Whats A Good Interest Rate For A Car Loan

This depends on a number of factors, including the lender you choose, your financial status, the age of the car and your Sometimes environmentally-friendly vehicles can qualify you for a lower interest rate as well.

A good interest rate has no definitive definition, as different interest rates will be more suitable for different people.

What To Know Before Applying For An Auto Loan

When looking for a car loan, it’s best to shop around with a few lenders before making your decision. This is because each lender has its own methodology when approving you for a loan and setting your interest rate and terms.

Generally, your credit score will make the biggest impact in the rates offered. The higher your credit score, the lower APR you’ll receive. Having a higher credit score may also allow you to take out a larger loan or access a broader selection of repayment terms. Choosing a longer repayment term will lower your monthly payments, although you’ll also pay more in interest overall.

If you’ve found a few lenders that you like, see if they offer preapproval going through this process will let you see which rates you qualify for without impacting your credit score.

Is A Lower Monthly Payment Always Better

It’s important to remember that a lower monthly car payment doesn’t necessarily mean that you’ll pay less overall for your loan. That’s because of interest.

In general, the longer the term of your loan, the lower your monthly payment will be. That’s because your repayment is stretched out over a longer number of months. But you’ll pay more in interest if you take out a longer-term loan.

Here’s an example: Say you take out a $25,000 auto loan at 3% interest for a term of 48 months. During your 4 years of payments, you’d pay $1,561 in total interest. If you take that same loan at that same interest rate but extend your term to 60 months 5 years you’d drop your monthly payment by $104 but you’d increase the amount of interest you’ll pay to $1,953.

A shorter-term loan, then, might be a better choice if your budget can handle a higher monthly payment. Youll pay less for your car by taking out a shorter-term loan.

If your financial situation changes, you can investigate refinancing your auto loan. Be aware, though, that refinancing isnt free. Youll have to pay fees, so make sure the reduction in interest rates is worth the costs of a refinance.

Don’t Miss: How Do I Find Out My Auto Loan Account Number

Capital One: Best For Convenience

Overview: Capital One will let you borrow as little as $4,000, but it requires you to purchase the car through one of its participating dealers. In a lot of ways, its financing works as a one-stop shop for your auto loan and vehicle purchase.

Perks: The Capital One Auto Navigator site lets you search for inventory in your area and gives you the ability to see how different makes, models and features will impact your monthly payment. This will give you a lot of information before you head to the dealer. Also, the quick prequalification allows you to check your rate through a soft inquiry, so your credit score wont be impacted.

What to watch out for: You can only use Capital One auto financing to shop at one of its participating dealerships, which makes this a poor option if you find a car you love elsewhere.

| Lender |

|---|

| Late fee |

How Does My Car Loan Term Length Affect My Interest Charge

It is important to realize that your interest rate is not the only factor that affects the total amount of interest charge you pay for your car loan. Your car loan term length plays a major role in how much you pay for your car no matter what interest rate you have. As a general rule, for the same interest rate, the longer your term length, the more your cumulative interest charge will be.

Lets continue the example above to illustrate this principle. Suppose still that you are financing your $12,000 car with a car loan requiring you to pay a 10% interest rate. However, you have a choice between a four year loan and the five year loan that we have discussed so far. The 48 month loan would require monthly payments of $304.35 while the 60 month loan would still require the $254.96 payments. Looking at the monthly payment, you may be tempted to take the 60 month loan because it saves you money every month and this decision is not necessarily wrong. Still you should consider the effect the extra 12 months will have on the interest charges you pay over the course of the loan. Remember, you have to pay 10% interest on the balance on your loan, so the longer you owe money on your car, the more interest you have to pay.

The graph below shows how the interest charges accumulate over the course of each loan.

