Why Do Sellers Hate Fha Loans

There are two major reasons why sellers might not want to accept offers from buyers with FHA loans. … The other major reason sellers don’t like FHA loans is that the guidelines require appraisers to look for certain defects that could pose habitability concerns or health, safety, or security risks.

Who Pays Fha Loan Closing Costs

Every FHA loan includes closing costs, but they can be reduced. While closing costs are generally considered to be the responsibility of the homebuyer, you may not have to pay for everything yourself. One of the biggest advantages of an FHA loan is the ability to avoid large upfront costs. To avoid high closing costs that could derail your home purchase, consider some of these options.

Is 10k Enough To Put Down On A House

Conventional mortgages, like the traditional 30-year fixed rate mortgage, usually require at least a 5% down payment. If you’re buying a home for $200,000, in this case, you’ll need $10,000 to secure a home loan. FHA Mortgage. For a government-backed mortgage like an FHA mortgage, the minimum down payment is 3.5%.

You May Like: Refinancing Auto Loan With Same Lender

Down Payment And Your Loan

Your down payment plays a key role in determining your loan-to-value ratio, or LTV. To calculate the LTV ratio, the loan amount is divided by the homes fair market value as determined by a property appraisal. The larger your down payment, the lower your LTV . Since lenders use LTV to assess borrower risk and price mortgages, a lower LTV means you pay lower interest rates on your mortgageand may avoid additional costs.

A lower LTV ratio presents less risk to lenders. Why? Youre starting out with more equity in your home, which means you have a higher stake in your property relative to the outstanding loan balance. In short, lenders assume youll be less likely to default on your mortgage. If you do fall behind on your mortgage and a lender has to foreclose on your home, theyre more likely to resell it and recoup most of the loan value if the LTV ratio is lower.

In addition to assessing your risk, lenders use the LTV ratio to price your mortgage. If your LTV ratio is lower, youll likely receive a lower interest rate. But if the LTV ratio exceeds 80%, meaning youve put less than 20% of the homes value as a down payment, expect higher interest rates. These rates cover the lenders increased risk of lending you money.

For loans that will accept down payments of 5% or less, consider Fannie Mae and Freddie Mac, individual lender programs, Government-insured FHA loans, VA loans, or USDA loans.

Fha Loans In Nc And Sc

Are you looking for an FHA loan in North Carolina or South Carolina? Dash Home Loans offers FHA loans for qualified home buyers throughout the Carolinas.

FHA loans, which are backed by the Federal Housing Administration , may help qualify for a home if you do not meet other requirements. Theyre ideal for individuals and families with low to moderate income and less than perfect credit scores.

Don’t Miss: How Long Does Sba Loan Take To Get Approved

Get Current Fha Loan Rates

For your convenience current FHA loan rates are published below. You can use these to estimate your mortgage interest rates and payments.

| Varies by County Limits | 15-yr & 30-yr Fixed |

To better compete with government insured loans, both of the major GSE have launched low downpayment loan options.

Freddie Mac has a Home Possible loan program which allows down payments as low as 3% to 5%, while Fannie Mae offers a HomeReady loan program that requires a 3% down payment.

Gifts From Family And Friends

The FHA is relaxed about some or even all of your down payment coming as gifts. But there are three main rules about this:

If your lender has any suspicions that the gift is not legitimate in any way, expect further investigations.

You May Like: Average Apr For Motorcycle

First Time Home Buyers Dont Need A Huge Down Payment

First time home buyers get access to many low-down-payment mortgages.

For example, conventional loans let you buy a house with 3% down and a 620 credit score, and FHA loans allow a 3.5% down payment with credit as low as 580.

There are even mortgages for first time home buyers with 0% down. The two most common are USDA and VA loans. However these have special requirements, so not everyone will qualify.

Even if you cant get a zero-down loan as a first time home buyer, theres a good chance youll qualify with just 3% or 3.5% down.

What Are Todays Low

Todays mortgage rates are low across the board. And many low-down-payment mortgages have below-market rates thanks to their government backing this includes FHA loans and VA and USDA loans .

Different lenders offer different rates, so youll want to compare a few mortgage offers to find the best deal on your low- or no-down-payment mortgage. You can get started right here.

Popular Articles

You May Like: Va Manufactured Home Loan

How Much Money Do I Need To Buy A House For The First Time

As of September 2021, the median home price in the U.S. is around $370,000. Assuming a 20% down payment, you would need $74,000 for a down payment, plus several thousand more for closing costs and fees to your lender, realtor, lawyer, and title company. Still, no set amount is required and home prices vary state-to-state and city-to-city. It’s all dependent on what you’re looking for in terms of size and type of property, neighborhood, amenities, and any other details specific to your situation.

