What Are The Current Mortgage Rates In Wisconsin

Mortgage rates in Wisconsin today are 30-year fixed-rate, 15-year fixed-rate, and 5/1 adjustable-rate mortgage . Wisconsin New Homebuyer Programs The Wisconsin Housing and Economic Development Administration, or WHEDA for short, offers several loan programs to help first-time homebuyers obtain mortgages.

Fha: The Mortgage Program First

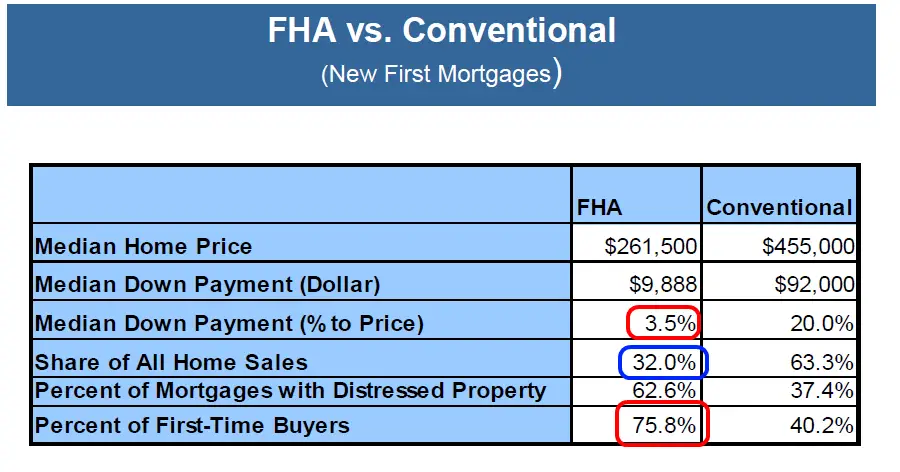

FHA is one of todays most popular home buying programs.

The FHA down payment is just 3.5% for most borrowers. As down payments go its certainly a lot less than the 20% up front some mortgage programs require.

But is there a way to make the FHA down payment even easier?

Glad you asked.

Down Payment Assistance Programs And Gifts

Rules for FHA loans are easier than most when it comes to the source of your down payment. So you may be able to accept the whole amount from a down payment assistance program or as a gift.

Still, its important to remember lenders may impose stricter standards than the FHA minimums outlined here. So that last bit of advice stands: shop around for a more sympathetic lender if yours has strict rules over down payment assistance and gifts.

Don’t Miss: Does Va Loan Work For Manufactured Homes

How To Get Rid Of Mip On Fha Loans

You can avoid paying mortgage insurance after paying down your loan-to-value ratio on your FHA loan to 78% by refinancing your FHA loan to a conventional loan.

Contact your lender and ask them if youre eligible to have your annual insurance premium removed.

If you put less than 10% down on an FHA loan you will have to pay the MIP for the life of the loan. You can remove MIP after 11 years if your down payment is higher than 10%.

Are Fha Loan Down Payments Required

Down payments are required when you buy homes with FHA loans. FHA loans have lower minimum down payment requirements compared to conventional loans but down payments are still needed.

Your minimum FHA loan down payment is determined by your credit score. If your credit score is 600 or higher, you only need to put down 3.5% of the purchase price of the home with an FHA loan through Freedom Mortgage. This means if you wanted to buy a $270,000 home with an FHA loan, you will need to make at least a $9,450 down payment.

You can choose to make a larger down payment than the FHA requires. Making a larger down payment can help you save on interest because you are borrowing less money to buy your home. Finally keep in mind that the amount of your FHA loan down payment can affect how much you pay for mortgage insurance premiums and for how long you need to pay these premiums.

To learn more about how much your monthly payment might be, check out our FHA loan calculator.

You May Like: Usaa Used Car Loan Interest Rates

Fha Dti Ratio Standards

You must show lenders you have the means to make your monthly loan payments consistently.

