Whats Behind The Numbers In Our How Much Can I Borrow Mortgage Calculator

When buying a home, the question How much can I borrow? should be the second question you ask. The most important consideration is, How much house can I afford? Thats because, even with all the angst involved in applying for and being approved for a home loan, lenders are often inclined to loan you more money than you expect.

Thats a surprising and important reality.

As much as you want to buy a home, lenders want to loan you money. And the bigger the loan, the happier they are. Youll know why when you see the estimate of the interest youll pay over the life of the loan. Its a really big number.

But if you know how much home you can afford, of course, youll want to learn how much you can borrow. The NerdWallet How much can I borrow? calculator can give you a solid estimate.

The calculator considers standard mortgage payment elements, such as principal and interest. Then, we take things a few steps further, factoring in taxes, insurance even homeowner association dues to help determine a real-life monthly payment.

We also examine your income and debt, just as a lender would, to determine the maximum home loan amount youre likely to qualify for.

Getting ready to buy a home? Well find you a highly rated lender in just a few minutes.

Enter your ZIP code to get started on a personalized lender match.

Today’s National Fha Mortgage Rate Trends

For today, Sunday, September 12, 2021, the national average 30-year FHA mortgage APR is 3.640%, down compared to last weeks of 3.710%. The national average 30-year FHA refinance APR is 3.660%, down compared to last weeks of 3.720%.

Whether you’re buying or refinancing, Bankrate often has offers well below the national average to help you finance your home for less. Compare rates here, then click “Next” to get started in finding your personalized quotes.

Weve determined the national averages for mortgage and refinance rates from our most recent survey of the nations largest refinance lenders. Our own mortgage and refinance rates are calculated at the close of the business day, and include annual percentage rates and/or annual percentage yields. The rate averages tend to be volatile, and are intended to help consumers identify day-to-day movement.

Availability of Advertised Terms: Each Advertiser is responsible for the accuracy and availability of its own advertised terms. Bankrate cannot guaranty the accuracy or availability of any loan term shown above. However, Bankrate attempts to verify the accuracy and availability of the advertised terms through its quality assurance process and requires Advertisers to agree to our Terms and Conditions and to adhere to our Quality Control Program.

What A How Much Can I Borrow Calculator Does

The NerdWallet How much can I borrow? mortgage calculator utilizes an easy step-by-step process:

To begin, input:

-

Your annual income

-

The mortgage term youll be seeking

-

Your monthly recurring debt

If you dont know how much your recurring debt payments add up to in a month, click the No. Help me! button. Well walk you through typical debts, like car loans and student debt.

At this point, well estimate your property taxes and insurance. You can also adjust those numbers if you have specific estimates.

Enter monthly HOA dues if you know what theyll be. If not, you can always come back to this later.

Now, your results will appear, including:

-

An estimate of the maximum mortgage amount that NerdWallet recommends

-

A ballpark of your monthly mortgage payment

-

The maximum amount a lender might qualify you for

-

And how much your monthly mortgage payment might be for that amount

Also Check: Does Va Loan Work For Manufactured Homes

What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

The Monthly Income Rule

If you want to focus your search even more, take the time to think about your monthly spending. While the Consumer Financial Protection Bureau reports that banks will qualify mortgage amounts that are up to 43% of a borrower’s monthly income, you might not want to take on that much debt.

“You want to make sure that your monthly mortgage is no more than 28% of your gross monthly income,” says Reyes.

So if you bring home $5,000 per month , your monthly mortgage payment should be no more than $1,400.

“With a general budget, you want to have 50% of your income going toward utilities, mortgage and other essentials,” says Reyes. Keeping your mortgage payment under 30% of your income ensures you have plenty of room for the rest of your needs.

Don’t Miss: How To Transfer Car Loan To Someone Else

How To Avoid The Uncertainty Of Interest Rate Changes

To avoid the uncertainty of interest rate movements, some people choose to fix their interest rate for a period. By doing this, you can avoid the chance that interest rates will go up and your payments will increase. However, youâll also miss out if interest rates go down and your repayments decrease.

You may also miss out on features such as offset accounts and redraw facilities, which can help you reduce the amount of interest you pay in the long term, even if they donât reduce your monthly repayments. For that reason, another alternative may be to take out a split rate loan, where you fix some portion of your home loan and leave the remainder on a variable rate.

