What Do I Need To Do To Receive A Military Deferment

If you would like to receive a military deferment during the first 12 months you are eligible, you are only required to submit a verbal request.

After the 12 months, you are required to submit documentation to enter the program. When you’re on active duty, it can be difficult to provide documentation. Having someone act as your Power of Attorney will allow them to complete necessary documentation to make the process smoother and continue your deferment without interruption.

What Is A 1099

The 1099-C Cancellation of Debt is an IRS tax form that lists the amount of debt that was cancelled on your student loans. The IRS treats debt cancellation as income, and Great Lakes is required to report student loan debt cancellation to the IRS. If applicable, you’ll receive a 1099-C from Great Lakes with the amount of debt cancelled on your Great Lakes-serviced loans. You’ll report the amount listed on your 1099-C statement on your federal tax return.

If you have student loan debt with another servicer that was cancelled, they may send you additional 1099-C statements.

Will The Privacy Of Personal Information Be Protected

Yes. Security is a built-in component of the OEN system and of the number itself.

Because the number is randomly assigned, personal information about the student cannot be inferred from it.

In addition, the “check digit” included in the number will identify it as a legitimate OEN.

Access to the data in the OEN system will be strictly limited, and the database containing personal information will be maintained by the ministry in a fully secure environment, protected by the most up-to-date technology.

The information gathered about students will be used only for educational purposes. The ways in which the data will be used must comply with Ontario’s Freedom of Information and Protection of Privacy Act, the Privacy Code of the Canadian Standards Association, and the privacy protection guidelines issued by the government’s Management Board Secretariat. Upholding the letter and the spirit of these laws and guidelines has been a fundamental principle in the design of the OEN system and the information-gathering and -management system it makes possible.

You May Like: What Is Fha And Conventional Loan

How To Prevent And Fix Problems

Write down your FSA IDusername and password on a piece of paper, along with your email address and the answers to your challenge questions. Keep this somewhere safe, or take a picture of it with your smartphone. It is not uncommon for people to forget their username or password, email address or the answers to their challenge questions.

If you have a mobile phone, add your mobile phone number to the FSA ID, as it can help you resolve problems with the FSA ID more quickly.

Loan Servicer For Private Student Loans

If you have private student loans, your loan information wont show up in the NSLDS. Private institutions such as banks, credit unions and online lenders originate these loans and hire loan servicers to manage the accounts much like federal student loans.

To find out who services your private student loan, log in to your lender website or app. You should be able to find details about your loans, including the loan balance, interest rates and loan servicer.

You can also check your credit reports. The loan servicer should be listed next to the account, along with contact information.

Don’t Miss: Does Va Loan Work For Manufactured Homes

How Can I Find My Payoff Amount

When you’re ready to pay off your Great Lakes-serviced student loans, finding the correct payoff amount is easy. Log in to mygreatlakes.org, if you haven’t already, to view your Account Summary, and then view the details for the loan you want to pay off. Choose get payoff amount and enter your desired payoff date to display your payoff amount.

What If There Isn’t Enough Money In My Checking Or Savings Account On My Due Date Or Withdrawal Date

If there’s not enough money in your account to cover your automatic payment, we’ll attempt to withdraw the money twice, just like we would if it were a returned check.

Your financial institution may apply overdraft fees if you don’t have enough money in your account on your due date or withdrawal date. We are not responsible for any overdraft fees assessed by your financial institution. If you have three consecutive failed payment attempts, we’ll automatically deactivate your Auto Pay. If you’re receiving an interest rate reduction for using Auto Pay, you’ll lose the incentive. Depending on the type of loan you have, you may be able to regain this benefit by re-enrolling in Auto Pay.

Don’t Miss: How Do Mortgage Loan Officers Make Money

Returning Of Federal Student Aid

All Federal Student Aid programs are governed by the Higher Education Act . These are known as Title IV Programs.

FSA funds are given with the expectation that the recipient will complete 100% of the semester. In general, the law assumes that a student “earns” federal student aid awards in proportion to the number of days in the term the student completes. When a student fails to complete any course in a given semester, due to either withdrawing or failing, a school must determine how much aid the student is entitled to receive. Any funds determined to be unearned must be returned the FSA program. This may result in the student owing money to the college.For example: If a student completed 30% of the semester, then 30% of the federal aid originally awarded is “earned”. This means that 70% of the student’s scheduled or disbursed aid remains must be returned to the FSA programs. Federal aid that must be returned is referred to as “unearned”.

