Find Out How Much You Owe Even If You Forgot Your Lenders

It can be easy to lose track of all of your student loans and your total balance, especially when you’re busy in college. Many students receive multiple small loans per semester, which can be a mixture of federal student loanssuch as Perkins, Stafford, and PLUSand private student loans. While your school financial aid office may be able to help you find some basic facts and figures, there are other effective ways to find out your total student loan balance.

Finding Your Private Student Loan Balances

Finding information about your private student loans can be a bit more difficult than getting your federal loan balances since private lenders sometimes sell their loans to other companies. If you’re not sure who your lender is for private student loans, call your school’s financial aid office for help or call your original lender if you know it.

If neither of those options works for you, you can figure out your private student loan lenders by reviewing your . The report should show all of your current debts and accounts, including all student loans.

You can safely get a free annual credit report from all three reporting agenciesEquifax, TransUnion, and Experianat AnnualCreditReport.com.

Can I Deduct The Student Loan Interest I Paid In The Prior Year On My Federal Income Tax Return

You may be able to deduct some or all of your paid interest from your income on your tax return, which could reduce the amount you owe in federal income tax. To determine how much of your paid interest may be deducted, we recommend that you contact your tax advisor refer to IRS Publication 970, Tax Benefits for Education or use the Student Loan Interest Deduction Worksheet in your Form 1040 instructions.

Read Also: Fha Loan Assumability

Does Postponing My Payments With A Deferment Or Forbearance Affect My Repayment Term

Periods when your loan is not in repayment due to school enrollment, a grace period, a deferment, or a forbearance do not count toward your repayment term. See How Long Do I Have Before I Must Completely Repay My Loan? for more information.

IMPORTANT: During a deferment or forbearance, you are responsible for paying the interest that accrues on your loan. If accrued interest is not paid before the deferment or forbearance ends, or an Income-Driven Repayment Plan is not recertified timely, interest will be added to your outstanding principal balance, which will increase the overall amount you’ll have to pay. To see how interest capitalization can affect your balance and the total amount of interest paid over the life of the loan, visit Nelnet.com/interest-capitalization.

To apply for a forbearance or deferment, log in to your Nelnet.com account, and then click Repayment Options.

Finding Your Loan Information

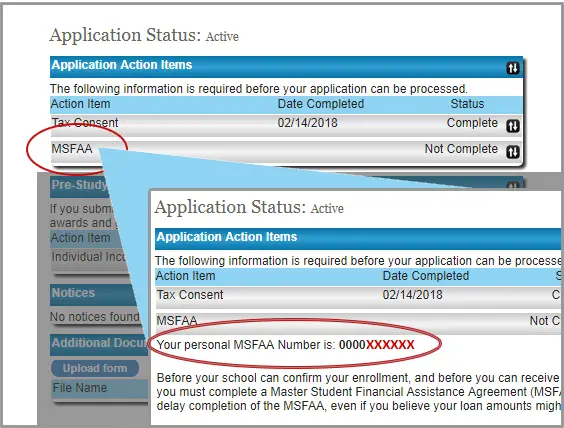

If you are unsure which agency is servicing your defaulted student loan, you may retrieve your loan information from the National Student Loan Data System . This system contains financial aid information collected from schools, agencies, and other educational institutions. You will need your Federal Student Aid ID information to access your account. Or, you may contact the Federal Student Aid Information Center .

Also Check: Usaa Auto Loan Requirements

Why Did You Contact My Father Mother Relative Or Acquaintance Regarding My Loan

When you completed your federal student loan application, you listed several personal references. When we don’t have a valid telephone number or mailing address for your account, we will contact your listed references by mail or telephone to get correct information.

You can conveniently update your address and phone information by logging in to your Nelnet.com account. Click My Info and Preferences, update your information on the Personal tab, and then click Save Changes.

What If I’m Behind On Payments Is Delinquent At The Time Im Requesting A New Repayment Plan

To bring your account up to date, you have the option to make a payment anytime, anywhere. See How to Make a Payment If you cant make the payment to bring your account up to date, Nelnet may be able to grant you a loan forbearance to cover the delinquency. Interest may continue to accrue during a forbearance, and may be capitalized at the end of the forbearance period. Log in to your Nelnet.com account and select Repayment Options to explore your options.

Read Also: How To Transfer Car Loan To Another Person

Can My Loan Be Discharged If I’m Filing For Bankruptcy

Student loans are rarely discharged in bankruptcy. If you are having trouble making your payments, remember Nelnet has many repayment plans to fit your budget and ways to postpone payments. Please contact us to learn more about these options. We are here to help.

Here are a few important things to know if you find yourself considering bankruptcy:

- Once youve filed for or begin bankruptcy proceedings, your creditors are notified, including your student loan servicer, and an automatic stay begins.