Factors That Determine If You’ll Be Approved For A Mortgage

Thinking about buying the home of your dreams? Consider these key financial factors before applying for a mortgage loan.

- 02/07/2019

- 1183

If you want to buy a home, chances are good you’ll need a mortgage. Mortgages can come from banks, credit unions, or other financial institutionsbut any lender is going to want to make sure you meet some basic qualifying criteria before they give you a bunch of money to buy a house.

The specific requirements to qualify for a mortgage vary depending on the lender you use and the type of mortgage you get. For example, the Veterans Administration and the Federal Housing Administration guarantee loans for eligible borrowers, which means the government insures the loan so a lender won’t face financial loss and is more willing to lend to risky borrowers.

In general, however, you’ll typically have to meet certain criteria for any lender before you can get approved for a loan. Here are some of the key factors that determine whether a lender will give you a mortgage.

Recommended Reading: Becu Auto Loan Phone Number

What Factors Impact The Amount You Can Borrow

Lenders consider several factors in determining the amount you qualify for, including:

-

Your debt-to-income ratio. Our How much can I borrow calculator? depends on an accurate input of your income and recurring debt. Youll want to really hone those figures down to a fine point, because lenders will be using them too.

-

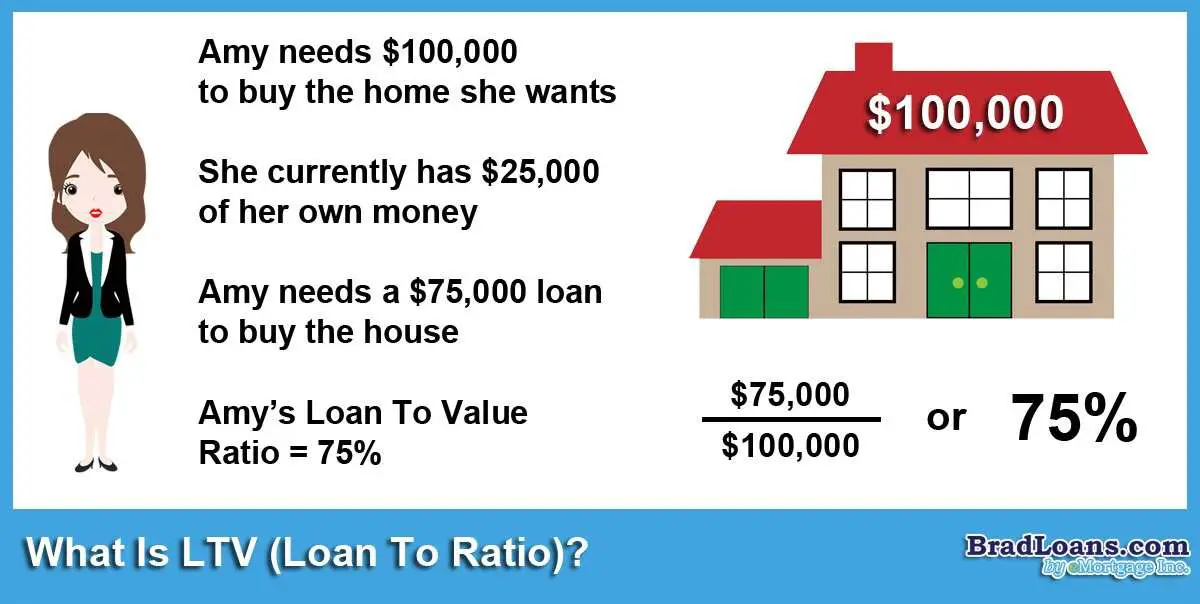

Your loan-to-value ratio. This ratio is a function of the amount of money you put down. If you want to drill down on this calculation, use NerdWallets loan-to-value calculator.

-

Your credit score. This number impacts the pricing of your loan, more than how much youll qualify for. But thats really important. If you dont know your score, get it here.