A student must complete more than 60% of the semester to earn 100% of the federal aid awarded. This does not mean the student will be entitle to all the federal aid awarded if the student withdraws before aid has been disbursed.

Face Masks Are Required Inside All College Buildings

All employees, students and visitors must wear face masks inside college buildings. This applies to everyone, regardless of vaccination status. Face masks are mandatory at all campuses indoors, regardless of COVID vaccination status. They can be voluntarily removed outdoorsregardless of vaccination statusor inside when eating, drinking.

Recommended Reading: Usaa Rv Loan Calculator

How Nslds Knows Your Student Loan Balances

The NSLDS receives information for its database from a variety of sources, including guaranty agencies, loan servicers, and other government loan agencies. When you enroll in a college or university, the school also sends information, including any student loan debt you took on, to the NSLDS. It notes when you took out the loan, when it was disbursed, when your grace period ended, and when you paid it off.

The NSLDS is useful because it gives a total picture of your federal loans at once, so you know right away how much federal debt you have. However, it doesn’t include any information about your private student loans.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: How To Get Loan Without Proof Of Income

What Is A Student Loan Servicer

A student loan servicer provides you with the tools and resources you need to successfully manage your loanfrom the point your first loan amount is disbursed through your school, to the point you’ve entirely paid off your loans. At Great Lakes, our servicing role includes:

- Keeping you up-to-date with information about your student loans.

- Monitoring your school enrollment and status while you’re in school.

- Assisting you as you pay back your loans.

- Helping you find the best repayment plan for your budget.

- If consolidation is right for you, guiding you to complete the application where you’ll be asked to choose one of the U.S. Department of Education’s consolidation servicers, of which, Great Lakes is one of them.

to share your thoughts with us. Your input helps us make changes to mygreatlakes.org that will benefit you and all of our customers.

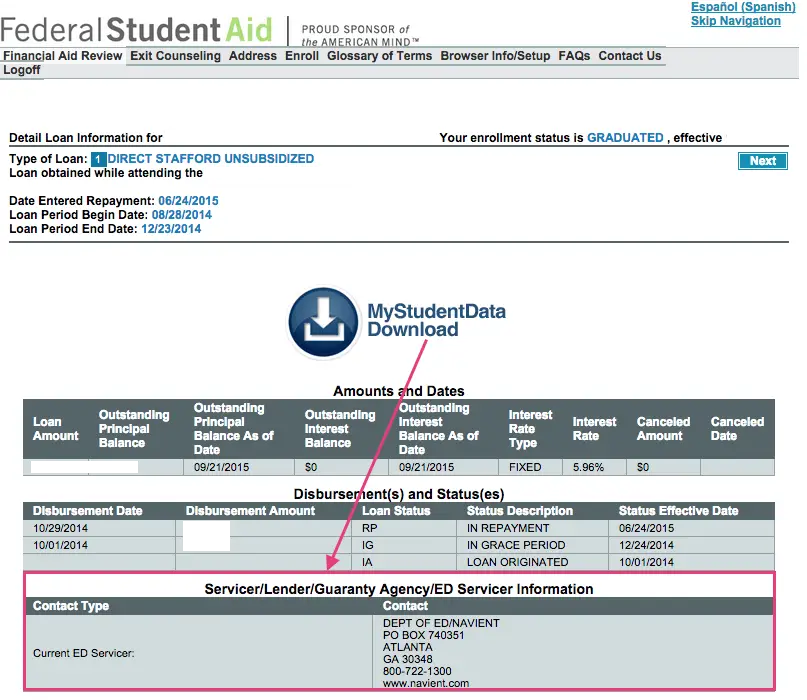

Where Can I Find My Loan Information : :

An important factor in keeping up with your student loan payments is knowing where to find all of your student loan information. StudentAid.gov is the U.S. Department of Educationâs comprehensive database for all federal student aid information. This is one-stop-shopping for all of your federal student loan information.

