Is A Refi The Right Choice For Me

If you have a high interest rate on your car loan, and current market rates have dropped, you may want to consider refinancing. Interest rates are at near-historic lows right now, and you may qualify for a better rate.

Borrowers whose credit has improved significantly since they first took out the loan may also be eligible for a better rate. For example, if you had a bankruptcy or default fall off your credit report, your credit score may be much higher now.

If you can refinance with a co-signer or co-borrower, then you may receive better rates if you were the only borrower on the original loan.

Apply For Your Auto Refinance Loan

There are a few steps youll need to take in order to apply for an auto refinance loan. Once youve decided on a lender, youll need to gather all of the required documents before applying. This can include information about yourself, like your name, address, and social security number, as well as information about your vehicle and your previous loan.

If youre interested in applying for an auto refinance loan, its a good idea to wait to apply until your finances are in order. For example, if your credit score is near a threshold, you might want to take steps to raise your score before applying in order to qualify for lower rates. Once your application is accepted, youll need to begin repaying your new loan. Its a good idea to set up automatic payments each month to make sure you never miss a payment.

Should I Refinance My Car

If you continuously keep asking yourself, Should you refinance your car? then its time you fix an appointment with some expert. Such a move may not just enable you to get out of the confusion but also help you to understand whether car refinancing is primarily right for your specific situation.

CarLoanStudent can assist you to get connected to a competent local specialist who can guide you on the subject.

Also Check: How Long For Sba Loan Approval

What Is A Student Loan Cash

Student loan refinancing is a form of mortgage that allows you to use the equity of your current home to pay off your student loan. To take advantage of this opportunity, you must: Repay the money received in full: At least one student loan. Pay the loan in your own name for example, you cannot invest in a loan for children.

How Refinancing Affects Credit Scores

Virtually every time you apply for a loan, the lender will run a hard inquiry on your credit report. According to FICO, this inquiry can knock as many as five points off your credit score temporarily.

Multiple hard credit inquiries can have a compounding negative effect on your credit scores, but if you apply for multiple auto loans within a short periodtypically 14 days but sometimes longerthey’ll all count as just one inquiry when calculating your credit scores and won’t have a negative impact.

When the lender opens a new credit account in your name, it could affect your credit scores again because it reduces your average age of accounts, a factor that influences the length of your credit history.

In both cases, the potential negative impact on your credit is typically minimal and temporary. If you start missing payments on your new loan, however, it could have a bigger and longer-lasting impact on your scores.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Is Refinancing Worth It

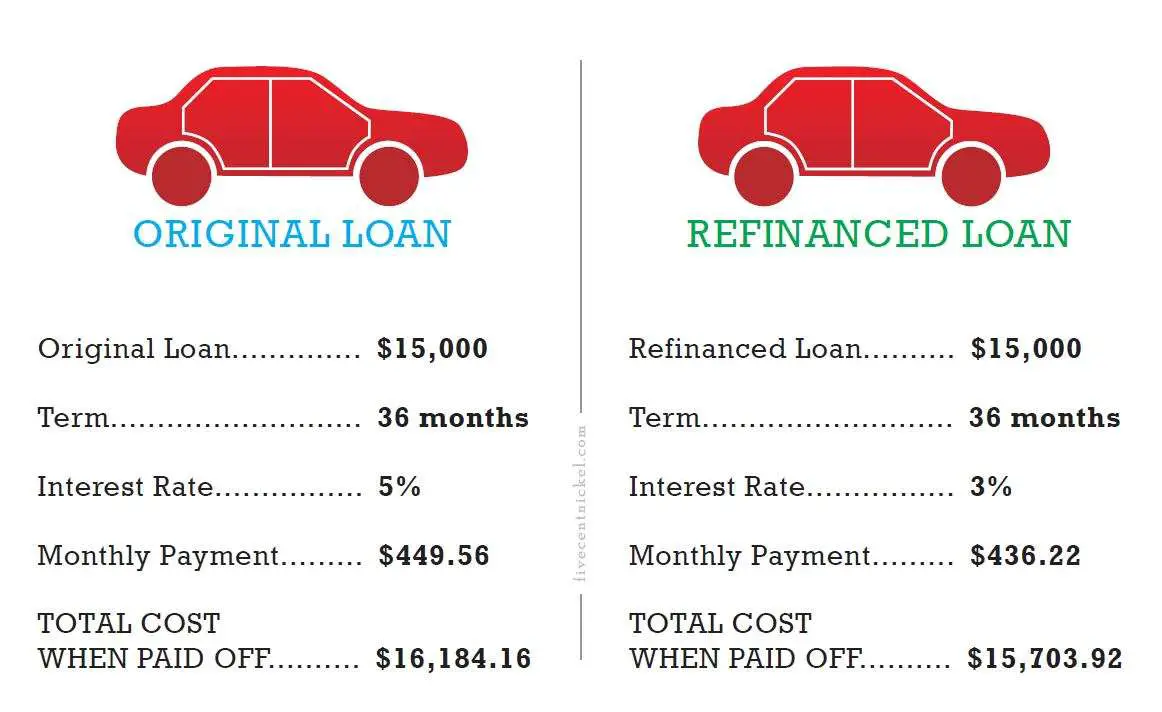

If youre simply refinancing, and you know youll get a better rate and save yourself some money, its really a no-brainer. If, however, youre not sure youll save any money, use this auto refinance calculator to estimate your savings and decide if it makes good financial sense to refinance.