Lenders use several tools to assess your ability to repay a loan. One of the most important is a number called the debt-to-income ratio . Your DTI ratio is the total of all of your debt divided by your gross monthly income. The lower the ratio, the less of a debt load you carry.

Dont Deplete Your Entire Savings

When the majority of your money is tied up in a home, financial experts refer to it as being house-poor.

When youre house-poor, you have plenty of money on-paper, but little cash available for the everyday living expenses and emergencies.

And, as every homeowner will tell you, emergencies happen.

Roofs collapse, water heaters break, you become ill and cannot work. Insurance can help you with these issues sometimes, but not always.

Thats why you being house-poor can be so dangerous.

Many people believe its financially conservative to put 20% down on a home. If 20% is all the savings you have, though, using the full amount for a down payment is the opposite of being financially conservative.

The true financially conservative option is to make a small down payment and leave yourself with some money in the bank. Being house-poor is no way to live.

Here are answers to some of the most frequently asked questions about mortgage down payments.

How can I buy a house with no money down?

In order to buy a house with no money down, youll just need to apply for no-money-down mortgage. If you dont know which mortgage loan is your best zero money down option, thats okay. A mortgage lender can help steer you in the right direction. There are multiple 100 percent mortgages available for todays home buyers.

Can cash gifts be used as a down payment?What are down payment assistance programs?Are there any home buyer grants?What are FHA loan requirements?

Read Also: Va Loan Requirements For Mobile Homes

Va Financial Loans: Zero Down

VA debts is booked about exclusively for veterans who satisfy minimum solution stages, and the ones now offering for the army.

If you are suitable, your own provider buys you one of the recommended mortgages around: zero deposit, low-interest price, no continuing home loan insurance, plus the alternative of a streamlined refinancing later.

With An Fha Loan Nearly All Borrowers Can Pay As Few As 35percent In The Homes Cost As A Down

But, as with all mortgages, youll probably have less financial rate if you possibly could have the ability to clean together a lot more possibly 5%.

But a bigger down payment can be maybe not a top priority for FHA homeowners. Usually, theyre nervous purchase a property as fast as possible so they are able get on ideal area of increasing home prices.

Recommended Reading: Usaa Used Car Refinance Rates

What Are The Benefitsto An Fha Loan

An FHA loan is a great option for a first time home buyer that doesnt have a great credit score or a lot of money to put down. FHA has shorter waiting periods than conventional loans for borrowers who have had credit events, such as bankruptcy, foreclosure, or a short sale, as long as they have re-established credit. FHA allows a relative to be a non-occupant co-borrower to assist the borrower in qualifying.

Closing Costsfor Fha Loans

There are fees and charges that you accumulate in the mortgage process with an FHA loan or any loan, and these fees are closing costs. FHA closing costs are approximately 3-4% of the homes purchase price, which can vary by state due to higher taxes. Some Down Payment Assistance programs can cover a portion of the closing costs associated with your FHA loan.

Don’t Miss: Can I Refinance My Sofi Personal Loan

How Much Is The Fha Mortgage Insurance Premium

Borrowers who put down 10% or less, the PMI is .85%. If a borrower puts down more than 10%, then the MIP goes down slightly to .80%.

For example, if you buy a $200,000 home and put in a 3.5% downpayment.

The LTV is 96.5%, so you have to pay a mortgage insurance premium of .85%, roughly $1700 per year. You can figure the amount you will have to pay for mortgage insurance using the FHA MIP chart below.

Typical Conventional Mortgage Down Payment Amount

Conventional loans are very popular still. Older people usually have 20 percent down because they are downsizing or upsizing, and they sell a house. They put that money towards a new place, Stevenson says.

But she usually sees the majority of people putting down between five and 10 percent of the loan amount. With a down payment of at least 5%, conventional loan rates drop compared to the 3% down payment option.

Read Also: Becu Car Repossession

What Kind Of Multi

How this works is that the borrower of the FHA home loan will qualify for and be approved to purchase a multi-unit property. This will be either for two units , three units , or four units . The most units you may have is four, and the main stipulation is that you live in one of the units. The property has to be your primary residence. This program cant be used to purchase investment property. You also, cannot count future rent payments as part of your current income for qualifying purposes.

