Your Credit Score And Loan Eligibility

The final metric used in determining your eligibility for a HELOAN or HELOC is your credit score. In short, your credit score is a three-digit number that gives lenders an idea of your risk level as a borrower. Factors affecting your credit score include:

- Payment history

- Negative history

So keep in mind that while the calculator will show you the size of the line of credit or loan you may be eligible for, that decision wont be final until the lender analyzes your credit.

Qualifying For A Home Equity Line Of Credit

Having equity alone doesn’t guarantee you’ll be able to qualify for a home equity line of credit. You’ll also need to have decent credit most lenders want to see FICO scores of at least 660 or more, and many have even stricter requirements. But 720 or more should put you in good shape.

You also can’t be carrying too much debt your total monthly debts, including your mortgage payments and all other loans, should not exceed 45 percent of your gross monthly income.

Lenders consider all these factors together when you apply for a HELOC. For example, they may allow a lower credit score or more debt if you have a lot of home equity available. Similarly, if you have a lower credit score they might only allow you to use 75 percent of your total home equity rather than the 90 percent they might allow someone with strong credit.

Are Home Equity Loan Rates Higher Than Mortgage Rates

Interest rates on home equity loans are usually higher than interest rates on primary mortgages because they carry more risk for the lender.

If you end up in foreclosure, the home will be sold and the primary mortgage will be paid off first from the proceeds of the sale. The home equity lender will be paid only if there’s money left over after the primary mortgage has been paid in full. There’s a risk that the home equity lender won’t be repaid in full, and a higher interest rate compensates for that risk.

Read Also: Can Other Than Honorable Discharge Get Va Loan

The Heloc Stress Test

Although you could potentially qualify for a credit limit of up to 65% of your home’s value, your real limit may be subject to a stress test similar to themortgage stress test. Banks and other federally regulated lenders will use the higher of either:

- theBank of Canada five-year benchmark rate, currently set to 5.25%, and

- your negotiated interest rate plus 2%.

How You Can Use Your Home Equity

You dont have to sell to tap the profit inside your home. Instead, you can borrow against that value with a home equity loan or line of credit. A home equity loan will provide you a lump sum all at once a HELOC, or home equity line of credit, allows you to draw on the available balance as you wish, similar to a credit card.

If you know how much you need to draw and you plan on using it at once, then a home equity loan may be the right choice for you. On the other hand, if youre looking for a more flexible arrangement where you can draw cash as you need it, a HELOC could be a better fit.

Using these kinds of loans for expenses that will add to the value of your home, such as completing a remodel or making upgrades, can also increase your equity.

Recommended Reading: What Commission Do Loan Officers Make

Things To Consider With Home Equity Lines Of Credit

There are both advantages and disadvantages to a home equity line of credit. The following are things to look for when considering such an action:

- There is no application fee or upon closing the fee should be refunded. If the lender charges an application fee, it should be ensured that it is a fee that can be refunded at closing.

- No closing or home loan appraisal costs.

- No check-writing or HELOC account management fees.

- Should not be any âusageâ fees, though some banks do charge account maintenance fees for unused accounts.

- The variable APR is equal or close to the prime rate, which is adjusted quarterly. Interest that is charged on the balanced that is borrowed should be the only cost that is associated with a home equity line of credit.

- There should be a periodic cap on the interest rate changes, which is the amount that the rate can be changed at a time. It is good to find a home equity line of credit that adjusts quarterly rather than monthly. The increments should be 0.5% or less.

- Rate increases should have a lifetime cap.

- The borrower should be able to convert a fixed rate loan if the interest rate rises.

- The borrower should be allowed to make Interest-only payments in the event conversion is needed.

- The borrower should be able to repay the principal should be unrestricted so that the loan can be repaid without having to put out more money.

Common Home Equity Loan Uses

Homeowners tap home equity for a wide variety of reasons. Some of the most common uses are:

- debt consolidation: consolidating high-interest credit card balances & other debts

- home improvement: repairs & additions

- vehicle purchase: less common when auto manufacturers offer low loan rates, but when auto rates are higher than equity rates it can make sense

- education: paying for a child’s college tuition

Other less common uses include funding other investments, business expenses, medical bills & emergencies, and vacations.

| Type of Use |

|---|

| 9% |

You May Like: Bayview Loan Servicing Reviews

Home Equity Lines Of Credit

A Home Equity Line of Credit is a revolving line of credit. During the initial draw period of the loan, which is normally around 10 years, the borrower is given a maximum line amount, much like the credit limit on a credit card. And much like a credit card, the borrower can access as much or as little of that amount as needed. If the borrower pays it back, they can borrow again later. Another important benefit is that HELOC monthly payments are flexible you can make interest-only payments if you wish.