Also Check: Suntrust Car Loan Rates

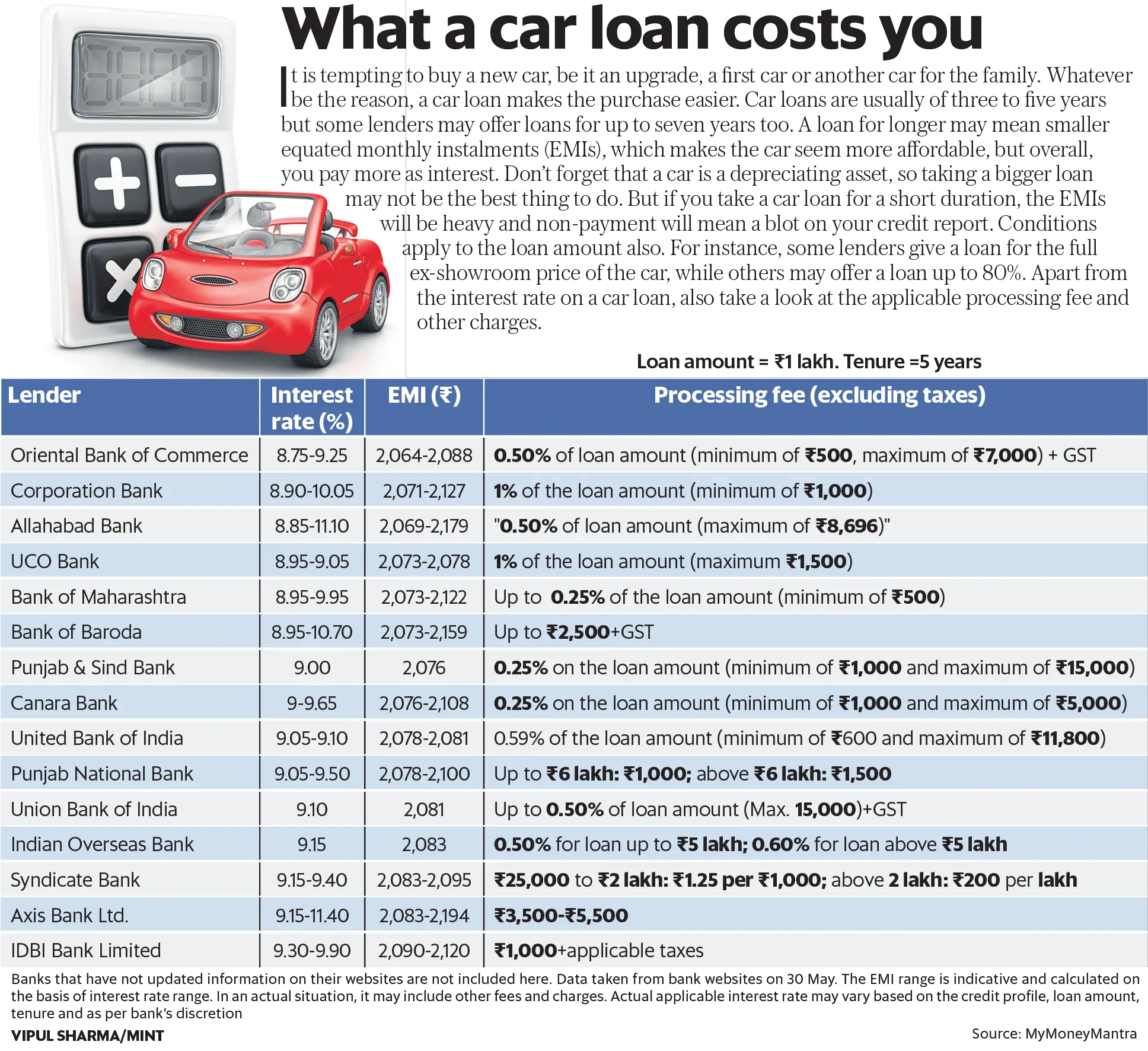

Interest Is What You Pay To Borrow Money From A Lender When You Finance The Purchase Of A Vehicle

Interest charges are included in your monthly loan payment and can add thousands of dollars to the amount you have to repay. Thats why its important to understand how car loan interest is calculated, what factors can affect your rate and how to minimize interest charges.

Help To Protect Yourself During The What

Youre responsible for paying everything thats included in the APR, even if your vehicle is totaled in an accident or stolen auto insurance may not always cover the full amount you owe. GAP insurance may provide you with financial protection if your car is ever totaled or stolen and the insurance settlement amount does not cover the unpaid principal balance due on your loan. That could mean you wont have to roll the unpaid principal balance of the existing loan into the cost of financing a new vehicle. Shop for your loan before you shop for your vehicle to determine available interest rates, APRs and payback periods.

