Can I Request More Money If I Used Net Profit

If you applied for PPP as a self-employed individual using net profit, you may discover you could get a larger loan by using gross income. The change in calculation methods is not retroactive. The IFR states that it applies to loans approved after the effective date.

However, it appears that whether you can get a larger loan amount depends on the status of your loan. Information provided by SBA to lenders states that a lender may cancel a PPP loan application and submit a new application on behalf of the borrower all the way up to the point where the loan funds have been disbursed to the borrower but a Form 1502 has not been submitted by the lender to the SBA.

Once the loan has been disbursed and the lender has filed Form 1502 with the SBA, there is no option to reapply for a larger amount.

Contact your lender if you have already submitted a loan application based on Schedule C net profits and have questions about the new calculations.

Keep in mind that if you already qualified based on the maximum owners compensation of $20,833 based on net profit on your Schedule C there is no need to do anything. .

How Do I Apply For Sba Paycheck Protection Program Loan Forgiveness

Our customer service agentscanât provide loan status through any of our contact channels, including phoneand messaging. To check the status of your loan or for additional questions,please go to the Paycheck Protection Program loan site.

For more information and requirements regarding PPP loan forgiveness, go to our PPP Loan Forgiveness website or visit the SBA PPP loan forgiveness website for all details.

How Must I Spend The Money

Similar to the first round of PPP, this program is primarily intended to keep employees on payroll and to pay other specific expenses.

To obtain full forgiveness, borrowers will need to spend at least 60% of loan proceeds on qualified payroll expenses during the covered period. Eligible nonpayroll costs cannot exceed 40 percent of the loan forgiveness amount. The list of eligible non-payroll expenses has been expanded and now includes:

- Covered supplier cost*

- Covered worker protection expenditure*

Covered operations expenditures means payment for any business software or cloud computing service that facilitates business operations, product or service delivery, the processing, payment, or tracking of payroll expenses, human resources, sales and billing functions, or accounting or tracking of supplies, inventory, records and expenses

Covered property damage cost means a cost related to property damage and vandalism or looting due to public disturbances that occurred during 2020 that was not covered by insurance or other compensation

Covered supplier cost means an expenditure made by an entity to a supplier of goods for the supply of goods that:

- a drive-through window facility

Don’t Miss: How Easy Is It To Get An Fha Loan

Tax Treatment Of Third

Round three PPP loans were not included in a company’s taxable income. If a loan was forgiven, expenses paid with the proceeds of the loan were tax-deductible. Further, this rule applied to new, existing, and previous PPP loans. In addition, any income tax basis increase that resulted from a PPP loan remained even if the PPP loan was eventually forgiven.

Any PPP loans that were wrongfully forgiven either due to omission or misrepresentation by the taxpayer will be treated as taxable income, as the IRS announced in August 2022. The IRS is encouraging anyone to whom this guidance applies to, if necessary, file an amended return.

Is There A Downside To Using Gross Income Instead Of Net Profit

Possibly. PPP borrowers must certify that current economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant. However, there has been a safe harbor for loans below $2 million.

The SBA appears to be concerned that the gross income calculation may be more subject to fraud or abuse. So it has warned that if a Schedule C filer elects to use gross income to calculate its loan amount on a First Draw PPP Loan and the borrower reported more than $150,000 in gross income on the Schedule C that was used to calculate the borrowers loan amount, the borrower will not automatically be deemed to have made the statutorily required certification concerning the necessity of the loan request in good faith, and the borrower may be subject to a review by SBA of its certification.

It goes on to say that SBA will review a sample of the population of First Draw PPP Loans made to Schedule C filers using the gross income calculation if the gross income on the Schedule C used to calculated the borrowers loan amount exceeds the threshold of $150,000. If the borrower exceeds this threshold, then SBA will, for the sample drawn, assess whether these borrowers complied with the PPP eligibility criteria, including the good faith loan necessity certification.

Recommended Reading: How Do Car Loans Work With Interest

How Can You Apply For Ppp Loan Forgiveness

Step 1: Contact your lender

Your lender will be able to help you understand which form you need to fill out. There are three government-created templates for loan forgiveness applications. However, your lender doesnt need to use them. They may decide to go their own way. So it is best to ask them what forms you need to complete.

Step 2: Get your documents in order

This is going to be a big list so take your time!

