Fha Mortgage Calculator Definitions

Many first-time home buyers arent aware of all the costs associated with homeownership.

When you pay your mortgage, youre not just repaying loan principal and interest to your lender. You also need to pay homeowners insurance, property taxes, and other associated costs.

The FHA mortgage calculator above lets you estimate your true payment when all these fees are included. This will help you get a more accurate number and figure out how much house you can really afford with an FHA loan.

Heres a breakdown to help you understand each of the terms and fees included in our FHA loan calculator:

Down payment.;This is the dollar amount you put toward your home purchase. FHA requires a minimum down payment of 3.5% of the purchase price. This can come from a;down payment gift;or an eligible down payment assistance program.

Loan term. This is the fixed amount of time you have to pay off your mortgage loan. Most home buyers choose a 30-year, fixed rate mortgage, which has equal payments over the life of the loan. 15-year fixed-rate loans are also available via the FHA program. FHA offers adjustable-rate mortgages, too, though these are far less popular because the mortgage rate and payment can increase during the loan term.

Principal and interest.;This is the amount that goes toward paying off your loan balance plus interest due to your lender each month. This remains constant for the life of a;fixed-rate loan.

Add Utility Bills And Rent Payment History

The most common items on your credit report are students loans, credit cards, mortgages, and personal loans. But you can also self-report other regular payments to credit bureaus. Meyer says some utility companies and landlords allow you to opt in to the credit bureaus, so each payment is recorded on your credit report. If you make your electric bill and rent on time each month, this is an easy way to potentially boost your credit score by a few points.

What Else Do I Need To Get Approved For An Fha Loan

Sufficient income is one of the most important things a person needs to get approved for an FHA loan. Its also the main factor lenders use when determining how much mortgage a person can qualify for.

But there are other things youll need to get approved for an FHA loan.

- Down payment: The minimum required down payment for FHA borrowers is 3.5% of the purchase price or appraised value, whichever is less. So be sure to account for this when figuring out how much house you can afford.

- According to HUD guidelines, borrowers need a credit score of 580 or higher to get approved for an FHA loan with maximum financing . Lenders sometimes require higher scores.

- Manageable debt: We talked about the debt-to-income ratio above. Its another one of the key requirements for the FHA mortgage program.

This article answers two common questions we receive from borrowers: How much of an FHA loan can I qualify for with my income? How much of a house can I afford to buy?

Its important to think of these questions separately, because they are two different things. We encourage all borrowers to establish a basic housing budget, before starting the mortgage application process.

The bottom line is that the FHA does not require a minimum income for this program. Thats generally left up to the lender, as long as the debt ratios look good. Nor is there a limit on how much you can earn.

Read Also: What Is The Average Student Loan Debt

How To Calculate Your New Fha Loan Mip Amount

To calculate your MIP amount for your new FHA refinance loan, youll need to determine following figures:

Next, subtract your MIP refund amount from your new UFMIP amount. This amount is the total UFMIP you owe on your new refinance loan.

= New loan UFMIP amount

New FHA UFMIP calculation

For example, if your new refinance loan is $200,000, then your new UFMIP amount is $3,500 . Now, lets say your MIP refund amount is $1,800. That means, youll only have to pay $1,700 UFMIP towards your new refinance loan .

Is An Fha Loan Right For You

If youre still debating the merits of an FHA loan compared to a conventional loan, know that a conventional loan is not government-backed. Conventional loans are offered through Fannie Mae or Freddie Mac, which are government-sponsored enterprises that provide mortgage funds to lenders. They have more stringent requirements, so keep in mind that youll need a higher credit score and a lower DTI to qualify.

Regardless of whether you choose a conventional or FHA loan, know that there are a few other costs of which youll need to be aware. You’ll have to pay closing costs, which are the fees associated with processing and securing your loan. These can vary depending on the price of the house and the type of mortgage, but you should budget 3% 6% of your homes value.

