Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Use A Piggyback Loan To Put 20% Down

Another strategy that could help increase your budget is to finance your home with two different home loans simultaneously. This strategy is known as an 801010 loan or piggyback loan.

An 801010 mortgage means youd get:

- A first mortgage for 80% of the homes cost

- A second mortgage for 10%

- A cash down payment of 10%

This gives you the benefit of having a bigger home buying budget . It also eliminates the need for private mortgage insurance , which is usually required on conventional loans with less than 20% down.

How Much Can I Afford With A California Va Loan

To determine how much of a VA loan youre able to take on, your mortgage lender will review your debt-to-income ratio . As you might have guessed, this is a comparison between the amount of money you earn each month, and the amount you spend on your recurring debts .

As a general rule, the Department of Veterans Affairs prefers borrowers to have a debt-to-income ratio no higher than 41%. In other words, the borrowers debts should use up no more than 41% of his or her income. But there are exceptions to this standard, particularly for borrowers with plenty of residual income.

In this context, your residual income is what you have left over each month after paying your recurring debts, such as your mortgage payment, car payment, and credit card bills.

Borrowers with residual incomes that are well above the minimum VA requirement tend to have some extra leeway when it comes to their debt ratios. So there are several overlapping factors at work, when determining how much you can afford to borrow with a California VA loan.

But were getting into the weeds here. If youd like to find out how much house you could buy in California when using a VA mortgage loan, please contact us.

Recommended Reading: How Old Can A Manufactured Home Be For Va Financing

What Salary Do You Need To Buy A $400k House

Now lets take what weve learned and put it into action with an example. Lets say you want to buy a $400,000 house. First, youll need to do the hard work of saving up $80,000 in cash as a 20% down payment.

With a 15-year mortgage at a 3% interest rate, your monthly payment could be around $2,200 . To manage that payment, youd need to be earning at least $8,800 as your monthly take-home pay .

So, to buy a $400,000 home, youd need to be earning a take-home salary of more than $105,000 per year . Keep in mind, youd actually need more than that after you add the cost of property tax and home insurance into your mortgage.

If that doesnt sound like you, dont worry. Try saving a bigger down payment to lower your monthly mortgage until its no more than 25% of your take-home pay. Or look for a smaller starter home in a more affordable neighborhood.

How Much House Can I Afford

This DTI is in the affordable range. Youll have a comfortable cushion to cover things like food, entertainment and vacations.

*DTI is the main way lenders decide how much you can spend on a mortgage.

This DTI is in the affordable range. Youll have a comfortable cushion to cover things like food, entertainment and vacations.

*DTI is the main way lenders decide how much you can spend on a mortgage.

Recommended Reading: What Is Fha And Conventional Loan

Other Factors That Affect Mortgage Affordability

Your principal and interest will make up the bulk of the monthly payment on your new home. But there are several other variables as well.

- Homeowners insurance: Lenders require you to have homeowners insurance in place before you close on the loan. Premiums vary based on your coverage levels and where you live, but expect to pay roughly $600-$1,500 a year. Thats about $50-$125 a month added to your mortgage payment

- Property taxes: The Census Bureau estimates the average homeowner pays about $2,500 a year in property taxes, though again, that amount can vary up or down based on where you live. But a $2,500 a year property tax bill translates to more than $200 added to your monthly payment

- Mortgage insurance: If you take advantage of a low or no down payment loan, you will likely owe mortgage insurance. Conventional loans with less than 20% down have a private mortgage insurance requirement, while FHA loans have an upfront and annual mortgage insurance premium . USDA loans also require upfront and ongoing mortgage insurance. VA loans do not have annual mortgage insurance, though there is an upfront funding fee. Mortgage insurance rates depend on your loan type, down payment, and credit score.

To estimate these costs for your situation, click the Advanced option on the mortgage calculator.

An Example Of What You’ll Pay With A Usda Loan

Let’s assume that you’ve used the mortgage calculator and found that you can afford a $275,000 home. Although you won’t need a down payment, you will need to take out mortgage insurance. This equates to an upfront fee of 1% of your loan amount , as well as an annual payment of 0.35% of your loan amount .

In this example, your upfront fee would be $2,750, and your annual payment would be $962.50, split into monthly payments of $80.21.

Finally, since USDA loan closing costs typically run between 3-6% of the purchase price, let’s say yours is 4.5% . Altogether, that’s an upfront cost of $15,1258 — with no down payment.

Upfront costs

You can learn more about USDA loans here.