Proof of eligible payroll costs

- Bank account statements or payroll statements that show how much you have compensated your staff

- Payroll tax filings

- Payment receipts for employee benefits programs e.g retirement benefits, employee health insurance

Proof of other eligible expenses/ non-payroll costs

- Mortgage interest payments related to your business property you need invoices and/or receipts

- Rent/lease payments related to your business property you need invoices and/or receipts

- Utility bills related to your business activity you need invoices and/or receipts

- Operational expenses e.g business software you need invoices and/or receipts

- Property damage costs you need invoices and/or receipts, plus proof that those costs relate to uninsured property damage e.g vandalism and public disturbances

- Supplier costs you need copies of your contracts and invoices

- Worker protection costs such as COVID-19 related protective equipment you need receipts, invoices and proof that these costs are COVID-19 related

How You Can Use Your Ppp Loan

The PPP loan has specific guidelines for use than other SBA loans, especially if you are looking for 100% loan forgiveness. However, the requirements have been relaxed for small businesses during the COVID-19 crisis to maximize the impact of relief funds.

Heres how you can and cant use your PPP loan:

You May Like: What Are Commercial Loan Rates Now

When Can I Reapply For A Ppp Loan

Existing PPP borrowers that did not receive loan forgiveness by Reapply for a First Draw PPP loan if they previously returned some or all of their First Draw PPP loan funds, or. Under certain circumstances, request to modify their First Draw PPP loan amount if they previously did not accept the full amount …

Application Form 2483 Explained

If you are not applying with a Schedule C, apply with form 2483. Weâll go through the application form box by box. We recommend you follow along by downloading a PPP loan application here. Check in with your lender before filling in the application. Some lenders will require you to submit your information through their online portal as opposed to submitting a paper application.

Recommended Reading: What Is An E Lock Loan

Second Draw Ppp Loans

The stimulus legislation created second draw PPP loans for those who:

- Previously received a first draw PPP Loan and has or will use the full amount only for authorized uses by the date the second loan is disbursed

- Have no more than 300 employees and

- Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

More information about qualifying for a second draw PPP loan can be found here.

The calculation for second draw loans is similar to first draw loans with one exception: if your business has a NAICS code beginning in 72 you may qualify for a loan of 3.5 times average monthly payroll. Other businesses will qualify based on 2.5 times average monthly payroll as before.

The March 3, 2021 Interim Final Rule describes the following method for calculating the loan amount:

The maximum amount of a Second Draw PPP Loan to a borrower that has income from self-employment and files an IRS Form 1040, Schedule C, is calculated as follows, depending on whether the borrower has employees:

For a borrower that has income from self-employment and does not have any employees, the maximum loan amount is the lesser of:

the product obtained by multiplying: the net profit or gross income of the borrower in 2019 or 2020, as reported on IRS Form 1040, Schedule C, that is not more than $100,000, divided by 12 and 2.5 .

This amount cannot exceed $29,167 for NAICS code 72 borrowers and $20,833 for all other borrowers.

What Kinds Of Ppp Loans Are Available

There is funding for three categories of PPP loans in this legislation:

- First time PPP loans for businesses who qualified under the CARES Act but did not get a loan

- Second draw PPP loans for businesses that obtained a PPP loan but need additional funding and

- Additional funding for businesses that returned their first PPP loan or for certain businesses that did not get the full amount for which they qualified.

Certain news organizations, destination marketing organizations, housing cooperatives, and 501 nonprofits may now also be eligible for PPP loans.

For all PPP loans, no collateral or personal guarantee is required. For these new loans, any amount not forgiven becomes a loan at 1% for five years.

Also Check: Can I Get Another Loan From Upstart

Who Qualified For A Ppp Loan

While the PPP loan program ended in 2021, lets take a look at who could have qualified and how the program worked.

Any small business with 500 or fewer employees might have been eligible for relief. This includes small businesses, S corporations, C corporations, LLCs, private nonprofits, faith-based organizations, tribal groups and veteran groups. Self-employed individuals who file an IRS Schedule C with their Form 1040, such as independent contractors and sole proprietors, are also eligible.

Restaurants and hospitality businesses may have qualified if they had 500 or fewer employees per location. Details on the size standards and exceptions are on the SBA website.

Ineligible businesses included those engaged in illegal activities, owners more than 60 days delinquent on child support obligations, farms and ranches, sex businesses, lobbyists and gambling establishments.

Also, in response to the outcry over public companies receiving PPP loans when most mom-and-pops, who really need the government help, didnt, the Treasury has ruled that hedge funds, private equity firms and most public companies with substantial market values were ineligible for PPP loans. Also, the program was closed to companies that were involved in bankruptcy proceedings.

