Public Service Loan Forgiveness

If you work a full-time job for a U.S. federal, state, local, or tribal governmentor a not-for-profit organizationyou could be on your way to student loan forgiveness. You’ll need to make 120 payments, which don’t have to be consecutive, to qualify.

This option isn’t for the recent graduate because it takes at least 10 years to earn. You’ll need to have a federal direct loan or consolidate your federal loans into a direct loan.

This program has been plagued by problems. The government created the PSLF program in 2007, and when the first borrowers became eligible for forgiveness in 2017, a significant controversy emerged. A year after the first round of borrowers gained eligibility, almost all of their applications had been denied. Many borrowers were being denied the forgiveness they had earned over technicalities. Some discovered their loan servicers had misled them about their eligibility. As of June 2021, only 5,500 borrowers had gotten their loan balances discharged under the program.

Temporary Expanded Public Service Loan Forgiveness might help you if your Public Service Loan Forgiveness application was denied. TEPSLF grants qualifying borrowers the forgiveness they were denied under PSLF, but only until the program runs out of funds.

If You Are Seeking Public Service Loan Forgiveness

The automatic forbearance wont undo your progress toward Public Service Loan Forgiveness, or PSLF. As long as you are still working with a qualifying employer, months spent in forbearance will count toward PSLF.

Making payments during the automatic forbearance won’t get you ahead on payments. You’re in the same boat whether you pay or not.

Under normal circumstances only full payments count. You also wont lose credit for the payments you already made.

Log On Your Student Loan Account

The federal government outsources student loan management to several different companies, and you may have student loans with multiple providers. If you already know who your student loan servicers are, you can log on to their websites to view your total balance. The balance may be listed on your most recent statement or on the main dashboard.

If youre having trouble finding the balance, contact the customer service department and ask them where to look.

Once youre logged in, you can view your total balance. Your balance may change throughout the month if your loans are deferred, and the lender is still charging you interest during this time.

You May Like: How To Find Student Loan Number

Also Check: What Credit Score Is Needed For Usaa Auto Loan

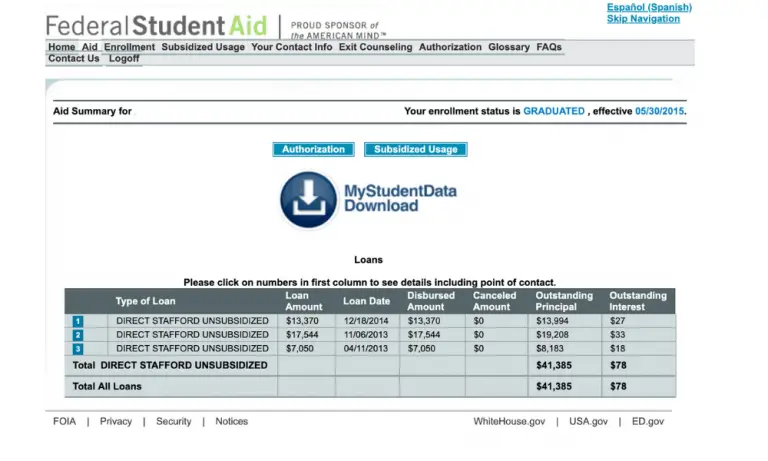

Federal Student Loan Balance

To review your loan history, click on the LOANS Tab . On the dashboard itself, as you scroll down the page, you can view all the information on

Sign in to your student loan repayment account check your balance, make regular or one-off repayments, or let SLC know if your details have changed.

3:21CU Boulders Office of Financial Aid shows you where to find your total loan balance, loan servicer contact Oct 12, 2017 · Uploaded by CU Boulder Office of Financial Aid

If you are a recipient of loans or grants then your record will be viewable in the National Student Loan Data System. Check if you may be

If You Want To Pause Payments

You don’t have to do anything to get a forbearance to stop student loan payments. Interest wont continue to accrue, as it normally would.

A forbearance could give you breathing room to address other financial concerns.

If you are jobless or working reduced hours, a forbearance may free up cash to pay the rent and utilities or grocery bills. Even if your pay is unaffected, a forbearance could help you divert some money toward building an emergency fund or help you pay another, more pressing debt.

Usually forbearance is granted at the discretion of the servicer and interest will continue to build. In this case, the Education Department instructed all servicers to automatically place all loans into a forbearance without interest.

Also Check: Rv Loan Rates Usaa

How To Repay Your Student Loan

Your student loan is taken out of your salary once you earn over £26,575 a year, £2,214 a month or £511 a week before tax.

