The Five Most Exploitative Things About Student Loans

Student loans have quickly become the most exploitative, unethical and deceitful loan systems on the market.

Uncapped to reasonable inflation they bleed those questing for higher education dry and profiteer off of hapless children committing to 30 year promises while still in school.

We have now arrived at a junction where it would be cheaper for an sixth form student to take out a mortgage, or a payday loan to cover the cost of their tuition fees than use the ‘student loan’ option.

I borrowed £37,506.67 so I could go to university, within 14 months of graduating, I owed £42,648.40. How did this happen? What is in the small print? Why is this justified?

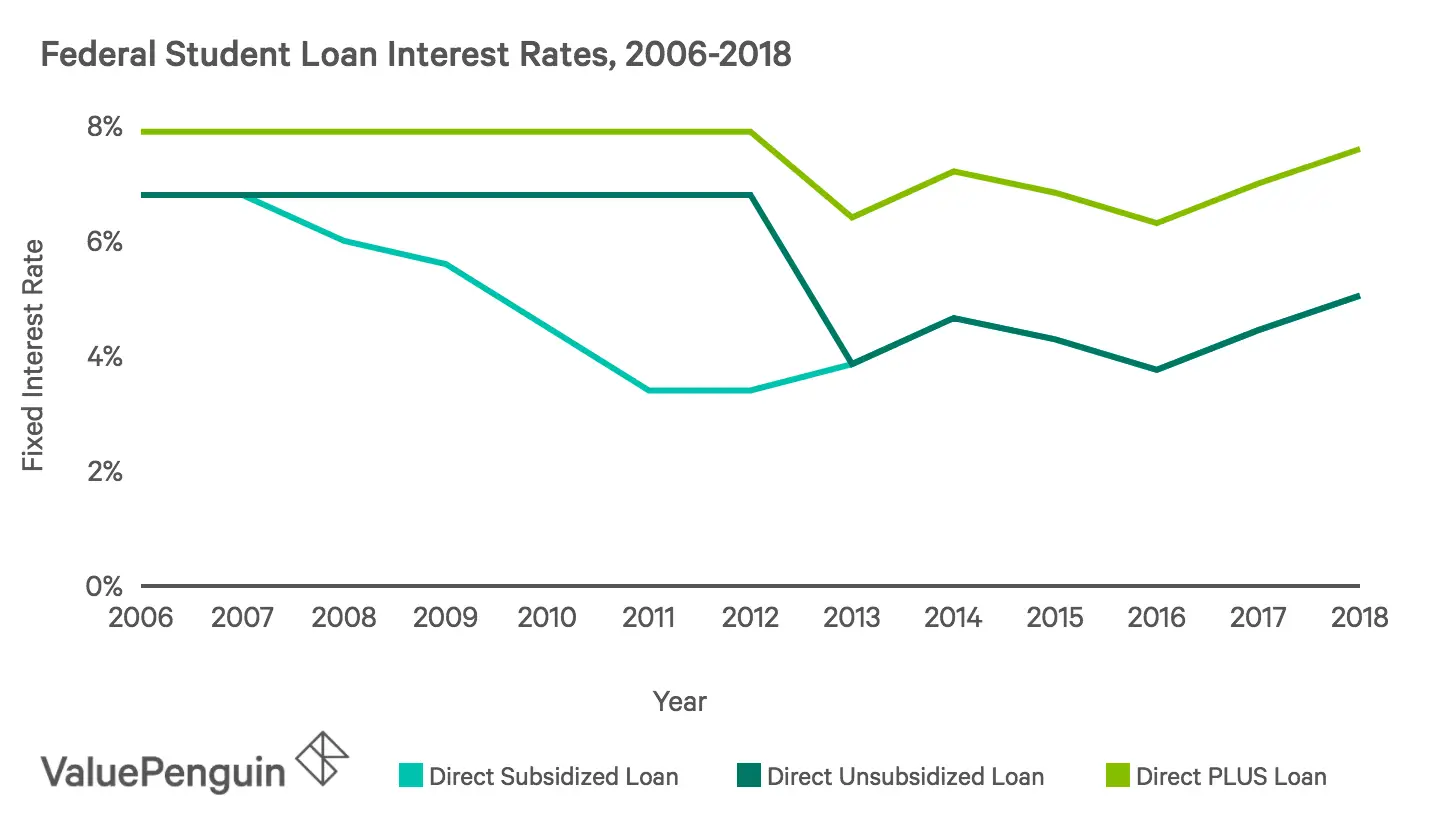

Interest rate

Interest rates on student loans vary considerably. However for most of the post-2012 cohort you will be paying RPI plus 3%. There are so many things wrong with this.

Firstly, RPI is the highest form of measured inflation, considerably more than the standard used CPI .

Secondly, where does the additional 3% come from?

Thirdly, RPI can change with the wind, it is currently 1.6%, so most of us are paying a total of 4.6% interest, however it looks like RPI is increasing to 3.1%, meaning we will be paying a total of 6.1% interest every single month.

As an idea of how exploitative that is, the Bank of England has set interest at 0.25% as a base rate.

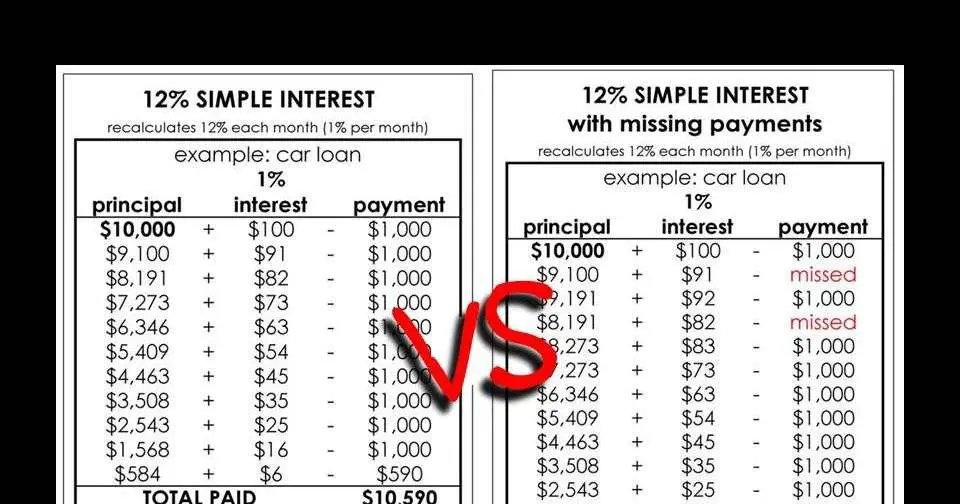

Compound interest

Student loans use a system of compound interest, in other words, you are paying interest on your interest.

Pay back rate

International comparisons

How Do Interest Rates Work

Depending on your credit worthiness and the type of loan you get, you can expect to pay somewhere between 1.25% and 12% interest for the money you borrow as part of a college loan.

Interest rate is expressed as an , or annual percentage rate. The APR refers to the amount of interest that is charged over one year.

Let’s use some round numbers to make this easy. If you have a 10,000 loan at 5% APR, you’d expect to pay around $500 in interest during the first year of the loan.

The simple equation is:

$10,000 principal x 0.05 APR = $500 in interest

However, the amount you actually pay depends on how the interest rate is applied. Yes, this is where that fine print comes in, but remember, we promised to make it easy so stick with us.

How To Reduce Capitalization On Student Loans

You can lower your Total Loan Cost if you pay your interest before the capitalization period. Two of these periods are the end of your separation or grace period and the end of your graduate school deferment. If youve chosen the interest repayment option for your student loans, your interest shouldnt capitalize, since youve paid it as it has accrued throughout school.

Alternatively, if youre making fixed payments or deferring payments until after school, try to make small additional payments. Or try to pay all or some of your accrued interest before your separation or grace period ends and interest capitalizes. These actions can help you avoidor at least lowerthe amount of capitalized interest after youre out of school, and every little bit helps.