The information in this article was obtained from various sources not associated with State Farm® . While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. State Farm is not responsible for, and does not endorse or approve, either implicitly or explicitly, the content of any third party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. State Farm makes no guarantees of results from use of this information.

Don’t Miss: Usaa Car Loan Reviews

Balloon Payments Can Affect Car Loan Repayments

Its also possible to have your regular repayments reduced through the use of a balloon payment, which is a lump sum owed to the lender at the end of the loan term. These balloon payments can be significant, anywhere between 30-50% of the loan amount, and can be effective for people who want more manageable repayments since the loan principal is being reduced.

Lets look at an example: if you took out a $30,000 car loan for 5 years at 6% interest and had a balloon of $9,000, your monthly payments would be reduced from $579.98 down to $451. At the end of the loan term, you would then have to pay the $9,000 sum left over in full.

| Cost of a $30,000 5 Year Car Loan at 6% Interest Rate | 30% Balloon |

|---|

Balloon payments can cost more over the loan term in interest, however, and you still have to pay that lump sum back at the end, which can catch some people out.

How A Lower Monthly Payment Can Cost You More

One of the most important things to understand about how auto loans work is the relationship between the loan term and the interest you pay. A longer loan term can dramatically lower your monthly payment, but it also means you pay more in interest.

Consider a $25,000 car loan at a 3.00% APR and a 48-month term. Over 4 years of payments, youll pay $1,561 in total interest on the loan. If you extend that same loan to a 60-month term , youll lower your monthly payment by $104but youll increase the total interest you’ll pay from $1,561 to $1,953.

Read Also: Usaa Car Refinance Rates

How Does Interest Work On A Loan

When you take out a loan, interest is calculated on the principal balance the amount youre borrowing. Its usually represented by an APR , which accounts for interest, administrative fees, and points.

The amount of interest you pay is based on the interest rate and length of the loan. Common loan periods for mortgages are 15- or 30-year terms, car loans can be around 60 months, and personal loan periods are of 2-5 years.

The length of your loan

Choosing a shorter loan term can have a pretty significant effect on the amount of interest you pay throughout your loan. Heres an example of a $250,000 mortgage with a rate of 3.75% looks like in two different scenarios:

- 30-year mortgage: Your monthly payments are $1,158 and the total cost of your mortgage is $416,804

- 15-year mortgage: Your monthly payments are $1,818 and the total cost of your mortgage is $327,250.

But heres the other thing about a shorter-term loan: you can usually find a lower interest rate because its less risky and cheaper for banks to lend you money. The downside is that your payments are higher, which leaves less money for other opportunities, like investing or retirement savings, so weigh up the pros and cons.

How payments change over the term of your loan

Your loan payments might stay the same, but how your payment is allocated towards interest and the principal often changes.

Fast facts:

Car Loan Application Process

The entire process of applying for a car loan has been simplified by the banks for the ease of the borrowers. These days right from applying till loan approval and disbursal everything can be done online without any personal visits to the banks. The entire process of the application works in the following way:

- Form fill up– In the very first step, the applicants need to fill up an application form of their desired bank with all the vital particulars such as their personal details and other required credentials.

- Document verification– After the submission of the application, the borrowers are required to upload all the documents mandated by the banks. Since the car is the guarantee in case of a car loan, documents regarding that need to be provided.

- Loan approval– If the bank finds all the document valid and find the borrower to be capable of paying the loan EMIs on time, they will approve the loan amount within a short duration of 2 days.

- Loan disbursal– The loan amount is disbursed to the applicant after a certain time. In other words, the banks provide a certain percentage of the amount that the buyer has invested in buying his/her car.

Read Also: Usaa Auto Loan Rates Used Cars

How To Quickly Secure The Low

We touched on how you needed professional support to get the most preferential interest rates. The only way you can do that in Canada is by going through a local dealership.

You are going to see websites that claim to have the lowest interest rates but these sites cannot hold a candle to what a dealership has available.

The dealerships have been doing car loans for a long time and already have existing relationships with all of the lenders across Canada. Aside from being able to get you a great interest rate, the dealership is going to help you with all of the paperwork which is something the websites wont do.

Should your credit score be well below 680, dont worry, the dealership will still be able to help you get a low-interest rate based on your current situation and also give you advice on how you can quickly raise your score.