Once the draw period ends, your HELOC enters the repayment period for any remaining outstanding balance. This usually lasts 10 or 20 years. HELOCs typically feature variable interest rates. However, some lenders offer the borrower opportunities to fix the interest rate.

So why use a HELOC instead of a credit card? Since its secured by your home, HELOCs typically have a much lower interest rate than credit cards or other unsecured loans. This, combined with the ability to withdraw and repay funds as needed and the flexible payment structure, makes a HELOC the best of both worlds between a credit card and a HELOAN for many use cases.

A HELOC can be the best option for customers that are:

- Undergoing a series of home improvement projects over time

- Starting a business and need flexible access to capital as-needed

- Paying tuition or other higher education costs

- Covering medical costs for a long-term illness

- Funding a sabbatical or time off to care for family

Sample Home Equity Payment Calculator

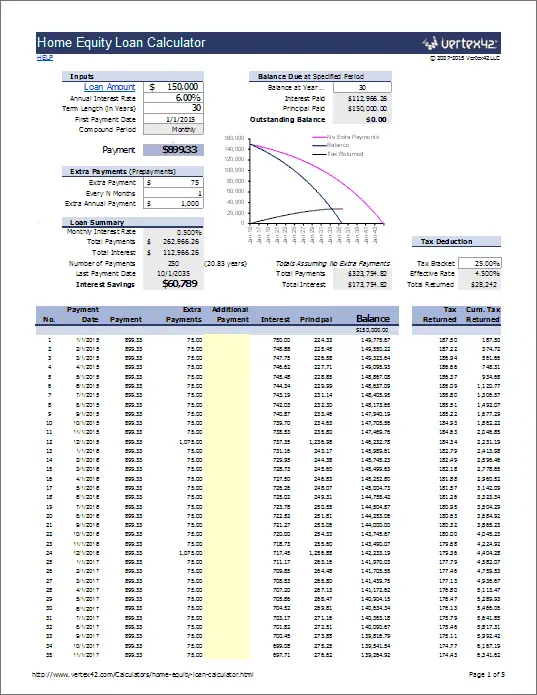

For a property valued at $500,000, with a first mortgage of $300,000, first multiple $500,000 x 0.90% = $450,000. Then calculate the difference between the total equity available and the total mortgage registered. In this case, you will calculate $450,000 $300,000 = $150,000.

For a home equity loan of $150,000, with an interest rate of 7.99%, a 1 year term, no amortization, calculate $150,000 x 0.70% = $11,985. Then divided $11,985 by the number of months in the one year term . $11,985 / 12 = $998.75 per month.

Recommended Reading: Usaa Auto Loan Refinance Rates

Heloc & Home Equity Loan Qualification

The three primary things banks look at when assessing qualification for a home equity loan are:

- Available equity in the home: as mentioned above, banks typically allow a max LTV of 70% to 85%

- People with an excellent credit score of above 760 will get the best rates. Those with good credit of 700 to 759 will still be able to access credit, though typically not at the best rate. People with a fair credit score of 621 to 699 will typically be able to obtain credit, though at higher rates. People with poor credit scores may not be able to obtain credit.

- Debt to income ratio: lenders generally like borrowers to spend less than 36% of their pre-tax income on monthly mortgage & debt payments, though some banks may allow borrowers to obtain funding with DTI ratios as high as 43%

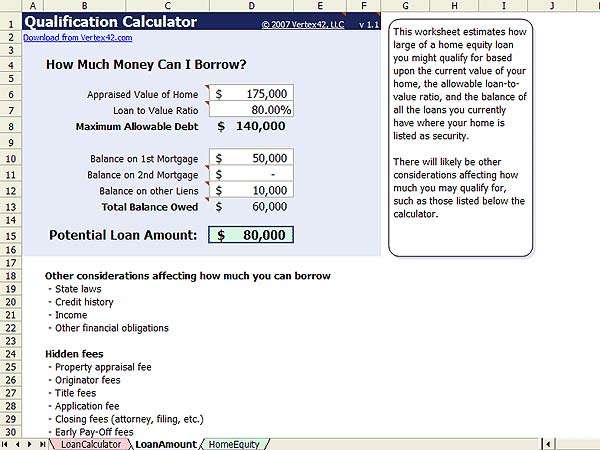

Calculate Your Estimated Borrowing Capacity Using Home Equity

Depending upon the market value of your home, outstanding mortgage balance, credit history and other factors, you may qualify for a home equity loan. Monthly payments on a Home Equity Loan are variable as they fluctuate with interest rate changes. Use this calculator to estimate your borrowing capacity on a Home Equity Loan.

