Work With A Local Bank If Possible

Not everybody banks with a local community bank, but if you do, you will find you are more likely to be able to work with a real person and get more information and better service throughout the process. The larger banks have long lists of businesses and organizations that have applied, and many have stopped taking new applications. You may need to move your business bank accounts to the local community bank to get into their queue, but it may be the difference between getting and not getting PPP money.

Am I Eligible For A Ppp Loan In This Round If I Did Not Receive A Previous Ppp Loan

Yes, the program will be open for both first-time borrowers and borrowers looking for a second loan. Please note that the requirements for first-time borrowers and second time borrowers are different. Continue reading below for a non-exhaustive list of eligibility requirements and other helpful information. Please be advised that qualifying as an eligible business does not guarantee a PPP loan will be offered.

Why Wait For The Longer Sba Loan Processing Time

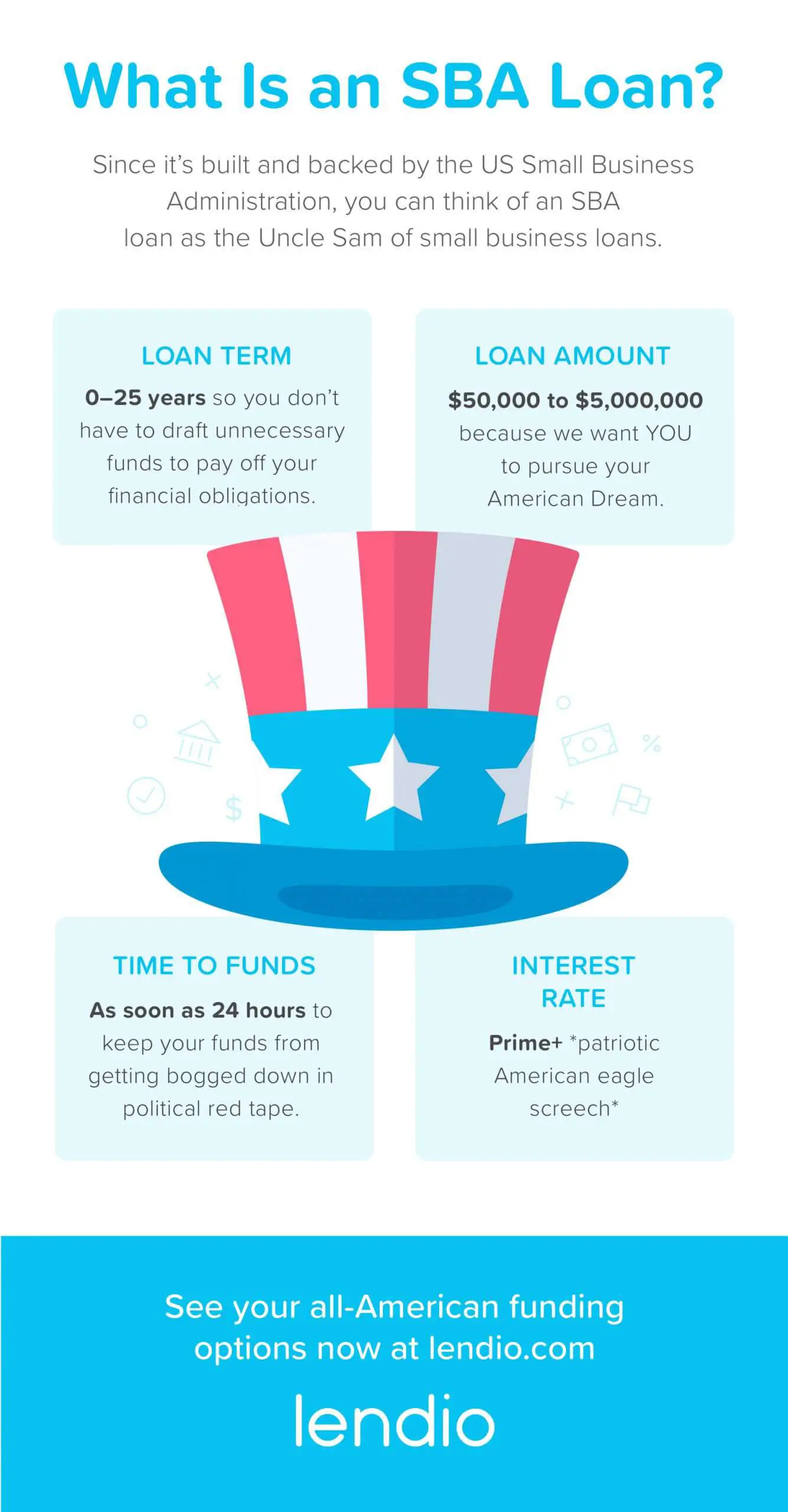

You may be wondering what the benefits of an SBA loan are, especially if youve got to wait for it. Chief among the pros of an SBA loan is youre not giving anything up. As a business owner, you can borrow anywhere from $500 to $5.5 million.