Don’t Miss: When Does Pmi Fall Off Fha Loan

How Is Interest Calculated On Private Student Loans

Private student loans, which are issued by banks, credit unions, and other non-government entities, can have either fixed or variable interest rates, which can fluctuate during the life of a loan.

Student loan interest rates can vary from lender to lender, to get a better understanding, lets take a look at an example.

If your loan balance is $2,000 with a 5% interest rate, your daily interest is $2.80.

1. First we calculate the daily interest rate by dividing the annual student loan interest rate by the number of days in the year..05 / 365.25 = 0.00014, or 0.014%

2. Then we calculate the amount of interest a loan accrues per day by multiplying the remaining loan balance by the daily interest rate.$20,000 x 0.00014 = $2.80

3. We find the monthly interest accrued by multiplying the daily interest amount by the number of days since the last payment.$2.80 x 30 = $84

So, in the first month, youll owe about $84 in monthly interest. Until you start making payments, youll continue to accumulate about $84 in interest per month.

Be sure to keep in mind that as you pay off your principal loan balance, the amount of interest youre paying each month will decrease.

What Is Compound Interest

Compound interest is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods. Thought to have originated in 17th-century Italy, compound interest can be thought of as “interest on interest,” and will make a sum grow at a faster rate than simple interest, which is calculated only on the principal amount.

The rate at which compound interest accrues depends on the frequency of compounding, such that the higher the number of compounding periods, the greater the compound interest. Thus, the amount of compound interest accrued on $100 compounded at 10% annually will be lower than that on $100 compounded at 5% semi-annually over the same time period. Because the interest-on-interest effect can generate increasingly positive returns based on the initial principal amount, compounding has sometimes been referred to as the “miracle of compound interest.”

You May Like: Usaa Refinancing Car Loan

What Is A Fixed Interest Rate

A fixed interest rate is a rate that stays the same for the life of the loan. If you borrow a loan at 5% interest, your interest rate will not change over the life of your loan. It will remain at 5%.

Federal student loans all have fixed interest rates. Private student loans will generally give you an option to choose a fixed or variable rate.

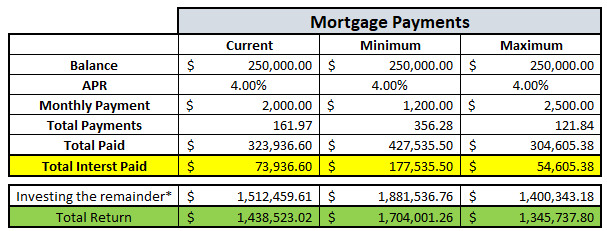

How Loan Payments Are Applied To Principal And Interest

Monthly student loan payments include both interest and principal, like almost all loans. The monthly payments are applied first to late fees and collection charges, second to the new interest thats been charged since the last payment, and finally to the principal balance of the loan.

As the loan balance declines with each payment, so does the amount of interest due. If monthly payments are level, or a fixed amount, the principal balance declines faster with each successive payment at least if your monthly payment is greater than the interest charged each month.

When a student loan borrower sends in a payment to their lender, the payment is applied to the principal balance only after it is applied to the interest.

If a borrower sends in more than the scheduled payment each month, the excess is usually applied to the principal balance, leading to the loan balance decreasing faster and faster each month. However, you should confirm with your lender on where an extra payment will go. Some lenders will apply it to a future payment.

Making extra payments will lead to the loan being paid off before the scheduled repayment term ends, effectively shortening the life of the loan and the total amount of interest paid.

Read Also: Golden1 Car Loan

How Interest Accrues On Student Loans

The interest on your student loan begins to accrue on the first day we disburse your loans funds to you or your school. It continues to accrue until youve paid off your loan. The interest rate for your loan is listed in your disclosure documents and billing statement. This is the same for both Federal Direct Loans and private student loans.

Why Would The Interest Rate Be Different From The Apr

- Discover Student Loans have zero fees, and no interest capitalization during the deferment period – as a result, the deferment period APR will be less than the interest rate.

