Can You Pay A Car Loan With A Credit Card

With payment plans, buying a car can be a reasonably affordable venture. The average monthly payment for a new car is around $480, according to Experian Automotive. A used car, on the other hand, will set you back around $360 a month. But what if you want to pay your car loan with a . Is that possible? The short answer is yes but the longer answer is more complicated. Allow us to explain.

Need a balance transfer credit card? Find the best one for you here.

Will I Definitely Be Prequalified

Sometimes the information requested by this tool isn’t enough for us to provide a prequalification amount. Something as simple as an address inconsistency or a freeze on your credit may prevent us from being able to give an immediate response. If that happens, we’ll provide you with the resources you need to connect with a dealer in our network who can work with you to find a car and financing that work for your budget.

How To Make A Jpmorgan Chase Bank Mortgage Payment

Learn your options for making a JPMorgan Chase mortgage payment. Mortgages 101

When paying off mortgage principal and interest, making timely payments is critical to protecting your credit. JPMorgan Chase, the servicer of Chase home loans, makes it easy with a variety of payment choices. Read on to learn about your options for making a mortgage payment with Chase.

Don’t Miss: Does Va Loan Work For Manufactured Homes

What Apr Does Chase Auto Finance Offer On Its Car Loans

Chase Auto finance offers a fixed apr car loan product that ranges from 2.99% APR up to 24.99% APR.

Your APR can vary depending on several factors, such as your credit score. Find out what your credit score is and whether there is any false or inaccurate information in your credit history with these credit monitoring tools.

Are There Any Limitations

Any financing will require an application and be subject to Chase’s then-current underwriting standards including but not limited to, income, credit, ability to repay, and collateral requirements. If you decide to apply for Chase financing, Chase will obtain a new credit report after receiving your completed application for credit.

Recommended Reading: What Car Loan Can I Afford Calculator

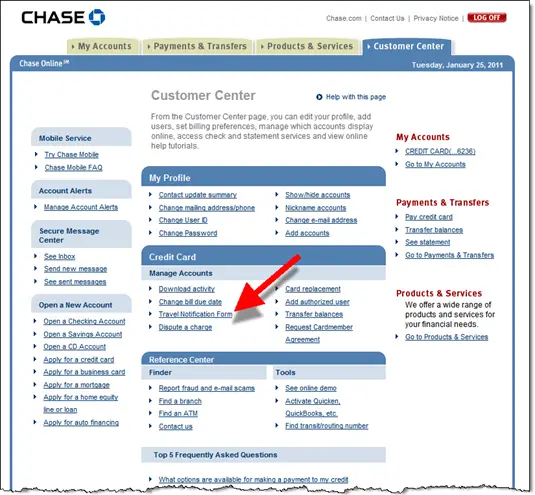

Change An Automatic Payment

Its easy to update your credit card payment on the go. Heres how:

Chase Online Bill Pay: Must enroll in Chase Online Banking and activate Online Bill Pay. Certain restrictions and other limitations may apply.

Chase Mobile® app is available for select mobile devices. Enroll in Chase Online or on the Chase Mobile® app. Message and data rates may apply.

My Chase Plan And My Chase Loan: What They Are And How They Work

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Ideally, you pay your credit card balance in full each month to avoid interest charges but unexpected expenses happen. Chases two “flexible financing offers,” which launched in 2019, give cardholders additional choices when they have a balance to repay.

These offers may not be available on all Chase cards at all times, and they do come with fees or interest, so it’s worth and comparing them to alternatives.

» MORE:

My Chase Plan is in some ways similar to and elements of a . My Chase Plan allows you to repay a purchase of $100 or more in equal monthly payments for a set monthly fee. The monthly fee is based on factors including the purchase amount and the length of time you have to pay off the purchase. Plans can range from three to 18 months, and you can have up to 10 active or pending plans on your account at one time.

» MORE:

» MORE:

The lowest amount you can borrow with My Chase Loan is $500, and the maximum amount depends on factors like your monthly spending and creditworthiness. Your loan wont take up your entire credit limit, however. Youll still be able to use your card for purchases.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

How The Penalty Fees Work

Several online complaints forums stated Chase Auto Finance assesses fees for late payments, insufficient funds and repossession charges. When we spoke to customer service, they did not disclose the exact amount of the fees. They explained that the fees are dependent upon the individual customers loan. The only fee we found information on was the loan origination fee.

