Lender Uncertainty Leads To Stricter Lending Practices

So, why do some lenders set higher standards than HUD? One reason is that they are afraid of being penalized down the road for the manner in which they originate their loans.

There is a lot of uncertainty regarding FHA guidelines and requirements for borrowers. As a result, some mortgage originators are nervous about making these loans in the first place. So they impose their own stricter criteria as an added layer of protection, which in turn makes it hard for some borrowers to qualify for the program. In short, fear or uncertainty toward government regulations tends to constrict credit availability.

According to Jaret Seiberg, an analyst with Guggenheim Securities: credit cant be widely available if lenders have to worry that each loan could result in litigation that wipes out years of profits.

HUD is trying to reduce such concerns by clarifying their rules and guidelines. They are currently in the process of revising and simplifying certain manuals and handbooks used by mortgage lenders. It remains to be seen whether or not this will have an effect on lending practices, and to what extent. But their efforts could make it easier to get an FHA loan in future. Time will tell.

S To Apply For An Fha Loan

FHA loans are insured by the Federal Housing Administration, an arm of the Department of Housing and Urban Development .

Thanks to their government insurance, FHA loans can offer low down payments, looser credit requirements, and low rates. This makes them popular with first-time home buyers. But repeat buyers are welcome to apply as well.

Although FHA mortgages are insured by the FHA, this agency doesnt actually lend money. You get an FHA loan from a private lender, just like you would a conventional loan.

So the first thing you need to do is choose a lender you want to apply with.

1. Find a lender

The first step to getting an FHA home loan is finding an FHA-approved lender. The good news is that the majority of banks and mortgage companies offer this type of mortgage, so finding a lender shouldnt be too difficult.

You can get FHA financing from banks, mortgage companies, credit unions, and online lenders. You can also use our review of the best FHA lenders as a starting point.

The right lender for you will depend on a few things. For instance, if you have a lower credit score, you want to make sure your lender accepts FHAs minimum of 580 .

You should also think about how you want to work with your lender. Do you prefer person-to-person interactions? Look for a local lender that focuses on in-person and over-the-phone lending.

2. Apply for a loan

After finding a lender, the next step is to submit a loan application.

3. Provide basic details

4. Compare Loan Estimates

What Are The Downsides Of An Fha Loan

A major drawback of FHA loans is the high cost of FHA mortgage insurance, which must be paid for the life of the loan if you put the minimum 3.5% down. FHA county loan limits also curtail your buying power since theyre set at 35% below conforming conventional loan limits in most counties in the U.S.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Types Of Fha Home Loans

There are a number of different types of FHA loans. The type of FHA loan you choose limits the type of home you can buy and how you can spend the money you receive. This makes it especially important to be sure that youre getting the right type of loan. If none of the following loan types match your goals, you might want to consider another government-backed FHA loan alternative.

Lets take a look at a few different FHA loan classifications.

