Common Uses Of Heloc: Why You Might Consider One

There are several reasons as to why the consumer should consider a home equity line of credit and many different reasons as to why borrowers use them:

- Home equity lines of credit are used as tools to consolidate debt. Many borrowers find that their home equity can be used as a way to consolidate their high-interest debts such as credit cards.

- There are potential tax benefits if used as a home improvement loan. The tax advisor can help the borrower learn if the interest is tax-deductible. Generally speaking HELOCs and home equity loans are considered tax deductible if the debt is obtained to build or substantially improve the homeowner’s dwelling.

- A home equity line of credit can give the borrower the cash to purchase a boat or a car.

- The borrower can pay for their childâs college education.

- The borrower can pay off a fixed second mortgage or an existing line of credit.

- Buy an additional home or investment property.

Are You Considering Taking Out a HELOC or Home Equity Loan?

Figure out your monthly payments & interest savings using our free HELOC calculator or compare a piggyback second mortgage versus paying PMI.

How Long Is The Repayment Period

Following the draw period, you will begin to repay the loan plus interest in a set repayment period, usually 10 to 20 years. This is a little shorter than a standard first mortgage, which is 30 years.

Repayment periods are usually governed by a fixed rate, though variable rates can be used as well. Typically, the draw period is variable and then the repayment period moves to a fixed rate, set as a percentage over the prime rate. Check with your lender and the specific terms of your deal to be sure of how its handled.

Payments made during the repayment period are amortized, meaning you make monthly payments of interest and principal. Over time, you will pay down the interest and pay more principal but expect steady payments for the duration of the repayment period.

A Homeowner’s Guide To Understanding Home Equity Options

One benefit of home ownership is the ability to use earned equity to borrow the money you need. There are different ways that people might harness the value of the equity, depending on their own goals, situation and opportunities.

There are really three options that most people will look to when seeking to use their equity:

Cash-out Refinance

A cash-out refinance, is really a refinancing of your existing mortgage with an additional lump sum added in, to be spent as you see fit. This can be viewed most simply as one loan replacing another.

Home Equity Loan

A home equity loan, is a lump sum payment as well, but it does not include your mortgage payment it is in addition to your mortgage, so is sometimes referred to as a second mortgage. The first mortgage has a senior position in the capital structure, but if you default on either loan you could still lose the house.

Home Equity Line of Credit

A HELOC is similar to a home equity loan in terms of working alongside your existing first mortgage, but it acts more like a credit card, with a draw period, and a repayment period and is one of the more popular options with todays homeowners.

Each option can be strategic, depending on your own circumstances so understanding more about why youd choose one over the other can help you to focus your research.