- Loan origination When customers qualify for a loan with Chase Auto Finance, the company charges a fee of $75.

How To Get A Chase Mortgage Loan

Although Chase Bank personal loans including personal loans for bad credit dont exist, the bank does offer one of the most important types of loans you might need: a home loan. If youre interested in a Chase mortgage loan youll need to follow the same steps plus a few extra outlined earlier to apply. You can work with a Chase banker or begin the prequalified application online.

If you want to apply for a loan with Chase and get prequalified, visit the Chase Bank website. Applicants in California and Michigan can file a written loan application to receive a copy of Chases loan evaluation criteria.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Chase Mortgage Payment Fees

Making a mortgage payment to Chase is free. You can incur a late fee, however, if you dont pay on time. The late fee amount is listed on your statement and is based on your loan amount, property location and the rates found in your agreement.

Although your Chase mortgage rate wont increase because of a late payment, Chase might report the lack of payment if its late by 30 days or more. Cutoff times for payments are 7:30 p.m. EST for payments made online from a Chase account and 8:30 p.m. EST for payments made online from a non-Chase account.

Chase might also charge you a non-sufficient funds fee of $0 to $25 if your payment is returned due to lack of funds.

Get Ready For Your Next Adventure

Industry Reviews and Awards

Subaru Guaranteed Trade-In Program1

1Guaranteed Trade-In Program Value may be combined with other offers. Customers must take delivery of any new previously untitled Subaru vehicle from a participating retailer inventory by the value expiration date. Only one trade-in offer per new Subaru vehicle purchased. Current GTP Values are for 8 years from the original vehicle warranty start date. Trade-in values are updated monthly. Vehicle values are based on the vehicle conforming to stated condition and mileage criteria found in the Rules and Eligibility section.

Subaru Vehicles

Also Check: Refinance Car Usaa

What We Love About Chase Auto Loans

Chase offers competitive interest rates on auto loans and has a low bar for eligibility. Consumers can get a loan with a fair credit score or higher, and there are no public income requirements listed. Chase doesnt require an application fee and, in most states, has no origination fee. As with several other auto lenders, it doesnt have a prepayment fee for those who choose to pay the loan off early.

What To Watch Out For

- No private party purchases. You can only use a Chase auto loan to buy a car from a dealership.

- Long turnaround. It can take up to three days to get preapproved through Chase many lenders can preapprove you in minutes.

- Potentially more expensive. If you choose not to make a down payment, youll end up paying more in interest and could have higher monthly repayments.

- Little information online. Its hard to find basic information about rates, terms, loan amounts and eligibility without applying to prequalify.

- Doesnt offer short loan terms. The shortest term length for a Chase auto loan is 48 months, so interest can add up over four years if you make minimum payments only.

Case study: Adriennes experience

Adrienne FullerPublisher

I took out a Chase auto loan when I purchased a used 2011 Toyota Tacoma at a dealership. I applied for financing through the dealer not with Chase directly so my comments are limited to that experience.

I have an excellent credit score and the sales rep offered me an interest rate of 3.8%. When I mentioned this to him, he said, Well how does 3.2% sound instead?

It seemed really odd to me that he could modify the offer so easily and makes me wonder how much I left on the table by not negotiating further. It also makes me wonder about the size of the kickback the dealer gets. If I had applied directly through Chase, would my rate have been even lower?

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Set Up Automatic Payments

Its easy to make sure your credit card is paid on time each month. Heres how:

Chase Online Bill Pay: Must enroll in Chase Online Banking and activate Online Bill Pay. Certain restrictions and other limitations may apply.

Chase Mobile® app is available for select mobile devices. Enroll in Chase Online or on the Chase Mobile® app. Message and data rates may apply.

What Is A Chase Auto Loan

Chase offers auto loans to buy either a new or used vehicle from a dealership. Terms range from four to eight years with APR rates as low as 2.59%. However, your creditworthiness will affect the rate you ultimately get.

What types of auto loans does Chase offer?

- New car loans. Borrow to buy a new vehicle through a dealership.

