Student Loan Debt Associated With More Debt Overall

Many adults with student loans also faced other debt burdens. Of those with student loans, about 23 million had at least one additional type of debt like credit card, vehicle or medical.

Among those with student loans, credit card debt was the most common additional debt , followed by vehicle loans , and medical debt .

Those with debt on top of their student loans also often owed more in student loans.

For instance, the median student debt of those with no credit card debt was $16,000 in 2017. However, those with both student and credit card debt owed a median amount of $20,000 in student loans.

Despite Cost Americans Still Opt For Higher Education

Higher education has long been considered the ticket to affluence and job satisfaction. The earnings premium for degree holders has grown steadily over the past several decades, and college graduates are more likely to become homeowners, according to the Federal Reserve Bank of New York. Among all Americans aged 25 and older, 58.9% have spent at least some time in college, and about 32.5% have earned a bachelors degree or higher. Younger Americans are more likely to prioritize going to college than previous generations. Among people aged 65 and older part of the baby boomer and silent generations 50% have spent some time in college, and 27% have a bachelors degree or higher. Among those aged 25 to 34 who would be considered millennials 65% have spent some time in college, and 36% have a bachelors degree or higher.

Roughly 4 In 10 Direct Loans Are On Hold

About $1.05 trillion of Americans student loan debt is in the form of direct loans. Thats a steep increase from five years ago when the total was $508.7 billion. Currently, 52% of direct federal loan debt is in repayment. About 8% is in default because the borrower hasnt made a payment in nine months or longer. The remaining 40% is on hold for a variety of reasons:

- 13% is held by students who are still in school

- 11% is in forbearance

- 5% is in a grace period

- 1% is classified as other

Forbearance and deferment enable many borrowers to postpone payments if they are experiencing economic hardship, like unemployment or a medical crisis are serving in the military or are continuing their studies through a fellowship, residency, or postgraduate study. The main difference is that interest always accrues during forbearance, but does not during some deferments.

The current breakdown is a significant change from the third quarter of 2013, when 42% of federal student loan debt was in repayment, 24% was held by students in school, 13% was in deferment, 8% was in forbearance, 7% was in a grace period, 5% was in default, and 1% was classified as other.

You May Like: Do Va Loans Cover Manufactured Homes

Which Graduate Degrees Are Students Borrowing The Most For

Of all graduate degrees, a medical degree takes longest to earn and costs the most. Doctors emerge from their training with an average debt load of $161,772. Lawyers follow with $140,616 worth of student loans, and educators rack up an average of $50,879 in outstanding loans. Of all degree seekers, the least indebted after graduation tend to be those earning MBAs, with an average student loan debt of $42,000.

How Much Is The Average Student Loan Debt In The Uk

Students who graduated from universities in England in 2020 owed an average of £40,280 in student loan debt, compared with just under £25,000 for graduates of Welsh universities, £23,520 for graduates in Northern Ireland, and £13,890 for graduates of Scottish universities. Those figures are vastly higher than they were in the year 2000 when indebtedness for graduates in all three countries was under £3,000.

Don’t Miss: Can You Use Fha Loan If You Already Own House

Federal Loan Debt Total Balance

Most of the total student loan debt balance is for federal loans, covering 92.2% of the total debt.

- $825.5 billion or 48.6% of federal loan debt is from Stafford loans.

- $552.1 billion or 32.5% of federal debt is from loans that have been consolidated .

- $272.3 billion in total federal student loan debt belongs to borrowers who owe between $20,000 and $40,000 .

- $263.1 billion in federal debt belongs to borrowers who owe $200,000 or more .

- Borrowers who owe between $5,000 and $10,000 account for a total of $54.6 billion or 34.8% of federal student loan debt.

The consolidated interest rate is the average of the existing loans interest rates rounded up to the nearest 1/8th%.

| Year |

|---|

¶Data sources include consolidated loans among graduate debt.

Average Student Loan Debt By Age

- 35-year-olds have the highest average student loan debt at $42,600.

- 7.38% of federal student loan debt belongs to adults under the age of 25.

- Adults aged 25 to 34 years old hold 32% of the federal student loan debt 38.4% belongs to 35- to 49-year-olds.

- 22.2% of federal student loan debt is from borrowers aged 50 years and older.

- In 2005, students under the age of 30 took out $76.3 billion in loan originations .

- In 2019, students under the age of 30 took out $47.1 billion .