Another attractive feature is the long-term nature of the products. For example, some repayment terms extend for more than two decades . The SBA also caps the amount borrowers should repay in interest. The longer-term combined with the cap translates into a lower interest rate for business owners like you when cash flow is tight. The SBA loan approval process is a bit of a waiting game, so lets get to it.

You May Like: Flex Modification Calculator

Sba Loan Process: Whats Involved

The SBA loan process can be confusing and difficult to navigate, particularly for first-time borrowers.

Hereâs an overview of the SBA loan process and how long each stage takes:

As you can see, there are a few steps involved from application to closing, and itâs important to be in close communication with your lender throughout the SBA loan process. If there are hiccups along the way, your lender will let you know of the best way to respond.

Top Results For How Long Are Sba Loan Modifications Taking

loan are loan loan

SBA Loan Processing Time: What You Should Know | Fora …

Copy the link and share

are

EIDL Loan Approval & Processing Time: What To Expect

Copy the link and share

Besthelloskip.com

loan how loan loan loan

Check Potential EIDL Loan Increase Amount & Progress

Copy the link and share

Bestexitpromise.com

EIDL Round 2 | SBA Extends Covid-19 Loan Application Deadline

Copy the link and share

Bestwww.sba.gov

loan loan

Copy the link and share

loan

How Long Does It Take To Get An SBA Loan? – Funding Circle

Copy the link and share

Also Check: Auto Loan 650 Credit Score

Ive Been Approved For My Ppp Loan: How Long Before I Get My Money

The SBAs rules say they must fund approved PPP loans within 10 calendar days from the date of approval, although if the borrower hasnt provided correct information then it can be up to 20 days. However, if day 10 falls on a weekend and/or bank holiday, then its the next business day. So it can be between 1013 days and 20-23 days. From the reports were seeing from the small businesses and independent contractors weve helped get funding, the PPP is generally pretty good about meeting or beating that deadline.

Do I Need To Use An Agent To Apply For An Sba Loan

The SBA does not require the use of an Agent for Packaging Services or to refer a loan application in order to apply for an SBA loan. SmartBiz clients choose to hire SmartBiz for a variety of reasons including making the application process more efficient, and increasing the likelihood of finding a bank that says ‘yes’. In fact, many of our clients are turned away by a bank or simply turned off with how long the typical process takes with them. We also find many clients take on an expensive loan from an alternative lender and save money by refinancing with an SBA loan. Compared to alternative financing sources, SBA loans offered by banks in the SmartBiz network are less expensive – even after fees – than the majority of alternative financing and alternative lender options.

Read Also: Is Carmax Pre Approval A Hard Inquiry

What Happens If Ppp Loan Funds Are Misused

If you use PPP funds for unauthorized purposes, SBA will direct you to repay those amounts. If you knowingly use the funds for unauthorized purposes, you will be subject to additional liability such as charges for fraud. If one of your shareholders, members, or partners uses PPP funds for unauthorized purposes, SBA will have recourse against the shareholder, member, or partner for the unauthorized use.

Is Applying Via Multiple Ppp Lenders Allowed / My Lender Is Taking Too Long Can I Start An Application With Another Lender

You can apply via multiple lenders if you think thats the right course for you or if your lender isnt moving quickly enough. You might get better service at smaller community lenders than at huge national banks processing millions of applications.

Due to the way the E-Tran system works, its almost impossible for your loan to be funded more than once. And in the small chance that happens, you can simply let the SBA know and return the overage .

Go deeper: Can you apply for PPP twice?

You May Like: Usaa Auto Loan Credit Requirements

How Do I Check On My Ppp Loan Status

If you applied through Womply, you can contact our support team and we will check for you. If you did not apply through Womply, youll need to contact your lender. Dont contact the SBA youll likely not get any response. Your lender will be the most informed about the status of your approval.Once youve submitted your application to your lender, be sure to check your email regularly and follow up quickly on any additional steps or information requested by the SBA or your lender.