What Are Paycheck Protection Program Loans

The Paycheck Protection Program loan is a type of SBA loan designed to provide funds to help small businesses impacted by COVID-19 to keep their workers on payroll. These loans may be completely forgiven if spent on eligible expenses during a specific time period.

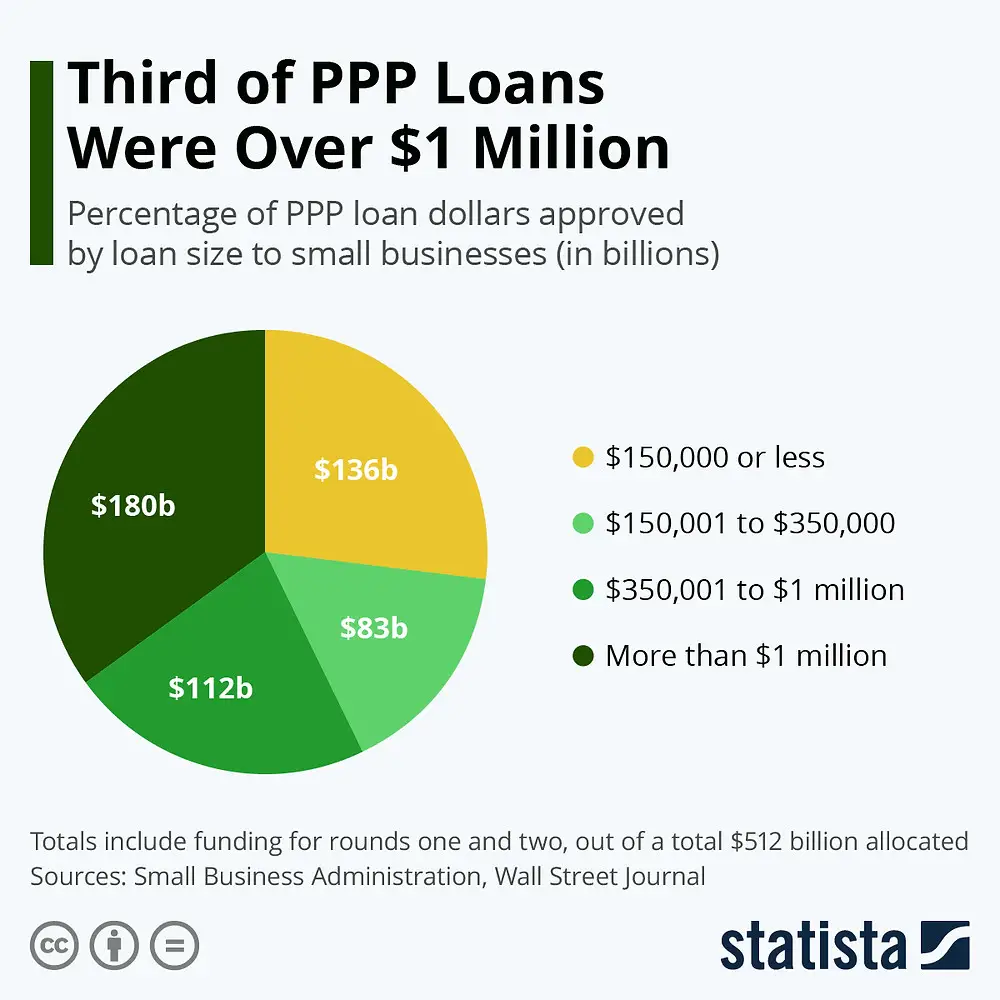

Congress approved another $284 billion in funding for these loans in the stimulus bill enacted on December 27, 2020. See below for more information on how to apply.

Please keep in mind this information is changing rapidly and is based on our current understanding of the programs. It can and likely will change. Although we will be monitoring and updating this as new information becomes available, please do not rely solely on this for your financial decisions. We encourage you to consult with your lawyers, CPAs and Financial Advisors.

As you read this, keep in mind that for the most part, the changes included in this legislation apply to all PPP loans except those already forgiven. In addition, the way the legislation is written, most provisions take effect immediately after the legislation is enacted, as if they were in the CARES Act that was passed March 27, 2020.

Recommended Reading: How To Get First Home Loan

Do You Need To Provide Documentation For A Loan Forgiveness

Youll need to provide documentation for all eligible expenses when you apply for forgiveness otherwise those costs wont count toward forgiveness. Stay in touch. Reach out to your lender with any questions you have about the loan and forgiveness. Since this is a new program, policies are likely to change.

What If I Have Unpaid Student Loan Debt

In order to expand small business access to the PPP, the SBA, in consultation with Treasury, has decided to eliminate the restriction on PPP qualification to those with past due or defaulted Federal student loans.

