbearancebasically, a pause on repaying your loan, usually for about 12 monthskeep in mind that even though your payments may stop while youre in forbearance, the interest will continue to accrue during that period and ultimately will be tacked onto your principal amount. If you suffer economic hardship and enter into deferment, interest continues to accrue only if you have an unsubsidized or PLUS loan from the government.

Read Also: Usaa Auto Refinance Calculator

Monthly Pi Payments = P X

P = principal amount

Climb Investco, LLC . California Finance Lender #60DBO-44527. NMLS Consumer Access .

*All outcomes information has been collected by Climb on a good-faith-efforts basis however, this information relies on inputs beyond Climbs ability to test or control. Accordingly, Climb makes no representation or warranty as to the accuracy of this information, and this information should not be relied on in making a decision whether or not to attend a course at the above-referenced entity. All student experiences are different and outcomes from a program are not guaranteed.

Climb loans are private loans and do not have the same terms or repayment options that are offered or may become available by the federal loan program, other private lenders, or the applicable school, such as Income Based Repayment, Income Contingent Repayment, PAYE, or discounted pricing for certain payment methods.

Tuition pricing is determined by School. Schools set up and administer payment products , powered by Climb and its partners . Climb does not provide payment processing, payment settlement, or money transmitter services, Climb is not a money services business, and Climb is not affiliated with and does not guarantee services of its payment processor partners or their compliance with applicable laws. Schools do not endorse loans originated by Climb InvestCo, LLC, and Climb InvestCo, LLC is not affiliated with any school.

133 W 19th St, 4th Fl. New York, NY 10011

Your Student Loan Repayment Term

Your loan repayment term is the number of years you have to pay it back. Federal loans generally have a standard repayment schedule of 10 years.2 For , the repayment term can range anywhere from 5-20 years, depending on the loan. You’ll be given a definite term for your loan when you apply.

Interest rates for federal and private student loans

The average interest rate will be different for federal student loans and private student loans. Federal student loans have a single, fixed interest rate, which means that your loan’s rate doesn’t change over time.

You may have noticed that there’s a range of interest rates associated with a private student loan. Private student loans are . That means the rate you’ll be offered depends on your creditworthinessand that of your cosigner, if you have onetogether with several other factors. When you apply for a loan, you’ll be given an interest rate, either , depending on which is offered and which type of rate you’ve chosen.

How much you’ll need to borrow for college

If you’re wondering for collegewhether it’s a public university or private universitythe can help. You can search for college costs and also build a customized plan based on your own situation.

Don’t Miss: Bayview Loan Servicing Hardship Application

What Does Student Loan Interest Mean To Me

Putting off payments or just making the minimum each month will leave you with a big interest cost over the life of your loan.

Use your new knowledge of how to calculate student loan interest on a loan and how compound interest works to pay off your loans early.

You work hard for each paycheck. Pay more today so you can save even more later.

Andrew Pentis, Eric Rosenberg and Christy Rakoczy contributed to this report.

What Else Affects Student Loan Interest

There may be multiple student loan options available, and which loan you get can influence how much interest youâll pay. Here are some other things that can affect student loan interest that you may want to consider.

Fixed Interest Rates vs. Variable Interest Rates

Fixed interest rates are exactly thatâconstant for the entire life of your loan. Variable rates, on the other hand, can move up and down depending on general economic conditions.

If you get a federal loan, it will be at a fixed interest rate.

Private loans, however, might have a variable rate. Typically, lenders will tie their variable interest rate to an index or benchmark rate. Lenders may then add in their own percentage, called a margin, to determine your total rate.

Broadly speaking, youâll pay a more predictable amount of interest with a fixed-rate loan. While itâs possible to start at a lower interest rate with a variable loan, the fact that they can change means that you could end up paying more. Generally, federal loans are said to have lower interest rates.

Simple Interest vs. Compound Interest

Simple interest loans charge interest on the principal balance of your loan and nothing else. Current federal student loans work this way. The same is true of many private loans.

But some private loans may compound interest. This means that they charge interest on the principal and any unpaid interest. In other words, youâll pay interest on interest.

Interest Rates and Credit

Read Also: Va Manufactured Home 1976

Student Loan Payment Calculators

Need to find out what your monthly student loan payment will be? We can help. Our first loan payment calculator will show you how much you’ll pay each month, so you can make sure the loan in affordable. Scroll down to learn more and access additional calculators.

Ready to explore your options? Instantly Compare Lenders for Your School!