- Used car loans. Borrow to buy a used car from a dealership.

- Auto loan refinancing. Trade in your current car loan for more favorable rates and terms.

How do Chase auto loan rates work?

The rate you get ultimately depends on the car youre wanting to buy and your overall creditworthiness. Use Chases online Payment Calculator to estimate your monthly payments and total interest over the life of the loan.

You May Like: Does Va Loan Work For Manufactured Homes

Paying Through The Mobile Web

Should you not wish to download the app to make your U.S. Bank car payment, you can open the web browser on your phone and log in to the company’s website from there. Choose “Payments” and then “Make a Payment.” Tap on the account you’d like to pay, as well as the account you’d like to draw the payment from. If you need to add a savings or checking account to make the payment, press “Pay From an External Account” and follow the prompts.

Select the payment frequency, as well as the payment date if making a one-time payment. Enter the amount you’d like to pay and then review all of the information to make sure it’s correct. Click the “Submit” button and you’re all done.

How To Pay The Bill

Pay online: Customers can pay your Chase Auto Finance online by visiting . You will need to provide your account information as well as your user identification and password. Acceptable methods of payment include credit cards, debit cards, checking and savings account.

Automatic payment: Customers can pay your Chase Auto Finance bill by having the funds automatically deducted from your checking or savings account. You will reduce your monthly bill by 0.25% when using your Chase savings account or Chase checking account.

Pay by mail: Customers can pay your Chase Auto Finance bill by sending payments to:

Chase Auto Finance

1820 E. Sky Harbor Circle S.Phoenix, AZ 85034

Pay by phone: Customers can pay your Chase Auto Finance bill by calling customer service at 1-800-336-6675. You will need your account details and acceptable form of payment.

Pay in person: Customers can pay your Chase Auto Finance bill in person by visiting a Chase bank location. The locations are listed on the website.

Don’t Miss: Usaa Car Loans Credit Score

How To Pay Off Your Auto Loan Without A Credit Card

If you dont have a concrete plan to pay your auto loan off, chances are good transferring your balance wont really help you. Instead of moving money around, you might be better off changing your money mindset. To really handle your debts, you need to pay them off not just move them from place to place.

Fortunately, most auto loans allow you to prepay your bill without a penalty. What this means is, you can pay more than your cars minimum monthly payment if you can afford it.

This may not be easy, but hardly anything worth doing is. If youre struggling to scrape together the cash for your car payment, consider these steps to leave some wiggle room in your budget:

I Cant Make A Payment

When customers cant pay your Chase Auto Finance bill, the company has options. Although limited, Chase Auto Finance provides customers with the ability to change your loan date and set-up payment arrangements.

- Change loan date Customers that cant pay your Chase Auto Finance bill have the ability to change the due date on your loan. You have the ability to change the date of your payment up to 20 days beyond the date of your predetermined payment. Chase Auto Finance restricts three dates that cannot be selected, the last three dates of any given month.

- Payment arrangements Customers that cant pay your Chase Auto Finance bill have the ability to make payments on an arranged schedule. Call customer service at 1-800-336-6675 and speak with a customer service representative. They will provide you with the details of the payment arrangement.