You should also budget 1% 3% of your purchase price for maintenance. The exact percentage is going to depend on the age of the house. If your house is newer, odds are less things are likely to break right away. Meanwhile, if the house is on the older end, you may need to set aside more. Finally, if you live in an area with homeowners association fees, youll end up paying for those on a monthly or yearly basis.

Recommended Reading: What Kind Of Car Loan Interest Rate Can I Get

Income And Proof Of Employment

You will need to be able to verify your employment history to qualify for an FHA loan. You should be able to provide proof of income through pay stubs, W-2sand tax returns. There are technically no income limits, but you will need enough income to have an acceptable DTI ratio. Having a higher income will not disqualify you from receiving a loan.

Whats The Difference Between Fha And Conventional Loans

Home loans fall into two broad categories: government and conventional. A conventional loan is any mortgage that is not insured by a federal entity. Because private lenders assume all the risk in funding conventional loans, the requirements to qualify for these loans are more strict. Generally speaking, FHA loans might be a good fit if you have less money set aside to fund your down payment and/or you have a below-average credit score. While low down payment minimums and competitive interest rates are still possible with a conventional loan, youll need to show a strong credit score to qualify for those advantages.

Each loan type has advantages and disadvantagesincluding different mortgage insurance requirements, loan limits, and property appraisal guidelinesso choosing the one that works best for you really depends on your financial profile and your homebuying priorities.

Read Also: Are Va Loan Interest Rates Lower

Upfront Mortgage Insurance Premiums Vs Annual Insurance Premiums

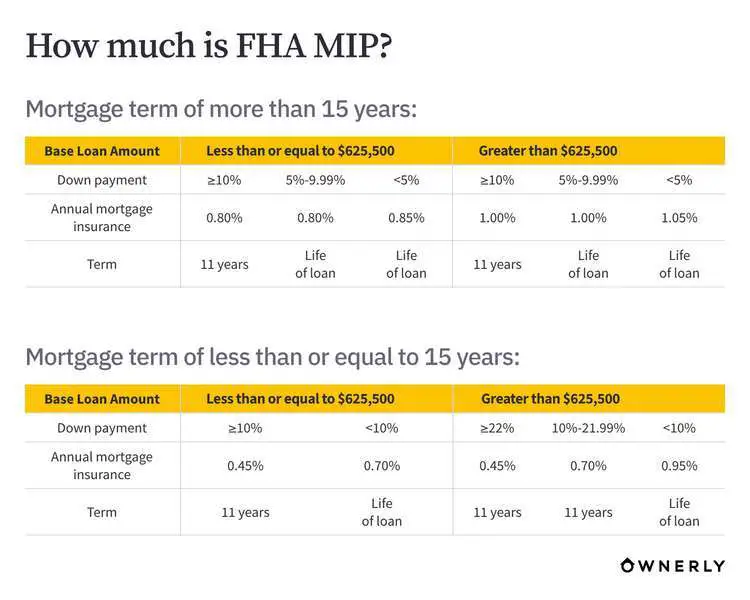

In addition to upfront mortgage insurance premiums, all FHA loans charge an annual insurance premium. Each premium charges a different percentage on the base loan amount and has specific requirements.

- Upfront mortgage insurance premiums is a one-time charge due at closing. All loan types are charged 1.75% on the base loan amount.

- Annual insurance premiums in most cases are paid over the life of the loan. The percentage youll be charged is dependent on the base loan amount, your down payment amount, and the loan term.

Fha Credit Score Requirements May Vary

The credit scores and qualifying ratios weve mentioned in this post so far are either the minimums required by Rocket Mortgage® or the FHA itself. Other lenders may have their own requirements including, but not limited to, higher FICO® Scores or a larger down payment.

In any case, we encourage you to shop around for the best loan terms and make sure youre comfortable before moving forward.

Read Also: How To Take Personal Loan From Bank

How Does Interest Work On An Fha Loan

FHA loans can be either fixed- or adjustable-rate loans.

- With fixed-rate loans, the rate doesnt go up or down based an index rate, so your mortgage payment is more stable and predictable throughout the life of the loan.