Paying for college is no easy process. Figuring out where the funds will come from can sometimes be even more challenging. These days about two-thirds of those earning bachelors degrees borrow some type of student loans. Before taking on any debt including student loans, its important to budget before you borrow. Increasing awareness of your spending helps you to exercise restraint and reduce the need to borrow. Otherwise, many students often treat loan limits as targets because they lack insights into how much student loan debt is reasonable.

To assist in the planning process, its a good idea to use a student loan calculator to estimate what your monthly payments might be based on the amount you might borrow, the interest rate of the loan, the length of the loan repayment period, and your estimated starting salary when you graduate. Although intended as a calculator for Federal Education loans , and most private student loans, many loan payment calculators also work for mortgages, auto loans and other forms of consumer credit.

Total Paid without Prepayment

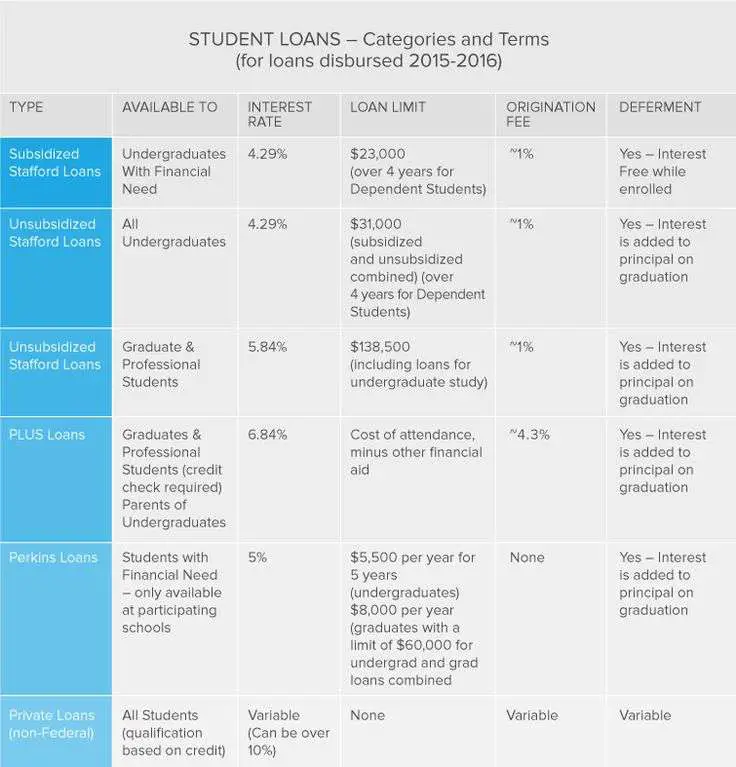

Different Loans For Different Folks

Before getting into the different types of available loan programs, lets do a quick refresher on how exactly student loans work. Like any type of loan , student loans cost some small amount to take out and they require interest and principal payments thereafter. Principal payments go toward paying back what youve borrowed, and interest payments consist of some agreed upon percentage of the amount you still owe. Typically, if you miss payments, the interest you would have had to pay is added to your total debt.

In the U.S.A., the federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options. Federal student loans are unique in that, while you are a student, your payments are deferredthat is, put off until later. Some types of Federal loans are subsidized and do not accumulate interest payments during this deferment period.

Don’t Miss: Usaa Home Loan Credit Score Requirements

When Do I Start Accruing Interest

Student loan interest typically accrues daily, starting as soon as your loan is disbursed. In other words, student loans generally accrue interest while youre in school.

Subsidized federal loans are the exception the government pays the interest that accrues while the borrower is in school, so borrowers generally dont have to start paying interest on subsidized loans until after the six-month grace period.

Is There Any Chance Of Another Student Loan Pause Extension

When announcing the extension to the end of January over the summer, the Biden administration called it a “final extension.” But the White House announced on Wednesday, December 22, that the pause will continue for another 90 days, pushing payments to May, citing the ongoing pandemic and need to further strengthen the nation’s economic recovery.

“We know that millions of student loan borrowers are still coping with the impacts of the pandemic and need some more time before resuming payments,” said Mr. Biden in his statement.

The pause saves 41 million borrowers $5 billion per month, according to a Department of Education news release.

“We are committed to not only ensuring a smooth return to repayment, but also increasing accountability and stronger customer service from our loan servicers as borrowers prepare for repayment,” said Education Secretary Miguel Cardona in the statement.

Several lawmakers have pressed student loan servicers ahead of the deadline to see if they are prepared to help millions of people transition back into repaying federal student loans.

Recommended Reading: Why Isn T My Car Loan On My Credit Report