Fha Minimum Down Payment: 35%

With an FHA loan, the minimum down payment depends on your credit score. If you have a credit score that’s 580 or higher, the minimum down payment is 3.5%.

If your score falls between 500 to 579, the minimum down payment required is 10%. FHA guidelines sometimes refer to this as the Minimum Required Investment it just means the down payment.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Can You Get A Construction Loan With Fha

The short answer is that an FHA construction loan is certainly possible under the guidelines of the FHA loan program, but you must find a participating FHA lender who is willing to make the loan.

First time home buyer oklahomaAs a first time home buyer, what are my options?Start your search online.Attend an online buying seminar.Contact a bank you are familiar with as a first step.Find a local Department of Housing and Urban Development-sponsored not-for-profit agency.Ask family and friends for a referral to lenders to consult.What are the criteria for first-time home buyers?Report and q

Homebuyers May Qualify For A Low

Visit FHALoans.com today to prequalify.

| 6,476,430 |

* U.S. Department of HUD as of August 15, 2019. Originations based on beginning amortization dates.

# Includes all conventional and government single family forward originations. Mortgage Bankers Association of America, âMBA Mortgage Finance Forecast,â August, 2019.

In March of 2019 the FHA announced tightened underwriting standards, which is expected to impact about 4% to 5% of the demand for FHA-insured loans, leading to somewhere between 40,000 and 50,000 fewer loans a year.

Don’t Miss: Refinance Parent Student Loans

What Do You Need To Know When Selling A Fha Home

From a seller’s point of view, the most important thing is to evaluate each proposal in terms of its overall strength and merits. Depending on the situation, the best deal can be obtained from an FHA borrower or a regular borrower. 2. Does HUD require home inspections and evaluations?

WHAT IS FHA MORTGAGE INSURANCE? Mortgage insurance is a policy that protects lenders against losses on home mortgages that results from defaults. A Federal Housing Administration loan is a mortgage insured by the Federal Housing Administration and approved by FHA-lender. It includes both an upfront cost at the time of mortgage get plus also includes an annual payment and a monthly cost.Insurance or Mortgage Insurance:First, we discuss what is the meaning of insuran

How The Fha 203k Refinance Works

The FHA 203K refinance process differs from any other loan program. First, you must find a contractor. The FHA and most lenders dont allow homeowners to do the work themselves. The only way to do the work yourself is to prove you have the qualifications for the work and the time to complete the work. This doesnt happen often because homeowners applying for a mortgage usually have a job. That job prevents them from having the time to complete the renovations. The FHA 203K allows up to 6 months for work completion thats not a lot of time if you work full-time.

Once you find a contractor, you can negotiate the costs. Its best if you shop around with different contractors. Get at least 3 bids. This way you have choices. The lender has the final approval on which contractor you choose. They look at not only the costs, but also the experience, and availability of the contractor. The contractor must meet the 6-monthd deadline. Its best to choose contractors with experience with the 203K process.

Once you have a contractor, the loan process can begin. You must personally qualify for the loan. See how below.

Recommended Reading: Best Fha Refinance Lenders

What Are Mortgage Insurance Requirements For Fha Loans

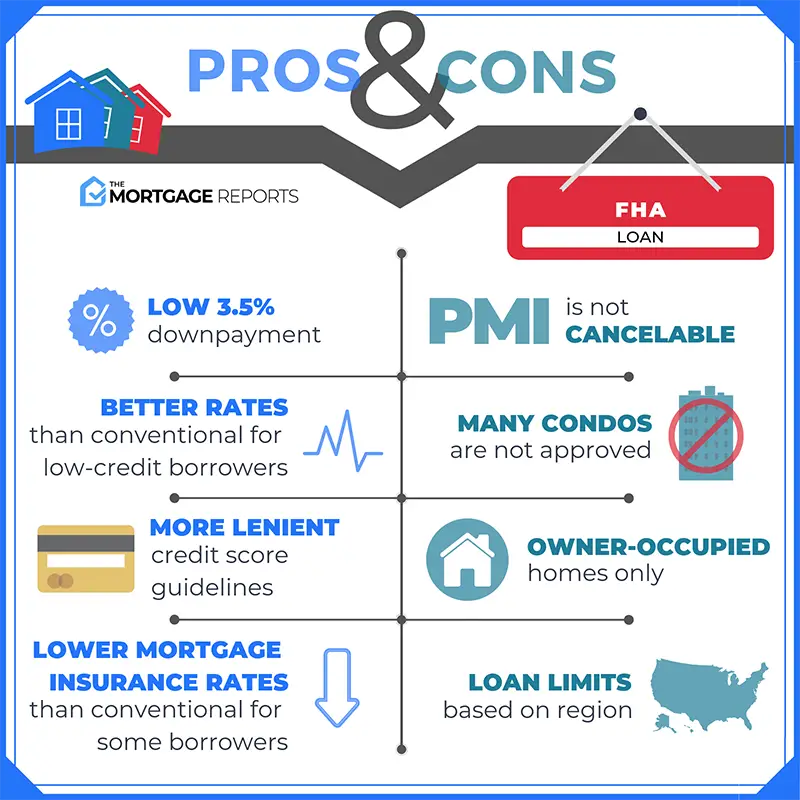

One catch to FHA loans is that borrowers are required to pay mortgage insurance premiums, or MIP, when they put less than 20 percent down. This additional payment is required because lenders are taking on more risk since the borrower made a lower down payment, which could impact the lender if the borrower failed to make payments on the loan and defaulted.