- The automatic stay prohibits creditors from continuing with collection efforts during your bankruptcy case.

- If your student loans aren’t discharged in your bankruptcy case, the student loan servicer will resume collection efforts once the case is over.

- Even if youre in a pending bankruptcy, interest will continue to accrue and the total amount you owe may increase. Please consult with a bankruptcy attorney to discuss your options.

How Much You Need To Repay

Verify your loan or line of credit contract to figure out the following:

- the total amount you owe

- the interest rate that will be applied to your debt

- how youll repay your debt

- how much youll pay

- how long it will take to pay back your debt

Contact the organization that provided your student loan or line of credit if you dont have the information listed above.

You May Like: Usaa Used Car Loan Interest Rates

What Do I Do With My 1098

You’ll have one 1098-E for each account listed on your Account Summary.

To file your taxes, you don’t need a physical copy of your 1098-E. Check with a tax advisor to determine how much of the interest paid on your student loans in the previous year is tax deductible. If you have more than one account, you’ll need to look at multiple statements and add the numbers together for your total deduction. Enter the amount from box 1 into the student loan interest deduction portion of your tax return.

If you want a physical copy of your 1098-E for your records, just print it out from our website. It’s as easy as that!

Why Do You Ask Me For My Complete Mailing Address Phone Number And Email Address When You Call Me

When we talk with you, we want to ensure we have your most current information. In part, this is because we need to make certain we only discuss account details with the correct parties associated with your loan. In addition, in the Borrower’s Rights and Responsibilities section of the promissory note you signed for your loan, you promised to provide your servicer with your most current contact information to help us reach you with important account notifications.

Read Also: Usaa Current Auto Loan Rates

What Are The Advantages Of Making Automatic Monthly Payments Through Auto Debit

Auto debit is a convenient, simple payment option offering you the peace of mind that comes with knowing your student loan payments are being made accurately and on time.

Nelnet does not charge a service fee for using auto debit. In addition, you don’t need to use stamps, envelopes, or a check, which saves you time and money.

Additionally, when you sign up for auto debit, you may be eligible for a 0.25% interest rate reduction * while your account is in an active repayment status.

*Your lender may modify or terminate its borrower benefit program at its discretion and without prior notice. Your failure to satisfy benefit eligibility requirements may result in the loss of benefit. Some lenders do not offer this benefit. back

Graduate Or Leave Full

You have six months after you graduate or leave full-time studies before you need to start repaying your OSAP loan. This is your 6-month grace period.

You will be charged interest on the Ontario portion of your loan during your 6-month grace period. This interest will be added to your loan balance .

You May Like: Car Loan Transfer To Another Person

Wells Fargo Private Student Loans

Wells Fargo has exited the student loan business. Our private student loans are being transitioned to a new loan holder and repayment will be managed by a new loan servicer, Firstmark Services, a division of Nelnet.

For assistance:

- Visit Firstmark Services online

Avoid processing delays: After your student loan has transferred to Firstmark Services, please ensure that payments are being sent using your new Firstmark Services account number and payment address. Wells Fargo will only forward misdirected payments for 120 days after transfer. After that 120-day period has passed, misdirected payments will be returned.

Alert: If you need assistance or services related to COVID-19, learn more about how we can help.

General student loan questions?Visit CollegeSTEPS® for guidance to help you manage your money confidently during college.

After your student loan is transferred, your student loan will no longer appear on Wells Fargo Online. If your student loan is your only account with Wells Fargo, you will no longer have access to Well Fargo Online after this transfer is complete. Firstmark Services will mail you written instructions describing how to set up online access using your new account number.

If you are a borrower or cosigner with a pending disbursement, please call us at Monday to Friday: 9 am to 5 pm Central Time, or login to check your loan status.

If your student loan payments are made by someone other than you, please advise them of these changes.

What Happens To My Student Loan If I Or My Benefitting Student Dies

If you or your benefitting student should pass away before your student loan is paid in full, your family or representative can get the loan discharged by sending an original or certified copy of the death certificate to Nelnet. If a death certificate isnt available, other documents are sometimes accepted on a case-by-case basis. These alternative documents include:

- Verification from an official of a county clerks office stating the student/borrower is deceased and a death certificate could not be readily provided

- Letter from a clergyman or funeral director

- Confirmation of death from a consumer reporting agency

- Announcement of death from a local newspaper containing enough information to verify the announcement is referring to the student/borrower

- Confirmation from the Social Security death registry

Any payments made on the loan after the confirmed date of death are returned to the estate. Its important to note that if Nelnet doesnt receive acceptable documentation of death, the loan resumes servicing at the same delinquency level it was being serviced when Nelnet was notified of the death.