- Adjustable-rate mortgage loans, or ARMs, move along with a specific benchmark index interest rate, such as the London Interbank Offered Rate, or Libor, which is a rate used by some large banks to charge each other for short-term loans. That means the interest rate and monthly payment can adjust periodically.

Adjustable-rate loans may have lower initial rates than fixed-rate loans, but they can go up over time.

For example, an adjustable-rate loan may be structured as a 3-1 ARM. This would mean your interest rate would be fixed for the first three years and could change annually after the initial three-year period. The loan could be set up so its interest rate could increase by up to 1% each year, with a maximum increase of 5% over the life of the loan.

The length of your mortgage loan also affects the rate you pay. The Consumer Financial Protection Bureau has an online tool that lets you explore potential rates based on a number of factors, including where you live, loan type, down payment and loan term.

S To Getting Approved For An Fha Loan

Step 1: Decide if an FHA loan is the right fit for you. The first step in the FHA process is determining whether this type of loan truly suits your needs. If youre having trouble qualifying for a conventional mortgage, either because of an imperfect credit score, high debt-to-income ratio, or limited down payment savings, an FHA loan might provide a feasible path to homeownership. Review the qualifications above to get a sense of whether you meet the minimum requirements for FHA borrowers, and then take a look at your credit score and savings to see what kinds of specific FHA lending options might be available to you.

Step 2: Choose which lender you want to work with. Keep in mind that there are more conventional loan lenders than approved FHA loan lenders, so you may need to do some research before finding one. Better Mortgage offers both options and our FHA loans are available in all 50 states. As a digital lender, weve eliminated unnecessary processing, origination, and commission fees that can drive up the cost of working with traditional lenders. On top of that, our online tools make it easy to instantly compare loan products and see detailed estimates to understand how different down payment amounts and interest rates impact the overall affordability of any mortgage. Note: if you apply for an FHA loan with Better, youll need a 620 minimum credit score.

Also Check: How To Get An Fha Loan With No Money Down

Who Qualifies For An Fha Loan

To receive an FHA loan, you must meet all of the following criteria:

- If your credit score is at least 580, then you’ll need 3.5% for a down payment. You’ll need 10% if your score is between 500 and 579.

- Debt-to-income ratio. Your DTI ratio is the monthly amount you pay toward debts divided by your gross monthly income. For an FHA loan, your DTI ratio should be 43% or lower.

- Property type. You can use an FHA loan to buy a single-family home, or a multi-family home for up to four families. You can also buy a condo or manufactured home.

- Borrowing limit. The FHA restricts how much you can borrow. The limit depends on where you live and what type of property you buy. For example, the limit for a two-family home in Los Angeles will be different than for a four-family home in Orlando. Enter your state and county information to see your borrowing limits on the US Department of Housing and Urban Development website.

- Property standards. You can use an FHA loan to buy a home with normal wear and tear, but not one with major structural or safety issues. For example, your roof must be in good condition, and the home can’t be near a hazardous waste location. The property also can’t be in an area subject to a lot of noise, like a high-traffic road.

Qualifying With No Credit History

Ideally, you want at least a year of reliable payments before you apply for an FHA loan. It is important to know that a lender may not reject an application simply because the applicant chose not to use credit in the past. No matter if you have traditional or nontraditional credit, your FHA loan officer will look into it when you apply.

Read Also: How To Get Better Interest Rate On Car Loan

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

Second Home Purchase As Primary Residence

Lets take a case scenario.

- Say John Jones makes $65,000 per year

- Currently living in Illinois

- Wants to retire this year and retire to Florida and buy a home there

- He currently owns a home in Illinois that is worth $200,000 and is free and clear

- He wants a mortgage in the new Florida home

- This is because he wants to use the proceeds of the sale of the house as a nest egg towards his retirement

- Johns social security income will be $1,000 per month when he retires

How should John go about getting his new Florida home.