| Loan Type | |

|---|---|

| Amount Drawn | Loan Amount |

Read Also: Transfer Auto Loan To Another Bank

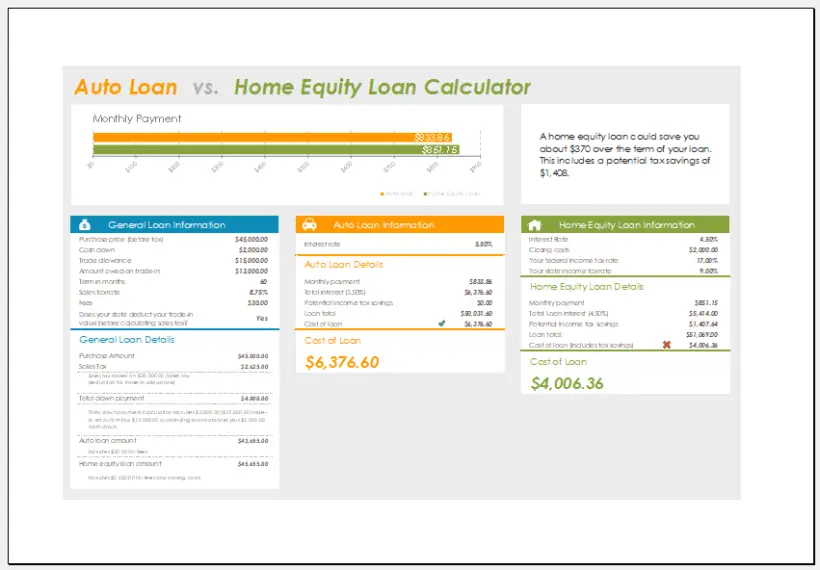

Home Equity Loan Calculator

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

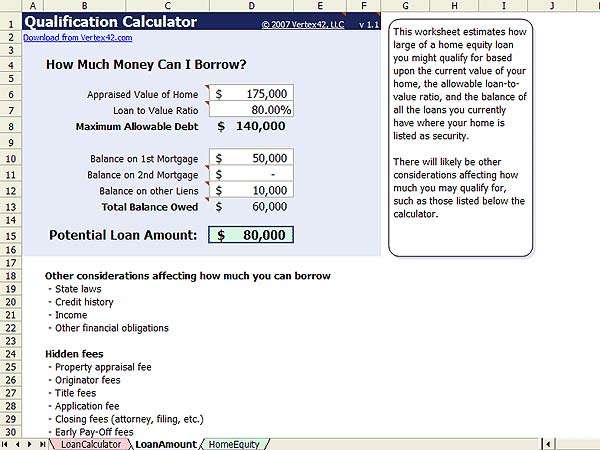

Use this home equity loan calculator to see if a lender might give you a home equity loan and how much money you might be able to borrow. Home equity refers to how much of the house is actually yours, or how much youve paid off. Every time you make a mortgage payment, or every time the value of your home rises, your equity increases. As you build equity, you may be able to borrow against it.

Getting ready to buy a home? Well find you a highly rated lender in just a few minutes.

Enter your ZIP code to get started on a personalized lender match.

How To Get A Home Equity Loan

Youll generally be eligible for a home equity loan or HELOC if:

-

You have at least 20% equity in your home, as determined by an appraisal.

-

Your debt-to-income ratio is between 43% and 50%, depending on the lender.

-

Your credit score is at least 620.

-

Your credit history shows that you pay your bills on time.

» MORE:Five ways to get the best home equity loan rates

Read Also: Va Manufactured Home Guidelines

Whats The Difference Between A Home Equity Loan And A Home Equity Line Of Credit

As mentioned above, a home equity loan is paid out in a lump sum and repaid in fixed monthly installments over a set term. On the other hand, a home equity line of credit , works much like a credit card. You can use the credit line up to the established limit, but you pay only for what you use plus interest. HELOCs have a set draw period, during which you can use the credit line. When the draw period ends, the HELOC goes into repayment and you cant tap any more equity from the credit line.

Tax Benefits Of Homeownership

Before the 2018 tax bill passed homeowners could deduct the interest expenses on up to $100,000 of debt from home equity loans & HELOCs, but interest on these loans is no longer tax deductible unless it is obtained to build or substantially improve the homeowner’s dwelling.

If you are planning on taking a large amount of equity out of your home it may make more sense to refinance your first mortgage, as first mortgages & mortgage refinance loans still qualify for the interest deduction on up to $750,000 of mortgage debt.

Homeowners who had up to $1 million in mortgage debt before the new tax law was passed will still retain the old limit even if they refinance their homes.

How Much Money Could You Save By Refinancing at Today’s Low Rates?

Our home refinance calculator shows how much you can save locking in lower rates.

You May Like: What Car Loan Can I Afford Calculator

What Is The Difference Between Getting A Heloc And Refinancing My Mortgage

Refinancing your mortgageallows you to borrow a lump-sum at an interest rate that is usually lower than what you would be able to get on a HELOC. Unlike a HELOC, however, you will have to make regular payments torwards your mortgage that include both principle and mortgage payments. With a HELOC, you can make interest-only payments, significantly reducing the amount you have to pay back each month. This can be helpful if you will only be able to make a repayment sometime in the future, like in the case of renovating your home.