You repay 9 percent of anything you earn over this amount.

How much you repay isnt based on the total amount you owe, it is based on how much you earn.

For example, someone who earns £2,600 a month will repay £34 every month but someone who earns £3,200 will repay £88 a month. It doesnt matter how much these people owe.

Plan 2 loans, which are for those who started their course in the UK after September 1, 2012, are wiped 30 years after the April you were first due to repay.

When Plan 1 loans get written off depends on where you are from and when you took out the loan it could be when you are 65 years old, or 25 or 30 years after you were first due to repay.

This means you dont need to pay the full amount back if you dont manage to by them, and your student loan does not affect your credit rating.

If someone with a student loan dies, the loan will be cancelled.

If you claim certain disability benefits and can no longer work because of illness or disability, you may also be able to cancel your loan.

If You Declare Bankruptcy

If you declare bankruptcy, you still have to pay your OSAP loan. This means you must continue to make a regular monthly payment.

Apply to the Repayment Assistance Plan if you cant make these monthly payments.

If youve been out of studies for more than five years, you can ask a bankruptcy court to have your OSAP loan included in your discharge. Contact your bankruptcy trustee for help.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

If Youre Behind On Your Student Loan Payments

Payments are automatically suspended for all borrowers, including those who were more than 31 days delinquent prior to March 13, 2020, or became more than 31 days delinquent soon thereafter. That means the loans are in forbearance and wont default.

Default on federal loans happens when a payment is 270 days past due, sending your loan to collections and exposing you to damaged credit, garnished wages and seized tax refunds.

For borrowers in loan rehabilitation, each month of the original forbearance period and the extension through January 2022 would also count toward the nine months needed for rehabilitation.

For those with federal student loans in default, all collection activities are suspended for as long as the forbearance lasts. You can get a refund for any forced student loan payments made since March 13, 2020. If your tax refund was seized before March 13, 2020, it will not be returned.

If your loans were already in forbearance, any interest that already accrued will still be added to your loan principal when your repayment begins, but during the current waiver no new interest will be calculated.

If Your Income Has Changed

If you experience a change in income and still want to keep your payments going, the best way to lower your payment to something more affordable is to apply for income-driven repayment. Youll get a new payment that is based on your family size and a percentage of discretionary income, and it will be in effect even after relief has expired. You can apply online at studentaid.gov.

If you are already enrolled in an income-driven plan, make sure to update your income if it has changed due to the economic downturn.