Also Check: What Happens To My Parent Plus Loan If I Die

What Is An Fha Loan Calculator

The NerdWallet FHA mortgage calculator is a tool that you can use to estimate both the monthly payment you’ll make and the total cost of financing your home with an FHA loan.

To get started, fill in:

-

The price you want to pay for a home.

-

Your down payment.

-

Your interest rate.

Next, choose whether you’re interested in a 15- or 30-year loan.

The FHA loan calculator will generate an estimated monthly payment based on your inputs. Then, you can dive down into as much detail as you like.

Select “Monthly” to see the costs you’ll pay toward your FHA loan each month. Choose “Total” for a breakdown of how much you’ll pay over the life of the loan, as well as the upfront costs. This includes;FHA mortgage insurance how much youll pay at closing, what the monthly premium will be and how long youll pay it.

Armed with a rough idea of what you can afford based on how much your monthly payment will be, youll be ready to shop FHA lenders to find a competitive mortgage rate.

What Are The Fha Loan Limits In 2021

Because home prices are always in flux, FHA mortgage limits — as well as FHFA conforming loan limits — are adjusted annually. In both cases, the limits increased in 2021.

This year, the baseline FHA limit on single-family properties is $356,362 — up from $331,760 in 2020. The maximum in higher-cost markets is $822,375, a jump from $765,600 the year prior.

Here’s a breakdown of these limits by property size and market cost:

| Number of Units |

|---|

| $1,581,750 |

Data source: HUD.

Special lending limits exist for borrowers in Alaska, Hawaii, Guam, and the Virgin Islands due to higher construction costs in these areas. Here’s how those limits break down:

- One-unit properties: $1,233,550

- Three-unit properties: $1,909,125

- Four-unit properties: $2,372,625

If you want to know the exact FHA loan limits for an area you’re considering buying in, your best bet is the FHA’s search tool. Just input your state, county, and limit type, and you’ll see the loan limits for that area in seconds.

Don’t Miss: How To Calculate Maximum Loan Amount Fha Streamline

The Cons Of Fha Loans

- Mortgage insurance. No, you don’t have to pay PMI. But FHA loans do come with a different type of mortgage insurance premium that comes to 1.75% of your loan at closing. Then you’ll pay an annual premium of 0.45% to 1.05% of your mortgage. If you’re on the fence between choosing a conventional mortgage or FHA loan, do the math to see whether PMI or FHA mortgage insurance will be more affordable.

- Minimum 3.5% down payment. This is still a relatively low minimum down payment. But if you’re struggling to come up with 3.5%, consider looking into a USDA or VA loan. These are two other government-backed loans, and if you qualify, you might not need a down payment at all.

- Borrowing limits. FHA loans restrict you to borrowing under a certain amount, which could keep you from buying a home you like.

- Minimum property standards. You won’t be approved for an FHA loan if your home has significant structural or safety issues, or if it’s in a loud area. These restrictions could prevent you from buying a major fixer-upper or a home in a certain area.

You may think you don’t qualify to buy a home, but an FHA mortgage makes it possible even if your finances aren’t as strong as you’d like.

What Else Will I Need To Get An Fha House Loan Approval

The required income plays an important role in the overall process of getting an approval, however, there are things you can have in mind in order to make it work like a charm. And who doesnt want that?

Herere a few things that a mortgage lender will look out for:

Debt-to-Income Ratio: Weve already talked about it above briefly. If you need to know about it in detail, weve suggested the same through a link above. See why a DTI is important in getting loan approval on behalf of a mortgage lender.

One of the things that have an effect on the approval is your Credit Score which, in accordance with HUD, must be 580 or more than that i.e., in order to get approved for an FHA loan with the highest financing . The FHA mortgage lenders may often ask for the higher credit scores.

Down Payment: Among others, the down payment required for an FHA loan is also significant. One who is lent an FHA loan is required to pay 3.5% of the appraised value or the purchase price. Therefore, this is something you must pay heed to when comprehending how much house you will need to afford for an FHA loan.

Don’t Miss: How To Apply For Federal Loan Forgiveness