For a HELOC, the interest rate is typically a lenders prime rate + 0.5%. Prime Rates are set by the lenders and can differ from institution to insitution. This means, unlike the fixed payments in a fixed-rate mortgage, a HELOC’s rate is variable. So if a lender increases its prime rate, then your HELOC interest payment increases. The rates are typcially higher than the rate of the initial mortgage.

Mortgages also often come with pre-payment limitations and penalties. You will not be able to pay off the amount you borrowed immediately, and it will continue to accrue interest. A HELOC, on the other hand, gives you the flexibility to borrow and pay off the credit whenever you want.

How To Impact Your Ltv

One of the best ways to help reduce your loan-to-value ratio is to pay down your home loans principal on a regular basis. This happens over time simply by making your monthly payments, assuming that theyre amortized . You can reduce your loan principal faster by paying a little bit more than your amortized mortgage payment each month .

Another way to impact your loan-to-value ratio is by protecting the value of your home by keeping it neat and well maintained.

Also Check: Va Loan On Manufactured Home

Requirements For Heloc Qualification

Lenders will be seeking some standard things when qualifying an applicant for a HELOC. They are looking to minimize their risk, so it helps to understand how you can help improve your own chances of success.

- : this refers to your CLTV, which most lenders want to see under 80% for a HELOC. To harness home equity, you must have it built-up.

- Solid FICO Score: though it is possible to secure a HELOC with a FICO of 620, it will be tougher than if your score is 720 or higher. Anything under 720, and the lender might impose additional fees or stipulations to feel secure in extending credit.

- Low DTI: your debt-to-income level is of equal measure as your credit score, perhaps even more important to lenders. To understand your DTI, divide your monthly expenses by your gross monthly income. If your DTI is higher than 45%, you will probably struggle to find a willing lender so look for ways to better manage your debt.

Lenders will offer a HELOC at an APR that is using a margin over the prime rate. The margin is usually constant, but the prime rate may change a lot over the life of the loan. If a lender offers a HELOC under prime, chances are that the rate is short term.

Pay attention to the way the lender words their offer it is common for a HELOC to have an introductory rate that is significantly discounted for a short period of time, like six months. This rate is a teaser, and the actual rate may be one that is higher than youd like.

Heloc & Home Equity Loan Qualification

The three primary things banks look at when assessing qualification for a home equity loan are:

- Available equity in the home: as mentioned above, banks typically allow a max LTV of 70% to 85%

- People with an excellent credit score of above 760 will get the best rates. Those with good credit of 700 to 759 will still be able to access credit, though typically not at the best rate. People with a fair credit score of 621 to 699 will typically be able to obtain credit, though at higher rates. People with poor credit scores may not be able to obtain credit.

- Debt to income ratio: lenders generally like borrowers to spend less than 36% of their pre-tax income on monthly mortgage & debt payments, though some banks may allow borrowers to obtain funding with DTI ratios as high as 43%

You May Like: How To Get Loan Originator License

How Is My Heloc Limit Calculated

In Canada, you can only borrow up to 65% of your home’s value with a HELOC. When combined with a mortgage, your Cumulative Loan To Value cannot exceed 80%. This means that your mortgage and HELOC combined cannot exceed 80% of your home’s value. If you owe 50% of your home value on your mortgage, you would be eligible for a HELOC of up to 30%. Below is the formula used:

Calculate Your Home Equity

Calculate your usable equity and find out how you can use it to help finance your renovation or buy your next home.

Total equity

Total equity is the estimated value of the property entered by the user, less the loan balance entered by the user.

Estimated usable equity

Estimated useable equity is 80% of the estimated value of the property less the loan balance. This is not necessarily the amount you would be able to borrow, as financiers’ lending criteria depends on a number of matters.