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

Don’t Miss: How Much Do Loan Officers Make In Commission

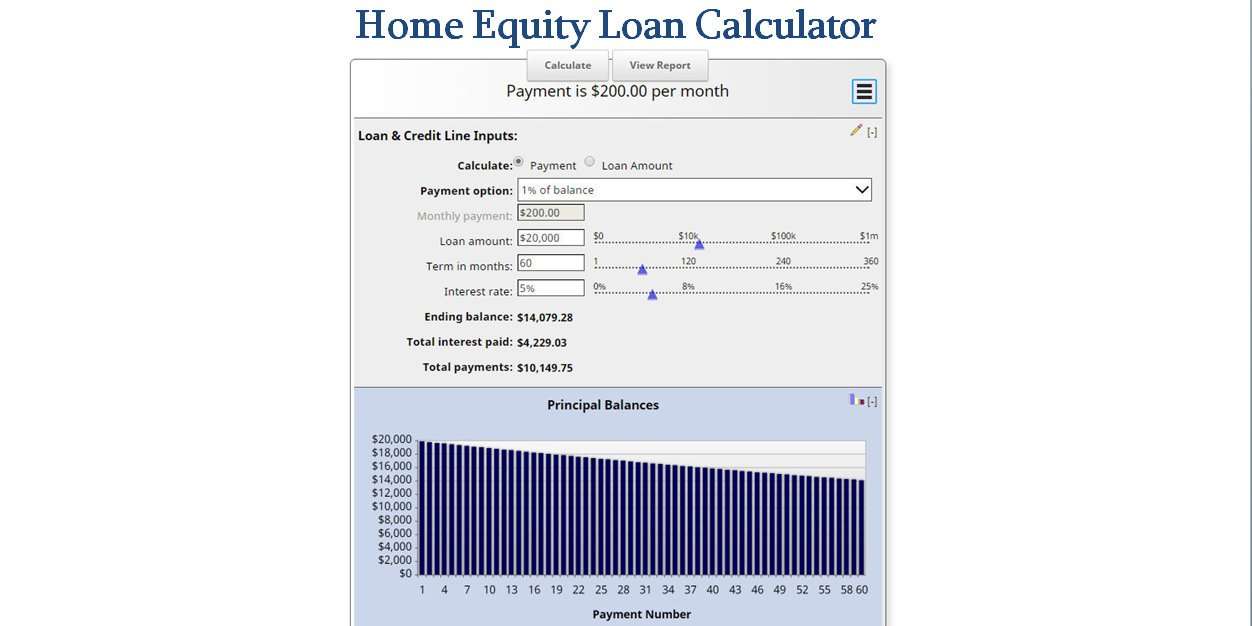

How Are Payments Calculated On A Heloc

A HELOC is a revolving line of credit that is always open for use and you are not forced to borrow from it. It’s there as needed. So if you have not borrowed from your HELOC then you have no monthly payments. But if you do have a balance, then the only monthly payment you have to pay is the interest. Use our payment calculator above or use the below formula:

One of the main advantages of the HELOC is the ability to pay down the pricinpal whenever one would like. No pricinpal monthly payment required.

How Do I Calculate A Home Equity Loan Payoff +

Using our calculator to do your home equity loan payment calculations is pretty easy. The home equity loan has a fixed interest rate, so all you need to know is your loan amount, the fixed interest rate, and the loan term. Input these values into the loan calculator and it will provide your monthly home equity loan payments.

Read Also: Current Usaa Car Loan Rates

How Can We Help

Routing Number: 074900657

First Merchants Private Wealth Advisors products are not FDIC insured, are not deposits of First Merchants Bank, are not guaranteed by any federal government agency, and may lose value. Investments are not guaranteed by First Merchants Bank and are not insured by any government agency.

