Who Is My Student Loan Servicer Heres How To Find Out

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Unable To Repay Student Loans

If you cant pay the full amount due on time or have to miss a student loan payment, your loan may be considered delinquent and you may be charged late fees. Contact your loan servicer immediately for help, and ask them about your options.

Learn about COVID emergency relief for federal student loans that has been extended through September 30, 2021.

Sallie Mae: How To Find Your 10day Payoff Amount

472-55436 hours agoYour Sallie Mae account number is a 10-digit number found on your billing statement and usually starts with the number “5”. You can call Sallie Mae directly at 1 472-5543 to get your 10-day payoff information. Your 10-day payoff will be your current Sallie Mae loan balance plus 10 days

Preview / Show more

See Also: Customer ServiceVerify It Show details

You May Like: Can I Use Capital One Auto Loan Anywhere

Nelnet Payment Options Student Loan Payment Helps

888.486.47225 hours ago Via Phone. Call us at 888.486.4722 and make a payment through our automated phone system or with a Customer Service Representative. When you opt in to eCorrespondence, you’ll receive your statements and messages from Nelnet in a more secure way, and you’ll help the environment. Log in to your Nelnet.com account to get started.

Preview / Show more

See Also: Phone Number, Customer ServiceVerify It Show details

Log Into The Fsas Loan Simulator

Once youre logged into the Federal Student Aid website, you can do a lot more than just locate your loans. Among the new tools of Next Gen, the loan simulator is a great one to start with.

Unfortunately, theres no similar tool that plug into all banks and could collect all your private student loans. You can employ our student loan calculators, however, to explore different possibilities and compare outcomes.

If youre considering postponing your repayment to focus on finding a job, for example, you could figure the cost of accruing interest on your debt with this calculator:

Read Also: How To Calculate Home Equity Loan Payment

Student Loan Stats At A Glance

Do you know what is the best way to bog yourself down in a quagmire of debt?

Get yourself a college degree.

The second highest consumer debt category is student loan debt, preceded by mortgages.

Student loan debt in the United States is higher than both auto loans and credit card debt as well.

The average student loan borrower owes $33,000. About 3 million students owe over $100,000. To put that in context, an average new car costs $36,700. You can get a small starter house in most small or mid-sized cities for $100,000.

When its time to start making repayments, shortly after graduation, the average monthly repayment is $300.

Imagine making monthly $300 payments for 6, 10, 15, or 20 years.

Over 45 million Americans dont have to imagine it. Its their everyday reality.

A student loan is a lifelong investment for many. Its as vital a bill payment as rent, a mortgage, or car loans.

If youre embarking on a decades-long journey of monthly student loan repayments, you must know how to find the student loan account information.

Federal Student Aid Information Center

To find out which lenders hold your Stafford, Direct and/or Perkins Loan, contact the Federal Student Aid Information Center.

- STEP 1: Call 433-3243. Listen to the telephone menu and select option ‘3’ and when prompted, say the word ‘LOANS’ to obtain information on your existing student loans and lenders.

- STEP 2: Have your FSA ID ready in order to access your data.

Don’t Miss: How To Calculate Mortgage Loan Payoff

Review Free Annual Credit Reports

The FSA website is the best way to see all your federal student loans, but it wont list any private student debt you might have. To see these student loans, you can request your free annual credit report.

Your credit report will include the following information:

- All the student loans you have, including both private and federal student loans.

- The lender or student loan servicer that holds each loan. You should also be able to see if a student loan was transferred or sold to a new servicer.

- The student loans initial balance and most recent balance.

- Payment history, including any missed payments and the date of the most recent payment on the loan.

While a credit report will likely list all your student loans, there are no guarantees. You might want to pull reports from all three major credit bureaus to be sure no loans are missed.

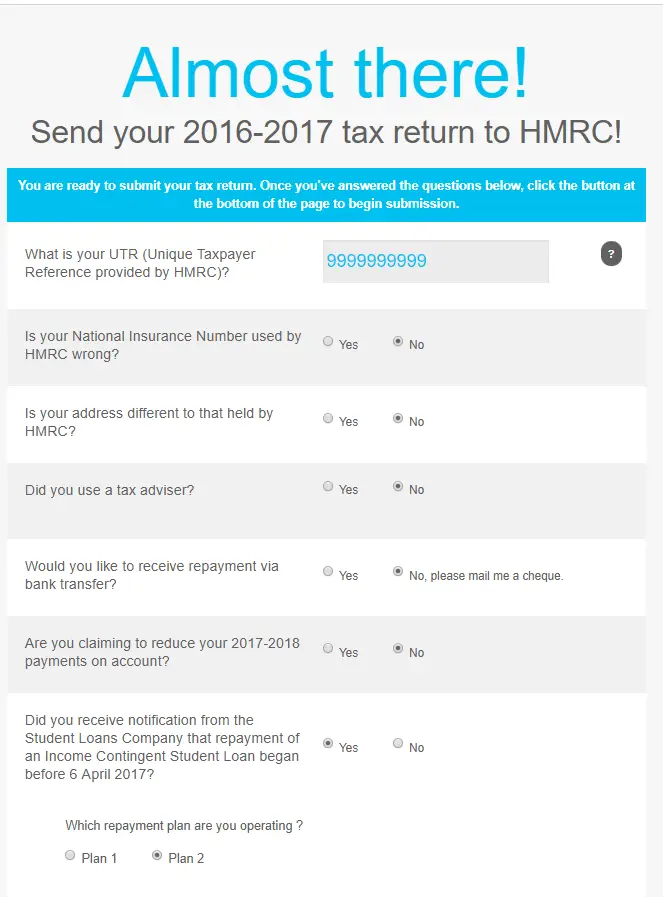

Manage Your Student Loan Balance

Sign in to your student loan repayment account to:

