How To Refinance Student Loans

Student loan refinancing helps you to consolidate your existing federal or private student loans, or both, into a new, single student loan with a lower interest rate. When you refinance student loans, you can get a lower interest rate, lower monthly payment and pay off your student loans faster. You can also choose to pay off your student loans anytime between 5 and 20 years. Most importantly, you can save money, which can be used for other life expenses, retirement, a home purchase, investing or to repay other debt. Student loan refinancing could save you more than $30,000 over the life of your student loans, depending on your current student loan balance and interest rate.

Con: You Could Lose A Federal Loan’s Advantages

If you consolidate a federal student loan with a private lender, you’ll lose the option to sign up for an income-based repayment plan. You’ll also no longer be eligible for the federal loan forgiveness and cancellation programs. These are major reasons to consolidate your federal loans only through the federal program.

If your student loan is still within its grace period, wait until that ends before you refinance it.

Option : Take Your Business Elsewhere

One of the biggest developments in student loans over the past five years has been the private student loan refinancing markets growth. There are now many companies that will refinance old high-interest loans at a lower interest rate. The catch is that you have to be a good credit risk for a new lender to take on your debt. That means a high credit score and sufficient income to pay all of your bills comfortably.

If Katies daughter fits the above description, she could refinance without having Katie co-sign. That means the loans fall off of Katies credit report, and her daughter potentially gets a lower interest rate and/or lower monthly payments. One benefit of this approach is that it would provide Katie with a cosigner release.

If you are considering going this route, be sure to check out our page on student loan refinancing lenders and strategy.

Recommended Reading: What’s Better Refinance Or Home Equity Loan

Sallie Mae Student Loans Review Nitro College

Jul 22, 2021 Securing a student loan can be intimidating. Today, wed like to take a deep dive into student loans from Sallie Mae.Loan Types: Variable & FixedTerms: 10-15 years3Rates : 1.13%-12.60%1

The MEFA REFI loan allows you to refinance your student loans by consolidating your existing student debt into one loan thats easy to manage.

6 days ago Student loan refinancing find the best places to refinance student loans from banks to lenders, comparing rates, terms, and bonuses!

Sallie Mae® higher education loans are designed for the needs of undergraduates, graduate students, and parents. Competitive interest rates; Multiple repayment;

Learn about the different ways to consolidate student loans, Retrieved from http://www.finaid.org/loans/privateloan.phtml; Sallie Mae .

Refinance your federal and private student loans with LendKey. Check your rates in two minutes and see if you can save on your student loan payments.

5 days ago Sallie Maes undergraduate fixed interest rates start at 4.25%, which is just slightly higher than SoFis starting point. This lenders graduate;

Fixed Rate Student Refinance Loan Rates · 5-year loan term: with an 8.50% APR, the monthly payment will be $1,025.83. Finance charges will be $11,549.59. · 10-;

Sallie Mae® higher education loans are designed for the needs of undergraduates, graduate students, and parents. Competitive interest rates Multiple;

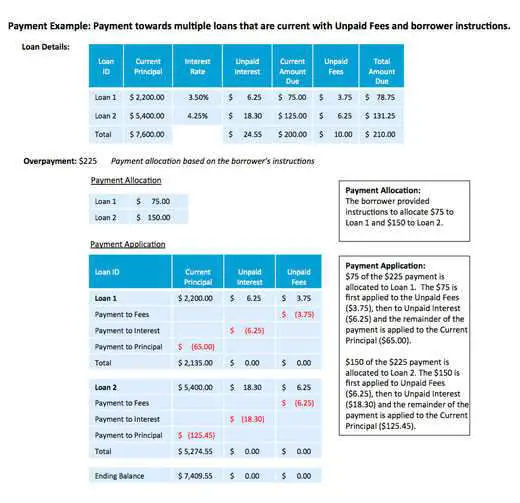

Late Student Loan Payments

You may be charged a late fee if you dont pay your loans Current Amount Due within 15;days after the Current Amount Due Date. The late fee amount is listed on your loans Disclosure and your billing statement.

If your student loan payments are late, you may also lose your eligibility for borrower benefits or repayment incentives. Late payments may also be reported to consumer reporting agencies, which could negatively impact your credit report.

Read Also: Which Student Loan Accrues Interest While In School

Choose Your Loan Terms

When you get a rate quote, you can usually adjust the loan term to meet your needs. A longer loan term can be tempting because it will give you a lower monthly payment. However, think twice before opting for a loan of 12 to 20 years.

Lenders typically charge higher interest rates on longer loans. Even though youll have a smaller monthly payment, the higher rate and longer term can make you pay much more in interest charges than you would with a shorter loan term.

In general, lenders save the lowest interest rates for borrowers who choose shorter loan terms. To get the lowest possible interest rate, choose a term of five to eight years in length. Your monthly payment will be higher, but youll get a better interest rate and save more money and get out of debt faster.