Negotiate With The Lender

In some cases, theres some wiggle room when it comes to lender fees. If your lender wants to compete for your business, theyre often willing to help you with lower closing costs. Comparing quotes from other lenders can help you navigate the negotiation.

These options are designed to help you anticipate, understand and manage the closing costs for your FHA loan. It’s important to remember that your down payment is separate from closing costs.

While closing costs are part of an FHA loan, they don’t have to be a deal-breaker. To learn more about FHA loans and how to pay the closing costs, speak to a Home Lending Advisor.

Read Also: Is Bayview Loan Servicing Legitimate

Is An Fha Loan Right For You

If youre still debating the merits of an FHA loan compared to a conventional loan, know that a conventional loan is not government-backed. Conventional loans are offered through Fannie Mae or Freddie Mac, which are government-sponsored enterprises that provide mortgage funds to lenders. They have more stringent requirements, so keep in mind that youll need a higher credit score and a lower DTI to qualify.

Regardless of whether you choose a conventional or FHA loan, know that there are a few other costs of which youll need to be aware. You’ll have to pay closing costs, which are the fees associated with processing and securing your loan. These can vary depending on the price of the house and the type of mortgage, but you should budget 3% 6% of your homes value.

You should also budget 1% 3% of your purchase price for maintenance. The exact percentage is going to depend on the age of the house. If your house is newer, odds are less things are likely to break right away. Meanwhile, if the house is on the older end, you may need to set aside more. Finally, if you live in an area with homeowners association fees, youll end up paying for those on a monthly or yearly basis.

Disadvantages Of Fha Mortgages

FHA loans aren’t the perfect mortgage for everyone. There are certain limitations and conditions that may affect whether they’ll be the right choice for you.

For starters, there are limits on how much you can borrow with an FHA mortgage. FHA county loan limits for single-family homes range from $271,050 in most of the country to as much as $625,500 in counties with high real-estate values. .

FHA mortgage insurance is required on all FHA loans. There’s an upfront premium of 1.75 percent, plus an annual premium paid as part of your monthly mortgage payments. This may make an FHA mortgage more costly than other loan options, particularly if you have good credit. If you put less than 10 percent down, you need to carry FHA mortgage insurance for the life of the loan. Most mortgages allow you to cancel mortgage insurance once you reach 20 percent equity.

FHA home loans have stricter property eligibility requirements. Homes must pass an inspection to ensure there are no structural problems or hazards.

FHA mortgage guidelines generally do not allow them to be used to buy a second home or investment property. They can only be used to buy a property for use as your primary residence.

More information: FHA mortgage pros and cons

Don’t Miss: Can You Refinance Your Car With The Same Lender

How Does Fha Mortgage Insurance Work

The biggest downside to an FHA loan is mortgage insurance.

As well as their guarantees from the FHA, lenders also need to charge mortgage insurance premiums to justify lending to higher-risk borrowers. The borrower pays for this insurance, but its the lender who gets the money in case of mortgage default.

MIP comes in two parts. First, theres an upfront mortgage insurance premium payable on closing. The cost is usually 1.75% of the loan amount. So this is what a $200,000 home purchase would look like:

- Purchase price: $200,000

- Loan amount before upfront MIP: $193,000

- Upfront MIP of 1.75%: $3,378

- Total loan amount: $196,378

Secondly, you have to pay a smaller premium each month. Most often, this is equal to 0.85% of the existing loan balance per year. For that $200,000 home purchase, it will cost about $136 per month, which is added to the monthly mortgage payment.

But monthly MIP on FHA loans tends to be more burdensome than with other types of mortgages. This is because if your down payment is less than 10%, youll be on the hook for these monthly premiums until you pay off your loan, perhaps 30 years later. Unlike conventional loans, your mortgage insurance wont automatically go away once you have sufficient home equity.

With conventional mortgages, you can stop paying private mortgage insurance once you have 22% equity in your home.