In many cases, people refinance because they need to lower their monthly payment, usually due to some unforeseen financial crisis. Finding balance between your immediate financial needs and long-term financial health is never easy but if you do the math and plan accordingly, you can make the right financial decision for you and your family.

If refinancing your vehicle is necessary to improve your cash flow, you may refinance now to get back into a positive financial situation. Once your personal finances have stabilized, start making extra payments on your auto loan to pay it down faster, provided that there arent prepayment penalties on your new loan. Youll pay off your auto loan sooner and save yourself some interest expense.

How Does Refinancing A Car Work

Think of refinancing as applying for a new loan. It works just like when you originally applied. You’ll fill out an application with the same type of information you submitted for your original loan like proof of income. You’ll also need to tell your lender about your current loan and your car . Your lender will check your credit and, if you’re approved, will tell you your options . If you accept, your old loan will be paid off, and youll start fresh with your new payments.

Read Also: How To Get Loan Originator License

Compare Auto Refinance Loans

Before applying for an auto refinance loan, you should be sure to compare quotes from multiple different providers. Some factors to take into consideration include:

- Loan amounts: Most lenders have minimum and maximum loan amount requirements, usually somewhere between $7,000 and $100,000. Make sure that the loan you want to refinance is in between these limits.

- Rates: One of the main goals of refinancing an auto loan is to lock in lower rates. Make sure to compare rates from multiple different providers to ensure youre getting the best possible deal.

- Repayment terms: Whether you want to pay off your loan faster, or need a longer term length with smaller monthly premiums, look for an auto refinance loan with repayment terms that meet your needs.

- Some lenders have minimum credit score requirements for borrowers. If your credit score isnt where you want it to be, consider holding off on applying until you raise your score.

- Car requirements: Not all lenders will issue auto refinance loans for all cars. Make sure that your car meets the requirements for any lenders that youre interested in.

Does Applying For An Auto Loan Affect My Credit Scores

If the lender pulls your credit, your loan application will show up on your credit reports as a hard inquiry. While hard inquiries can affect your credit, each one may only knock a few points off your scores. And shopping around may not hurt depending on the credit-scoring model, any auto loan inquiries that take place within a given time span ranging from 14 to 45 days will count as a single inquiry.

You May Like: How To Get Loan Originator License

Within Two Years Of The Payoff Date: Is Refinancing Still Worth It

Even if youre getting close to paying off your vehicle, you could still benefit from refinancing. Maybe something has occurred that requires you to change your term or monthly rate so that you can lower your monthly payments. Or, perhaps your current lender is difficult to work with their representatives may be hard to reach and challenging to communicate with.

The good news is that it’s rarely too late or too early to refinance. If you can save money on payments at any point in your car loan, or if you’d rather pay off your vehicle in one year instead of two years, you may want to look into refinancing options. Lenders may offer incentives for refinancing, such as the cash back and 90-day payment break offered by Desert Financial.

If you can lower your interest rate by at least one percent or if you’re willing to extend your loan so that you can lower your monthly payments refinancing within two-to-three years of your payoff date may be a good option.

Should I Refinance My Car Loan Before Buying A House

Experts say not to apply for credit before buying a house. But does this apply to car loan refinancing?

Refinancing your car can help you snag a lower interest rate and a lower monthly auto loan payment. But depending on your credit history, refinancing your car right before buying a home can impact your mortgage application.

If youre not sure what to do first buy a home or refinance your car loan heres what to think about.

2021 Auto Refinance Rates

Don’t Miss: Fha Mortgage Refinance Rate

Why Do Lenders Want Me To Refinance

There may be times when advertisers reach out to encourage you to pre-qualify for auto loans. Your financial institution wants to keep you happy, but they also want to make money. They do this by lending and charging interest to their customers. By offering to refinance your loan, they are gaining another potential interest-paying customer.

Your existing lender might encourage you to refinance to prevent you from seeking out a lower rate elsewhere, if interest rates have changed or if they can see that your personal credit situation has improved. By offering the best rates, banks are able to keep their account holders business, potentially help you save money, and ensure a positive experience to promote future business.

Does My Car Loan Qualify For A Refinance

Auto lenders have rules on which cars are eligible for an auto loan refinance. Most lenders wont refinance a loan for a car with more than 100,000 miles or with a salvage title.

The lender will also assess the cars value before approving a refinance request. If the value is too low, you wont qualify. The lender will calculate the cars loan-to-value ratio, which generally needs to be below 125% to qualify.

Before you apply to refinance your car loan, determine the LTV ratio. To find the cars current value, use sites like Kelley Blue Book, Edmunds and NADAguides. Take the average from all three sites to find a general estimate.

Calculating the LTV is simple. Divide the current loan balance by the cars value: the resulting percentage is the LTV. For example, lets say you have a $9,000 balance on a car worth $11,000. In this case, your LTV ratio would be 82%.