- In 14 years, the value of student loan originations among borrowers under 30 years old declined 51.1%.

Find more detailed research in our report on the Student Loan Debt by Age.

Read Also: Va Home Loan For Manufactured Home

Q Whats With All These Proposals To Forgive Student Debt

A. Some Democratic candidates are proposing to forgive all or some student debt. Sen. Elizabeth Warren, for instance, proposes to forgive up to $50,000 in loans for households with less than $100,000 in annual income. Borrowers with incomes between $100,000 and $250,000 would get less relief, and those with incomes above $250,000 would get none. She says this would wipe out student loan debt altogether for more than 75% of Americans with outstanding student loans. Former Vice President Joe Biden would enroll everyone in income-related payment plans . Those making $25,000 or less wouldnt make any payments and interest on their loans wouldnt accrue. Others would pay 5% of their discretionary income over $25,000 toward their loan. After 20 years, any unpaid balance would be forgiven. Pete Buttigieg favors expansion of some existing loan forgiveness programs, but not widespread debt cancellation.

Forgivingstudent loans would, obviously, be a boon to those who owe moneyand wouldcertainly give them money to spend on other things.

But whoseloans should be forgiven? What we have in place and we need to improve is asystem that says, If you cannot afford your loan payments, we will forgivethem, Sandra Baum, a student loan scholar at the Urban Institute, said at aforum at the Hutchins Center at Brookings in October 2019. Thequestion of whether we should also have a program that says, Lets alsoforgive the loan payments even if you can afford them is another question.

Student Debt In Perspective

Student loans help pay for tuition and fees, as well as room and board and other educational costs like textbooks. Among those who borrow, the average debt at graduation is $25,921 or $6,480 for each year of a four-year degree at a public university. Among all public university graduates, including those who didnt borrow, the average debt at graduation is $16,300.1 To put that amount of debt in perspective, consider that the average bachelors degree holder earns about $25,000 more per year than the average high school graduate.2 Bachelors degree holders make $1 million in additional earnings over their lifetime.3

Whats more, the share of student-loan borrowers income going to debt payments has stayed about the same or even declined over the past two decades.4 Although 42 percent of undergraduate students at public four-year universities graduate without any debt, a student graduating with the average amount of debt among borrowers would have a student debt payment of $269 a month.5 In recent years, most students with federal loans became eligible to enter an income-driven repayment plan for federal loans. Under such plans, students typically limit student-loan payments to 10 percent of their discretionary income. The average monthly payment was $117 for borrowers from four-year public universities in income-driven repayment plans in 2011, the most recently available data.6

You May Like: Usaa Prequalify Auto Loan

How Are Student Loans Repaid

Slowly or in many cases, not at all. A sizable chunk of student loans are in limbo or totally abandoned.

- 3.3 million borrowers are currently deferring their federal student loans. In this instance, deferment means that interest doesnt accrue.

- 2.6 million borrowers currently have federal student loans in forbearance. Interest is still piling up for them.

- An astounding 4.7 million borrowers have their federal student loans in default. That means that 10% of all people with student loans havent made student loan payments on their debt in more than 9 months.

- Students that left college before completing their degree are more than twice as likely to eventually default on their loans compared to students that graduated.

- More than half of all defaulted debts are on loans that amount to less than $10,000.