This change will make PPP loans available to more borrowers with financial need and is consistent with Congresss intent that PPP loans be prioritized for small business concerns owned and controlled by socially and economically disadvantaged individuals as defined in section 8 of the Small Business Act.

According to the Department of Education, Black and Brown students rely more heavily on student loan debt than their peers and experience delinquency at disproportionately high rates. As a result prohibiting delinquent student loan borrowers from obtaining PPP loans is more likely to exclude business owners of color from access to the loans they need.

Read Also: What Is The Jumbo Loan Limit For 2021

What Counts As Payroll

Payroll is the same as defined in the CARES Act with one new addition :

- Salary, wages, commissions or similar compensation,

- Payment of cash tips or equivalent ,

- Payment for vacation, parental, family, medical, or sick leave

- Allowance for dismissal or separation

- Payment required for the provisions of employee benefits including insurance premiums

- Payment of any retirement benefit

- Payment of State or local tax assessed on the compensation of employees.

- New: group benefits are defined to include group life, disability, vision, or dental insurance

It does not include:

- The compensation paid to an employee in excess of $100,000 on an annualized basis, as prorated for the period during which the payments are made or the obligation to make the payments is incurred.

- Any compensation of an employee whose principal place of residence is outside the United States

- Qualified sick and family leave wages for which a credit is allowed under sections 7001 and 7003 of the Families First Coronavirus Response Act

- Do not include amounts paid to 1099 contractors in payroll they may apply on their own.

Individual partners in a partnership do not apply on their own. The payroll calculation for partnerships is found in this guidance.

What Is The Interest Rate On Ppp Loans

PPP loans have an interest rate of 1%. Loans issued prior to June 5, 2020, have a maturity of two years. Loans issued after June 5, 2020, have a maturity of five years. Loan payments will be deferred for borrowers who apply for loan forgiveness until SBA remits the borrower’s loan forgiveness amount to the lender.

Don’t Miss: What Is Being Done About Student Loan Debt

How Do You Apply For A Ppp Loan

Business owners need to fill out a PPP loan application SBA Form 2483 for first-draw loans and SBA Form 2483-SD for second-draw loans and gather all supporting documents.

You can apply for a new PPP loan through any participating lender. Keep in mind: Some banks prioritize current account holders, so if you have a relationship with a bank offering PPP loans, apply there first. The deadline to apply is March 31, 2021

A few fintech companies and online lenders, such as Bluevine, are approved to accept PPP loan applications. These companies typically offer a streamlined loan application process and may be able to approve loans and deliver funding more quickly than traditional banks.

Who Is Eligible To Apply For A Self

In order to apply for a PPP loan as a self-employed individual or independent contractor, you have to meet the following criteria:

- Must be in operation before February 15, 2020

- Must have income from self-employment, sole proprietorship, or as an independent contractor

- Must live in the United States

- Must file a Form 1040, Schedule C for 2019

- Must have net profit for 2019

Also Check: When Can I Refinance My Home Fha Loan

Ppp First Draw Eligibility Criteria

If the following statements apply to your business, you are eligible to apply for your first PPP loan.

-

Your business was operational before February 15, 2020

-

Your business is still open and operational

-

You have no more than 500 employees

-

If your business has multiple locations, you have no more than 500 employees per location

Are All Independent Contractors Or Self

Small business owners, sole proprietors, gig workers, self-employed individuals, and pretty much anyone who has 1099 income can qualify for PPP loans. As long as you were in operation on or before February 15, 2020 and reported taxable earnings/income for 2019 or 2020, you can likely apply for PPP assistance.

If you identify as one or more of these:

- Sole proprietor or small business owner

If you have one or more sources of self-employed income:

- Sale of goods or services

- Business income

You May Like: How To Apply For Ppp Loans

Heres How You Can Spend Your Ppp Loan

-

Replace your compensation

-

Pay interest payments on a mortgage or loan you use to perform your business*

-

Make business rent payments*

-

Make business utility payments*

-

Make interest payments on any other debt incurred before February 15, 2020

-

Operations expenses for business software and cloud computing services and other human resources and accounting needs that facilitate business operations

-

Payments to a supplier for goods that are essential to the operations of the borrower pursuant to a contract or purchase order in effect before the PPP loan is disbursed or with respect to perishable goods

-

Property damage costs related to looting due to public disturbances in 2020 that are not covered by insurance or other compensation

*You must have claimed a deduction on your 2019 or 2020 taxes for expenses described in 2, 3, and 4 above.