You may also like: 5 common PPP loan responses and what they mean.

Have Your Paperwork Ready

While the SBA has an application that they have given banks, many banks have their own process. You will need:

- Tax returns for at least 2019, but if you have 2 years of tax returns easily available, get those ready.

- Payroll reports that show clearly how you achieved your total loan amount.

- Legal company formation documents or organization legal structure/setup, ownership, etc.

- You will need to document in one way or another how COVID-19 has negatively impacted your business. The easiest way to do this is to compare your sales from February to April 2019 to your 2020 sales for the same months. Also document the downturn in sales from January 2020, monthly, through the current month. The last piece is to create a forecast of the continued impact on your sales based on the current trends. If you followed step 2 correctly, you should have this forecast scenario in hand already.

You May Like: Usaa Pre Qualify Auto Loan

Your Accounting Firm Can Help Build Your Case

For that reason, Brian says that he and the Redpath team have recommended tight, accurate documentation of their loan needs “from the first day” of the program.

“The SBA is questioning companies with the benefit of hindsight,” he says. “They’re seeing companies that had a good year, and they’re asking, ‘Did you really need it?'” Building a body of evidence that stands up to that benefit of hindsight is essential to ensuring forgiveness in the short and long term.

While your legal counsel is best positioned to argue your actual eligibility for PPP forgiveness, your accounting firm can help interpret the financial vagaries and document your need for PPP funds. “It’s not as clear-cut as once thought,” Brian says. “The best way to increase your likelihood of forgiveness is to prepare.”

What Expenses Are Eligible To Be Included In My Ppp Application

In addition to the expenses that were eligible under the previous round , both first-time applicants and borrowers applying for a second draw may also use their PPP loan to cover the following expenses: covered operations property damage costs due to public disturbances that occurred during 2020 that are not covered by insurance covered supplier costs and covered worker protection expenditures and personal protective equipment to help a loan recipient comply with federal, state or local health guidance including requirements issued by the CDC, OSHA, HHS and state or local governments.

Don’t Miss: How Long Does An Sba Loan Take

What Is The Sba Ppp Loan Scheme

First things first, lets take a quick look at what the SBA PPP loan scheme is. As we have said, PPP stands for Paycheck Protection Program, and it was a loan scheme introduced to help small businesses through the coronavirus pandemic. It was just one of the things introduced to support companies as part of the Coronavirus Aid, Relief, and Economic Security Act that was established in 2020. The theory behind the PPP loan was to help companies retain staff throughout the pandemic. The loans were granted to successful applicants to allow them to receive money to cover their payroll, along with payroll related expenses. The money would cover the wages of employees to ensure that companies didnt have to make staff redundant in order to survive. Along with the PPP loan scheme, the US Government announced a loan forgiveness scheme. But what does this mean? Lets take a look.

Can I Get A Second Sba Loan

Yes, many customers get a second SBA loan as their business grows and needs additional capital. If you receive approval for more than one SBA loan within 90 days of each other, the loans will be treated as if they were one loan for purposes of determining the amount of the SBA guarantee fees, if any.

You May Like: Rv Payment Calculator Usaa

How Do I Calculate My Ppp Loan

How PPP loans are calculated. PPP loans are calculated using the average monthly cost of the salaries of you and your employees. If you’re a sole proprietor, your PPP loan is calculated based on your business’ net profit. Your salary as an owner is defined by the way your business is taxed.Feb 24, 2021

Are Employees Of Foreign Affiliates Included For Purposes Of Determining Whether A Ppp Borrower Has More Than 500 Employees

Yes, according to the interim final rule on the treatment of foreign affiliates, released on May 19, 2020. However, due to borrower confusion, the SBA will not find any borrower that applied for a PPP loan prior to May 5, 2020, to be ineligible based on the borrowers exclusion of non-US employees from the borrowers calculation of its employee headcount.

According to the interim final rule, borrowers must count non-US employees toward the 500 limit, but these employees are excluded for average payroll and loan calculations.

Also Check: Average Apr For Motorcycle

How Long Does Sba Microloanapproval Take

The SBA also has a microloan program, which, as the name suggests, is for smaller amounts that have a cap of $50,000. The beauty of these loans is that the SBA loan processing time is quicker than the more substantial loans. As such, you can have the funds in your account in as little as a month. However, it could take up to three months.