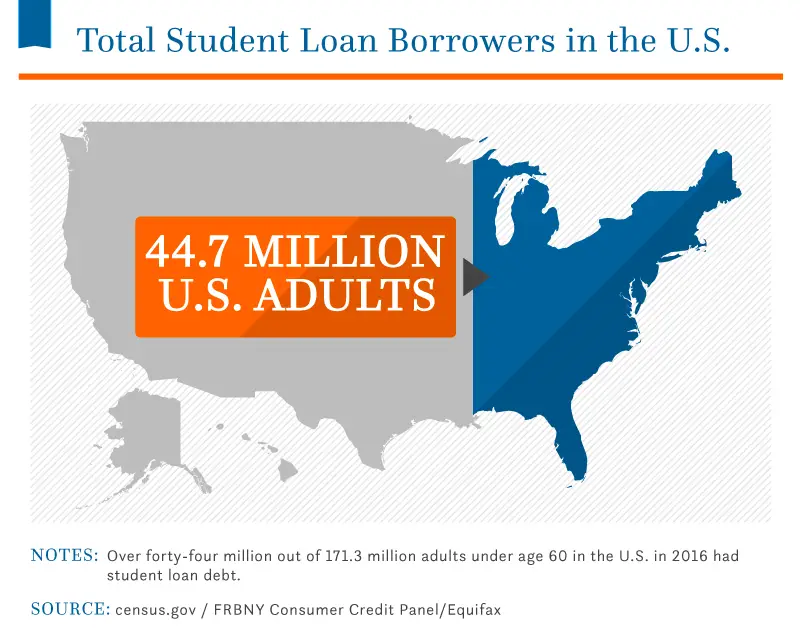

How Many Americans Have Student Loan Debt

- About 42 million Americans currently have student loan debt.

- According to the most recent data, there is currently $1.64 trillion total in student loan debt in the United States.

- 62% of 2019 graduates left college with student loan debt.

- As of 2019, the average student loan debt per person in the United States was $31,172.

- There were 42.3 million federal student loan borrowers in 2020.

You May Like: How Much Commission Do Loan Officers Make

Student Loan Debt Across Demographics

Due to privacy and antidiscrimination laws, not all debt-related demographic information is recorded or publicized the available data is usually expressed in terms of percentages within each particular group.

- 23 million indebted student borrowers are women 17.4 million are men.

- 7.5 million student borrowers under the age of 25.

- 14.8 million borrowers are between the ages of 25 and 34.

- 14.1 million indebted borrowers are between the ages of 35 and 49.

- 6.1 million are aged 50 to 61 years.

- 2.2 million are ages 62 and older.

- 389 million federal loan borrowers are undergraduate certificate recipients.

- 581 million are associateâs degree recipients owe an average of $21,890 each in federal loans.

- 33.6 million are bachelorâs degree holders.

- 12.1 million are masterâs degree holders.

- 2.1 million are doctoral degree recipients.

- 2.2 million are professional degree holders.

Student Loans By Race And Ethnicity

Logically, the initial amount borrowed has a tremendous impact on outstanding student loan debt as well as the amount a borrower ultimately pays. Most undergraduate students borrow less than $10,000 total.

- 40.2% of White undergraduate students use student loans to pay for school.

- 55% of student loans go to White students.

- 50.8% of Black students use student loans.

- 20% of loans go to Black students.

- 23% of Asian students use 4% of student loans.

- 0.3% of loans go to Pacific Islanders.

- Black students are the most likely to receive Federal loans.

- Asian students are least likely to receive Federal loans.

- White students are most likely to receive nonfederal loans.

- Pacific Islanders are the least likely to receive nonfederal loans.

- In the 2015-2016 academic year, Pacific Islanders received the largest average loan at $12,820.

- That same year, White students received the second-largest average loan at $12,350.

- American Indian and Alaskan Natives received the lowest average loan amount at $9,400.

- 32% of Black and African American undergraduate student loan recipients borrow $40,000-$59,999, cumulatively.

- 62.5% of Asian student borrowers take out less than $10,000 in loans to pay for college.

Read Also: What Is A Student Loan Account Number

Things You Should Know About Student Loan Debt

Student loan debt is a growing problem that many college students are facing, and it can make the process of getting out of college even more difficult. There is no denying the fact that student loans need to be paid back. In this article, we will explore 7 things you should know about student loan debt.

Average Student Loan Debt Statistics

Lets start off with a snapshot of those five student loan debt stats we mentioned in the intro.

So, if 45 million Americans are carrying around this type of debt, whats the repayment situation? On average, Americans take 20 years to pay off college loans, though they can take up to 46 years or more.7 Twelve percent of borrowers pay off their student loan debt after about four years, but this is not the norm.8 In fact, 12 years after starting college, the average borrower has paid off only 34% of this debt.9 And some Americans still owe on their student loans into their 70s!10

The average student loan interest rate is 5.8%, though this number varies based on loan type.11

Lets put some of these numbers together in our Student Loan Payoff Calculator for two repayment examples:

- If you pay that average monthly payment of $393 on a $38,792 loan with 5.8% interest, itll take you 11 years, and youll end up paying $14,052.09 in interest.