At StudentAid.gov, you can find:

- Your student loan amounts and balances

- Your loan servicer and their contact information

- Your interest rates

- Your current loan status

To access StudentAid.gov:

Go to StudentAid.gov Have your FSA ID available. This is the same username and password you used to electronically sign your FAFSA. To learn more about the FSA ID, visit studentaid.gov. If prompted, enter your name, Social Security number, your date of birth and your FSA ID. Read the privacy statement. You must accept these terms to use StudentAid.gov. Select âSubmitâ

StudentAid.gov can be a valuable tool for you in keeping track of your student loan information. Checking StudentAid.gov and communicating with your loan servicer will give you the information you need to get back on track for your student loan repayment.

Ready Set Repay is an initiative of the Oklahoma College Assistance Program, an operating division of the Oklahoma State Regents for Higher Education

Don’t Miss: Which Bank Is Best For Construction Loan

Keep Track Of Your Loans

The National Student Loan Data System is the U.S. Department of Educations comprehensive database that helps federal student loan borrowers find information about their loans including:

- Loan amounts disbursed and current balances

- Schools attended and their contact information

- Your student loan holder and contact information

- Grace period details

- Loan interest rate

To access the NSLDS, youll need your federal FSA ID, the same ID you used when completing the FAFSA.

Lost your FSA ID? If youve forgotten your FSA ID username or password, you can retrieve it from the Federal Student Aid FSA ID website. You can retrieve the FSA ID using the email or phone number you provided when creating the FSA ID or answering the Challenge Questions.

Print the Loan Tracking Worksheet to record details of your loans. If you don’t know who the lender or servicer is and you don’t have a coupon book or bill for these loans, access your to see who is reporting outstanding loans in your name.

Can I Set Up Auto Pay To Withdraw More Than My Regular Monthly Payment

Yes, you can increase your Auto Pay amount at any time on mygreatlakes.org. When youenroll in Auto Pay, you can specify an additional amount to be withdrawn each month. If you’re already enrolled in Auto Pay, you can modify your monthly payment amount. This is a great way to pay your loan off more quickly.

Also Check: How To Refinance An Avant Loan

How Will My Loan Funds Be Used

Your loan funds must be used to pay educational expenses, which include tuition, room and board, books and school supplies, fees, equipment and room materials, and travel and miscellaneous expenses. When your loan funds are disbursed , your school will generally apply your loan funds first to any charges you owe the institution, and any remaining funds will be sent to you directly.

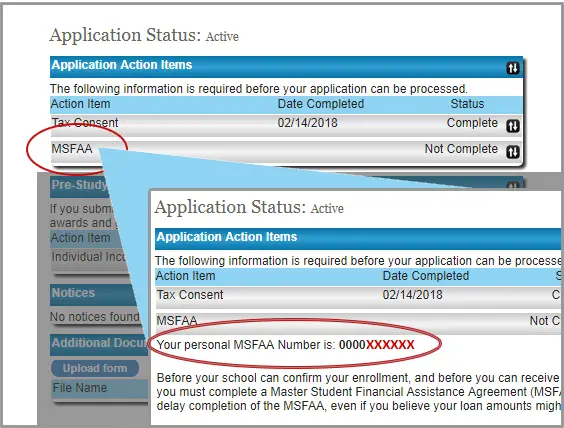

Track Your Financial Aid Status

The Office of Financial Aid will contact you if additional documentation is needed. You can track your Financial Aid Status from your MyECC portal by clicking on the Financial Aid Self-Service link or you may access it directly at Financial Aid Self-Service link. Here you will find a financial aid checklist of items to be completed, as well as links to helpful resources.

Don’t Miss: Usaa Car Loans Credit Score

Why You Should Track Your Student Loans

While it might seem complicated, it is essential to keep track of your student loans and the amount of debt you owe, including knowing how much you borrowed and how much you owe once you add interest. This can be helpful while you are in college, and as you start your budgeting process after graduation. Many options exist for repayment plans, including the following:

- Standard plans: Payments are calculated to guarantee loans are paid off within 1030 years.

- Graduated plans: These are designed to ensure loans will be repaid within a certain amount of time, but payments will increase gradually over time.

- Income-based: These repayment plans calculate your monthly payments based on how much you earn, with higher wages equaling higher payments.