Recommended Reading: Mlo Endorsement To A License Is A Requirement Of

How Can I Change My Repayment Plan

To explore options or make changes to your repayment plan, contact us, log in to your Nelnet.com account, or see Repayment Plans. You can also visit the office of Federal Student Aid’s website at StudentAid.gov to review other options like consolidation.

You may prepay your loan at any time without penalty, regardless of repayment plan.

To learn more about the various repayment plans you may be eligible for, log in to your Nelnet.com account and click Repayment Options.

How To Make An Additional Payment

NSLSC Account

You can make a payment in between regularly scheduled payments from the National Student Loans Service Centre website.

Log in to your NSLSC secure account to:

- add or update your banking information, and

- make an additional payment using your banking information

Online banking

- Add the National Student Loans Service Centre as a payee through your online banking site

- Use your loan number as your 7-digit account number

Have the NSLSC withdraw an additional payment from the bank account on your file or listed on the form:

Fill out the form and mail it to:

National Student Loan Service Centre P.O. Box 4030 Mississauga ON L5A 4M4

Read Also: Refinancing Auto Loan With Same Lender

Why Don’t I Qualify For The Income

Each of the four Income-Driven Repayment plans has unique qualifications for eligibility. The Income-Contingent Repayment Plan, Pay As You Earn repayment plan, and Revised Pay As You Earn repayment plan are for Direct Loans only. The Income-Based Repayment Plan is for both Federal Family Education Loan Program and Direct Loans.

There may be other reasons you didnt qualify for example, if we did not receive all of the information needed to evaluate your eligibility. For more information about qualification requirements, see Repayment Plans You can also log in to your Nelnet.com account to find out if you’re eligible.

How Can I Get My Student Loan Discharged If I Become Disabled

Certain types of student loans may be discharged if you qualify for the Total and Permanent Disability Discharge Program. The loans that qualify are Federal Family Education Loan Program Loans, Perkins Loans, and Direct Loans, and also the Teacher Education Assistance for College and Higher Education Grant service obligations. To apply and to get status information about your application, you can create an account at DisabilityDischarge.com or call 888.303.7818. For more information about the TPD process, visit StudentAid.gov.

Read Also: Avant Refinance Apply

What Does It Mean That Interest Is Capitalized

Interest accumulates based on your interest rate and the principal balance of your loan. When interest remains unpaid at the end of certain periods such as when your loan enters repayment, when you exit an Income-Based Repayment Plan, when you miss your Income-Driven Repayment Plan recertification date, or after a deferment or forbearance ends the outstanding interest usually is added to the principal. This adding of the outstanding interest to the principal is known as capitalization.

After outstanding interest is capitalized, any future interest that accrues will be based on the interest rate and the new principal amount . Therefore, capitalization increases the total cost of your loan.

You can minimize interest capitalization by making payments during any period when payments are not due.

To see how interest capitalization can affect your balance and the total amount of interest you pay over the life of your loan, see Interest Capitalization.

What Is The Difference Between Auto Debit And Making A One

Auto debit is a convenient, simple payment option that offers you the peace of mind that comes with knowing your student loan payments are being made accurately and on time every month. You only have to sign up once to have all of your monthly payments made automatically.

Your Nelnet.com account allows you to make a one-time online payment even when your student loan payment is not due. Plus, you can direct your payment to specific loan groups. For more information on these and other ways to pay, see How to Make a Payment.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Resolve Student Loan Disputes

If you and your loan servicer disagree about the balance or status of your loan, follow these steps to resolve your disputes:

1. Talk with your loan servicer

You may be able to solve a dispute by simply contacting your loan servicer and discussing the issue. Get tips on working through an issue with your loan servicer to resolve the dispute.

2. Request help from the FSA Ombudsman Group

If you have followed the guide and still cannot resolve your issue, as a last resort, contact the Federal Student Aid Ombudsman Group. The FSA Ombudsman works with student loan borrowers to informally resolve loan disputes and problems. Use FSA’s checklist to gather information youll need to discuss the dispute with them.

How Would A Deferment Or Forbearance Impact Auto Debit And Incentives

Automatic monthly payments are not debited during deferment or forbearance. If the 0.25% auto debit interest rate reduction incentive or an on-time payment incentive is active on the account, it may become inactive during the deferment or forbearance period, and may return to an active status once your deferment or forbearance ends, depending on your lenders guidelines *. If your account is set up for auto debit when your deferment or forbearance ends, the auto debit will resume.

*Certain lenders, including the U.S. Department of Education, suspend the .25% interest rate reduction when your loan is not in an active repayment status. back

Don’t Miss: What Type Of Loan Do I Need To Buy Land

Are There Any Fees Associated With Repaying A Federal Student Loan

If you are late on a payment or your payment is returned, your lender has the discretion to charge you a fee. * Your lender may charge other fees related to collecting a defaulted loan. Below is a list of possible fees. If you have specific questions regarding fees, contact us.