How Do I Apply For A Student Loan

You can apply for a student loan through banks, online lenders, credit unions and the federal government. To apply for a federal student loan, you’ll fill out the Free Application for Federal Student Aid , which opens up on Oct. 1 each year. Once you fill it out, you will be notified about your eligibility for federal student loans and other financial aid.

To apply for a private student loan, first compare a few lenders to determine which offers the best rates and terms for your needs. You can prequalify with most lenders, which lets you see your loan offer before submitting a formal application. When you’ve selected a lender, you can apply online, over the phone or in person, if the lender has physical locations.

Recommended Reading: What Is Certificate Of Eligibility Va Home Loan

Refinancing Your Private Or Federal Loans

For those with private student loans, federal student loans, or a combination of the two, refinancing is another option to consider. Unlike consolidation, refinancing with a private lender such as SoFi allows you to combine private and federal loans into one, and it may lower the amount of interest youre currently paying or lower your monthly payment.

Refinancing may be better for people whose financial situation, including employment, cash flow, or credit, has improved since graduating. And just like with consolidation, refinancing gets you one loan, and one monthly payment, so you no longer have to juggle multiple loan servicers and payments.

Check to see if refinancing your loans could be the right choice for you.

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Home Loans General Support:

- Mon-Fri 6:00 AM 6:00 PM PT

- Closed Saturday & Sunday

- Mon-Thu 8:00 AM 8:00 PM EST

- Fri 8:00 AM – 7:00 PM EST

- Closed Saturday & Sunday

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Refinance A Sallie Mae Student Loan: The Bottom Line

When looking at a student loan lender, consider more than interest rate and length of the loan. Choose a lender that offers a grace period for repayment that starts after graduation. Also look for a lender that offers a relief plan should you find yourself in financial trouble and unable to make your payments. Some lenders have payment pause, while others allow you to make interest-only payments for an extended period.

If you get a student loan with Common Bond, for instance, you dont need to start repayment until six months after you graduate. They will also pause payments if you lose your job.

Refinancing a Sallie Mae student loan takes some legwork. If you decide that refinancing is necessary, make sure to check out the best student loan refinancing companies out there.

You May Like: How To Stop Loan Payments

How To Get Approved For Student Loan Refinancing

Should I refinance my student loans? If you want to save money and get a lower interest rate, then student loan refinancing can be a smart option for you. Since the federal government doesnt refinance student loans, you will work with a private lender to refinance student loans. Each lender has its own underwriting criteria, and each applicant’s financial background and circumstance is unique. Therefore, student loan refinancing is not available to everyone. However, here is the best advice to get approved for student loan refinancing:

What Does Navient Do

Navient, which operates independently from Sallie Mae, focuses on the enhancement of its customers financial success. In addition to servicing federal student loans, Navient is known for consumer lending and business processing solutions. It also offers private student loan servicing.

With Navient, people with federal loans have access to federal benefits like income-driven repayment plans, deferment or forbearance. Qualifying individuals can sign up for income-driven repayment plans such as Income-Based Repayment , Income-Contingent Repayment , Pay As You Earn and Revised Pay As You Earn plans. If you lose your job or go through a financial hardship, you can defer your payments or put them into forbearance, which allows you to postpone your payments without racking up late fees or entering into collection.

You May Like: How To Pay Home Loan Faster

Compare Student Loan Refinancing Rates First

Dont just go directly to a lenders website and apply for student loan refinancing. Compare student loan refinancing rates first. This way, you could get a lower interest rate and find the best lender for you. Before you refinance student loans, compare rates, loan terms and other fine print.

Insider Tip:Student loan refinancing rates are incredibly low right now. Its a good time to refinance in case rates go up again.

Compare Multiple Options When Refinancing Your Loans

If you decide to refinance your Sallie Mae student loans, be sure to shop around and compare as many lenders as you can.

Remember to consider interest rates as well as repayment terms and any fees charged by the lender to find a loan that works for you.

Depending on whether youre approved for refinancing and the terms you get, you might be able to pay off your loans faster.

If youre wondering how long itll take to pay off your student loans, enter your current loan information into the calculator below to find out. Use the slider to see how increasing your payments can change the payoff date.

Enter loan information

Read Also: How Does Pre Approval For Auto Loan Work

Do This To Get The Lowest Interest Rate

If you want the lowest interest rate, choose a variable interest rate. When it comes to student loan refinancing, the advantage is that variable interest rates are lower than fixed interest rates. The disadvantage is that your interest rate can increase over time.

Insider Tip:If you think interest rates will remain low for awhile, and you can pay off a good amount of your student loan debt, then a variable interest may be best for you.

Career Training Smart Option Student Loan

These student loans are for those seeking a trade certificate as opposed to a college degree. If youre interested in obtaining professional training in something like plumbing, construction, or film and video editing, this is the loan program for you. Because these programs dont necessitate full-time attendance, Sallie Mae doesnt require you to be enrolled at least half time for this loan.