Don’t Miss: Loan Processor License California

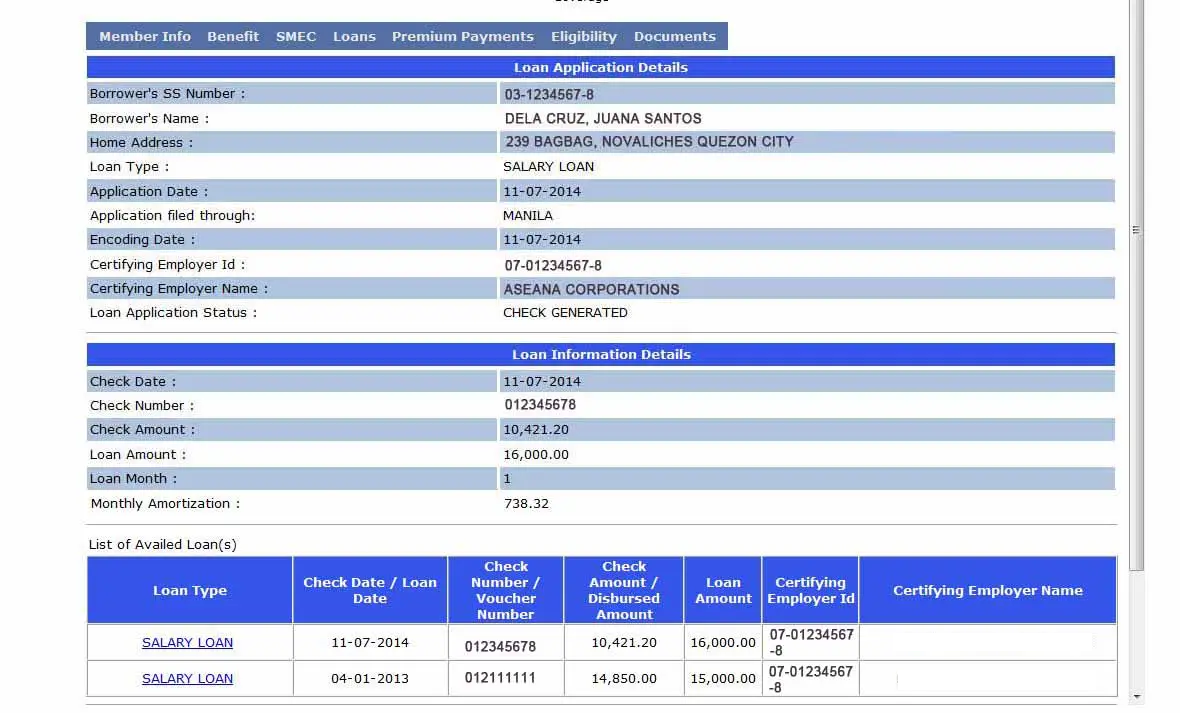

Get A Loan Out Of Default

| Loan | ||

|---|---|---|

| The collection agency listed on your collection notice |

You can confirm which collection agency holds your account by calling: |

|

| Ontario Student Loans | The collection agency listed on your collection notice | You can confirm which collection agency holds your account by calling the Account Management and Collections Branch, Ministry of Finance: |

Learn how you could be eligible for financial relief and how the deferral may apply to your debt.

How To Figure Out Your Total Student Loan Balance The

Feb 4, 2020 Use your My Federal Student Aid account or the National Student Loan Data System to find out how much you owe in federal loans and visit

Jun 23, 2021 You can find information about your student loans, including your balance, through the U.S. Department of Education for federal loans,

Read Also: How To Transfer A Car Loan To Someone Else

Teacher Loan Forgiveness Program

Student loan forgiveness for teachers is neither generous nor easy to qualify for. Teachers can have up to $17,500 of their federal direct and Stafford student loans forgiven by teaching for five complete and consecutive academic years at a qualifying low-income school or educational service agency. Loans that were issued before October 1, 1998, are not eligible.

You must be classified as a highly qualified teacher, which means having at least a bachelor’s degree and having full state certification. Only science and math teachers at the secondary level, and special education teachers at the elementary or secondary level, are eligible for $17,500 in forgiveness. Forgiveness is capped at $5,000 for other teachers.

You can qualify for both teacher and public service loan forgiveness , but you can’t use the same years of service to be eligible for both programs. So you’d need 15 years of teaching service to qualify for both programs, along with meeting all the specific requirements to earn each type of forgiveness.

Different Loans For Different Folks

Before getting into the different types of available loan programs, lets do a quick refresher on how exactly student loans work. Like any type of loan , student loans cost some small amount to take out and they require interest and principal payments thereafter. Principal payments go toward paying back what youve borrowed, and interest payments consist of some agreed upon percentage of the amount you still owe. Typically, if you miss payments, the interest you would have had to pay is added to your total debt.

In the U.S.A., the federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options. Federal student loans are unique in that, while you are a student, your payments are deferredthat is, put off until later. Some types of Federal loans are subsidized and do not accumulate interest payments during this deferment period.

Recommended Reading: What Is A Student Loan Account Number

Manage And Repay Student Loans

May 17, 2021 To ensure your payments are manageable, find out about selecting repayment plans. Or, learn how to contact your loan originator to address

Your profile will provide personalized information like your federal student loan balance, disbursement dates and contact information.

Feb 12, 2020 How much do you still owe in student loans? Take these steps to find out.

How Do I Check My Help Debt

Your myGov account will show you how much you owe and any repayments you have made.

If you don’t have a myGov account, you can set one up following the instructions on the ATO website or you can call the myGov helpdesk on 13 23 07 .

The myHELPbalance portal will show your available HELP balance .

myHELPbalance portal does not:

- show how much you owe,

- show loan fees or indexation on your debt, or

- include any debts incurred before 2005.

You will need your Commonwealth Higher Education Student Support Number , a student ID from any university, higher education provider or VET Student Loans provider you have studied at, and your first name, last name and date of birth to access myHELPbalance.

A CHESSN is a unique identifying number. It is important that you only have one CHESSN.

You can find your CHESSN on your Commonwealth Assistance Notice , given to you by your university or higher education provider or VET Student Loans provider.

If you can’t find your CAN or CHESSN, ask your provider.

Please note, if you have been given a provisional CHESSN by your provider, you will not be able to use a provisional CHESSN to access myHELPbalance. You will only be able to view your HELP balance once your provider has submitted your enrolment information to the Department, and the Department has verified that information, including your CHESSN. This may take up to two weeks after the census dates of units of study you are enrolled in.

