Will Speaking Out Really Make A Difference

Student loan interest affects hundreds of thousands of people across the country not just students, but those who are not in school anymore and are struggling to repay their loans.

Speaking out will help make politicians aware of what is important to people all across Canada. This comes at a time when the youth voter demographic is getting stronger and more important in terms of federal election influence. With the looming federal election, now is the time to speak up and make leaders across Canada hear our priorities.

And it works! Its only thanks to the work of thousands of people like you that the BC government was convinced to eliminate interest charged on the BC portion of student loans.

When Does Interest Start On Student Loans

For students that demonstrate need, the government offers subsidized direct loans. If you qualify, the government pays your interest while youre in school, so your balance doesnt grow. Once you graduate, though, the interest becomes your responsibility.

Unsubsidized loans, meanwhile, charge interest from the day the loan is disbursed. Since you arent required to make payments, interest will build up, and youll graduate with a loan balance higher than you started with.

Do parent PLUS loans accrue interest the same way? Unfortunately, there are no subsidized loans for parents. Additionally, regular repayment begins after the loan is completely disbursed .

For Some Graduates Student Loans Are Interest

Yes, you did read that title correctly. Some with a mathematical bent will have probably worked out why from the seven need-to-knows if not let me explain.

Effectively, you only pay any interest if you earn enough to have cleared the amount you originally borrowed within the 30 years. If not, you’re just repaying the amount borrowed, not the interest.

Let’s work up the income scale here try not to just jump to your expected income level, as the early examples are useful to understand the concept

-

Extremely low-income graduate earnersSalary under £27,295 for their working life.

Someone who went to university and then never earned over the repayment threshold within the 30 years wouldn’t repay a penny of what they borrowed, never mind interest.

- Middle income graduate earnersStarting salaries £20,000 – £30,000, above-inflation pay rises after. As the interest rate added depends on earnings, it probably won’t be at the maximum rate for the first decade or so of your career, as for that you need to earn above £49,000. Yet more importantly, at this level of earnings you likely won’t repay all of the original borrowing plus the interest added within the 30 years before the debt wipes. This means while you may pay some interest, most won’t come close to paying all the interest added to their account, let alone all of it at the maximum interest rate.

This little graph shows you how it works.

Recommended Reading: Capitalone Autoloans.com

How Much Interest Will You Actually Repay

To find if overpaying is worth it, it’s worth trying to get an idea of how much of the interest you’re actually likely to be repaying. Using the MSE student loan calculator can give you an idea, but remember it has to make many assumptions so is a rough indicator only. Here’s how to interpret the results…

a) Is the ‘what you repay amount’ less than your initial borrowing? If so, you won’t be repaying any interest at all, as you won’t repay even what you initially borrowed.

b) Is the ‘amount converted into today’s money’ less than your initial borrowing? That means you’re paying less interest than inflation, which means in economic terms, holding onto the loan means it’s shrinking.

Going back to my shopping baskets analogy… if you borrow £10,000 which buys 100 shopping baskets’ worth of money, and inflation increases the price of those shopping baskets to £15,000, but you only need repay £14,000 in real terms, the loan has shrunk.

In both cases, the gain from repaying is likely to be very limited. If you are repaying more than this, so the ‘total in today’s money’ is higher than your original borrowing, then that difference is the real cost of interest to you of the loan.

Choose An Interest Rate Option Temporary Covid

You have 2 interest rate options to choose from for your Canada Student Loan:

- a floating interest rate equal to the prime rate, or

- a fixed interest rate of the prime rate + 2%

The prime rate comes from the rates of the 5 largest Canadian banks. The highest and the lowest prime rates are removed, then an average of the remaining 3 is used.

Interest rates can change as the prime rate varies. Please log in to your NSLSC account for more information about the current interest rates.

Your student loan has a floating interest rate by default. You can change to a fixed interest rate at any time after you enter repayment. If you switch to a fixed rate, you can not change back to a floating rate. To choose a fixed interest rate anytime during your repayment period, contact us.