Interest Rates and Repayment Terms

Loan terms: 5 to 15 yearsVariable interest rate: 6.37% to 13.47%

You May Like: Does Applying For Personal Loan Hurt Credit

Benefits Of Refinancing Sallie Mae Student Loans

To refinance your student loans, you apply for a loan from a student loan refinancing lender. The new loan is designed to cover the amount of your existing debt, and it will have different terms than your current loans. Depending on your credit and which loan term you choose, you could qualify for a lower rate, longer repayment term, and a smaller monthly payment.

If you have other student loans, such as federal loan or private loans from another lender, you can consolidate them together when you refinance so you only have one loan to manage.

There are many advantages to refinancing Sallie Mae student loans:

You Can Refinance Sallie Mae Student Loans Heres How

If you want to refinance your Sallie Mae loans, youll need to find another lender that offers refinancing.

Lindsay VanSomerenUpdated August 10, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Sallie Mae once allowed its borrowers to consolidate their student loans however, it ended this service in 2008 after loan consolidation was no longer profitable for the company.

While you cant consolidate your Sallie Mae student loans anymore, you do have other refinancing options available.

Heres how to refinance Sallie Mae loans :

Don’t Miss: How To Apply For Fha Loan In Illinois

Am I Eligible For Student Loan Refinancing

You can refinance one or more federal and/or private student loans, but you must meet a lenders requirements for credit and income. Most lenders look for a of 650 or higher, along with a steady source of income or an offer of employment. If you cant meet these criteria on your own, you could qualify by applying with a creditworthy cosigner, such as a parent.

Along with your credit score and annual income, some lenders also look at your savings and debt-to-income ratio. Finally, some lenders require proof of graduation, as theyll only approve borrowers who have obtained their degree. If you left school before graduating, there are relatively few student loan refinance providers that will work with you.

Select A Lender And Loan Terms

With your comparison complete, you should have the information necessary to make a final decision as to which lender you want to refinance your loans. Typically, this will be the lender that offers the lowest interest rate, paired with other qualities that align with your personal goals.

In addition to choosing a lender, you will need to finalize some of the other terms of your loan, including:

Fixed or variable interest rate

Variable interest rates are often lower to start than fixed interest rates, but are likely to change over the life of the loan , and very often increase. Fixed interest rates, on the other hand, will never change. Fixed interest rates are often recommended for borrowers who value stability, since your payment amount will never change.

Repayment period

Repayment periods of five, 10 and 20 years are all common. Typically, loans with longer repayment periods will come with lower monthly payments, but will cost more in interest over the life of the loan compared to loans with shorter repayment periods. If your goal is to save as much money as possible, you should choose the shortest repayment period that you can afford.

You May Like: How To Get Low Interest On Car Loan

Have A Good To Excellent Credit Score

For student loan refinance, lenders want borrowers with a good to excellent credit score. Why? Your credit score is a measure of your financial responsibility. Lenders want to ensure that you make on-time payments and pay back your debt. The best student loan lenders expect a minimum credit score in the mid to high 600s. That said, some lenders dont have a minimum credit score.

Insider Tip:;To maximize your chances for approval, a credit score of 700 or higher is best.

Sallie Mae Loan Application Process

You can apply for any Sallie Mae student loan entirely online. Its easy and only takes fifteen minutes to complete. Once youve submitted your application, Sallie Mae will review how they collect, share, and protect your personal information, which is standard.

After youve submitted everything, Sallie Mae reviews your credit results with you. If you used a co-signer, then they review results for both of you. However, they may need additional information before approving your student loan. If this is the case, Sallie Mae will tell you what further documentation you need to provide by either mail, online, or fax.

Once Sallie Mae has everything they need, they can approve your application. Youll find out what interest rate youve been approved for at this stage, and youll choose which repayment option you would like to have during school.

Youll next accept the terms and conditions by digitally signing your consent. From there, Sallie Mae will contact your school to validate your eligibility. Theyll verify how much money you need and determine your enrollment status.

Also Check: What Is Auto Loan Interest Rate

Should You Refinance Sallie Mae Student Loans

If you have Sallie Mae student loans that are private student loans, refinancing can be a great financial option. You can save money, pay off student loans and repay debt more quickly.Remember, you should only refinance if you can get a lower interest rate, lower monthly payment or if you can change loan terms. Most borrowers refinance student loans to lower their interest rate. If these reasons fit your financial goals, then refinancing your Sallie Mae student loans could be a smart financial option.

Getting A Lower Rate From Sallie Mae

Helping a borrower who fell behind on his Sallie Mae payments lead to an unlikely discovery: Sallie Mae will lower interest rates for some borrowers.

Editors Note: I originally published this article in March of 2013. Over the years, Sallie Mae has had different versions of Rate Reduction programs. While the name hasnt changed, the rules seem to vary from borrower to borrower. The tactics mentioned below have helped numerous borrowers over the years. Going after the rate reduction program is an excellent way for borrowers struggling to get a much lower interest rate. Borrowers who have stronger finances, such as a decent income and credit score, will likely do better if they refinance their student loans with another lender.

Don’t Miss: Should I Get An Unsubsidized Student Loan