The downside of SBA microloans is that they can be less straightforward. Thats because the SBA initially lends the funds to designated intermediary lenders at a discount. They then have the authority to issue loans to small businesses.

If youre a for-profit startup in the process of polishing up your credit, the microloan could be the right product for you. A big reason for this is that the credit score standards tend to be less stringent than the 7 loan. The microloan is popular among women and veteran-owned businesses, as well as minorities and low-income entrepreneurs. A piece of information to keep in mind with microloans: Youre looking at repayment terms of 10 years.

Sba 7 Loan Process Vs Alternative Lender Term Loan Timeline

If youâre looking to get your hands on a sizable lump sum loan, but would like to get it faster, look into a business term loan through an online lender.

A sample timeline might be:

Some alternative lenders even provide same-day business loans. Alternative lenders do still look for good credit scores and time-in-business but offer flexibility that could work to your advantage.

Don’t Miss: Usaa Pre Qualify

How Long Does The Sba Have To Approve Ppp Forgiveness

When the coronavirus pandemic hit in 2020, it caused a lot of panic for business owners. Suddenly, they werent able to operate in the way that they had been, and a lot of companies didnt know how they would be able to survive.

Thankfully, the US Government announced a new loan scheme that would support businesses throughout this time. This loan scheme was called the Paycheck Protection Program.

Along with offering the PPP loan scheme, the US Government also offered a forgiveness scheme. This would allow those who received these loans to get the loan forgiven before the expiry date if they fit the necessary criteria. The PPP loan scheme is new, and because of this, a lot of people are still struggling to figure out the application for PPP loan forgiveness. In this quick guide to the SBA PPP loan forgiveness, well be taking a look at how you apply for loan forgiveness, and more importantly, how long it takes for your application to be approved. So, lets dive right in.

How Long Do I Have To Apply For Loan Forgiveness

The PPP rules currently provide that you may submit a loan forgiveness application at any time after the end of your Covered Period and before the maturity date of your loan, as long as you have an outstanding balance on your loan. However, we understand the SBA may be changing the deadline to apply for PPP loan forgiveness.

Please check with sba.gov for the latest guidance on your forgiveness application window.

Please note that your PPP loan deferral period will end prior to your maturity date. If you applied for forgiveness prior to your deferral period, you will need to begin making payment on any unforgiven amount once the SBA has made a decision on your forgiveness application. If you have not applied for forgiveness prior to your deferral period, you will need to start making payments at the end of your deferral period.

Also Check: Bayview Loan Servicing Payments

You Should See Your Second Ppp Loan Hit Your Account After The 10

Just got my second-draw PPP loan & I’m still a little bit flabbergasted by how easy it was to get one.Even for those of us who are “stable”#freelancers, we’re still always chasing incremental gains. And a huge chunk of change like this is a game changer.

Jenni Gritters

The SBA manages funding for the PPP loan, although third-party banks and lenders have assisted it throughout the process. According to the SBA, approval of funds should occur within 10 calendar days.

Of course, this defines the approval process. The actual funding of your account process will likely take a few more days depending on whether or not there’s a weekend or holiday occurring at the same time. The precise timing also depends on what bank you have and how quickly they fund direct deposits.

Can I Submit My Application To Cross River During The Mandated Sba Freeze If I Have 20 Or More Employees

As of Wednesday, February 24 at 9AM ET, the SBA has mandated a two-week freeze, ending on March 10, on the processing of PPP applications for businesses with 20 or more employees. During this period, applicants with 20 or more employees may still fill out and submit their application to Cross River, but these applications will not be approved by the SBA until the mandated freeze has expired and the loan has had time to be processed by the SBA. Employee count is based on the total number of employees, including full-time, part-time and seasonal employees.

Recommended Reading: Mlo Average Salary

What Is An Sba 504 Loan & How Long Does It Take For Approval

Were going to talk about the Small Business Administrations 504 loan program. If you arent familiar with it already, it helps small businesses get loans to finance the acquisition of fixed assets for expansion and modernization. Before the lender can process an SBA 504 loan, it must first go through a Certified Development Company-a step that throws off the typical processing timeline.

Because SBA loans require both approval from the SBA and the Certified Development Companies, it can take some time to complete the process. As a result, the time it will take for you to receive your SBA 504/CDC loan approval varies. On average, you can expect to wait about a month and a half after you submit your application for financing. SBA loans are typically processed fairly quickly by lenders, but the processing times can be as long as six months for this business financing program.