Also Check: What Are Typical Loan Origination Fees

Home Affordability By Interest Rate

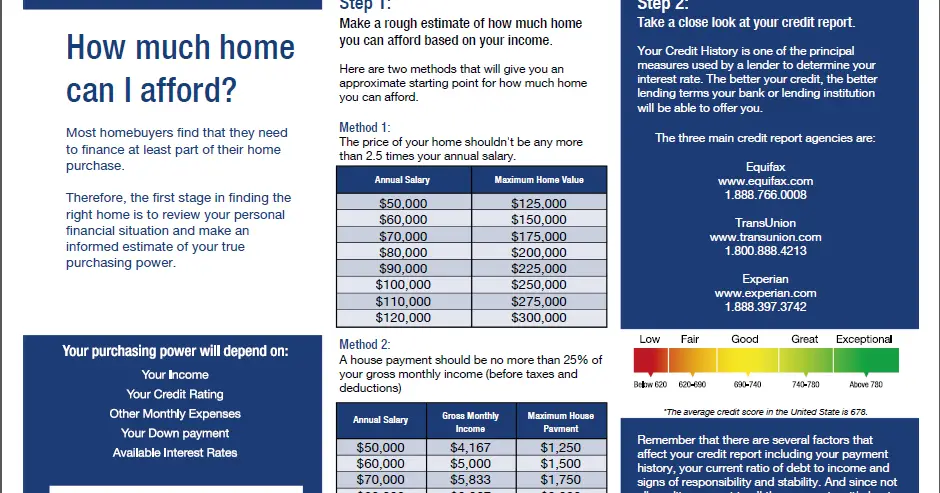

Regardless of your annual salary, your mortgage interest rate will affect how much house you can afford.

For those who with a low or moderate income, timing your home purchase for when interest rates are low is a great way to increase your home buying budget.

| Annual Income | How Much House You Can Afford |

| $50,000 | |

| 3.25% | $246,600 |

The example above assumes a 3% down payment and $200 in monthly debts outside the mortgage. Rates shown for sample purposes only. Your own interest rate and payment will vary.

Remember, your interest rate depends on your credit score and down payment, among other factors.

So getting the lowest interest rate isnt just a matter of timing the market its also important to present a strong application and shop around for the best deal.

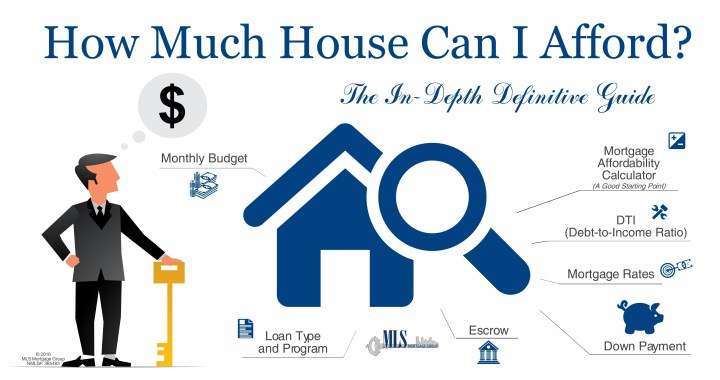

Understanding How Much Mortgage You Can Afford

Buying a houseis a huge undertaking, and its easy to get wrapped up in the excitement of it all. Its crucial to be realistic about what you can afford.

You want to hunt for homes that are in your price range so you dont fall in love with a house thats simply out of reach. Knowing your budget and sticking to it will make the entire home buying process run smoothly.

Don’t Miss: Can I Refinance My Sofi Personal Loan

How Do Lenders Calculate Home Affordability

Basic mortgage affordability factors include your monthly income, other debt obligations, and credit score. Your lender will compare the money coming in to the money going out and represent this as a figure called the debt-to-income ratio, or DTI. Lenders are looking for borrowers who have stable, reliable income- the kind of people who can make their mortgage payment on time every month.

The last thing a lender wants is to put you in a home that will make you house poor, or worse, put you on the road to foreclosure. Your lenders goal is to make sure youre at low risk for default while giving you the purchasing power you need to make a competitive offer on a home you love.

How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

Read Also: Fha Loan Assumability

How Much Of A Down Payment Do You Need For A House

A 20% down payment is standard, if you can afford it. Though some mortgage loans may only require as little as 3.5 percent down, or none at all, a larger down payment will have a greater impact on your monthly mortgage payment.Your down payment effectively reduces the total amount of your home loan, which increases your home affordability estimate, and at the same time, decreases your mortgage payment each month. For example, below is a chart showing how a certain level of down payments, based on a percentage of the sale price, directly impacts your monthly mortgage payment :

| Percentage |

|---|

List out your expenses and then add them together to get your total monthly spending.

Try A 35%down Fha Loan

FHAinsured loans allow a 3.5% down payment as long as the applicant has a FICO score of 580 or higher. Those with FICOs between 500 and 579 must put 10% down.

FHA mortgage insurance can make these loans more expensive. They require both an upfront premium and a monthly addition to your loan payment.

Still, FHA allows for much higher debttoincome ratios compared to conventional loans. Sometimes, you can use up to 50% of your beforetax income or more toward your FHA loan payment.

Plus, you could always refinance out of the FHA loan later to eliminate these mortgage insurance fees.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

How Much House Can I Afford On My Salary

Want a quick way to determine how much house you can afford on a $40,000 household income? $60,000? $100,000 or more? Use ourmortgage income calculatorto examine different scenarios.

By inputting a home price, the down payment you expect to make and an assumedmortgage rate, you can see how much monthly or annual income you would need and even how much a lender might qualify you for.

