Home Loan Meaning Types Eligibility And Features

08 min read

Buying a house is one of the biggest dreams come true for most people and an extravagant affair altogether. Imparting life to such a dream requires a lot of effort from the buyersâ end and the best one can do to accommodate the home in their budget is through a home loan.

A home loan can be opted to buy a new house/flat or a plot of land where you construct the house, and even for renovation, extension, and repairs to an existing house.

Other Types Of Home Loans

In addition to these common kinds of mortgages, there are other types you may find when shopping around for a loan. These include:

- Construction loans If you want to build a home, a construction loan can be a good choice. You can decide whether to get a separate construction loan for the project and then a separate mortgage to pay it off, or wrap the two together. In general, you need a higher down payment for a construction loan and proof that you can afford it.

- Interest-only mortgages With an interest-only mortgage, the borrower pays only the interest on the loan for a set period of time. After that time period is over, usually between five and seven years, your monthly payment increases as you begin paying your principal. With this type of loan, you wont build equity as quickly, since youre initially only paying interest. These loans are best for those who know they can sell or refinance, or for those who can reasonably expect to afford the higher monthly payment later.

- Balloon mortgages Another type of home loan you may come across is a balloon mortgage, which requires a large payment at the end of the loan term. Generally, youll make payments based on a 30-year term, but only for a short time, such as seven years. At the end of that time, youll make a large payment on the outstanding balance, which can be unmanageable if youre not prepared. You can use Bankrates balloon mortgage calculator to see if this kind of loan makes sense for you.

Type Of Loans Available In India

There are numerous types of loans available in India. However, most people choose a personal loan over other types in spite of having a variety of assets, which they can mortgage to avail loans at a lower interest rate. One of the reasons behind this scenario is the lack of knowledge about different types of loans available in India.

Don’t Miss: How To Refinance An Avant Loan

What Is The Most Common Type Of Mortgage Loan

Because they have fewer restrictions and are available for more property types, conventional mortgages are the most common type taken by consumers. But how common a loan type is shouldnt be a criterion in determining which mortgage is right for you.

If youre a veteran, a VA loan will undoubtedly be the better choice. For individuals with impaired credit, FHA is the preferred mortgage. If youre purchasing a very expensive property, and need a considerable loan amount, jumbo mortgages will be the best option. And if you live in a rural area, you may find a USDA mortgage to be the preferred option.

Home Loan Interest Rates

BURSAHAGA.COM” alt=”North Carolina Home Equity Loan Rates > BURSAHAGA.COM”>

BURSAHAGA.COM” alt=”North Carolina Home Equity Loan Rates > BURSAHAGA.COM”> The average home loan interest rates are from 6.5% to 12.00% in India as of March 2021. The rates usually vary from lender to lender, RBI-prescribed repo rate, inflation, economic activities, and many other factors.

Some banks also give a special privilege to women, bank staff, and senior citizens by providing a 0.05% concession on the home loan interest rate.

Further, a home loan interest rate can either be fixed or floating in nature. A fixed-rate home loan remains the same for a period specified by the bank. This type of home loan is immune to market fluctuations.

In the case of floating-rate home loans, the interest rate applicable varies based on the market fluctuations. It may or may not be beneficial for the borrower.

Read Also: How Long For Sba Loan Approval

Types Of Mortgage Loans For Home Buyers

The US real estate is showing strong signs of revival. Analysts and experts alike concur in the conclusion that the sector is slowly but steadily gaining momentum and that this is a trend that will hold for the rest of the year. For prospective home buyers, this means that this is the time to do homework on home mortgage loan options and to make a move sooner rather than later.

With such positive and definite signs of the market becoming more vibrant like national home value rising, higher house prices and higher demand for turn key houses, time is of the essence. As the market becomes more brisk, every moment one waits before making a move is a moment in which home prices will be appreciating.

Choosing the right mortgage loan is very important. A home owner is more likely to be able to stay with their repayment if they choose a home and a mortgage that they can afford. There are different kinds of mortgages and an understanding of the different types of them will guide one to choosing the one that is most suitable.

Here are four types of mortgage loans for home buyers today: fixed rate, FHA mortgages, VA mortgages and interest-only loans.