The Real Problem With The Fha Down Payment

The truth is that the FHA down payment requirement is not a big problem. By historic standards, the FHA down payment is far smaller than a lot of competing mortgage options. Theres a reason why more than 640,000 first-time borrowers used the FHA program in FY 2018.

The real issue is that in a changing economy with lots of consumer debt its hard to save.

Of buyers who said saving for a down payment was difficult, explains NAR. Fifty percent of buyers reported that student loans made saving for a down payment difficult. Thirty-seven percent cited credit card debt, and 35% cited car loans as also making saving for a down payment hard.

The way to win the FHA down payment challenge is to budget, pay bills in full and on time and save NAR says that 58% of all buyers paid for their down payment by saving. This approach will help you accumulate money and bulk-up your credit score. And if you happen to get some help with gifts and seller concessions, so much the better.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Fha Loan Down Payments

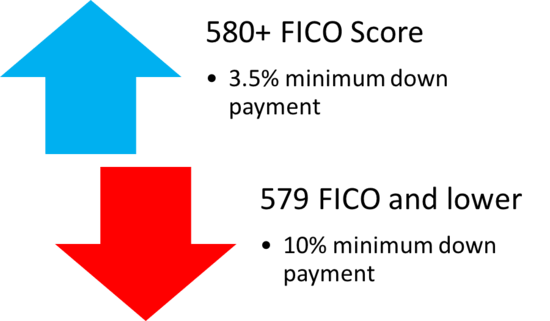

Your down payment is a percentage of the purchase price of a home and is the upfront amount you put down for that home. The minimum down payment youre able to make on an FHA loan is directly linked to your credit score. Your credit score is a number that ranges from 300 850 and is used to indicate your creditworthiness.

An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the 500 579 range. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans. A mortgage calculator can help you estimate your monthly payments, and you can see how your down payment amount affects them.

Note that cash down payments can be made with gift assistance for an FHA loan, but they must be well-documented to ensure that the gift assistance is in fact a gift and not a loan in disguise.