Read Also: Usaa Rv Financing

If You Want To Continue Making Payments

Borrowers might want to continue making payments on federal loans if they want to pay down their debt faster.

If you do continue making payments, you won’t pay any new interest on your loans during the forbearance. This 0% interest rate will save you money overall, even though your payment won’t be lower.

The full amount of your payment will be applied to the principal balance of your loan once all interest accrued prior to March 13 is paid.

-

Those sticking to a standard repayment timeline could consider making payments. You likely won’t have much outstanding interest and additional payments can help you chip away at your principal during the break. To preserve your flexibility, we suggest opening a savings account and banking those monthly payments, then making a lump-sum payment against your highest-interest loan when repayment begins.

-

Borrowers enrolled in income-driven repayment or planning to do so shouldn’t bother making payments now if the ultimate plan is to pay until the loans are forgiven usually 20 or 25 years. If you want to pay off your loans sooner, then paying now could help you lower the total interest you owe on top of your principal.

-

Borrowers seeking Public Service Loan Forgiveness do not need to make payments until at least Feb. 1, 2022. The months of automatic forbearance will count toward the 120 payments needed for forgiveness.

Contact your loan servicer with any questions about continuing or restarting payments during the forbearance period.

Should You Refinance Or Consolidate To Simplify Repayment

Staying on top of all your loans is like a part-time job. You have to keep tabs on your borrowed amount, interest rate, due date and the minimum amount due every month.

To streamline your payments, you might want to think about consolidating or refinancing your loans.

Federal Loan Consolidation

A federal direct consolidation loan brings all your federal loans together into one easy-to-manage loan. Your interest rate is fixed and averaged out between all your loans, then rounded up to the nearest one-eighth of a percentage point. This is only available for federal student loans private student loans arent eligible.

You should consolidate if:

- You have many different loan servicers.

- You want to enroll in an income-driven repayment plan or Public Service Loan Forgiveness , and you must consolidate certain loans to make them eligible.

- You want to lower your payments. Repayment terms on consolidation loans stretch up to 30 years.

You should skip consolidation if:

- You want to pay off your loans sooner.

- You want a lower interest rate.

- You have interest rate discounts or other repayment perks with your current lenders.

- Youre already on track for an IDR plan or PSLF consolidation will restart your clock on these programs.

Read Also: How To Transfer Car Loan To Another Person

Extend Your Grace Period By Another Six Months If You:

You make loan payments to the National Student Loans Service Centre, not to OSAP.

Your payments are based on a 9 ½ year pay-back schedule. This pay-back schedule is the average amount of time it takes to pay back an OSAP loan.

You can make payments on your loan at any time to repay it faster.

Get repayment assistance:

If youre having trouble repaying your loan, you might be able to get repayment assistance.

If you have a severe permanent disability and you cant attend work or school, you can apply for the Severe Permanent Disability Benefit. Contact the National Student Loans Service Centre.

Extend your repayment period:

You can lower your monthly payments by extending your repayment period from 9 ½ up to 14 ½ years. Log in to your National Student Loans Service Centre account.

Determining Your Private Student Loan Balance

There are two ways to find out how much you owe in total private loans. You could call your school’s financial aid office and request a list. But if you attended more than one school — say if you have undergrad and grad school loans — you’ll need to contact all of the different educational institutions you attended.

You could also check your credit report, which will list your total outstanding debt balance for all your loans. You can get a free copy of your credit report from each of the three major credit reporting agencies . You’re entitled to one free credit report each year from each of these reporting agencies and can request that report at AnnualCreditReport.com.

Read Also: What Car Loan Can I Afford Calculator

How To Check My Student Loan Balance

As much as it isnt nice to hear that you are in tens of thousands of pounds debt, it is important to know how much you owe the Student Loans Company.

Ready to rip off the plaster? Log in via Gov.uk to manage your student loan balance.

If you applied for student finance via the Student Awards Agency for Scotland , you need to log into the SAAS portal.

You will need your customer reference number or the email address you signed up with.

You will also need to log in with a password and a secret answer.

How To Find Your Private Student Loan Balance

Because the NSLDS is only for federal loans, your private student loans wont show up in the database. If you refinanced any federal loans, those wont show up either because once you refinance your student loans, they become private loans.

To find any private student loan balances :

Don’t Miss: Usaa Auto Loan Approval Odds