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

Read Also: How Much To Loan Officers Make

Principal And Interest Of A Mortgage

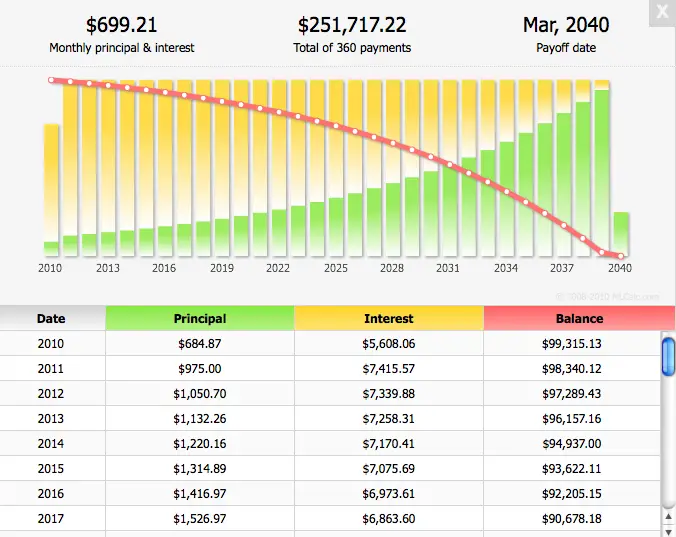

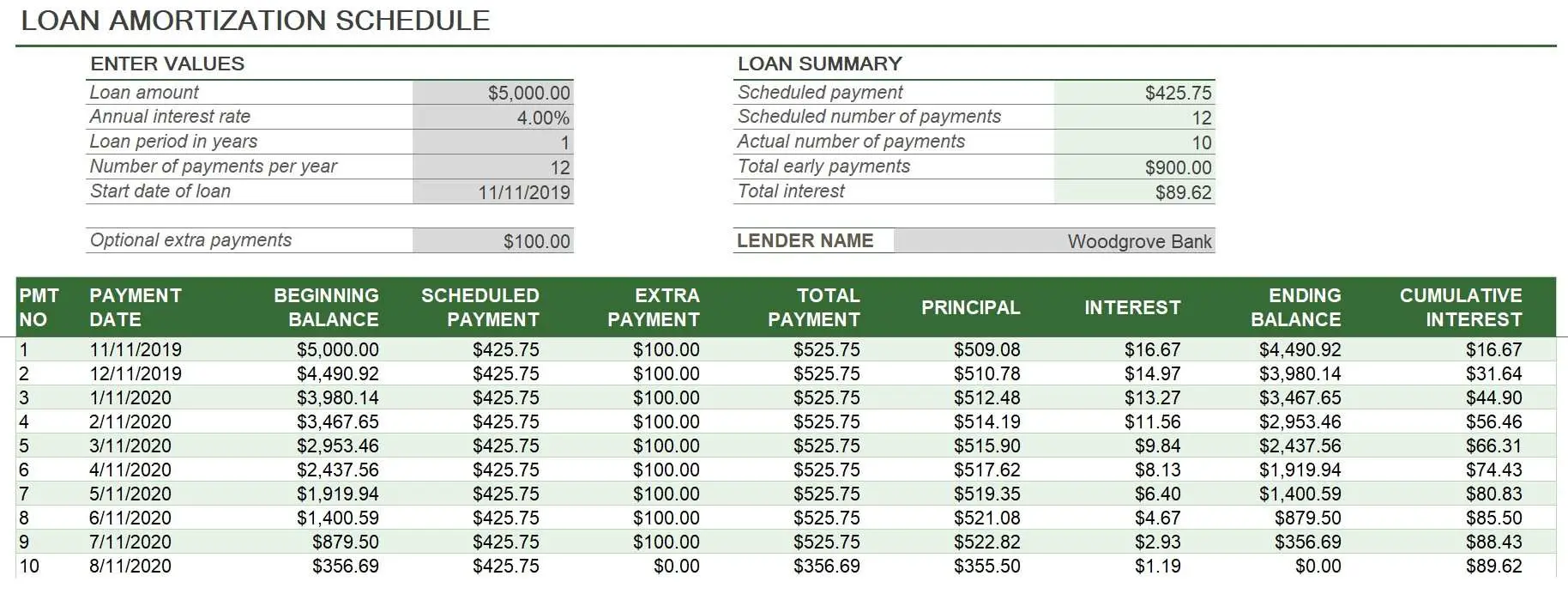

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender’s charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

Tips For Buying An Affordable Home

Suppose you qualify for a large home loan. Does that mean you need to borrow the entire amount your lender is willing to loan you? Of course not.