- check your balance

- see how much youve repaid towards your loan

- see how much interest has been applied to your loan so far

- make a one-off repayment

- set up and amend Direct Debits

- tell the Student Loans Company if youve changed your contact details

- tell SLC if youre going overseas for more than 3 months

This service is also available in Welsh .

You can also make one-off repayments towards your student loan, or towards someone elses loan, without signing in.

To sign in youll need your:

- customer reference number or email address

- password

- secret answer, for example your mothers maiden name

If you do not know these, you can reset them using the email address you had when you applied for your loan. Contact SLC if youve changed your email address.

Recommended Reading: How To Transfer Car Loan To Another Person

Recommended Reading: Can I Include Closing Costs In My Fha Loan

What Should I Do After Finding My Loan Servicer

Once you know who your loan servicer is, you can create an account on their site. Youll usually create a username and password and then share relevant information like your full name, address and Social Security number. Youll also likely be asked to create several security questions and answers for your account as well.

Once you are registered, you can connect your bank information and make payments directly from your bank account. You can send checks as well.

Typically, youll get a 0.25% interest rate deduction if you sign up for automatic payments. If youre not interested in autopay, find out if you can sign up for online alerts to be reminded when a payment is due.

Knowing your student loan servicer is more than just knowing who to pay each month its knowing who to turn to if you need to change your repayment terms or apply for deferment or forbearance.

But since student loan servicers dont always give the best guidance, its important to do your own research so you can make the best student loan decisions for you.

Rebecca Safier and Dillon Thompson contributed to this report.

Who Is My Student Loan Servicer

Your student loan servicer is the company that manages your student loans. Essentially, its a third party that acts as a middleman between you and your lender. When you make a payment toward your student loan, it is managed by your loan servicer.

Student loan servicers work with borrowers to help manage their student loan repayment. If borrowers would like to change their repayment plan or apply for deferment or forbearance, they should discuss their options with their loan servicer first.

Borrowers do not choose their loan servicer, but rather, are assigned one. If you have federal student loans, your loan servicer is assigned by the Department of Education.

Below are nine loan servicers that currently manage federal loans, plus an additional loan servicer that deals with default resolution though be aware that this list may soon change.

Originally, the Department of Education had planned to change its roster of servicers in 2020, but while some new contracts have been announced, the only change as of December 2020 has been the departure of former servicer CornerStone.

| Loan servicer | |

|---|---|

| Default Resolution Group | 1-800-621-3115 |

If you have federal student loans, your answer to, Who is my student loan servicer? will be one of the companies on the list above. Note also that your loan servicer can change during the life of your loan, so make sure to check your student loan accounts for the most current information.

Recommended Reading: What Bank Has The Lowest Home Equity Loan Rates

Online Transfers And Payments

You can make a payment by transferring funds from a Wells Fargo deposit account or a non-Wells Fargo account through Wells Fargo Online®.

Sign On to Wells Fargo Online®, select your student loan account then Make a Payment.

It could take 1 2 business days for this payment to reflect on your account. Payments received by Midnight Pacific Time online will be effective as of the date of receipt. If received after Midnight Pacific Time they will be effective the following day.

How To Check Private Student Loans

Unlike with federal student loans, there is no centralized database with all private student loan information.

And private student loans don’t qualify for the current interest-free forbearance. They also aren’t being considered for student loan forgiveness. If you want to lower your payment or repay your private loan faster, consider student loan refinance.

Youll know your loans are through a private lender if you check studentaid.gov or use the other methods mentioned above and cant verify your loans are federal.

If you are not in touch with your lender, one good way to track down your private student loan debt is through your credit report. Pulling a free credit report wont affect your credit score and will give you a list of your debts. Your credit report will show your outstanding balance from the date the information was collected and will tell you which lender owns the debt. Contact the lender listed to get more information on your private student loan.

You can also check with your school. Because student loans are disbursed directly to the college, your schools financial aid office may have a record of where your loan money came from.

About the author:Cecilia Clark is a student loans writer with NerdWallet, where she helps readers navigate the landscape around college finances.Read more

Also Check: How Much Can I Get From Fha Loan

Acs Loan Servicing Problems Where To Find Help

5 hours ago Federal Loans : Log into StudentAid.gov, select “My Aid” in the top right corner, and see who is currently servicing your student loans. Private Loans : Either contact the school that originated the loan, or look on your credit report at AnnualCreditReport.com and see who

Preview / Show more

See Also: Contact Support, Credit Union Services Show details

What Do I Do With My 1098

Youll have one 1098-E for each account listed on your Account Summary.