This is how you can access the best interest rate car loans in Ancaster, by going through a local dealership, so make it a priority to reach out to one now before rates rise.

If you need help or advice on anything to do with auto loans in Ancaster, contact Car Nation Canada today, we can help!

How Do I Get A Lower Interest Rate On My Credit Card

Your credit score plays a major role in determining the APR on your credit cards because it gives lenders an idea of your lending history. Several factors go into your credit score, but the most important ones are your payment history and amounts owed. Keeping up with your payments and paying off your debts can help you raise your credit score.

But most credit card companies dont just call and say, Hey, want a lower rate!? There are actually scammers that make calls like that.

You can always call your credit card company and ask to have your rates reduced. Its best if you have a good payment history with them.

Recommended Reading: Can You Refinance An Fha Loan

What You Need To Access The Best Auto Loans In Canada

The first thing you need is a good credit score, the consensus amongst industry experts is 680 but aim for 700 for added peace of mind.

If you are not sure what your current score is, you can get access to your score for free by signing up with Equifax or TransUnion.

Your credit score is important, not just for getting a car loan but renting an apartment, buying a house, or even applying for certain types of jobs, so make it a habit to always check your score monthly.

If your score does fall under 680, the most common reason is you either missed a payment/s or are carrying too much debt. In either case, you should make it a priority to always pay your debts on time and reduce the amount of debt you are carrying.

No Social Security Number

Your Social Security Number is given to everyone who works in the U.S. The function of an SSN is to track your income for tax purposes. This document is usually a bonus for lenders, as it not only means that you earn an income but that they can see exactly how much you earn.

Although this is a bonus to lenders, it wont be a deal breaker for all lenders if you dont have an SSN. There are lenders that will give an auto loan to international students without an SSN.

Recommended Reading: Can I Refinance My Sallie Mae Loan

How To Get A Lower Car Loan Interest Rate

Aside from the oft-parroted advice of doing your research and shopping around , you can help yourself to a lower car loan rate by doing some or all of the following:

You might also have heard of 0% car finance, which is a car loan that only requires repayments on the principal without any interest. This might seem cheaper but it usually isnt, since 0% finance deals often come with a higher price tag on the car. If this price is high enough, it can negate any potential interest savings.

How Do These 3 Factors Affect Your Monthly Payment

A lower monthly payment always sounds good, but its important to look at the bigger financial picture: That lower payment could also mean youre paying more for your car over the life of the loan. Let’s see how adjusting each of the 3 factors can affect your monthly payment:

- A lower loan amount. Let’s say youre considering a $25,000 car loan, but you make a $2,000 down payment or negotiate the price of the car down by $2,000. Your loan amount becomes $23,000, which saves you $44.27 per month .

- A lower APR. Consider that same $25,000 car loan and lets assume a 4-year term. One financial institution offers a 3.00% APR and another offers a 2.00% APR. Taking the lower APR will save you $10.98 per month.

- A longer loan term. Extending a $25,000 loan from 4 years to 5 years lowers your monthly payment by $104.14, but, youll end up paying $391.85 more in interest charges over the life of the loan.

Use the Bank of America auto loan calculator to adjust the numbers and see how differences in loan amount, APR and loan term can affect your monthly payment.

Don’t Miss: Which Student Loan Accrues Interest While In School

Your Auto Loan Needs To Work For Your Situation

Lenders will most likely present options for several terms and rates, resulting in different monthly payments. You may be inclined to go with a longer term to get a lower monthly payment, but this will cause you to pay more interest over the life of your loan.

Consider this example: If you take a $30,000 car loan at a 3.50% APR with a 48-month term, you would pay a total of $2,193 in interest. If you extend that same loan to a 72-month term, your monthly payment will be about $208 less, but you will end up paying $3,300 in interest.

In reality, you will need to balance the lowest term possible with the monthly payment that fits your budget. NerdWallet recommends spending less than 10% of your take-home pay on a car payment. With our car payment calculator, you can input various loan amounts, rates and terms to see different payment scenarios. Taking time to understand how car loans work before you buy a car can help you choose the best loan for your budget and situation.

About the author:Shannon Bradley covers auto loans for NerdWallet. She spent more than 30 years in banking as a writer of financial education content.Read more