Best For Small Loan Amounts With No Credit Check

The average pawn shop loan was around $150 in 2017, according to the National Pawnbrokers Association. If you dont think youll qualify for a traditional personal loan, you may want to consider a pawn shop loan. You wont need a credit check to get one and they may be less risky than a payday loan or title loan.

Don’t Miss: How To Get Loan Originator License

Best For Lower Interest Rates

Secured personal loans often come with lower interest rates than unsecured personal loans. Thats because the lender may consider a secured loan to be less risky theres an asset backing up your loan. If you dont mind pledging collateral and youre confident you can pay back your loan, a secured loan may help you save money on interest.

Loan Against Insurance Policies:

If you have an insurance policy, you can apply for a loan against it. Only those insurance policies that are aged over 3 years are eligible for such loans. The insurer can themselves offer a loan amount on your insurance policy. Approaching the bank for the same is optional. You need to submit all the documents related to the insurance policy to the bank.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

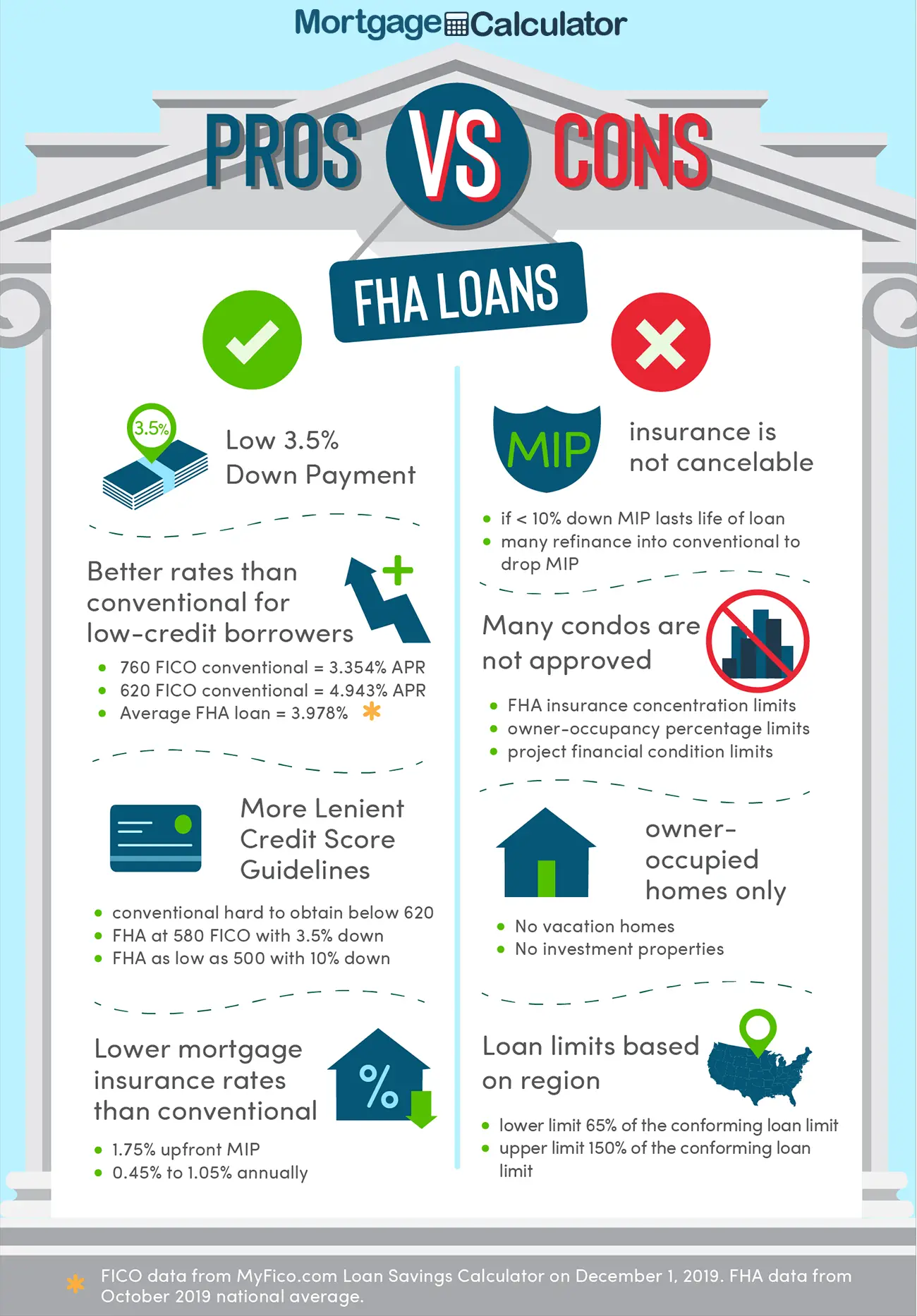

Federal Housing Administration Loans Vs Conventional Mortgages

FHA loans are available to individuals with as low as 500. If your credit score is between 500 and 579, you may be able to secure an FHA loan if you can afford a down payment of 10%. If your credit score is 580 or higher, you can get an FHA loan with a down payment for as little as 3.5% down. By comparison, you’ll typically need a credit score of at least 620, and a down payment between 3% and 20%, to qualify for a conventional mortgage.

When it comes to income limitations and requirements for FHA home loans, there is no minimum or maximum.

For an FHA loanor any type of mortgageat least two years must have passed since the borrower experienced a bankruptcy event . You must be at least three years removed from any mortgage foreclosure events, and you must demonstrate that you are working toward re-establishing good credit. If you’re delinquent on your federal student loans or income taxes, you won’t qualify.

| FHA Loans vs. Conventional Loans |

|---|

State And Local Government Mortgage Assistance Programs

States, counties, and large cities often make home loan funds available to borrowers within their jurisdictions. Theyre usually designed to help low and moderate-income borrowers become homeowners. Though theyre rarely outright first mortgages, they more typically function as a second loan to cover the down payment on a property.

Theyre most commonly used in conjunction with FHA loans. Since FHA loans require a 3.5% down payment, the local government loan will provide the funds for that down payment. FHA typically accepts these arrangements.

Since the loans are small, and usually carry very low interest rates, they wont significantly increase your monthly payment. But many have a provision where if you pay the loan on time for several years, the remaining outstanding balance will be forgiven.