FHA loans come with two mortgage insurance premiums:

- Upfront mortgage insurance premium: 1.75 percent of the loan amount, paid when the borrower gets the loan the premium can be rolled into the mortgage

- Annual mortgage insurance premium: 0.45 percent to 1.05 percent, depending on the term of the loan , the loan amount and the initial loan-to-value ratio, or LTV the premium is divided by 12 and paid monthly

For a homebuyer who borrows $150,000, this means the upfront MIP would be $2,625 and the annual MIP would range from $675 to $1,575 .

Unlike private mortgage insurance for a conventional loan, FHA loan borrowers who put down less than 10 percent are required to pay these premiums for the entire term of the mortgage. The only way you can stop paying them is if you refinance into a non-FHA loan or sell the home.

Why Are Fha Loans Good For First Time Home Buyers

FHA loans are federally insured home loans for working and middle class Americans. Because the loans are secured, the lenders offer excellent interest rates to new owners and those with poor or no credit.

How to afford a houseHow much house can you really afford? This will show you how many houses I can afford. Rate your deposit. Your home budget will depend on how much you can afford each month and how much you need to save. Set your monthly budget. Use your debt as a guideline. Estimate the possible interest rate. Take local costs into account.How much house can I actually afford?To calculate the amount of housin

You May Like: What Credit Score Is Needed For Usaa Auto Loan

How Much Is Pmi On A Fha Loan

Borrowers pay two types of mandatory FHA mortgage insurance premiums. The first is a lump-sum upfront mortgage insurance premium charge equal to 1.75% of your loan amount. UFMIP is typically financed into the loan amount. The annual mortgage insurance premium ranges from 0.45% to 1.05% of the loan amount, and is divided by 12 and added to your monthly payment.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: Auto Loan Usaa

Do No Down Payment Mortgages Really Exist

Purchasing a home with no down payment saved doesnt mean that you dont have to make a down payment it simply means that youre not using your own hard-earned and saved cash to pay for the down payment. It means youre going to borrow your down payment , which in return means youre taking on even more debt. This is why its important that youre in good financial standing before you take on even more debt than is technically necessary.

Loans Canada Lookout

How Much Money Do I Need To Put Down On A Mortgage

When you buy a home, one of the biggest up-front expenses is the down payment. Not to be confused with closing costs, the down payment is the portion of the purchase price that you pay upfront at closing. Generally, if you put less money down on a home at closing, youll pay more in fees and interest over the loans lifetime .

Read Also: Refinance Avant

How To Decide If An Fha Loan Is The Right Choice

An FHA loan does offer significant benefits, but it’s not the right choice for every would-be homebuyer. An FHA loan could make sense for you if:

- Your credit needs improvement. Conventional mortgage loans usually require a , while FHA loans allow for lower credit scores. Even if you’ve had more significant credit problems, such as a bankruptcy, you could still qualify for an FHA loan.

- You don’t have much saved for a down payment. Since FHA loans allow you to put down as little as 3.5%, they’re an option for homebuyers who haven’t been able to set aside a significant sum.

- You need help with closing costs. Conventional mortgages require borrowers to pay hefty upfront costs in addition to the down payment, which can easily total in the thousands. To help homebuyers, the FHA allows some closing costs to be rolled into the mortgage and paid over time.

FHA loans have their advantages, but there’s a trade-off in the form of the mortgage insurance. Homebuyers who take out an FHA loan must pay an upfront premium that’s usually 1.75% of the base loan amount. There’s also an ongoing annual mortgage insurance premium that usually costs 0.45% to 1.05% of the loan amount. This annual premium lasts for the life of the loan unless you refinance later on or put down 10% or more, in which case it falls off after 11 years.

Down Payment Assistance Programs And Gifts

Rules for FHA loans are easier than most when it comes to the source of your down payment. So you may be able to accept the whole amount from a down payment assistance program or as a gift.

Still, its important to remember lenders may impose stricter standards than the FHA minimums outlined here. So that last bit of advice stands: shop around for a more sympathetic lender if yours has strict rules over down payment assistance and gifts.

Also Check: What Car Loan Can I Afford Calculator