The calculator also answers the question from another angle, for example: What salary do I need to buy a $300,000 house?

Its just another way to get comfortable with the home buying power you may already have, or want to gain.

How Much Mortgage Can I Afford

You need to think about how much youre willing to pay for a mortgage and how that will impact you over time, but you also must know how much mortgage youll be able to get. Its possible that these are two different numbers.

In general, experts suggest that you should spend no more than 30% of your income on your home.

This should leave you, in most cases, with plenty of finances to cover your other needs like groceries, clothing, and medical expenses. This is a baseline suggestion, however, it can be very helpful for those who have recently left the service to get an idea of what they can realistically afford.

Of course, going with a 15-year mortgage vs. a 30-year will also have an impact. When we faced this decision process for our first VA loan, we wanted something affordable that we could also pay off in 15 years so that wed have options for what to do with that home. However, for a bigger home, it might make more sense to spread that payment out over time. Ultimately, you need to be realistic about your earning potential civilian side and how many working years you have left. Dont take on a massive 30-year mortgage if youre 60 and mostly planning to live off your military pension. That puts unnecessary financial stress on you.

Don’t Miss: Does Va Loan Work For Manufactured Homes

Know Which Mortgage Option Is Right For You

Okay, now lets talk about types of mortgages. Most of them are garbage designed to help you pay for a home even if you cant afford it.

But when you do the math, you find that these mortgages charge you tens of thousands of dollars more in interest and fees and keep you in debt for decades longer than the option we recommend.

Thats why getting the right mortgage is so important! Setting boundaries on the front end makes it easier to find a home you love thats in your budget.

Here are the guidelines we recommend:

- A fixed-rate conventional loan. With this option, your interest rate is secure for the life of the loan, keeping you protected from the rising rates of an adjustable-rate loan.

- A 15-year term. Your monthly payment will be higher with a 15-year term, but youll pay off your mortgage in half the time of a 30-year termand save tens of thousands in interest.

Your mortgage lender will most likely approve you for a bigger mortgage than you can actually afford. Do not let your lender set your home-buying budget. Ignore the banks numbers and stick with your own.

Knowing your house budget and sticking to it is the only way to make sure you get a mortgage you can pay off as fast as possible.

Why Get A Va Mortgage Loan

A VA mortgage loan does not require a down payment, but may include additional costs, such as a funding fee. A funding fee is a mandatory one-time fee paid directly to the Department of Veterans Affairs . The fee is a percentage of the loan amount and can be paid at closing or included into your loan amount and monthly payment.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Why Its Smart To Follow The 28/36% Rule

Most financial advisers agree that people should spend no more than 28 percent of their gross monthly income on housing expenses and no more than 36 percent on total debt that includes housing as well as things like student loans, car expenses and credit card payments. The 28/36 percent rule is the tried-and-true home affordability rule that establishes a baseline for what you can afford to pay every month.

Example: To calculate how much 28 percent of your income is, simply multiply your monthly income by 28. If your monthly income is $6,000, for example, your equation should look like this: 6,000 x 28 = 168,000. Now, divide that total by 100. 168,000 ÷ 100 = 1,680.

Depending on where you live and how much you earn, your annual income could be more than enough to cover a mortgage or it could fall short. Knowing what you can afford can help you take financially sound next steps. The last thing you want to do is jump into a 30-year home loan thats too expensive for your budget, even if you can find a lender willing to underwrite the mortgage.

Don’t Miss: Transferring An Auto Loan

How Much House Can I Afford With A Usda Loan

One of the main benefits of a USDA loan is that it doesn’t require a down payment, making it easier for manyto become a homeowner. However, USDA loans have strict criteria you’ll need to meet to qualify — including living in a USDA-designated area and not exceeding the income threshold for that area. You’ll also need to have a DTI under 41% and a monthly mortgage payment that doesn’t exceed 29% of your monthly income.

Minimum Down Payment Requirements

Putting at least 20% down on a home will increase your chances of getting approved for a mortgage at a decent rate, and will allow you to avoid mortgage insurance.

But you can put down less than 20%. The minimum down payment required for a house varies depending on the type of mortgage:

-

FHA loans, which are backed by the Federal Housing Administration, require as little as 3.5% down.

-

VA loans, guaranteed by the U.S. Department of Veterans Affairs, usually do not require a down payment. VA loans are for current and veteran military service members and eligible surviving spouses.

-

USDA loans, backed by the U.S. Department of Agriculture’s Rural Development Program, also have no down payment requirement. USDA loans are for rural and suburban home buyers who meet the program’s income limits and other requirements.

-

Some conventional mortgages, such as the Fannie Mae HomeReady and Freddie Mac Home Possible mortgages, require as little as 3% down. Conventional loans are not backed by the government, but follow the down payment guidelines set by the government-sponsored enterprises Fannie Mae and Freddie Mac.

Down payment requirements can also vary by lender and the borrower’s credit history. The minimum down payment for an FHA loan is just 3.5% with a credit score of 580 or higher, for example, but the minimum is 10% with a credit score of 500 to 579.

Recommended Reading: Does Va Loan Work For Manufactured Homes