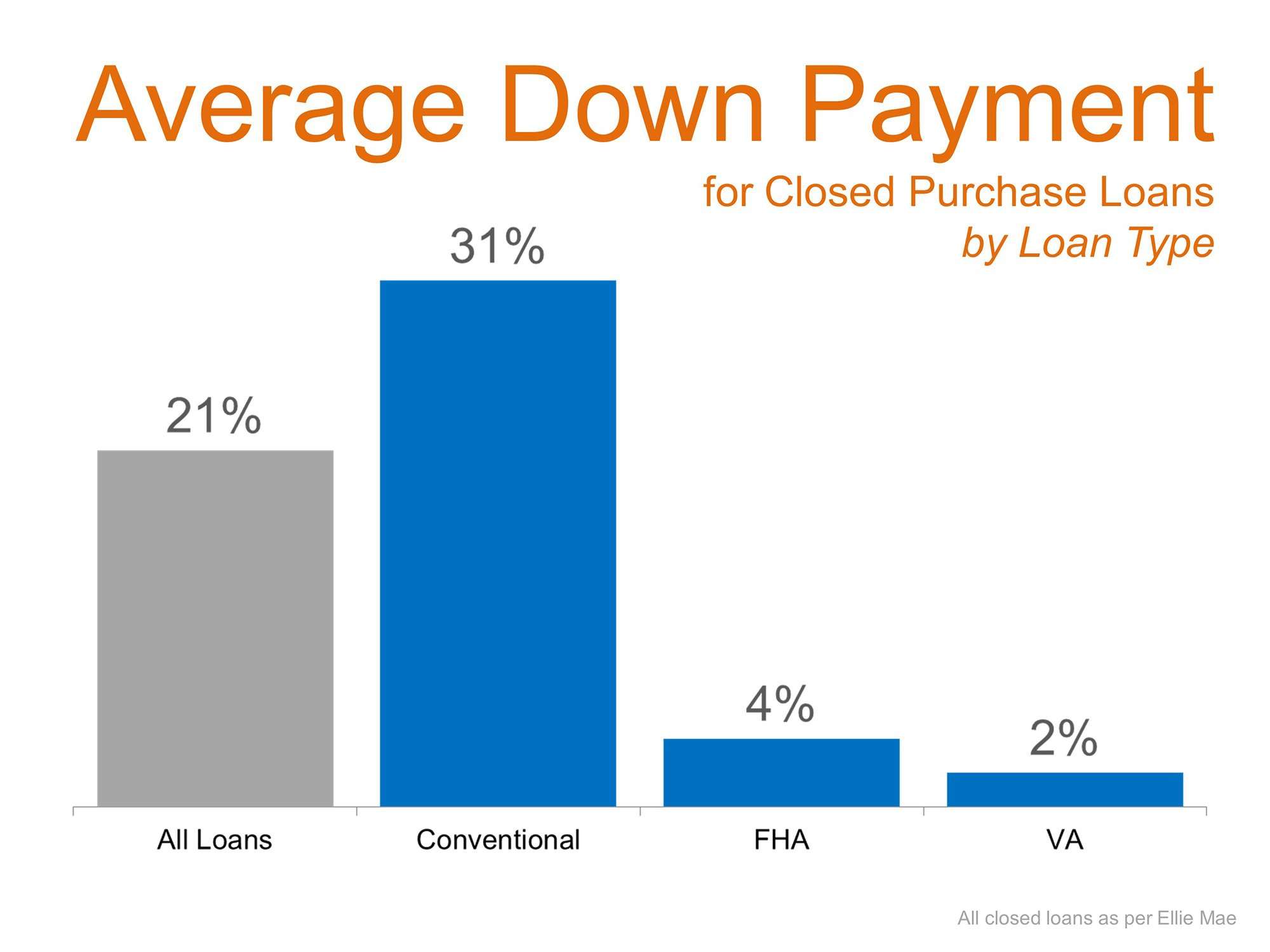

Home Buyers Dont Need To Put 20% Down

Its a common misconception that 20 percent down is required to buy a home. And, while that may have true at some point in history, it hasnt been so since the advent of the FHA loan in 1934.

In todays real estate market, home buyers dont need to make a 20% down payment. Many believe that they do, however .

The likely reason buyers believe 20% down is required is because, without 20% down, youll likely have to pay for mortgage insurance. But thats not necessarily a bad thing.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Fha Loan Down Payment Chart

Your FHA down payment will vary depending on your home price. This chart compares the FHAs minimum down payment of 3.5% to the traditional 20% down payment some experts still recommend.

| Home Price | |

|---|---|

| $100,000 | $82,500 |

Clearly, you can get into a home much faster if you pursue the FHAs low down payment option.

But if you can easilyput down more than 3.5%, you might consider it. A larger down payment can mean a lower interest rate, since the lender is taking on less risk.

Youll also pay less in mortgage insurance. FHA loan requirements stipulate that borrowers must pay an upfront and annual mortgage insurance premium . If you put down less than 10% which most people do on an FHA loan youll owe MIP for the life of the loan.

The MIP falls off after 11 years if you put down more than 10%. But if you have that much saved upfront, you may be better served by a conventional loan .

Your MIP rate decreases the more you put down. It also varies based on whether you take out a 30-year or 15-year loan.

Just keep in mind that the more you put down, the lower your emergency fund will be. And during a job loss or medical event, you may wish that you had kept more cash.

Final Thoughts On Fha Loans

If you’re in the market for a loan with lenient credit, lower down payment and low-to-moderate income requirements, an FHA loan might be right for you. Check out your options online with Rocket Mortgage®.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: Credit Score For Usaa Auto Loan

Fha And Conventional 97 Rate Quotes Available

Its hard to tell if an FHA or conventional loan is the best mortgage option for your home purchase just by reading an article. To help you determine which type of loan is best for your financial situation, you can receive live quotes from real lenders now.

Lee Nelson

MyMortgageInsider.com Contributor