Assessing how much mortgage you can handle requires a bit of a look into your current and predicted future financial situation. Before you take on the maximum loan you can get and start looking at more expensive houses, consider these tips.

Don’t Miss: Does Va Finance Mobile Homes

Calculate Your Monthly Payment By Hand

You can calculate your monthly mortgage payment, not including taxes and insurance, using the following equation:

M = P /

P = principal loan amount

i = monthly interest rate

n = number of months required to repay the loan

Once you calculate M , you can add in the monthly property tax and homeowners insurance premium, if you have them. These are fixed costs that aren’t determined by how much you borrow from the bank, so they can easily be added to the monthly cost.

How Can I Qualify To Borrow More

If youre disappointed by the how much can I borrow results, remember that there are many factors at work. Small improvements in one or more can make a substantial difference:

A bigger down payment always helps. The more money you put down, the better youll look in the eyes of the lender.

Be a tactical buyer. If school districts wont play a role in your family for years, consider finding a home in a transitioning neighborhood maybe buying a starter home rather than a forever home. Youll likely get a better home value and wont need to borrow as much.

Reduce debt even a little. Paying off or down a credit card or two can help in several ways. Your debt-to-income ratio will go down and you may even get a nice bump in your credit score.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

Types Of Mortgage Calculators

In addition to a calculator that helps you determine the amount of your monthly mortgage payment, there are others that help you analyze various scenarios when it comes to your mortgage. Well give the basics on each of them before digging a little deeper regarding the information you need to make the most use of the calculator.

Recommended Reading: Usaa Certified Dealers List

How To Use The Maximum Mortgage Calculator

Not sure where to start? Let us help you:

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

You May Like: How Do I Find Out My Auto Loan Account Number

Estimate How Much House You Can Afford

To help you get started, you can use our calculator on top to estimate the home price, closing costs, and monthly mortgage payments you can afford based on your annual income. For our example, lets suppose you have an annual income of $68,000. Youre looking to get a 30-year fixed-rate loan at 3.25% APR. For your down payment and closing costs, youve saved $55,000. See the results below.

- Annual income: $68,000

| Total Monthly Mortgage Payment | $1,587 |

Based on the table, if you have an annual income of $68,000, you can purchase a house worth $305,193. You may qualify for a loan amount of $252,720, and your total monthly mortgage payment will be $1,587. Since your cash on hand is $55,000, thats less than 20% of the homes price. This means you have to pay for private mortgage insurance . Take note: This is just a rough estimate. The actual loan amount you may qualify for may be lower or higher, depending on your lenders evaluation.

The following table breaks down your total monthly mortgage payments:

| Monthly Payment Breakdown | |

|---|---|

| Total Monthly Mortgage Payment | $1,587 |

According to the table, your principal and interest payment is $1,099.85. When we add property taxes and home insurance, your total monthly mortgage payment will be $1,481.34. But because you must pay PMI, it adds $105.30 to your monthly payment, which results in a total of $1,587 every month.

The Bottom Line: How Much Home Can You Afford

So, what percentage of your income should go toward your mortgage? The answer will vary depending on your income and how much debt you have. But your income is only one of the many factors that determine how much home you can afford. Lenders look at everything from your credit score to your liquid assets when they decide how much to offer you.

To learn more about how much of a mortgage loan you can afford to borrow, check out our home affordability calculator. If youre ready to get started, you can apply online or give us a call at 452-0335.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Current Mortgage Balance And Payment

Together with your home value estimate, your current mortgage balance is used to determine how much equity you have for the purposes of loan qualification as well as figuring how much cash you can take out.

The payment can be useful because sometimes the reason for refinancing is to try to lower your payment, usually accomplished either through lowering your rate or lengthening your term. Including this info will let you better compare options.

Home Price And Loan Amount

Homebuyers can pay higher interest rates on loans that are particularly small or large. The amount youll need to borrow for your mortgage loan is the homeprice plus closing costs minus your down payment. Depending on your circumstances or mortgage loan type, your closing costs and mortgage insurance may be included in the amount of your mortgage loan, too.

If youve already started shopping for homes, you may have an idea of the price range of the home you hope to buy. If youre just getting started, real estate websites can help you get a sense of typical prices in the neighborhoods youre interested in.

Enter different home prices and down payment information into the Explore Interest Rates tool to see how it affects interest rates in your area.

Read Also: How To Get Loan Originator License