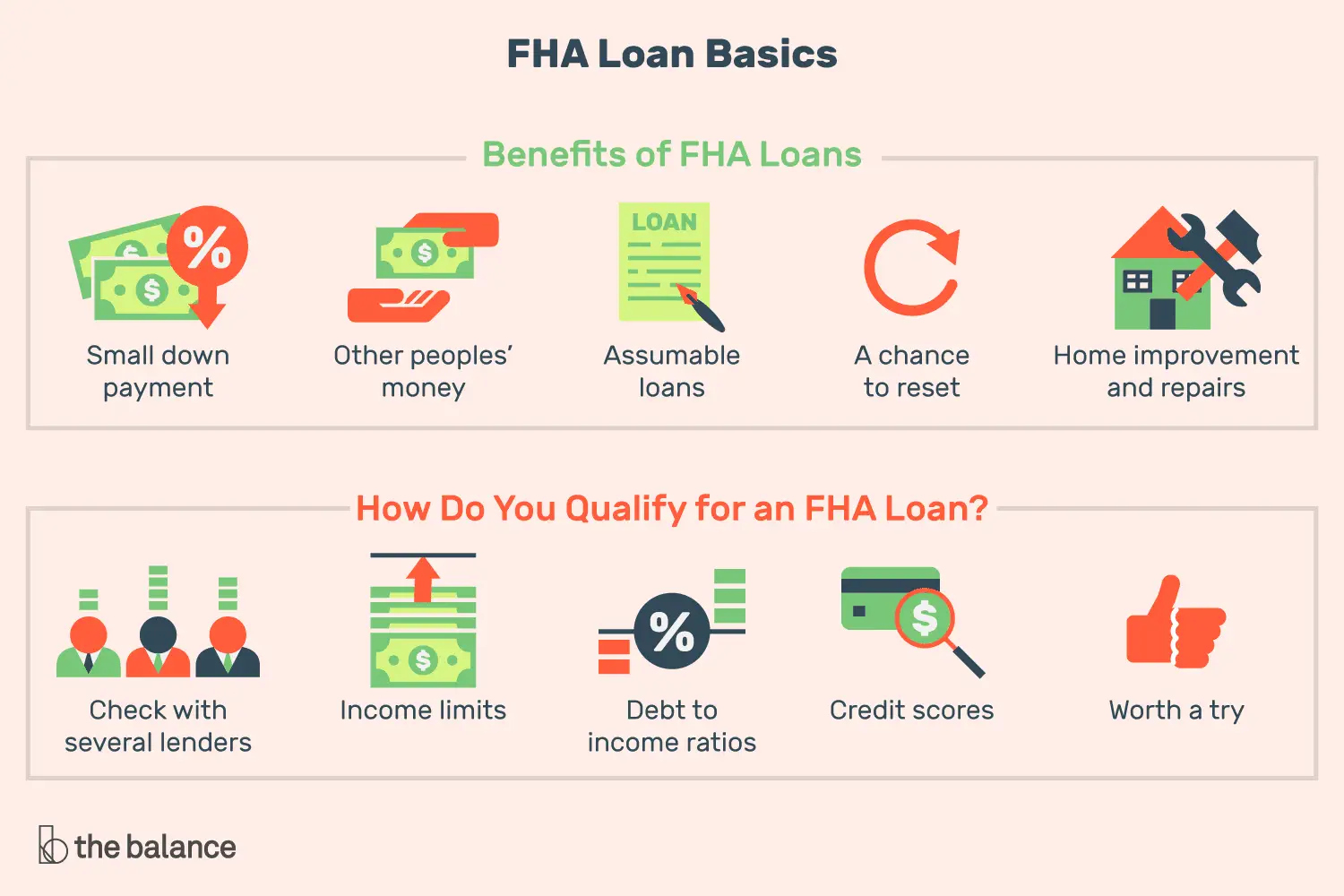

How To Qualify For An Fha Loan

FHA loans can be great for first-time homebuyers as they may qualify for a down payment as low 3.5% of the purchase price. And people with lower incomes and credit scores may also qualify for FHA loans. This loan type makes homeownership possible for many.

Taking out a loan to buy a home is exciting, but its also a big decision that takes significant time and consideration. We want to provide you with the right information to help you make the best choices for you and your family, and this guide will help you understand what an FHA loan is and how to apply for one.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

You Might Not Get Approved If You Have Lots Of Debt

FHA loan officers wont approve your loan if theres a good chance you wont be able to afford the mortgage and your other debt, such as car and credit card payments.

A good rule of thumb is that your mortgage payment shouldnt be more than 31% of your income before taxes. Your mortgage payment PLUS your other monthly debt payments usually cannot be more than 41% of your income, though in certain cases you can get approved if your debt obligations total 50%.

How To Decide If An Fha Loan Is The Right Choice

An FHA loan does offer significant benefits, but it’s not the right choice for every would-be homebuyer. An FHA loan could make sense for you if:

- Your credit needs improvement. Conventional mortgage loans usually require a , while FHA loans allow for lower credit scores. Even if you’ve had more significant credit problems, such as a bankruptcy, you could still qualify for an FHA loan.

- You don’t have much saved for a down payment. Since FHA loans allow you to put down as little as 3.5%, they’re an option for homebuyers who haven’t been able to set aside a significant sum.

- You need help with closing costs. Conventional mortgages require borrowers to pay hefty upfront costs in addition to the down payment, which can easily total in the thousands. To help homebuyers, the FHA allows some closing costs to be rolled into the mortgage and paid over time.

FHA loans have their advantages, but there’s a trade-off in the form of the mortgage insurance. Homebuyers who take out an FHA loan must pay an upfront premium that’s usually 1.75% of the base loan amount. There’s also an ongoing annual mortgage insurance premium that usually costs 0.45% to 1.05% of the loan amount. This annual premium lasts for the life of the loan unless you refinance later on or put down 10% or more, in which case it falls off after 11 years.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Who Is A Good Candidate For An Fha Loan

Anyone who wants a home but doesnt have a lot of money for a down payment and/or has a poor credit score.