But if the current balance is $15,000 and the car is only worth $10,000, your LTV would be 150%. This is much higher than what most lenders allow, so refinancing is likely impossible.

You May Like: Can You Get A Va Loan On A Manufactured Home

When Is Refinancing A Mortgage Worth It

- Refinancing rates are falling everywhere

- Your creditworthiness has improved since you applied for a mortgage

- You want to shorten the loan period to pay off the house faster

- You want to extend the term of the loan to lower your monthly payment

- You want to set a fixed rate before your variable rate mortgage gets more expensive.

Understand How Your Credit Will Be Impacted

Virtually every time you apply for credit, the hard inquiry will reduce your credit score by a few points. If you then open a new loan account, itll lower the average age of your accounts, which can also lower your credit score.

That said, both of these factors are much less important in calculating your credit score than your payment history and making timely payments on your new loan will increase your score over time. So unless youve applied for a lot of other credit accounts recently or you dont have a long credit history, refinancing is unlikely to make much of a difference.

Don’t Miss: Does Collateral Have To Equal Loan Amount

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You Got A Bad Deal On Your Current Loan

This can happen if you financed through a dealership without doing your due diligence. Dealership financing typically comes from banks, independent lenders and captive financial arms or those that are owned by the car manufacturer. But sometimes dealers dont quote those lenders best rates and instead quietly mark them up to pad their profits, says Daniel Blinn, managing attorney of the Connecticut-based Consumer Law Group. The best course is to avoid this in the first place by carefully comparing rates and negotiating a better rate or financing elsewhere. Consumers who have their financing in place before they visit a dealership will be in a much stronger position to negotiate the best possible deal, said Blinn.

Read Also: Does Va Loan Work For Manufactured Homes

Can You Refinance Your Auto Loan With Your Existing Lender

The rules for refinancing an existing loan with the same lender vary by financial institution. PenFed Credit Union, for example, does not allow refinancing for cars already financed with the credit union. Other lenders do allow borrowers to refinance an existing loan.

Keep in mind that it may not always be beneficial to refinance with the same lender. You might find a better deal by refinancing with another institution.

You Cant Afford Your Car Loan Payments

Maybe youve lost your job. Or perhaps you overestimated your ability to pay. Usually when refinancing, youll have the option of extending the loan beyond the original ending date. That, along with any reduction in your rate, can reduce your monthly payments. But that will also eat up some or even all of the savings from refinancing. As a last resort, you also could consider a cash-out refinancing, in which a lender will refinance your loan and give you cash up to and in some cases more than the difference between the amount you owe and the vehicles value, if higher. But such borrowing is extremely risky, especially since youre already in a financial crisis.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

When To Refinance Your Car: A Decision

5-minute readAugust 24, 2021

If youre in the process of paying off the auto loan you took out to purchase your car, you might be wondering if its possible for you to refinance that loan. More importantly, you may find yourself asking, Should I refinance my car?

The great allures of an auto refinance include more manageable monthly payments, lower overall interest costs and even changing your loan term. That said, the cost of the new loan may be more money than its worth.

We broke down a complicated financial decision into a simple screening process for yourself.

How Long Should I Wait To Refinance My Car

Wait at least 60-90 days from getting your original car loan to refinance. It typically takes this long for the title on your vehicle to transfer properly, a process you need to be complete before any lender will consider your application. This will also give you time to check credit scores and work to improve them if needed. Typically, refinancing your auto loan will only save you money if you have a good to excellent credit score since lenders reserve the best rates for borrowers with great credit.

Also Check: How Long For Sba Loan Approval

You Already Have The Best Rate

If you purchased your car new, you likely got an attractive new car rate, especially if you took advantage of a special interest offer, which can feature rates as low as 0%. The refinancing rates for some lenders, among them Bank of America, are higher than even their used-car rates, even if your vehicle isnt even a year old. Also, interest rates have been fairly low in recent years, and while a rate drop may be on the horizon, that alone may not be enough to justify a refinancing if your goal is to save a significant amount of money.

Auto Loan Refinance How Long To Wait

Nicholas Hinrichsen – Published: November 15, 2021

- Your car is close to “positive equity”. What that means is that the Kelly Blue Book or Black Book Value is close to the outstanding loan balance.

- Your credit has improved by at least 30 points. In these cases you’re entitled to lower rates

- You’ve made all your payments on your car for at least 6 months

- Interest rates have not gone dramatically up

Consumer Solutions

Also Check: Usaa Used Car Loan Rate

Look Into Multiple Types Of Financing

When you first borrowed money to buy a car, it may have been through dealer-arranged financing. However, many banks, credit unions and online lenders offer direct financing to car buyers and owners.

In general, its best to start with the financial institutions you already work with. In some cases, you may qualify for a loyalty discount based on your existing relationship with the bank or credit union.

Dont stop there, though, even if the terms are excellent. Take some time to compare that quote with rate offers from other banks and lenders. This process can take some time, but the more options you compare, the higher your chances will be of getting the best auto loan terms available to you.