FIRST MERCHANTS and the Shield Logo are federally registered trademarks of First Merchants Corporation

How Home Equity Loan Payments Are Calculated

The calculator on this page tells you how much you may be able to borrow, but it’s not a home equity loan payment calculator that figures monthly payments on a loan.

A home equity loan has equal payments every month. The monthly payments depend on three factors:

-

Loan amount.

-

Loan term. The term is the number of years it will take to pay off the loan. For a given amount and interest rate, a longer term will have lower monthly payments, but will charge more total interest over the life of the loan.

-

Interest rate. Usually, a longer loan term has a higher interest rate.

Also Check: Va Home Loan Statement Of Service

Considering A Home Equity Loan But Unsure How Much Equity You Currently Have

A home equity loan is easy, if youve got the equity to back it up. Coincidentally, the question isnt will you be approved, but rather, how much are you eligible to borrow?

Before you apply for a loan youll want to be sure you have equity in your property. Weve created an easy online home equity calculator tool to give you an idea of what you may be eligible to borrow.

Should I Use Heloc Or A Credit Card +

Like credit cards, home equity lines of credit are a revolving line of credit. The idea is to take a loan based on the value of your home but to take only small portions of that loan as the need arises, instead of taking one lump sum. HELOC interest rates are never fixed, but they are generally lower than what you tend to get with credit card loans.

Recommended Reading: Usaa Credit Score Range

To Determine Your Payments During The Draw Phase:

Choose “100 percent of interest owed” as your payment option and then proceed as above. The calculator will give you your interest-only payments for the loan.

To see how borrowing more money or a varying interest rate would affect your payments, use the sliding green triangles to adjust those values.

Understand Your Home Equity Loan Payments

Our home equity loan calculator doesnt calculate monthly payments youll see the monthly payment information on the loan estimates you collect while youre comparing offers.

There are three factors that will affect your monthly home equity loan payments:

Read Also: One Main Financial Approval Odds

Other Considerations When Applying For A Heloc

Applying for a HELOC could potentially affect your credit score . It acts as a revolving line of credit, similar to a credit card, and a high utilization rate can negatively impact your credit score.If used correctly, however, it can decrease your total credit utilization rate and act as a positive indicator of good borrowing behaviour.

Home Equity Loan Requirements

Qualification requirements for home equity loans will vary by lender, but here’s an idea of what you’ll likely need in order to get approved:

-

Home equity of at least 15% to 20%.

-

A credit score of 620 or higher.

-

Debt-to-income ratio of 43% or lower.

In order to confirm your home’s fair market value, your lender may also require an appraisal to determine how much you’re eligible to borrow.

Also Check: Bayview Loan Servicing Tucson

Home Equity Loan & Heloc Payment Calculator

Home equity loans and HELOCs are two versions of the same type of loan but with some major differences. Both are secured by the equity in your home, but the way you borrow money and calculate your loan payments are completely different. This Home Equity Loan and HELOC payment calculator is versatile enough to calculate payments for both types of loans. It can also calculate your total payments over the life of the loan, the total amount of interest you’ll pay, your loan balance at any point in time and provides an amortization schedule for paying off the loan.

Find Out How Much Untapped Cash You Have In Your Home

It is generally assumed that most people know what their home equity is. However, many people are still confused about the topic. As a homeowner, you need to understand how home equity works. That is especially true if you are looking to refinance a mortgage or borrow money against your residence.

You May Like: Usaa Car Loan Credit Score

Are There Any Home Equity Loan Tax Benefits

You may qualify for a tax deduction on your home equity loan, depending on how the money is used. If you took out the loan to buy, build or substantially improve your home, then you can likely deduct the interest paid on your monthly home equity loan payments under the mortgage interest deduction. However, the interest wont be tax-deductible for other purposes, such as debt consolidation or buying a second home.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Do Loan Officers Make Commission

What Does Having Equity In Your Home Mean

Equity is the value of how much of your house you own. For example, if your mortgage balance is £150,000 and your house is worth £200,000, you have £50,000 equity in the property.

If you sold your house for £200,000, you would use £150,000 of this to pay off your mortgage, and you could keep the remaining £50,000 or use it towards buying a new property.

Your equity is made up of the deposit you paid towards the house purchase and any of your mortgage you have paid off. It should keep going up until your mortgage is paid off you then have 100% equity in your home.