- For our student loans, accrued interest capitalizes at the start of the repayment period – since we do not charge fees, and assuming you make all your scheduled payments on time, the repayment period APR will be equal to the interest rate.

Don’t Miss: Car Loan Usaa

Fixed Vs Floating Interest Rates

You can request to have a fixed interest rate. You can only make this change once. Contact the NSLSC or the Alberta Student Aid Service Centre for more information.

|

CIBC prime rate plus 2% |

Prime rate of Canadian banks plus 2% |

To compare the cost of choosing floating and fixed rates, use the Government of Canadas loan repayment estimator.

How To Make Interest Payments On Student Loans

When it comes to paying interest on student loans, two things remain true:

- Timing is everything!

- More is more!

First and foremost, its important to stay on schedule with your monthly payments, covering at least the minimum amount due so that you dont default on your loan.

Since the accruement of interest can make loans expensive over time, its wise to pay more than the minimum due and/or make loan payments while youre still in school. Amounts as low as $25 a month while youre in school can make a difference. For more information, explore .

When applying for student loans, it is recommended that you exhaust federal student loan options before moving on to private student loans, but both may be necessary to cover your costs. With that in mind, see if you can find a private student loan with a competitive interest rate.

Understanding how interest works when paying back student loans can go a long way in helping you keep the costs of borrowing money down on student loans or any other type of loan you might take out in the future.

Now that you know the answer to the popular question How is interest calculated on student loans?, its time to learn more! Plan ahead with the following resources:

Also Check: What Is A Loan Commitment Fee

How Simple Interest Is Calculated

To calculate simple interest, youll multiply your outstanding principal balance by the daily interest rate applied to your loan, then multiply that result by the number of days in your payment cycle. To come up with the daily interest rate for your loan, youll divide your loans interest rate by the number of days in the year.

Say you have a $10,000 loan with an interest rate of 5.28 percent. Heres how you would calculate your interest payment using simple interest:

This is how much youll pay in interest during your first month of repayment. As you pay off your principal, that monthly interest charge will shrink. For example, once you whittle down your principal to $5,000, heres what the formula looks like:

The Interest Rate Changes Every September

This change is based on the RPI rate of inflation in the year to the previous March. The RPI rate was 1.5% in March 2021, so interest is currently charged at 1.5% to 4.1%, depending on whether you’re still studying and how much you earn.

Of course, if in any year March’s RPI is anomalously high, you’ll pay a high rate for the year but if it’s anomalously low, it’ll be cheap for the year. As student loans are repaid over a long period, things usually even themselves out.

Recommended Reading: How To Get Mlo License California

How Your Payments Are Applied To Your Loan

When you make the minimum payment on a loan, it’s likely that you are primarily paying off accrued and compounded interest. This means that your monthly minimum may not cover as much of the principal loan amount as you think. However, if you increase your payments, you can really begin to make a dent in the principal loan amount.

Unlike some other sorts of loans, such as mortgages, you can increase your student loan payments when you are able. For instance, if you received a bonus at work, you might put some of that towards a student loan payment thereby reducing your principal and overall debt over time.

How Does Student Loan Interest Compound

Even though student loan rates are expressed as an annual rate, the interest is usually compounded daily. On a $10,000 loan, you might think that a 4.45% interest rate would mean $445 paid in interest during the year, but thats not the case.

Instead, your annual rate is divided by 365, to get your daily interest rate. So, in the above example, youd be charged an interest rate of 0.012% each day. At the end of your first day, your interest charge totals $1.20 and its added to the $10,000. On the following day, your interest is calculated on $10,001.20. At the end of the year, youll pay a total of $455.02 in interest providing the lender with an extra $10 just because of the way interest is compounded.

When you consider that this daily compounding takes place over all the years you are in school and beyond, you can see how interest charges lead to repaying so much more than you borrow.

Read Also: Usaa Auto Refinance Rate

Sign Up For Automatic Payments

Many lenders will give you a small interest rate deduction if you sign up for automatic payments. This means that each month, your payment is automatically deducted from your bank account.