To file your taxes, you dont need a physical copy of your 1098-E. Check with a tax advisor to determine how much of the interest paid on your student loans in the previous year is tax deductible. If you have more than one account, youll need to look at multiple statements and add the numbers together for your total deduction. Enter the amount from box 1 into the student loan interest deduction portion of your tax return.

If you want a physical copy of your 1098-E for your records, just print it out from our website. Its as easy as that!

You May Like: How Much Can I Borrow Fha Loan

Where Can I Find My Loan Information : :

An important factor in keeping up with your student loan payments is knowing where to find all of your student loan information. StudentAid.gov is the U.S. Department of Educationâs comprehensive database for all federal student aid information. This is one-stop-shopping for all of your federal student loan information.

At StudentAid.gov, you can find:

- Your student loan amounts and balances

- Your loan servicer and their contact information

- Your interest rates

- Your current loan status

To access StudentAid.gov:

Go to StudentAid.gov Have your FSA ID available. This is the same username and password you used to electronically sign your FAFSA. To learn more about the FSA ID, visit studentaid.gov. If prompted, enter your name, Social Security number, your date of birth and your FSA ID. Read the privacy statement. You must accept these terms to use StudentAid.gov. Select âSubmitâ

StudentAid.gov can be a valuable tool for you in keeping track of your student loan information. Checking StudentAid.gov and communicating with your loan servicer will give you the information you need to get back on track for your student loan repayment.

Ready Set Repay is an initiative of the Oklahoma College Assistance Program, an operating division of the Oklahoma State Regents for Higher Education

How To Find Your Student Loan Balance

The dreaded question of every college graduate: How much do I owe in student loans?

Kat TretinaUpdated April 30, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as Credible.

With the typical graduate having up to 12 different federal and private student loans, it can be difficult to keep track of them all. But finding out exactly how much you owe is essential for managing and paying off your debt.

In this post:

Read Also: Why Are Tax Returns Needed For Home Loan

Get The Status Of A Recent Payment

Reservist Status In The Canadian Forces

If you are a reservist in the Canadian Forces on a designated operation you can delay repayment and interest on your student loan.

Complete the Confirmation of Posting Assignment for Full-Time Students form and submit it with your loan application to maintain your interest-free status. Make sure you attach a copy of your notification of posting instructions that you received from the Department of National Defence.

If you need help with this, contact your provincial or territorial student aid office.

Also Check: What Is An Ellie Mae Loan

How Do I Find My Student Loans

The process for finding your loan servicer will be different depending on whether you have federal or private student loans.

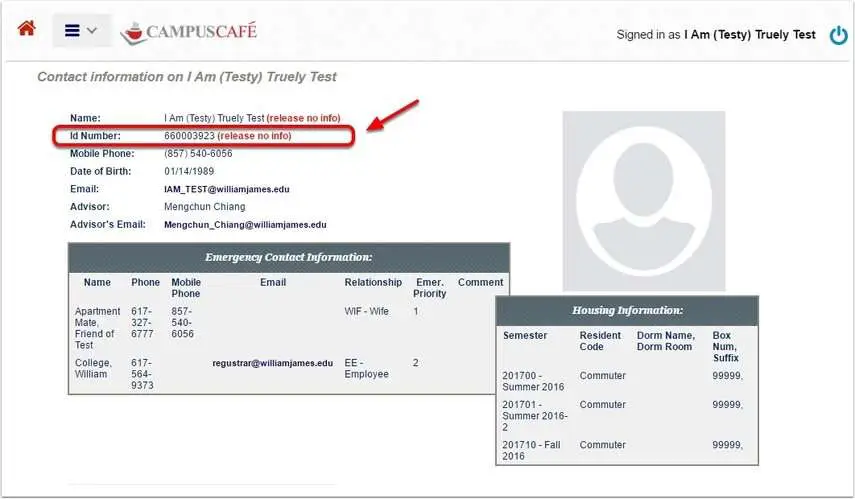

If you have federal student loans, you can find your loan servicer by signing into your Federal Student Aid account. Youll log in with your FSA ID. Once youve accessed your dashboard, youll see your student loan servicer and other details about your loans.

Alternatively, you can find your federal student loan servicer by calling 1-800-4-FED-AID .

Along with identifying your loan servicer, you will also find other information on your student loans, including the type of student loans you have, the loan amounts, interest accrued and outstanding balances.

You May Like: Va Loan Manufactured Home With Land

Customer Service Discover Student Loans

Just NowDiscover Student Loans. Customer Service. PO Box 30947. Salt Lake City, UT 84130-0947 General Correspondence: Customer Service. PO Box 30948. Salt Lake City, UT 84130-0948 Special Delivery : Discover Student Loans. Customer Service.

Preview / Show more

See Also: Customer Service Show details

Recommended Reading: How To Be The Best Loan Officer