The FHA has health and safety requirements for houses. If you find a broken-down house at a low price and see it as a bargain, the FHA will probably see it as a dump and not give you the loan.

FHA mortgages are often ideal for first-time home buyers. Their income and credit histories might improve, at which time they could refinance with a conventional loan and get out from under the mortgage insurance premium.

Even if their financial situation doesnt improve, an FHA mortgage is often the best way for somebody to get their foot in the door of a new house. That sure beats having it slammed in their face.

About The Author

Tips On How To Get An Fha Loan

EXPECTED READ TIME: 3 MINUTES

May 21, 2021

Getting an FHA mortgage is just like obtaining any other loan. You apply and turn in your documentation. If everything looks good, you get a prequalification letter. Then you start shopping. Those are the exact steps that you’d take if you were applying for a most loans including FHA, VA, or conventional.

Read Also: Is Bayview Loan Servicing Legitimate

What Are Fha Loan Requirements In Nc And Sc

FHA loans in Charlotte, NC or other areas in the Carolinas are available to buyers as long as they meet FHA loan requirements. North and South Carolina FHA loan requirements include:

- A credit score of at least 580. However, if your score is between 500 and 579, you may still be eligible for an FHA loan if you make a down payment of at least 10% of the homes purchase price.

- Borrowing no more than 96.5% of the homes value through the loan, meaning you need to have at least 3.5 percent of the sale price of the home as a down payment.

- Choosing a home loan with a 15-year or 30-year term.

- Purchasing mortgage insurance, paying 1.75% upfront and 0.45% to 1.05% annually in premiums. This can be rolled into the loan rather than paying out of pocket.

- A debt-to-income ratio less than 57% in some circumstances.

- A housing ratio of 31% or less.

FHA lenders in NC and SC will provide you with all the information you need and can help determine if you qualify for an FHA loan.

Income Requirements for FHA Loans

Theres a common misconception that FHA loan requirements include income restrictions. While FHA income guidelines can be confusing, FHA loans are available to those who have any type of income. There are no minimum or maximum income requirements.

Fha And Conventional Loan Differences

Conventional loanshave higher requirements than FHA loans. Borrowers need a minimum credit score of 620.

When scores surpass 720, individuals should opt into a conventional loan over an FHA to pay less monthly.

Aspiring homeowners who can afford a large down payment are likely better off choosing a conventional loan. In addition, FHA appraisals are more stringent.

Also Check: Becu Lienholder Address

Federal Housing Administration Loans Vs Conventional Mortgages

FHA loans are available to individuals with as low as 500. If your credit score is between 500 and 579, you may be able to secure an FHA loan if you can afford a down payment of 10%. If your credit score is 580 or higher, you can get an FHA loan with a down payment for as little as 3.5% down. By comparison, you’ll typically need a credit score of at least 620, and a down payment between 3% and 20%, to qualify for a conventional mortgage.

When it comes to income limitations and requirements for FHA home loans, there is no minimum or maximum.

For an FHA loanor any type of mortgageat least two years must have passed since the borrower experienced a bankruptcy event . You must be at least three years removed from any mortgage foreclosure events, and you must demonstrate that you are working toward re-establishing good credit. If you’re delinquent on your federal student loans or income taxes, you won’t qualify.

| FHA Loans vs. Conventional Loans |

|---|

Fha Foreclosure Waiting Period

If you have previously lost a home to foreclosure, you’ll have to wait three years before applying for an FHA loan. There are some exceptions, however, for circumstances like a serious illness.

Those who have experienced bankruptcy can also qualify for an FHA loan, though you’ll have to demonstrate that you’re now on better financial footing. Some allowances may be made on an individual basis, but in general, you’ll need to wait two years after a Chapter 7 bankruptcy and at least a year after a Chapter 13 bankruptcy to apply for an FHA mortgage.

Read Also: What Is The Maximum Fha Loan Amount In Texas

Have A Fico Score Of At Least 580

The minimum FICO score to qualify for the FHA loan program is 580, but the FHA is not a lender, its the insurer, and its the lender who sets their minimum credit score requirements, which often sit around 640 for FHA loans .

If you dont know your credit score, check your it now for free. If your score is well above 640, youre safe to apply for an FHA loan. If not, call your chosen mortgage lender and ask what their minimums are for processing FHA loan applications before you officially apply.

Our Fha Loan Approval Process

Assurance Financial understands you may have questions when you decide to buy a home. You may wonder where is there an FHA loan officer near me? or Is an FHA loan or another mortgage the right option for my situation?