If you are confident you would have the funds to cover the monthly payment, this could also help you avoid late payments and any fees that go along with that.

Your Student Loan Repayment Term

Your loan repayment term is the number of years you have to pay it back. Federal loans generally have a standard repayment schedule of 10 years.2 For , the repayment term can range anywhere from 5-20 years, depending on the loan. You’ll be given a definite term for your loan when you apply.

Interest rates for federal and private student loans

The average interest rate will be different for federal student loans and private student loans. Federal student loans have a single, fixed interest rate, which means that your loan’s rate doesn’t change over time.

You may have noticed that there’s a range of interest rates associated with a private student loan. Private student loans are . That means the rate you’ll be offered depends on your creditworthinessand that of your cosigner, if you have onetogether with several other factors. When you apply for a loan, you’ll be given an interest rate, either , depending on which is offered and which type of rate you’ve chosen.

How much you’ll need to borrow for college

If you’re wondering for collegewhether it’s a public university or private universitythe can help. You can search for college costs and also build a customized plan based on your own situation.

You May Like: Bayview Loan Servicing Tucson

Student Loan Interest Calculations

Calculating the accrual of interest on a student loan is relatively simple. It can be done manually or using an interest calculator.

To calculate interest manually To determine the student loans daily interest, take the loan balance, and multiply it by the interest rate. Then divide by 365. For example, a $10,000 loan at a 5% interest rate would generate $1.37 per day of interest.

To calculate the interest online There are many interest online calculators. This calculator makes the process simple and is ideal for estimating interest generated in a day, a month, a year, or over the life of the loan.

Does student loan interest accrue during school?Many student loans come with special rules for students who are still in school. With the notable exception of a federal subsidized loan, student loans do accrue interest during school.

Should I Consolidate For A Better Rate

It depends. Loan consolidation can simply your life, but you need to do it carefully to avoid losing benefits you may currently have under the loans you are carrying. The first step is to find out if you are eligible to consolidate. You must be enrolled at less than part-time status or not in school currently making loan payments or be within the loan’s grace period not be in default and carrying at least $5,000 to $7,500 in loans.

Recommended Reading: Refinance Auto Loan With Same Lender

Which Excess Payment Option Is Right For You

Standard Allocation

We automatically apply the excess amount to the:

And, your account will show as Paid Ahead.

If there are multiple loans in an account, after all interest is paid, any remaining amount is applied to the unpaid principal balance of the loan with the highest interest rate, with unsubsidized loans considered first. If multiple loans have the same highest interest rate and subsidy, the remaining amount is prorated among these loans, based on the unpaid principal balance for each loan.

If there are multiple loans in an account with the same interest rate, the excess is prorated between loans. For example:

- You have two loansone with an outstanding balance of $3,000 and the other $2,000.

- Let’s assume after all accrued interest is satisfied, that $50 remains.

- $30 will be applied to the $3,000 balance and $20 will be applied to the $2,000 balance.

To get the prorated ratios:

If an excess payment is not sufficient to pay all accrued interest, the payment will be prorated based on the amount of accrued interest on each loan. This can happen if you are on an income-driven repayment plan.

Custom Allocation

Keep in mind:

Repaying Your Student Loan

Student loans must be paid back. Many students have two loans that need to be managed separately. Heres what to expect after you leave school.

On this page:

Most students leave school with an Alberta student loan and a Canada student loan.

Having two loans means you need to handle twodebts and two payment schedules.

Your Alberta loan is managed through MyLoan and your Canada loan is managed through the National Student Loans Service Centre Online Services. You must create individual accounts through these websites and handle your repayments separately.

This is what the lifecycle of student loans looks like:

|

While youre a student |

Loans are interest-free and you dont need to make payments. |

|

Grace period The first 6 months after you leave school, beginning the first day of the month after your end date |

Loans are interest-free, and you dont need to make payments. |

|

Repayment Begins 6 months after you leave school |

Interest is added to your loan balance monthly. |

|

Repayment begins. A monthly repayment schedule is set up for you automatically. |

Don’t Miss: Fha Maximum Loan Amount Texas