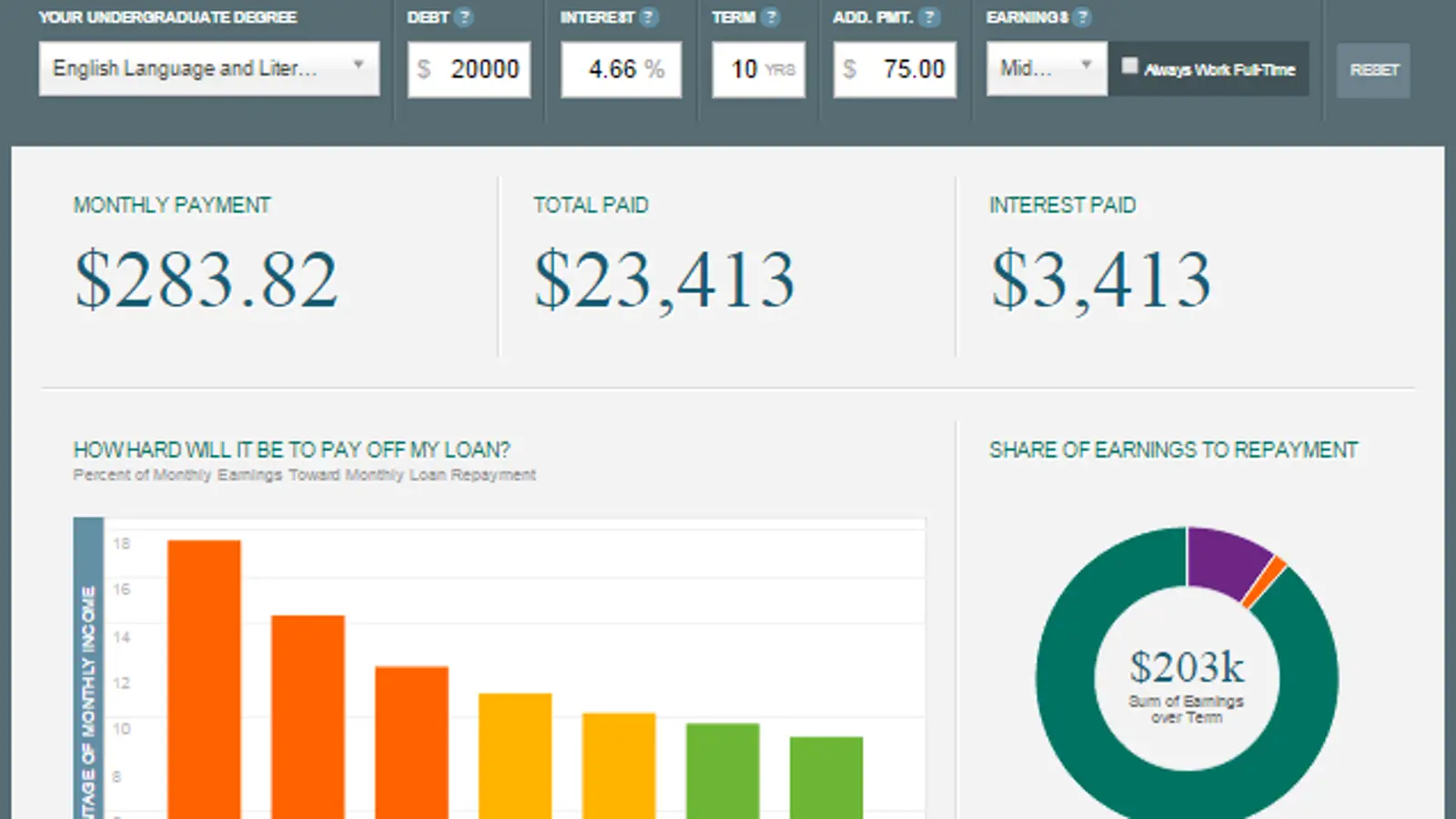

Use the repayment estimator to see how interest rates affect your monthly payment.