Fortunately, Assurance Financial makes it easy to get answers. You can apply online for your mortgage with Abby, your virtual assistant, in just minutes. You can also contact a local loan officer to get more information. Once we look at your credit and application, we can give you a free quote and pre-qualification, so you can understand how much your home may cost. This process also allows you to understand whether you qualify for a home loan.

Once you are ready to apply and decide an FHA loan is right for you, Assurance Financial can walk you through the whole application process. You may need to submit documentation, and you will need to find a property to buy before completing this step. Once we have your application, we take care of processing in house. The processing stage involves underwriting, appraisal and approval.

Finally, we are able to move to funding once you have been approved. You will sign with a notary to close your loan, and we will fund your loan. At this point, you may be able to start getting ready to move in.

At every stage, Assurance Financial works to keep the process smooth and easy to understand. If you ever have questions, your mortgage expert is there to help.

Read Also: Does Va Loan Work For Manufactured Homes

Review Fha Closing Costs And Sign The Final Documents

The last step in getting an FHA loan is reviewing your closing costs and signing the documents. Be aware that there will be other costs at signing, known as closing costs, but you might be able to negotiate having the seller pay them.

If you cant arrange that, you can pay the costs upfront or add them into the loan. Each local FHA office determines which specific costs and amounts are reasonable and customary. Here are the items you need to bring with you at closing:

- Valid identification

- Proof of homeowners insurance

- Closing funds in either a cashiers check or an electronic wire

Take the time to go over the closing documents carefully with a notary and verify all the information is correct. Once you sign on the dotted line, you are legally bound to that mortgage, and the only way youll be released from that responsibility is by selling your home, paying off your mortgage or foreclosing on your property.

Ashley Eneriz contributed to the reporting for this article.

How Much Money Do I Need For A Down Payment

The larger the down payment you are able to make, the less youll have to finance when you purchase a home. On a conventional mortgage, making a down payment of at least 20% will prevent you from having to pay for private mortgage insurance. The minimum down payment required varies based on the type of mortgage you obtain. In 2019, the median down payment for first-time buyers was 6%.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Getting Started Before You Find A Home

FHA home loans were designed to help Americans fulfill their dream of homeownership and are therefore the easiest type of real estate mortgage loan to for which you can qualify. Among the home loan options available that require a minimal down payment, FHA loans are the most popular. In fact, the FHA loan is the most flexible type of home mortgage loan available.

How To Get Fha Loan With No Down Payment

The lowest down payment the FHA offers is 3.5% down. There is no zero down like the VA offers. But there are ways the borrower can get help paying for the down payment and even the closing costs.

- Gift funds are one of the main ways borrowers come up with their down payment money without paying for it themselves. The money has to be a gift and cannot be expected to be repaid. This gift can come from a relative, your parents, an employer, or charity. You’ll need to document the contribution with a gift letter. There are also the local city, county, and state grants to help with down payment assistance. But these programs do take longer, and not all lenders work with them.

- Seller concessions can be up to 6% of the sales price of the home. These can go towards the closing costs but not the down payment.

Read Also: Car Loan Transfer To Another Person

How Do You Apply For An Fha Mortgage

Applying for an FHA loan is like any other mortgage application process, meaning get ready for a lot of paperwork. The only difference is the mortgage broker must be authorized to make FHA loans.

Most are, and you can check with FHA Lender finder on the internet to find a list of brokers. Consider getting a mortgage pre-approval before going out home shopping, so your offer carries more weight with sellers.

Understand The Costs Of An Fha Loan

The drawback of an FHA loan is the mandatory private mortgage insurance . PMI is insurance you must pay as the borrower both upfront and monthly that protects the lender in the event you default. PMI is required for anybody who puts less than 20% down on a home. Learn more about the fees associated with FHA loans.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

How Do Fha Loans Work

FHA loans can give people with lower incomes or those with lower credit scores the ability to become homeowners. In order to offer a more relaxed credit requirement and a lower down payment, FHA requires you to pay mortgage insurance. If you defaulted on your loan, FHA would be responsible for paying off the remainder of your loan. Mortgage insurance limits the amount of money the lender may lose.

Mortgage insurance is considered a closing cost. Closing costs are the upfront fees required when you close on a home, and they’re separate from your down payment. Lenders and third parties can cover up to 6% of closing costs on FHA loans, including attorney, inspection and appraisal fees.

FHA-backed loans allow for financial gifts from family, employers and charitable organizations to help cover closing costs.

The borrower is responsible for paying two FHA mortgage insurance fees: