What Home Can I Buy With My Income

A quick recap of the guidelines that we outlined to help you figure out how much house you can afford:

- The first is the 36% debt-to-income rule: Your total debt payments, including your housing payment, should never be more than 36% of your income.

- The second is your down payment and cash reserves: You should aim for a 20% down payment and always try to keep at least three monthsâ worth of payments in the bank in case of an emergency.

Let’s take a look at a few hypothetical homebuyers and houses to see who can afford what.

How Much Mortgage Payment Can I Afford

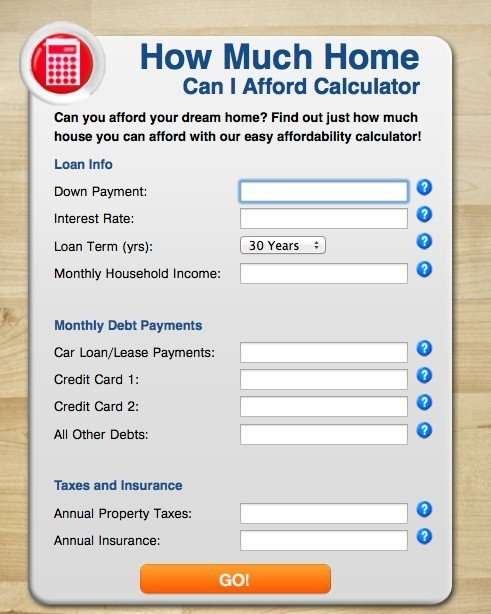

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a down payment. As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

While your household income and regular monthly debts may be relatively stable, unexpected expenses and unplanned spending can impact your savings.

A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of some unexpected event.

How Will My Debt

When you apply for a mortgage, lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as a percentage.

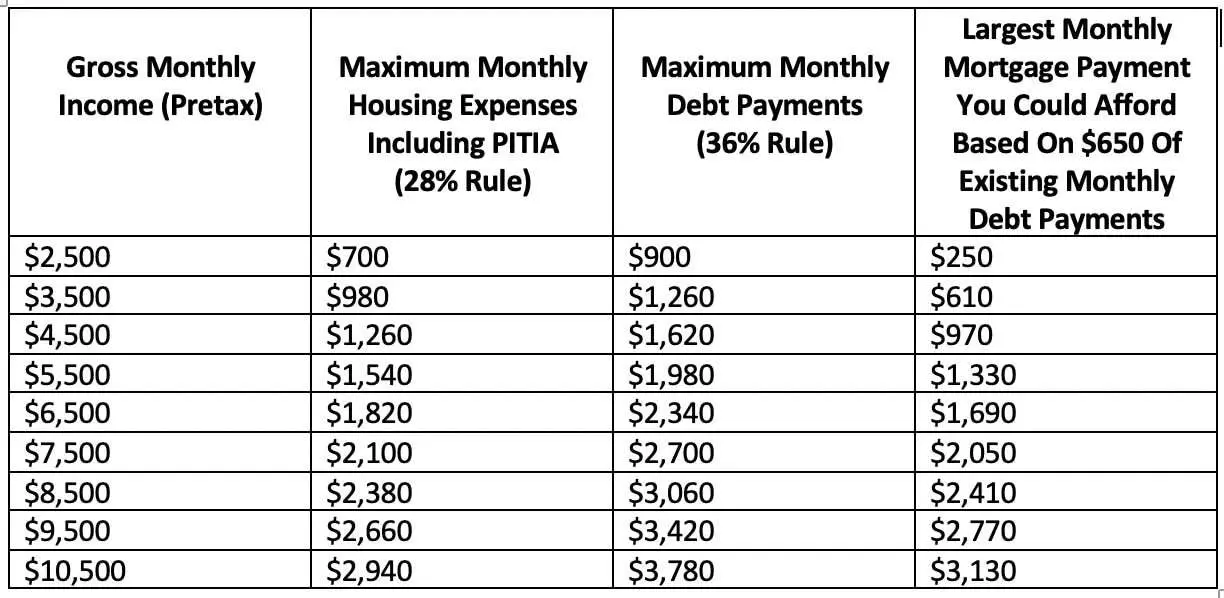

Lenders often use the 28/36 rule as a sign of a healthy DTImeaning you wont spend more than 28% of your gross monthly income on mortgage payments and no more than 36% on total debt payments .

If your DTI ratio is higher than the 28/36 rule, some lenders will still be willing to approve you for financing. But theyll charge you higher interest rates and add extra fees like mortgage insurance to protect themselves in case you get in over your head and cant make mortgage payments.

You May Like: Auto Loan Formulas

Why You Should Wait To Buy A Home

Along the same lines of thinking, you might consider holding off on buying the house.

The bigger the down payment you can bring to the table, the smaller the loan you will have to pay interest on. In the long run, the largest portion of the price you pay for a house is typically the interest on the loan.

In the case of a 30-year mortgage the loanâs interest can add up to three or four times the listed price of the house . For the first 10 years of a 30-year mortgage, you could be paying almost solely on the interest and hardly making a dent in the principal on your loan.

Thatâs why it can make a significant difference if you make even small extra payments toward the principal, or start with a bigger down payment .

If you can afford a 15-year mortgage rather than a 30-year mortgage, your monthly payments will be higher, but your overall cost will be drastically lower because you wonât be paying nearly so much interest.

How Does Your Debt

An important metric that your bank uses to calculate the amount of money you can borrow is the DTI ratio comparing your total monthly debts to your monthly pre-tax income.

Depending on your , you may be qualified at a higher ratio, but generally, housing expenses shouldnt exceed 28% of your monthly income.

For example, if your monthly mortgage payment, with taxes and insurance, is $1,260 a month and you have a monthly income of $4,500 before taxes, your DTI is 28%.

You can also reverse the process to find what your housing budget should be by multiplying your income by 0.28. In the above example, that would allow a mortgage payment of $1,260 to achieve a 28% DTI.

Also Check: How To Calculate Amortization Schedule For Car Loan

Minimum Down Payment Requirements

Putting at least 20% down on a home will increase your chances of getting approved for a mortgage at a decent rate, and will allow you to avoid mortgage insurance.

But you can put down less than 20%. The minimum down payment required for a house varies depending on the type of mortgage:

-

FHA loans, which are backed by the Federal Housing Administration, require as little as 3.5% down.

-

VA loans, guaranteed by the U.S. Department of Veterans Affairs, usually do not require a down payment. VA loans are for current and veteran military service members and eligible surviving spouses.

-

USDA loans, backed by the U.S. Department of Agriculture’s Rural Development Program, also have no down payment requirement. USDA loans are for rural and suburban home buyers who meet the program’s income limits and other requirements.

-

Some conventional mortgages, such as the Fannie Mae HomeReady and Freddie Mac Home Possible mortgages, require as little as 3% down. Conventional loans are not backed by the government, but follow the down payment guidelines set by the government-sponsored enterprises Fannie Mae and Freddie Mac.

Down payment requirements can also vary by lender and the borrower’s credit history. The minimum down payment for an FHA loan is just 3.5% with a credit score of 580 or higher, for example, but the minimum is 10% with a credit score of 500 to 579.

Assessing Your Mortgage Eligibility

After the 2008 UK financial crisis, lenders began employing strict measures before approving mortgages. By 2014, the Financial Conduct Authority required lenders to perform thorough affordability assessments before granting loans. The evaluation considers your personal and living expenses, as well as the level of monthly payments you can afford. It includes a stress test which simulates how consistently you can pay your mortgage under drastic financial changes. To determine the loan amount, lenders specifically consider your credit score and history, debt-to-income ratio , size of the deposit, and the price of the property you are buying.

Expect lenders to scrutinise your employment records, how long youve held your current job, and your present address. They also check the length and history of your bank accounts, together with other debt obligations you must fulfil. To do this, they review your also known as your credit report, which is used to determine your credit score. This gives insight into your ability to make mortgage payments. Ultimately, your records must prove youre a reliable debtor who always pays on time.

Mortgage Affordability Assessment Factors

To prepare for your mortgage application, be sure to gather the following documents:

If you are self-employed, expect lenders to ask for additional documentation. They require proof of income, such as a statement from your accountant covering 2 to 3 years of your accounts.

| Income |

|---|

| £211,600 | £306,600 |

Recommended Reading: Can I Roll Closing Costs Into My Va Loan

Td Bank Mortgage Affordability

Before you get a mortgage from TD Bank, it is important to know how TD calculates your mortgage affordability. TD takes into account the following factors:

- The location of your future home

- Whether your future home is a detached home or condo

- Your household income

- Your down payment

- Your monthly bills and expenses including groceries, transportation, shopping, and insurance.

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

Your location and property type are used to provide estimates for your potential property taxes, utilities, and condo fees.

TD calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 39% and a maximum total debt service ratio of 44%. This means that your mortgage payment, property tax, heating costs, and half of your condo fees cannot take up more than 39% of your gross income. In addition, this amount plus your total debt payments cannot take up more than 44% of your gross income.

Another factor in determining your mortgage affordability is your down payment. According to TD, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

To Calculate Your Total Debt Service Ratio:

Now, on top of your housing costs listed above, lets assume your non-housing related debts come in at $800 per month . Your TDS ratio would fall within the limit, at 41%.

When it came to buying my own place, I was well within these numbers, but how much I could end up spending on a new mortgage still made me squeamish. Already in my 40s, shouldnt I be paying off my mortgage instead of adding to it?

Thats not reality, says Calla. As difficult as it might be, she says its important to not compare yourself to others. Make the decisions that best suit your lifestyle and goals.

The math behind your down paymentIn my case, I was selling my condo to finance the purchase of my new home, so I calculated how much I would have for a down payment based on an estimate of my current homes value.

First, I tallied the costs associated with moving, including real estate agent commissions, legal fees, moving-day expenses, a home inspection and land transfer taxes . To calculate closing costs, the rule of thumb is to budget for 4% of your homes purchase price. A $500,000 home, for instance, would require $20,000.

| Scenario 1 |

|---|

| $200,000 |

Recommended Reading: Can I Refinance An Fha Loan

Cleaning Up Your Creidt Profile

- Be sure you check your credit report 6 months in advance of purchase consideration so you can clear up any outstanding issues like missed payments or identity theft.

- If you have significant credit card debt lenders will presume you need to spend 3% to 5% of the balance to service the debt each month.

- If you have multiple credit cards with outstanding balances it is best to try to pay down your small debts and the cards with a lower balance in order to make your overall credit profile cleaner.

- If you decide to cancel unused credit cards or cards that are paid off be sure to keep at least one old card so you show a long opened account which is currently in good standing.

- Do not apply for new credit cards or other forms of credit ahead of getting a mortgage as changes to your credit utilization, limits and profile may cause your lender concern.

How Much House Can I Afford With A Va Loan

With a military connection, you may qualify for a VA loan. Thats a big deal, because mortgages backed by the Department of Veterans Affairs typically dont require a down payment. The NerdWallet Home Affordability Calculator takes that major advantage into account when computing your personalized affordability factors.

Remember to select ‘Yes’ under ‘Loan details’ in the ‘Are you a veteran?’ box.

For more on the types of mortgage loans, see How to Choose the Best Mortgage.

Don’t Miss: Loan Originator License California

Take The First Step With Our Home Affordability Calculator

Keep in mind that our house affordability calculator only provides an estimate of what you could afford. You can call us today to speak with one of our Loan Consultants to get prequalified and to find out how much you can spend on a home.

You should also bear in mind that your mortgage payment includes not just principal and interest, but also taxes and insurance in most situations. Think of the acronym PITI, which stands for principal, interest, taxes and insurance.

For property tax information, consult the property profile offered by New American Funding. The cost of insurance includes your homeowners insurance premium, and, when applicable, any mortgage insurance premium and homeowners association fees.

You can call us today to speak with one of our Loan Consultants to get pre-approved and to find out how much you can spend on a home.

What Is An Fha Loan Calculator

The NerdWallet FHA mortgage calculator is a tool that you can use to estimate both the monthly payment you’ll make and the total cost of financing your home with an FHA loan.

To get started, fill in:

-

The price you want to pay for a home.

-

Your down payment.

-

Your interest rate.

Next, choose whether you’re interested in a 15- or 30-year loan.

The FHA loan calculator will generate an estimated monthly payment based on your inputs. Then, you can dive down into as much detail as you like.

Select “Monthly” to see the costs you’ll pay toward your FHA loan each month. Choose “Total” for a breakdown of how much you’ll pay over the life of the loan, as well as the upfront costs. This includes FHA mortgage insurance how much youll pay at closing, what the monthly premium will be and how long youll pay it.

Armed with a rough idea of what you can afford based on how much your monthly payment will be, youll be ready to shop FHA lenders to find a competitive mortgage rate.

You May Like: Does Va Loan Work For Manufactured Homes

Home Affordability And The Covid

The coronavirus pandemic and the resulting economic downturn have shaken up the real estate market. As of June 2021, mortgage rates remain at historic lows, but there is no way to know whether they will fall even lower or start to move back up.

The fact remains that interest rates are lower right now than they have ever been. If you are in a good financial position to purchase a home at the moment meaning you have enough cash for a down payment, a good or great credit score, stable employment, and a low debt-to-income ratio it may make sense for you to take that step now rather than later.

- Categories

Why You Should Consider Buying Below Your Budget

There is something to be said for the idea of not maxing out your credit possibilities. If you look at houses that are priced somewhere below your maximum, you leave yourself some options. For one, you will have room to bid if you end up competing with another buyer for the house. As an alternative, youâll have money for renovations and upgrades. A little work can transform a home into your dream house â without breaking the bank.

Perhaps more importantly, however, you avoid putting yourself at the limits of your financial resources if you choose a house with a price lower than your maximum.

You will have an easier time making your payments, or you will be able to pay extra on the principal and save yourself money by paying off your mortgage early.

You May Like: Usaa Credit Score Range

Have A Question About Our Mortgage Calculators

What is a mortgage calculator?

Its a tool that gives you an estimate of how much you could borrow from us or what your monthly repayments and other costs might be, for a mortgage in the UK.

We have different calculators that can help you in different ways each calculator does something slightly different.

Who is a mortgage calculator for?

Its for you if youre a first time buyer, youre looking to remortgage, move or buy an additional home, or youre a buy-to-let landlord.

What information do I need to use a calculator and how do you decide what I can afford?

When you apply for a mortgage or use our calculator, well ask you for information like

- How many people are applying

- Your income

- How much you regularly spend on things like your credit or store cards, loans, overdrafts, maintenance and pension

- Why youre applying for example, buying your first home, moving home, or buying a second home

We wont ask about groceries, utility bills or travel.

How much can I afford to borrow?

Our calculators give you a idea of what you might be able to borrow from us to buy a home, and what your monthly and total mortgage payments could be, for different types of mortgages.

Which mortgage calculator is right for me?

The most popular place to start is our borrowing calculator or our affordability calculator.

View Affordability From Two Perspectives:

- Your overall monthly payments which included household expenses, mortgage payment, home insurance, property taxes, auto loans and any other financial considerations

- How lenders determine what you can afford. Just like lenders, our Affordability Calculator looks at your Debt-to-Income Ratio to determine what home price you can afford.

Also Check: Is Bayview Loan Servicing Legitimate

Avoid The Pitfalls When Determining How Much House You Can Afford

When determining how much house they can afford, people tend to use two basic strategies. Most base their assessment on how large of a loan lenders are willing to give them. But others use their current rent to determine how much they can afford to spend on monthly mortgage payments. The problem with these two approaches is that they tend to lead people to overestimate their budgets.

To know how much house you can afford, you not only need to think about how much you have saved but how much youll be spending. Even though youll no longer be spending money on rent, youll have a slew of new payments that you need to consider, such as closing costs, property taxes, homeowners insurance and fees. And if the home you purchase needs work, youll also have to factor in the cost of home improvements.