Bond issues usually provide funds for state and local government mortgage assistance programs. For that reason, funds will be available only if a recent bond issue has been approved and funded. But they wont be available if there hasnt been a recent bond issue.

You can check with your lender or with your local government to find out if any such financing programs are available.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

How Different Types Of Home Loans Work

With so many different home loans out there, it’s hard to know which one is best. We’ve gone through our various home loans to help you work out which one is right for you.

Your home loan options are more adaptable and personalised than ever before. You may prefer a shorter duration loan with higher repayments or pay a little less for longer. You may opt for the flexibility of a variable rate, or for the certainty of a fixed rate.

What Are The Different Types Of Mortgage Loans

Mortgage types for homebuyers are categorized as conventional or government-backed and can be either conforming or nonconforming. Depending on the type of loan, you might have to choose between fixed or adjustable interest rates.

- Conventional loans: Conventional loans are mortgages issued by private lenders. They are not guaranteed by the federal government. A conventional loan can be conforming, with limits set by the government and Fannie Mae and Freddie Mac, which back conforming loans or nonconforming, with less standardization for eligibility, pricing and features. A jumbo loan with a high dollar amount is an example of a nonconforming loan.

- Government loans: These loans are insured by the government and often have more lenient eligibility requirements than conventional loans. Examples of government loans include FHA, VA and USDA home loans.

- Fixed-rate mortgages: A fixed-rate mortgage includes a set interest rate for the entire duration of the loan.

- Adjustable-rate mortgages: An adjustable-rate mortgage has a rate thats initially fixed for a set period, then it adjusts. For example, a 5/1 adjustable-rate mortgage has a fixed interest rate for the first five years of the loan duration, then there’s an annual adjustment.

You May Like: Need To Refinance My Car With Bad Credit

Home Equity And Refinance Loans

A refinance loan replaces your existing mortgage with a new one. Home refinance loans are useful to homeowners who want to lower their monthly mortgage payments, reduce their interest rate or switch from an adjustable-rate to a fixed-rate loan. A cash-out home refinance loan allows you to borrow more than you have remaining on your principal balance and use the extra cash however you want.

Home equity loans and home equity lines of credit are types of second mortgages, which add another payment to your existing mortgage.

Here are the major types of home refinance loans and second mortgages:

- Rate-and-term refinance: With a rate-and-term refinance, you get a new mortgage with a different interest rate and/or term length. The result might be a lower monthly mortgage payment or paying less in interest.

- Cash-out refinance: In a cash-out refinance, you get a new mortgage for an amount thats higher than your principal balance you can use the extra cash for any purpose.

- Home equity loan: A home equity loan, a type of second mortgage, allows homeowners to borrow against the equity in their home and pay the money back over time.

- Home equity line of credit : With this type of second mortgage, your bank sets up a revolving line of credit like with a credit card and you can borrow up to a limit thats based on your home equity. You pay back only what you borrow.

For more information, read about the differences between reverse mortgages, home equity loans and HELOC.

Bank Loan Vs Bank Guarantee

A bank loan is not the same as a bank guarantee. A bank may issue a guarantee as surety to a third party on behalf of one of its customers. If the customer fails to fulfill the relevant contractual obligation with the third party, that party can demand payment from the bank.

The guarantee is typically an arrangement for a banks small-business clients. A corporation may accept a contractors bid, for example, on the condition that the contractors bank issues a guarantee of payment in the event that the contractor defaults on the contract.

A personal loan might be best for someone who needs to borrow a relatively small amount of money and is sure of their ability to repay it within a couple of years.

Read Also: Usaa Pre Approval Car Loan

Choosing The Right Loan Type

Each loan type is designed for different situations. Sometimes, only one loan type will fit your situation. If multiple options fit your situation, try out scenarios and ask lenders to provide several quotes so you can see which type offers the best deal overall.

Conventional

- VA: For veterans, servicemembers, or surviving spouses

- USDA: For low- to middle-income borrowers in rural areas

- Local: For low- to middle-income borrowers, first-time homebuyers, or public service employees

Loans are subject to basic government regulation.

Generally, your lender must document and verify your income, employment, assets, debts, and credit history to determine whether you can afford to repay the loan.

Ask lenders if the loan they are offering you meets the governments Qualified Mortgage standard.

Qualified Mortgages are those that are safest for you, the borrower.

Loans Against Insurance Policies

Yes, you can also avail of loans against your insurance policy. However, note that all insurance policies don’t qualify for this. Only policies, such as endowment and money-back policies, which have a maturity value, can avail loans.

Thus, you can’t avail of a loan against a term insurance plan as it doesn’t have any maturity benefits. Also, loans can’t be availed against unit-linked plans as the returns aren’t fixed and depend on the market’s performance. It’s essential to note that you can opt for a loan against endowment and money-back policies only after they’ve acquired a surrender value. These policies gain a surrender value only after paying regular premiums continuously for three years.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

One Year Traditional Arms

A mortgage loan in which the interest rate changes based on a specific schedule after a fixed period at the beginning of the loan, is called an adjustable rate mortgage or ARM. This type of loan is considered to be riskier because the payment can change significantly. In exchange for the risk associated with an ARM, the homeowner is rewarded with an interest rate lower than that of a 30 year fixed rate. When the homeowner acquires a one year adjustable rate mortgage, what they have is a 30 year loan in which the rates change every year on the anniversary of the loan.

However, obtaining a one-year adjustable rate mortgage can allow the customer to qualify for a loan amount that is higher and therefore acquire a more valuable home. Many homeowners with extremely large mortgages can get the one year adjustable rate mortgages and refinance them each year. The low rate lets them buy a more expensive home, and they pay a lower mortgage payment so long as interest rates do not rise.

Can You Handle Interest Rates Moving Higher?

The traditional ARM loan which resets every year is considered to be rather risky because the payment can change from year to year in significant amounts. Unless the buyer plans to quickly flip the property or has plenty of other assets and is using an interest-only loan as a tax write off, almost anyone taking adjustable rates should try to pay extra in order to build up equity in case the market turns south.

Pradhan Mantri Awas Yojana

With the Credit-Linked Subsidy Scheme under PMAY, first-time homeowners can get Home Loans at subsidised interest rates. This can allow you to save as much as Rs < 2.67> lakh on the Home Loan. There are additional benefits like extended loan tenure of up to < 20> years available under this facility.

Only banks registered under the scheme are eligible to offer this subsidised loan. If you are a first-time property owner and looking for a lender, do consider one that is registered under this PMAY scheme to avail of the benefit.

Read Also: Rv Loan Usaa

S For Applying For Loan

Types of Loans in India