* The U.S. Department of Education does not assess late or returned payment fees. back

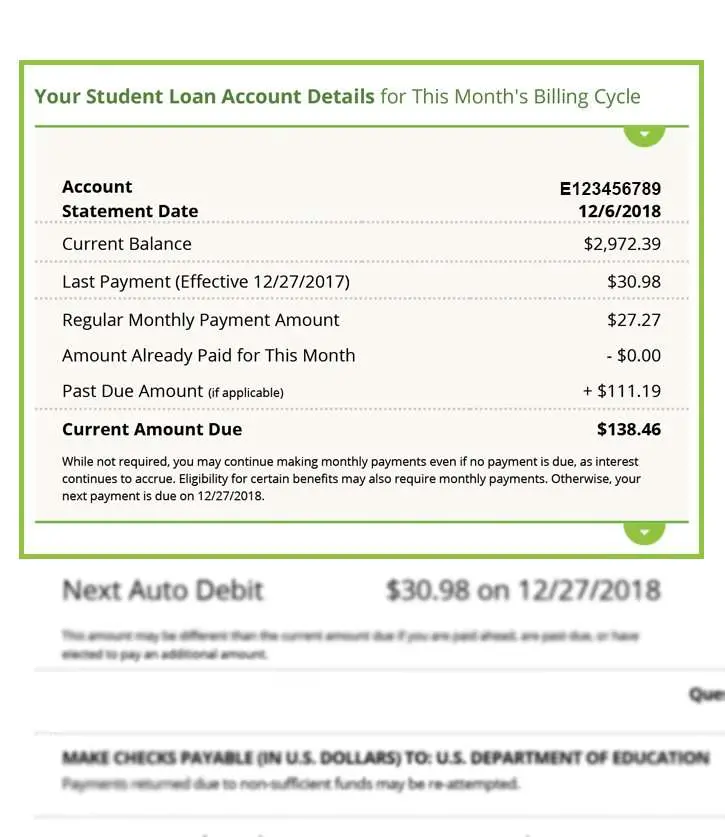

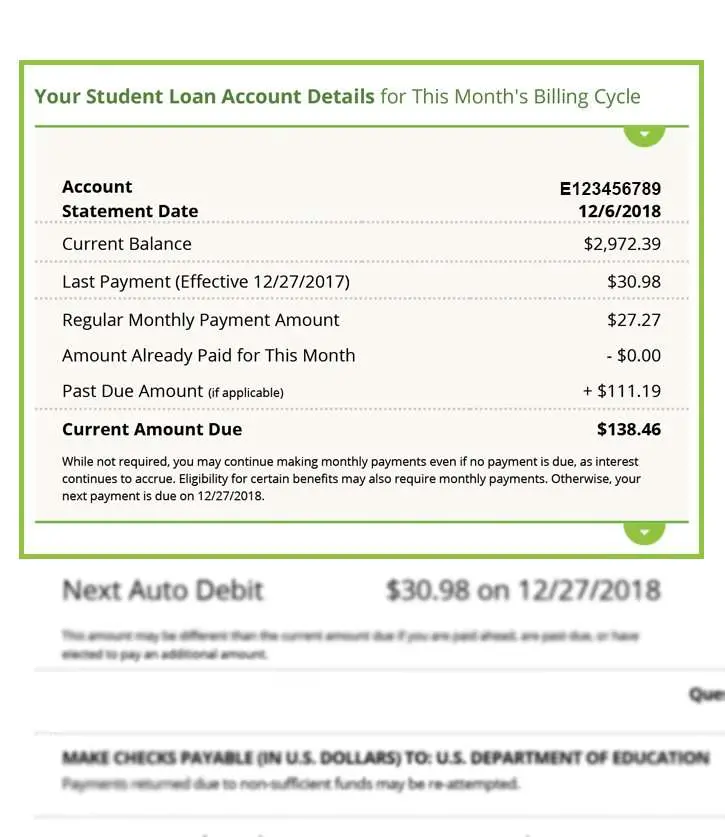

- Late fee: Any payment not received within 15 or more days after the due date may incur a late fee of up to six cents for each late dollar as determined by your lender and described in the terms of your promissory note. Your late fee is calculated based on the unpaid portion of your regular monthly payment amount. You can find information about late fees in the account snapshot on your monthly billing statement.

- Returned payment fee: A payment returned due to non-sufficient funds may be reattempted a maximum of one time. A returned payment may be assessed a $5 fee.

- Miscellaneous fees: You may be charged certain reasonable costs incurred in collecting your loan. Costs can include, but are not limited to, attorney fees and court costs.

You may reduce this extra cost by paying more than your current amount due to cover the amount of your fee. If a fee is charged to your account, we will include detailed information about the fee on your monthly billing statement.