Once you have a solid number to start with, you can begin to create a repayment plan to get rid of that debt as quickly as possible. You can develop a repayment plan that works for your salary and lifestyle and pays down the debt quickly to save you money over time. You can always contact your loan servicer to update your payment plan if your situation changes. This does not have a negative impact on your credit.

How To Get Help With Fsa Id Problems

If you encounter problems with the FSA ID, call 1-800-557-7394 .

You can also contact the Federal Student AidInformation Center , which is sponsored by the U.S. Department of Education, by calling 1-800-4-FED-AID or clicking on the Chat with Us button. Do not send username or passwordinformation by email, as it is not secure.

Read Also: What To Do If Lender Rejects Your Loan Application

How Do I Know If I’ll Receive The 1099

If applicable, you’ll receive a letter notifying you of the amount of debt that was cancelled on your Great Lakes-serviced student loans and a paper 1099-C statement by the end of January 2021. If you received loan forgiveness by applying for certain forgiveness programs, disabilities, or Borrower Defense to Repayment, you may receive form 1099-C.

Can I Change The Day That Auto Pay Withdraws Money From My Account

We withdraw money from the checking or savings account you select on your payment due date. You canselect a new payment due date for eligible Great Lakes accounts. If your loans don’t have a payment due, you can select which day of the month you want Great Lakes to withdraw money from your checking or savings account.

Read Also: Jp Morgan Chase Lien Release Department

New York State Aid Programs

New York State has several programs designed to help eligible state residents secure the funds to finance their post-secondary education.

Minimum Academic Standards

The following chart outlines the minimum academic requirements for receipt of all New York State Aid programs:

* Applicable to students in a four-year degree program.

Pursuit of a Program

Program pursuit must be determined independently from satisfactory academic progress. Satisfactory program pursuit is defined as receiving a passing or failing grade in a certain percentage of a full-time course load in each term for which an award is received. The percentage increases from 50 percent of the minimum full-time course load in each term of study in the first year for which an award is received to 75 percent of the minimum full-time course load in each term of study in the second year for which an award is received, to 100 percent of the minimum full-time course load in each term thereafter.

Repeating a Course

If a student repeats a course for which previous credit has been earned of a D- grade or better, it is not counted as part of a full-time load for TAP purposes or as part of the required part-time load for APTS unless required by curriculum.

Loss of State Aid

Students failing to meet the Satisfactory Academic Progress or Program Pursuit requirements will be denied aid the following semester . For example, students who do not meet the standards in the Fall semester will be decertified for the Spring semester.

Finding Your Federal Student Loan Balances

You can always access student loan information through your My Federal Student Aid account, where you can find your federal student loan balances under the National Student Loan Data System . This is the U.S. Department of Education’s central database for student aid, and it keeps track of all your federal student loans.

You’ll need a Federal Student Aid ID username and password to log in to the site. The ID serves as your legal signature, and you can’t have someonewhether an employer, family member, or third partycreate an account for you, nor can you create an account for someone else. The NSLDS stores information so you can quickly check it whenever you need to, and it will tell you which loans are subsidized or unsubsidized, which is important because it can determine how much you end up paying after graduation.

If your loans are subsidized, the U.S. Department of Education pays the interest while you’re enrolled in school interest accrues during that time with unsubsidized loans. To qualify for a subsidized loan, you must be an undergraduate student who has demonstrated financial need. Unsubsidized loans are available to undergraduate, graduate, and professional degree students, and there are no financial qualifications in place.

Recommended Reading: How Much Car Loan Can I Afford Calculator

Verify Status In Apache Access

An email or, in some cases, a letter from Tyler Junior College Financial Aid Office will direct students to Apache Access after TJC has received the student’s FAFSA. Students must know their student ID number to log into Apache Access.

After logging into Apache Access, click on the Financial Aid icon. Then click on the Financial Aid Traffic Light icon. This will take you to the Financial Aid Traffic Light menu. This screen will always give you your financial aid status at a glance. Any YELLOW lights require student action.

Students who are beginning the processing will need to complete the steps as follows:

Students should also activate their Apache Access Student email to receive additional information from Financial Aid. Financial Aid only uses the student TJC email address to communicate with students.

Deadline to submit ALL verification requirements*:Fall Classes: June 1These days are for step 1. See FAFSA deadlines above.

*Both 1st Step & Student Requirement light must be GREEN