- If you take 30 years to pay off a $38,792 loan with 5.8% interest , youll end up handing over $43,526.30 in interest. That means youre paying more in interest alone than the actual amount borrowed in the first place! Ouch.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Economic Impact Of Debt Cancellation

The sheer size of student debt can be characterized as a weight on the U.S. economy as well as a burden on the millions of individuals who owe it. About 92% of student loan debt is backed by the U.S. government. That fact has made it a political issue. During the 2020 presidential election, some Democratic candidatesamong them Sen. Elizabeth Warren and then-Senate Minority Leader Chuck Schumer suggested canceling some or all student debt. They said it could be done by a president’s executive order rather than through legislation. In 2021, Sen. Warren continued to call on the administration to cancel up to $50,000 in federal student loan debt for each borrower.

The American Rescue Plan passed by Congress and signed by President Biden in March 2021 includes a provision that student loan forgiveness issued between Jan. 1, 2021, and Dec. 31, 2025, will not be taxable to the recipient.

Average Student Loan Monthly Payment

Heres what you can expect as an average student loan payment, according to the Federal Reserves Survey of Consumer Finances:

| Average monthly student loan payment | $393 |

| Median student loan payment | $222 |

Analysis: The average monthly payment for student loan borrowers depends not only on the amount they owe, but their interest rate and how many years theyll take to repay their debt.

The standard repayment term for federal student loans is 10 years, but extended and income-driven repayment plans allow borrowers to stretch out their payments for as long as 20 or 25 years. These repayment plans can ease the burden of monthly student loan payments, but they can also dramatically increase total repayment costs.

Similarly, borrowers who opt for longer private student loan repayment options will likely pay much more in interest over time compared to those who choose shorter terms.

Tip:

Enter loan information

| 62 and older | $37,739.13 |

While student loan debt is often thought of as a problem disproportionately affecting millennials, borrowers ages 35 and older hold 60.69% of all student debt. Additionally, borrowers aged 35 to 61 tend to have the highest loan balances.

Although borrowers 24 and younger have the lowest average loan balances of any age group, many are still enrolled in school and taking out additional loans. Borrowers 24 and younger hold less than 7.5% of total student loan debt.

Read Also: Usaa Auto Refi Rates

The Growth Of Student Debt

For much of American history, college was for the elite. If you couldnt afford it, you didnt go. That started to shift in 1944 when, hoping to keep the economy strong, Congress passed the G.I. Bill, which included massive amounts of funding for World War II veterans to go to college.

It was not until the late 1950s that federal student loans first appeared. Even then, they were limited, intended to encourage people to study subjects that would help the U.S. compete with the Soviet Union in the space race.

The student loan system as we know it today was born out of the Higher Education Act of 1965, which was designed to strengthen the educational resources of our colleges and universities and to provide financial assistance to students in postsecondary and higher education.

That financial assistance came primarily in two forms grants, which didnt need to be paid back, and low-interest student loans, which did.

We need to remember that these loans were only ever originally intended for students from upper income families, students whose families had the means to pay back the loans, said Michelle Asha Cooper, president of the Institute for Higher Education Policy.

Throughout the late 1970s, 80s and early 90s, though, Congress continued to pass new laws, one after another, that expanded eligibility for student loans, eliminated income requirements and allowed parents to borrow for their kids educations.

Federal Loan Debt Under Cares

42.9 million borrowers owe $1.57 billion in federal student loans. Between the second and third financial quarter of 2020, the CARES Act offered student loan debt relief that affected a minimum of 20 million borrowers.

- An estimated 35 million Americans may qualify for student debt relief under the CARES Act of 2020.

- Between 2020s 2nd and 3rd financial quarters, the amount of student loan debt in repayment decreased 82% while student debt in forbearance increased 375%.

- Between the 3rd and 4th financial quarters, student loans in forbearance declined 0.44%.

- Also during that period, the number of loans in repayment grew 33.3%.

- The number of loans in default also declined by 1.79%.

- 56.65% of all debt from federal student loans remains in forbearance until September 2021.

- 22.2 million or 48.8% of borrowers have loans in forbearance.

- 400,000 or 0.88% of federal student loan borrowers have loans currently in repayment, which is a 97.8% decrease from the 2nd financial quarter when 40.1% of borrowers had loans in repayment.

- 8% of the student loan debt balance belongs to students who are still in school.

- 2.81% of the total federal student loan debt is in a grace period.

- 7.8% of federal debt is in defaulted loans.

Some federal loans do not qualify for relief under the CARES Act. Borrowers with such loans may still be eligible for other payment arrangements, such as deferment or income-driven repayment plans.

You May Like: How To Get Loan Originator License