Also Check: Usaa Auto Refinance

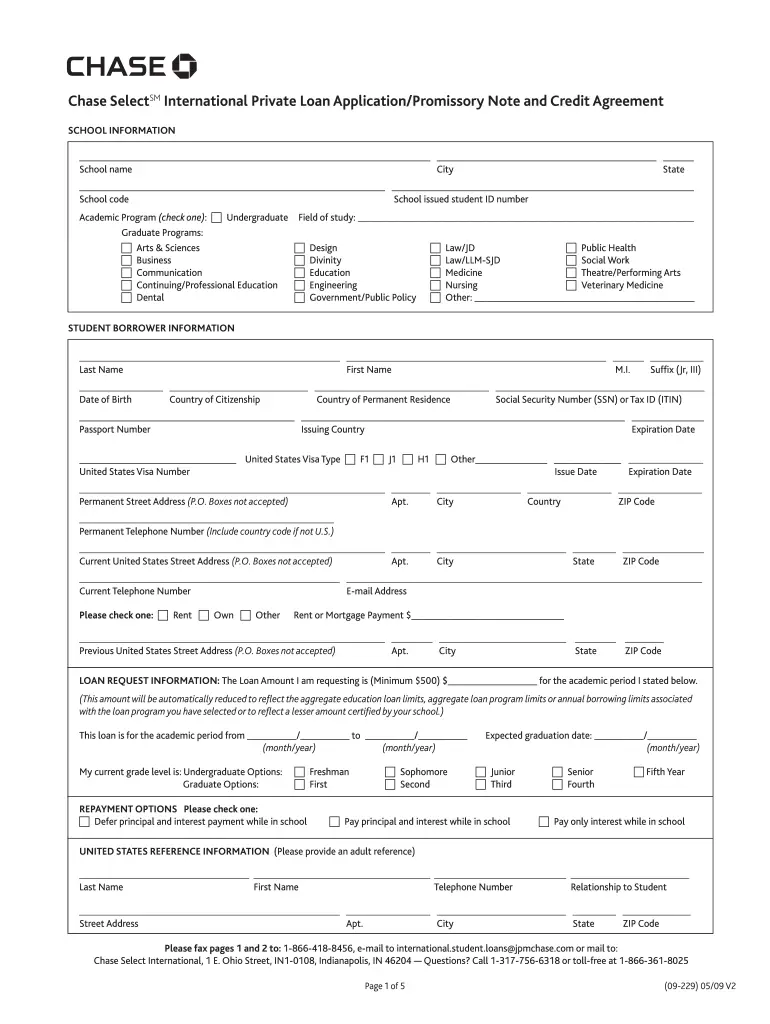

What Information Do I Need To Apply

To complete an application, you’ll be asked to provide your personal information such as name, address, Social Security number, employment information, income, email address and your vehicle make, model, trim and the details of your requested financing. If you’re an existing Chase customer the information stored in your Chase profile will pre-fill upon signing in. Keep in mind we may ask for additional information based on your auto finance application.

What To Do When You Cant Pay Your Chase Auto Finance Bill

As one of the oldest and largest institutions in the United States, JP Morgan Chase provides services to millions across 60 countries. The services offered by JP Morgan Chase include asset management, investment banking, private equity, commercial and personal loans. One division that provides excellent customer service is Chase Auto Finance. This division offers deals and discounts for new cars, used cars and auto financing and refinancing.

You May Like: How To Get Loan Originator License

Can I Pay My Auto Loan With A Credit Card

Can you pay your auto loan with a credit card? Well, yestechnically you can. Most lenders wont allow you to use a credit card to pay your loan directly, but you know those convenience checks your credit card company sends in the mail, encouraging you to transfer a balance? You can use one of those in a pinch just be prepared to bite the bullet and pay whatever fee it entails.

Likewise, tapping your credit cards cash advance limit is another way to make your car payment when moneys tight but remember theres no grace period for cash advances, so that balance starts accruing sky-high interest charges immediately. And these days there are services that allow you to pay just about anything with a credit card, even your rent for a fee, of course.

Offers matched to your credit profile

- $0 Fraud Liability for unauthorized use offers you peace of mind

- Feel confident knowing pre-qualifying will not affect your credit score

- Pick the credit card design that speaks to you

- Access to an unsecured credit card no security deposit required

- Nationwide acceptance use anywhere Mastercard is accepted in app, in store, and online

- Pre-qualifying is quick and easy and will let you know if you are qualified without impacting your credit score

- Pre-qualify without impacting your credit score

- A card for your everyday needs

- Reports your payments to all three major credit bureaus

- Use your card in app, in store, and online Nationwide wherever Mastercard is accepted

Drawbacks Of Using Another Banks Payment Service

When using another banks payment service to make mortgage loan payments to Chase, youll need to set up the payments on the other banks website. Sometimes banks mail a check instead of processing an online transaction, which means that your payment might not process the same day its made. Chase recommends scheduling your payment five to seven business days in advance. Also, if you want to make additional principal or escrow payments, they might not be applied correctly when using a third-party payment service.

Up Next: Chase Interest Rates: How to Get the Banks Best Rates

Also Check: What Is The Maximum Fha Loan Amount In Texas