Don’t Miss: Ussa Car Loans

Stamp Duty And Set Up Costs Calculator

The purpose of this calculator is to assist you in estimating the upfront costs associated with your loan. It should be used solely for the purpose of providing you with an indication of the upfront costs you may incur, so you can include an estimate for these amounts into your savings plan. Stamp duty and registration costs have been calculated using the rates from the relevant government authority websites and do not take into account any concessions you may be eligible for or any surcharges or additional and duties that may apply given your individual circumstances. We cannot guarantee that these rates are correct, up to date or are the ones which would apply to you. You should confirm the government costs and duties payable with the relevant government authorities.

We have made a number of assumptions when producing the calculations. Our main assumptions are set out below:

Home Equity Line Of Credit Combined With A Mortgage

Most major financial institutions offer a home equity line of credit combined with a mortgage under their own brand name. Its also sometimes called a readvanceable mortgage.

It combines a revolving home equity line of credit and a fixed term mortgage.

You usually have no fixed repayment amounts for a home equity line of credit. Your lender will generally only require you to pay interest on the money you use.

The fixed term mortgage will have an amortization period. You have to make regular payments on the mortgage principal and interest based on a schedule.

The credit limit on a home equity line of credit combined with a mortgage can be a maximum of 65% of your homes purchase price or market value. The amount of credit available in the home equity line of credit will go up to that credit limit as you pay down the principal on your mortgage.

The following example is for illustration purposes only. Say youve purchased a home for $400,000 and made an $80,000 down payment. Your mortgage balance owing is $320,000. The credit limit of your home equity line of credit will be fixed at a maximum of 65% of the purchase price or $260,000.

This example assumes a 4% interest rate on your mortgage and a 25-year amortization period. Amounts are based on the end of each year.

Figure 1: Home equity line of credit combined with a mortgage

| $260,000 | $260,000 |

Buying a home with a home equity line of credit combined with a mortgage

- personal loans

- car loans

- business loans

Also Check: What Is An Rv Loan

Other Considerations When Applying For A Heloc

Applying for a HELOC could potentially affect your credit score . It acts as a revolving line of credit, similar to a credit card, and a high utilization rate can negatively impact your credit score.If used correctly, however, it can decrease your total credit utilization rate and act as a positive indicator of good borrowing behaviour.

Qualify For A Home Equity Line Of Credit

You only have to qualify and be approved for a home equity line of credit once. After youre approved, you can access your home equity line of credit whenever you want.

Youll need:

- a minimum down payment or equity of 20%, or

- a minimum down payment or equity of 35% if you want to use a stand-alone home equity line of credit as a substitute for a mortgage

Before approving you for a home equity line of credit, your lender will also require that you have:

- an acceptable credit score

- proof of sufficient and stable income

- an acceptable level of debt compared to your income

To qualify for a home equity line of credit at a bank, you will need to pass a stress test. You will need to prove you can afford payments at a qualifying interest rate which is typically higher than the actual rate in your contract.

You need to pass this stress test even if you dont need mortgage loan insurance.

The bank must use the higher interest rate of either:

- 5.25%

- the interest rate you negotiate with your lender plus 2%

If you own your home and want to use the equity in your home to get a home equity line of credit, youll also be required to:

- provide proof you own your home

- supply your mortgage details, such as the current mortgage balance, term and amortization period

- have your lender assess your homes value

Youll need a lawyer or a title service company to register your home as collateral. Ask your lender for more details.

You May Like: Drb Loan Consolidation Reviews

Qualifying For A Home Equity Line Of Credit

Having equity alone doesn’t guarantee you’ll be able to qualify for a home equity line of credit. You’ll also need to have decent credit most lenders want to see FICO scores of at least 660 or more, and many have even stricter requirements. But 720 or more should put you in good shape.

You also can’t be carrying too much debt your total monthly debts, including your mortgage payments and all other loans, should not exceed 45 percent of your gross monthly income.

Lenders consider all these factors together when you apply for a HELOC. For example, they may allow a lower credit score or more debt if you have a lot of home equity available. Similarly, if you have a lower credit score they might only allow you to use 75 percent of your total home equity rather than the 90 percent they might allow someone with strong credit.