If you have a provincial part to your loan, it may be under a different interest rate. Contact your province for your current rates.

You May Like: Usaa Car Refinance Rates

When Do I Have To Start Paying Off My Student Loan

With most lenders, you can usually begin making payments as soon as you want to. You can even pay your loan off completely without penalty. But the good news is, you typically dont need to make monthly payments while in school. You usually have until 6 months after you graduate though there are a couple of lenders that dont give you this grace period.

If youre going to grad school, youre usually able to defer your undergraduate loans, as well. Just keep in mind that interest will still accrue, so making payments even if interest-only is still a good idea if you can.

Most private lenders offer flexible repayment options, too, that include interest-only repayment options, deferral options, and more. Just make sure you ask your lender about the different loan repayment plans before you take out the loan.

How Much Can I Borrow

The maximum amount you can borrow each academic year depends on your grade level and dependency status. See the chart below for annual and aggregate borrowing limits. You may not be eligible to borrow the full annual loan amount because of your expected family contribution or the amount of other financial aid you are receiving. To see examples of how your Subsidized or Unsubsidized award amount will be determined. Direct loan eligibility and loan request amount must be greater than $200 for a loan to be processed.

If you are a first-time borrower on or after July 1, 2013, there is a limit on the maximum period of time that you can receive Direct Subsidized Loans. This time limit does not apply to Direct Unsubsidized Loans or Direct PLUS Loans. If this limit applies to you, you may not receive Direct Subsidized Loans for more than 150 percent of the published length of your program. See your financial aid adviser or for more information.

Recommended Reading: Usaa Classic Car Loan

What Does Student Loan Interest Mean To Me

Putting off payments or just making the minimum each month will leave you with a big interest cost over the life of your loan.

Use your new knowledge of how to calculate student loan interest on a loan and how compound interest works to pay off your loans early.

You work hard for each paycheck. Pay more today so you can save even more later.

Andrew Pentis, Eric Rosenberg and Christy Rakoczy contributed to this report.

Increase Monthly Payments To Repay Your Loan Faster

Recommended Reading: Bayview Loan Modification

How And When Do I Repay

- Full-time courses youll be due to start repaying the April after you finish or leave your course, but only if you’re earning over the repayment threshold. For example, if you graduate in June 2021, youll be due to start repaying in April 2022, if you’re earning enough.

- Part-time courses youll be due to start repaying the April four years after the start of your course, or the April after you finish or leave your course, whichever comes first, but only if you’re earning over the repayment threshold.

How you’ll repay depends on what you choose to do after your course:

- If you start work, your employer will automatically take 9% of your income above the threshold from your salary, along with tax and National Insurance.

- If you’re self-employed, youll make repayments at the same time as you pay tax through self-assessment.

- If you move overseas, youll repay directly to the Student Loans Company, instead of having it taken automatically from your pay. The repayment threshold could be different from the UK, which means the amount you repay could be different. Find out more about repaying from overseas.

How Long Will It Take To Pay Off My Loan

When you repay a loan, you pay back the principal or capital as well as interest . Interest growing over time is the really important part: the faster you pay back the principal, the lower the interest amount will be.

E.g. You borrow $40,000 with an interest rate of 4%. The loan is for 15 years. Your monthly payment would be $295.88, meaning that your total interest comes to $13,258.40. But paying an extra $100 a month could mean you repay your loan a whole five years earlier, and only pay $8,855.67 interest. Thats a saving of $4,402!

Play around with our Loan Payoff Calculator, above, to see how overpayments can shorten the length of your loan.

The following guide focuses particularly on student loans, but the tips and advice can apply to all types of loans. So read on to learn how to shorten and shrink your loan.

You May Like: Car Refinance Usaa

What Can I Do To Help

The first step is to take action! Send an email to the Prime Minister to show your support for the elimination of interest on student loans.

Next, you can share the campaign on your social media. Spread the word and encourage your friends and family to show their support too!

You can also contact your students union to see how you can help with on-campus actions and promotion of the campaign.

Every volunteer can help make a huge difference!

Spread the Word!

When Do I Start Accruing Interest

Student loan interest typically accrues daily, starting as soon as your loan is disbursed. In other words, student loans generally accrue interest while youre in school.

Subsidized federal loans are the exception the government pays the interest that accrues while the borrower is in school, so borrowers generally dont have to start paying interest on subsidized loans until after the six-month grace period.

Read Also: Avant Vs Upstart

Whats The Fastest Way To Pay Back My Student Loan

Some people recommend the snowball method to pay off your loans the fastest, while others recommend making a payment every other week. The reality is that there are various strategies for , but there is no one-size-fits-all option. Do your research, budget wisely, and do what works best for you and your financial situation.

How Compound Interest Works In Your Favor

Looking at the examples above, its easy to see how this effect works over time. You naturally make a little more headway on your principal every month, even though your payment amount remains the same. This is known as amortization.

If you use amortization to your advantage, you can save yourself a lot of money over the life of your loan.

If your loan doesnt have prepayment penalties, you can pay it off faster by making higher payments every month. Because youve already paid the interest for that payment period, any additional money will go right toward the principal.

That will have a lasting benefit, because a lower principal amount means that those daily compounding calculations will be applied to increasingly smaller numbers.

Paying as little $10 extra per month can yield significant savings over the life of your loan. Paying $100 extra or more can save you thousands.

You May Like: Usaa Personal Loan With Cosigner

Subsidized And Unsubsidized Loan Limits

The amount you can borrow through the Federal Direct Loan Program is determined by your dependency status and classification in college. The annual and aggregate loan limits are listed in the charts below.

| Undergraduate Annual Loan Limits |

|---|

| Health Professions* Aggregate Loan Limits | $224,000 |

* Some professional students may be eligible for increased unsubsidized loan limits. Contact your adviser to determine if you are eligible.

How Certain Are You Of Future Earnings

So think about whether you’re sure you’ll stay in your current profession, could you opt out? Take a pay cut? Take time out to bring up a child? The less certain you are of future solid strong earnings, the more you should hedge towards not overpaying the loan as the downside risk is bigger than the upside gain. If you don’t repay the loan and should’ve done, it’s because you’ll be a higher earner. Yet overpay now and then have a salary drop, and you may’ve ended up throwing money away.

Don’t Miss: Refinance Fha Mortgage Calculator

How Student Debt Affects Your Credit Score

Student loans and lines of credit form part of your credit history. If you miss or are late with your payments, it can affect your credit score.

Your credit score shows future lenders how risky it can be for them to lend you money. A poor credit score can also affect your ability to get a job, rent an apartment or get credit.

The Five Things To Consider Before Overpaying Your Student Loan

You’re allowed to pay extra off your student loan, without penalties, whenever you want. And with what looks scary interest added to statements, this is superficially appealing to many who have spare cash.

The decision for previous generations of students was pretty easy. Most could simply compare the interest rate with what they would earn saving. Yet as I hope you’ve understood so far, that doesn’t apply to most post-2012 starters…

It’s dangerous to use the headline rate of 4.1% to compare student loans to savings as most graduates won’t pay this.

So if you can overpay the loan, here’s what you need to consider first .

Recommended Reading: Capital One/auto Pre Approval

Student Loan Planner Disclosures

Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

How To Pay Less Student Loan Interest

One of the best ways to reduce student loan interest is to pay extraeven if its just a little bitwith each payment.

Heres why:

Your interest is calculated based, in part, on your principal amount. So the lower your principal, the less interest youll have to pay each month. Plus, when your principal balance reaches $0, you have successfully paid your loan in fulland you no longer need to pay principal or interest.

So the goal is to pay down the principal as quickly as possible.

If you send more than the amount due each month, the extra funds are first applied to any outstanding interest and the remaining amount goes directly toward paying down your principal. This helps you to pay off your loan more quicklyand reduce your total estimated interest charges.

Don’t Miss: Refinancing A Fha Loan To A Conventional Loan